Introduction

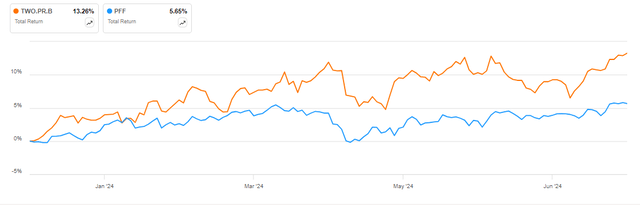

Two Harbors Investment Corporation’s Series B 7.625% preferred shares (NYSE:TWO.PR.B) have significantly outperformed the iShares Preferred and Income Securities ETF (PFF) so far in 2024, delivering a low double-digit total return against the mid-single-digit return for the benchmark ETF:

Two Harbors Series B preferred shares vs PFF in 2024 (Seeking Alpha)

I expect this outperformance to continue as the Series B preferred shares offer a well-covered dividend both from a net income and common equity perspective. Furthermore, given the outlook for monetary policy, the Series B preferred shares offer the highest capital appreciation to par value out of the three preferred series issued by the company.

Company overview

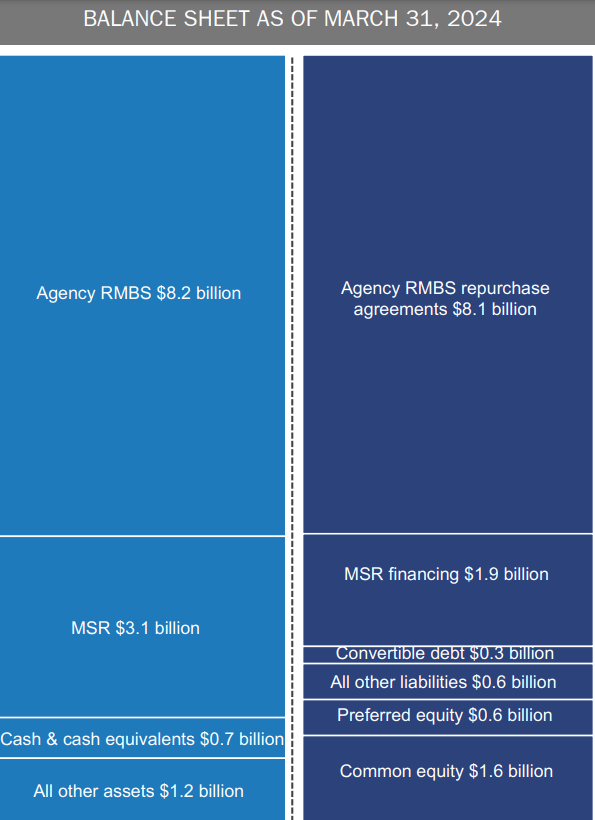

You can access all company results here. Two Harbors Investment Corporation (TWO) is an mREIT specializing in agency residential mortgage-backed securities, or RMBS, which account for 62% of the company’s balance sheet, and mortgage servicing rights, or MSR, which make up 23% of the company’s asset base.

Balance sheet composition (Two Harbors Investment Q1 2024 Investor Presentation)

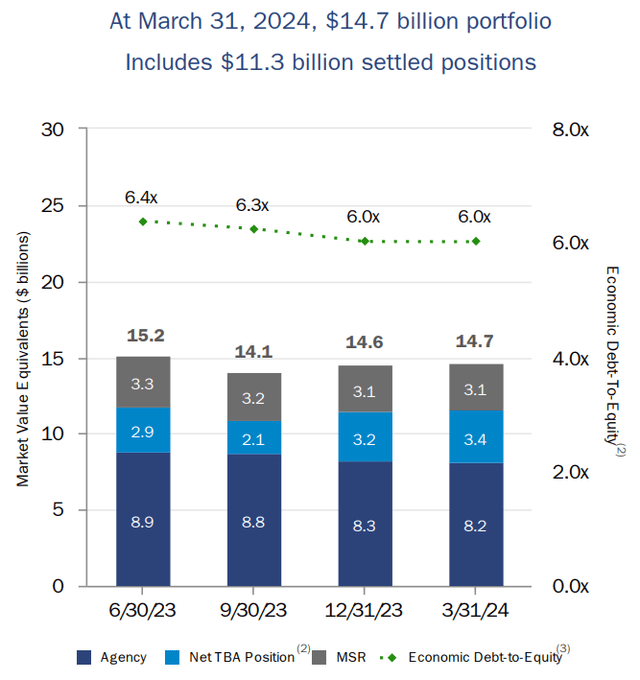

As you can see from the balance sheet above, the mREIT has levered its common equity 8.25 times. The economic Debt-to-equity ratio stands at 6.0 if we account for the agency-to-be-announced securities (TBAs) portfolio.

