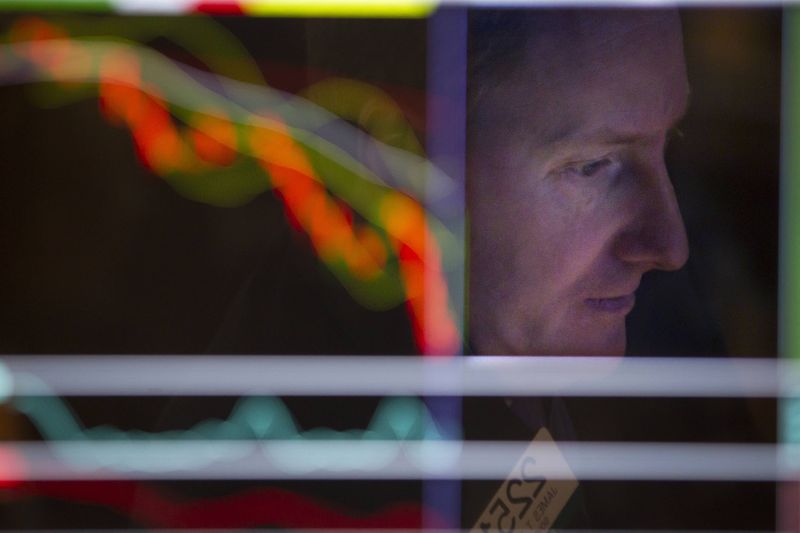

© Reuters. RTX slips after cutting full-year forecast due to engine quality issue

RTX Corp (NYSE:) has downgraded its sales guidance for the full year, falling short of the average analyst estimate.

Full-year revenue is now seen in the range of $67.5 billion to $68.5B, down from the previous guidance of $73.0B to $74.0B. Analysts were looking for $73.6B in FY sales.

Shares fell 3.5% on the new guidance.

RTX Corp still expects its adjusted earnings per share to be in the range of $4.95 to $5.05 for the full year, in line with the estimated $5.01.

The company also maintains its outlook for free cash flow at about $4.3B.

The revision to the FY sales outlook is made as the company anticipates recognizing a pretax charge of approximately $3B in the third quarter. This charge is attributed to a matter related to Pratt & Whitney’s powder metal manufacturing.

Read the full article here