Introduction

As it has been almost four months since publishing my initial investment thesis on Befesa (OTCPK:BFSAF) I wanted to update my thesis as I’m getting close to pulling the trigger on a long position. I already have written put options on this company specializing in steel dust recycling but I will likely just buy the stock outright sooner rather than later.

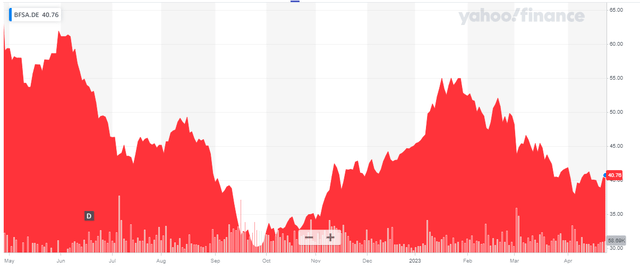

Yahoo Finance

As mentioned in the previous article: Befesa has its main listing in Germany on the Deutsche Boerse, but the company is actually Luxembourg based and as such dividends are subject to the standard 15% Luxembourg dividend withholding tax. There are 40M shares outstanding, resulting in a current market capitalization of approximately 1.6B EUR. The company’s most liquid listing is in Germany where it’s trading with BFSA as its ticker symbol. The average daily volume exceeds 70,000 shares. I will refer to the German listing of Befesa, and the base currency used throughout this article is obviously the Euro.

2023 should be fine as new plants will be operational

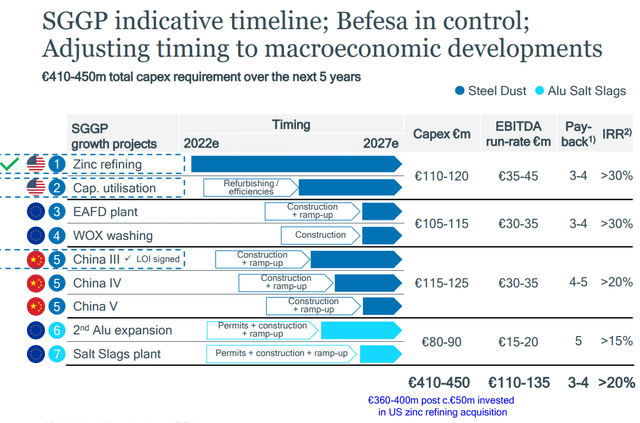

This article is meant as an update to the more extensive article published in January. For all relevant details, background information and detailed plans on how Befesa plans to increase its EBITDA by 2027, I’d like to refer you to that January article.

Before discussing the expectations for 2023, we should have a look at how Befesa performed in 2022, and more specifically in the final quarter of that year. And that final quarter was a bit lighter than I would have liked as the company reported a full-year adjusted EBITDA of 215M EUR, indicating the Q4 adjusted EBITDA was approximately 51M EUR. Not bad, but I was anticipating a Q4 EBITDA that would be about 10% higher as I was eyeing a full-year EBITDA of in excess of 220M EUR.

The weaker than expected Q4 results likely caused the weak performance of the share price in the past few months as the stock is trading about 10% lower than when the previous article was published and it lost about 30% of its value since the end of January.

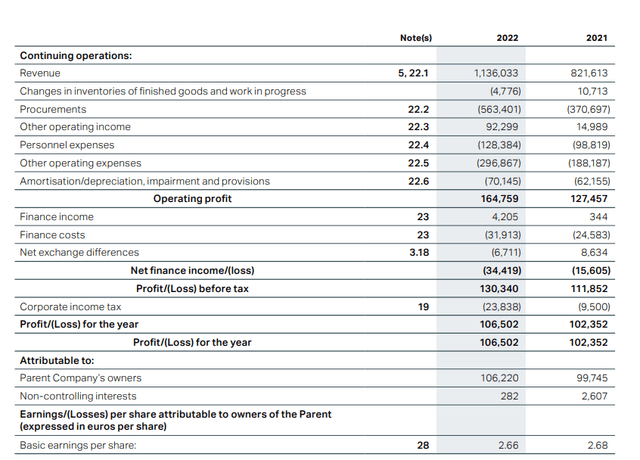

I think that’s a little bit of an overreaction as the 2022 results were still very decent. As you can see below, the financial results were pretty robust. The total revenue increased to almost 1.14B EUR and Befesa generated an operating profit of almost 165M EUR.

Befesa Investor Relations

We also clearly see the net finance costs are increasing as Befesa’s debt has a floating interest rate but this was offset by the strong operating performance, resulting in a pre-tax income of 130.3M EUR (up by more than 15% compared to 2021), but the reported net income increased by just 4% due to the higher tax bill in 2022 (vs. a surprisingly low tax bill in 2021). The net income attributable to the shareholders of Befesa was 106.2M EUR which resulted in an EPS of 2.66 EUR per share. Keep in mind the share count increased 2022 as the company completed a capital raise in 2021 resulting in a higher average weighted share count in 2022.