Leverage evolution over the past year (Two Harbors Investment Q1 2024 Investor Presentation)

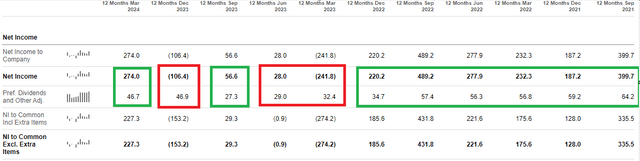

Preferred dividend coverage

In Q1 2024 Two Harbors paid $11.8 million in cumulative preferred dividends, or just 5.8% of its $203.6 million net income before preferred distributions. Looking further back in time on a trailing twelve-month (TTM) basis (which better captures the dynamic change in the valuation of the company’s portfolio as interest rates and mortgage spreads change) we find that the company largely navigated the Fed interest rate hiking cycle well, with the dividend not covered only during three quarters on a TTM basis.

Quarterly net income and preferred dividends (Seeking Alpha)

Outlook for Fed rates

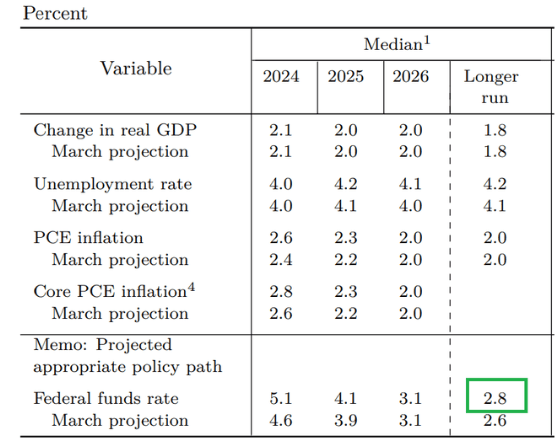

Interest on mortgages is highly dependent on rates set by the Federal Reserve. As rates fall, the value of RMBS held by Two Harbors is likely to appreciate, improving preferred dividend coverage. Current futures pricing indicates the Fed is likely to bring rates to 3.75-4.00% in July 2025, 1.5% lower than current levels. Furthermore, in its June 2024 summary of economic projections, Fed officials signaled they expect further cuts post 2025, to a level of about 2.8% in the long term.

Outlook for macroeconomic indicators (Federal Reserve June 2024 Summary of Economic Projections)

