© Reuters

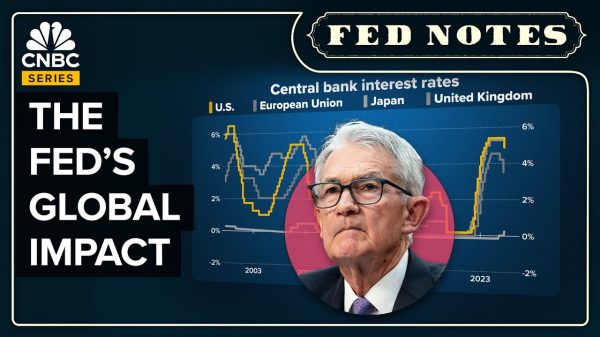

Investing.com — The Dow eked out a win, but that was of mere consolation as stocks posted their worst weekly loss since March ahead of the Fed chair Jerome Powell’s appearance at the Jackson Hole economic policy symposium next week.

The rose 0.1%, or 27 points, fell 0.20%, and the was flat.

Alphabet leads tech lower as Treasury yields remain elevated

Tech added to losses led by weakness in seen so far this week, pressured by worries that rising Treasury yields, the enemy of growth sectors like tech, could continue to advance as Powell will likely reiterate the need for higher for longer rate environment at the Jackson Hole symposium next week.

Treasury yields took a breather on Friday just a day after the closed at its highest level since 2007.

Further upside could see the 10-year Treasury yield move break out to near 5%.

“If you assume a breakout to the upside in the 10-year Treasury yield from current levels… then the 4.8% to 5% range could potentially be a decent objective,” David Keller, Chief Market Strategist at StockCharts told Investing.com’s Yasin Ebrahim in an interview on Friday.

Deere impresses on earnings stage, but succumbs to fears of peak sales; Estee Lauder delivers weak guidance

Deere & Company (NYSE:) fell more than 5% as fears grow that the boom in sales of tractors and other machinery last have peaked amid falling crop prices offset a quarterly beat and raise.

Estee Lauder Companies (NYSE: delivered annual guidance that fell short of Wall Street estimates, offsetting better-than-expected quarterly. The cosmetic company’s downbeat guidance comes as a slow recovery in Asia continued to weigh on performance. Its shares fell more than 3%.

Chips flat, but headed for third weekly loss ahead of Nvidia’s results

Chip stocks inched higher, but continue to stare down the barrel of a third weekly loss as investors appear to continue taking profit of gains ahead of Nvidia’s results due Wednesday.

Tech bulls on Wall Street are optimistic that the chipmaker will deliver quarterly results that top estimates, and suggest that Nvidia (NASDAQ:) may not have delivered blowout guidance on its data center business as it will likely continue to ride the AI wave of demand.

“With demand for AI training having lifted substantially in the past quarter and with no other silicon supplier now capable of providing part volumes within an order of magnitude of NVDA’s output, we believe any unfilled demand will just be pushed into forward quarters fueling future sales and EPS,” Wedbush said in a note.

Read the full article here