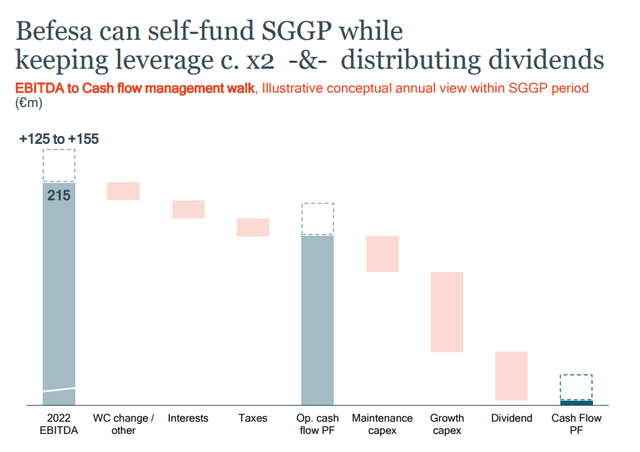

My initial investment thesis was based on Befesa’s ability to generate a positive free cash flow which would be very helpful to autonomously fund its expansion plans. And despite the slightly lower than expected EBITDA result in Q4 2022, Befesa appears to be nicely on track.

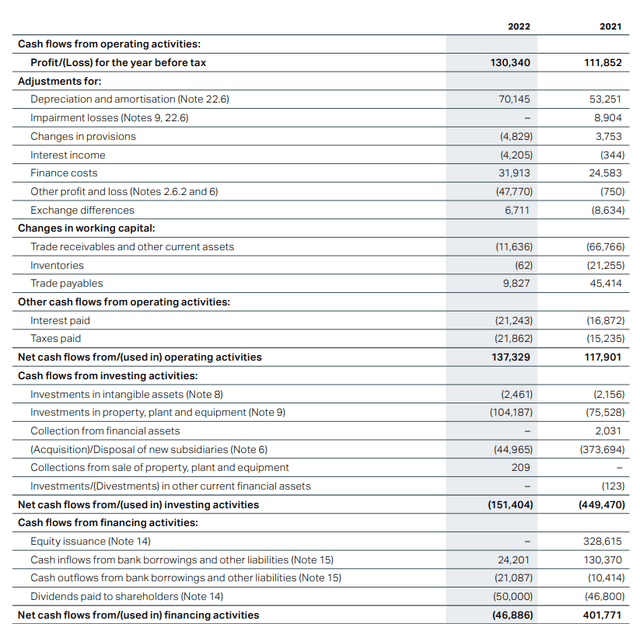

The company reported a total operating cash flow of 137.3M EUR but this includes a 2M EUR investment in the working capital position and excludes the 10-12M EUR in lease liabilities, so on an adjusted basis, I think it’s fair to work with an underlying operating cash flow of approximately 127M EUR.

Befesa Investor Relations

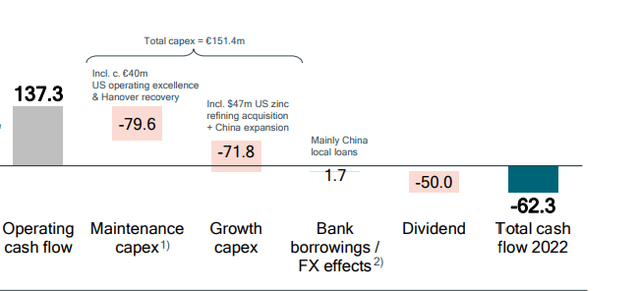

The total capex was 107M EUR (2.5M EUR was spent on intangible assets and 104.2M EUR was spent on tangible assets) excluding M&A, but the image below (taken from the corporate presentation) clearly shows the total sustaining capex was just 40M EUR as the 40M EUR investment included in the maintenance capex includes investments in efficiency and rebuilding the Hanover plant which burned down a little while ago. While the plant obviously is being rebuilt, I’d like to argue this should not be considered as “pure” maintenance capex.

Befesa Investor Relations

Just to err on the cautious side, I will use 50M EUR as sustaining capex which, in combination with the 127M EUR in underlying operating cash flow, results in a free cash flow result of 77M EUR. That’s 1.93 EUR per share and may not sound very inspiring, but Befesa is a growth story. The company plans to pay a dividend of 1.25 EUR per share which means about 27M EUR is retained and will be used to fund the company’s expansion plans.

Befesa Investor Relations

While I initially expected Befesa to be able to self-fund these expansion plans, the company will have to step up its game a little bit as the FY 2022 net free cash flow result after covering the dividend was not sufficient to cover the anticipated 50-75M EUR in annual growth investments.

Fortunately there’s some sort of snowball effect. As new projects are completed they will start contributing to the EBITDA and the bottom line and the free cash flow (before and after making the dividend payment) should gradually increase over the next few years. Befesa has reiterated it expects to self-fund its capex program until 2027 as we should see the first few growth projects starting to contribute this year. The Henan plant in China was completed in December 2022 while the Hanover plant is currently ramping up again as well and these two elements should have a positive impact on this year’s EBITDA.

Befesa Investor Relations

The company has not provided an official 2023 guidance just yet (it’s waiting for the zinc treatment charges to be established, this will likely weigh on the results), but the company mentioned it sees a “solid floor” in 2022 results. This likely confirms the 215M EUR EBITDA is the bottom, and Befesa also confirmed it expects a positive impact of 10-15M EUR from its zinc hedge book as the company hedged a portion of its production at higher prices.

Investment thesis

While Befesa’s recent results were not exactly spectacular, investors need to keep in mind this company is a dominant player in the steel dust recycling sector and has aggressive growth plans. The only uncertainty is the interest rate risk, but the company has hedged about half of its floating rate risk which means that although one should expect a higher interest expense, the increase should be rather gradual until the term loan expires in 2026.

I’m looking forward to seeing Befesa’s official guidance for 2023, but I expect a high single digit EBITDA growth towards 230M EUR which should result in a net income of around 100M EUR and a free cash flow result of approximately 105-110M EUR. I have written put options on Befesa which are currently out of the money but may establish a long position in the common shares sooner rather than later as well.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here