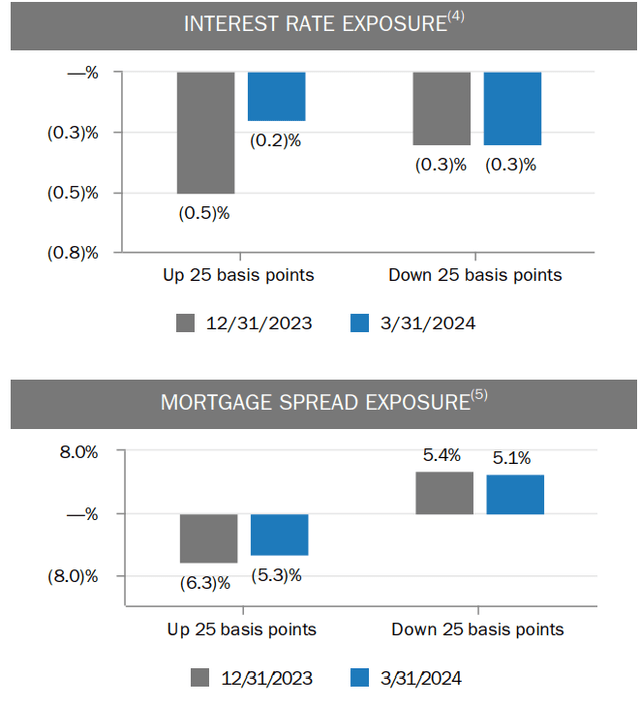

Exposure to interest rates is currently well-hedged at Two Harbors, with a 0.25% across-the-curve up or down move likely to only impact the portfolio by -0.2% or -0.3% respectively. The company remains more exposed to mortgage spreads, with a 5.3% increase in spreads negatively affecting the portfolio by 5.3%. Respectively a 0.25% decline in spreads will boost portfolio valuations by 5.1%.

Interest rate and mortgage spread exposure (Two Harbors Investment Q1 2024 Investor Presentation)

Given the interest rate exposure of Two Harbors outlined above, the company will benefit from lower interest rates mainly through potentially lower rates on its repurchase agreements, which carry an interest rate of SOFR (secured overnight financing rate) plus 18 to 24 basis points.

Preferred stock comparison

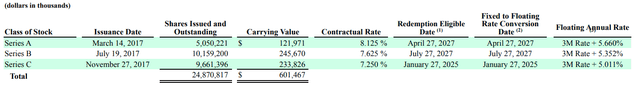

In addition to the Series B 7.625% preferred shares ((TWO.PR.B)), the company has Series A (TWO.PR.A) and Series C (TWO.PR.C) preferred shares outstanding. All three series will switch from fixed to floating, with the Series B conversion due on July 27, 2027.

Preferred series details (Two Harbors Form 10-Q for Q1 2024)

As visible from the 10-Q snippet above, the Series B are most comparable to the Series A shares, which convert to a floating rate in April 2027. While the Series B shares will reset to a 0.3% lower coupon compared to the Series A, I think the Series B shares are most attractively valued due to:

- Larger capital appreciation potential of 8.46% to par value (5.17% at the Series A), which offsets the marginally lower current yield (8.55% on the Series A vs 8.27% on the Series B). In essence, the Series B would not have to be called/bought back for about 10 years for the Series A shares to outperform.

- Higher margin of safety due to discount to par, respectively larger capital gain potential in case of preferred share buyback.

In any case, the difference between the Series A and Series B shares potential returns is quite small, likely in the low single digits. The Series C shares appear to be a play on the higher-for-longer theme, as they reset in January next year but offer the smallest floating rate annual rate premium of 5.011%.

All in all, I would currently recommend buying the Series B shares, would not mind buying the Series A shares as an alternative, and would avoid the Series C shares given the outlook for monetary policy.

Preferred coverage by market capitalization

Across its three series of preferred shares, the company has $621.77 million in nominal preferred shares outstanding. They are covered by an equity market capitalization of $1.46 billion, or coverage of 2.35 times, which is very attractive. Furthermore, shareholders’ equity adjusted for the preferred shares stands at $1.6 billion, implying an even greater equity coverage for preferred shareholders.

Risks

Given the strong preferred dividend coverage over the past few years, both by net income and shareholders’ equity, the main risk facing shareholders is either turmoil in the mortgage market (which would increase mortgage spreads, negatively affecting valuations) or increases in the Fed funds rate (which is a view held by some economists given sticky inflation in the 2-3% area) which would severely reduce demand for fixed-income investments such as real estate.

I would argue that these risks are well-contained given the outlook for monetary policy and the focus on agency securities, which are likely to outperform non-agency RMBS in the event of a mortgage market downturn. Nevertheless, if you hold the view that the Fed will cut significantly less than current market pricing suggests, you may instead want to opt for the Series C preferred shares as they will likely outperform both the Series A and Series B shares in such an environment.

Conclusion

Two Harbors Investment Corporation Series B shares have outperformed the PFF ETF so far in 2024. I fully expect the strong performance to continue as the Series B shares offer an ~8.27% dividend yield and a similar capital appreciation potential to par value. Should monetary policy develop largely as the markets and the Fed expect, the well-covered current income offered by the Series B preferred shares will be quite attractive. As such I recommend going long the Series B preferred stock, with the Series A also a good alternative.

Thank you for reading.

Read the full article here