© Reuters.

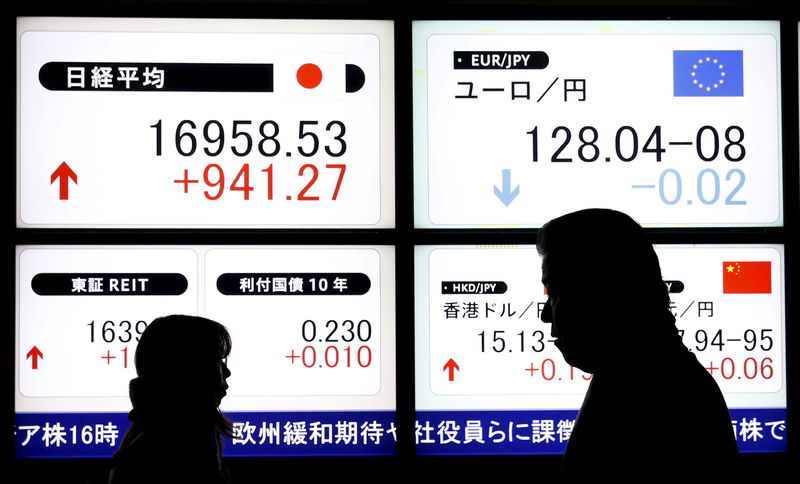

Investing.com — Most Asian stock markets rose on Monday, tracking a rally on Wall Street as investors cheered the passing of a bill to avert a U.S. default, with Japanese stocks racing back to 33-year peaks.

Focus now turns to a string of central bank meetings for more economic cues, starting with Australia and India on Tuesday and Thursday, respectively. These come ahead of the Federal Reserve next week.

The index was the best performer for the day, up 1.9%, while the broader rose 1.3%. Both indexes regained their highest levels in 33 years after having briefly pulled back last week.

Japanese stocks have by far outpaced their global peers this year, amid optimism over economic resilience in the country and a dovish Bank of Japan.

Broader Asian markets rose as the passing of the U.S. debt ceiling deal cleared up a key source of anxiety for risk-driven markets. Wall Street indexes also rallied on Friday, providing a positive lead-in for regional bourses.

But U.S. stock futures were flat in late trade on Sunday, indicating that the rally may now be cooling. Hotter-than-expected data spurred some fears of a hawkish Federal Reserve, ahead of an next week.

Still, most Asian stocks pushed higher. South Korea’s rose 0.6%, while the index added 0.4%.

Australia’s index rose 1.1%, with focus turning to a meeting on Tuesday. While general consensus is for the bank to hold, there still stands a slim possibility for a 25 basis point hike, given that Australian rose more than expected in April.

India’s and indexes rose 0.4% and 0.5%, respectively, with the steady this week, given that has cooled in recent months.

Chinese markets lagged their peers, with the down 0.5%, while the traded sideways. While a showed that China’s services sector grew at a faster-than-expected pace in May, growth still remained well below pre-pandemic highs, indicating that the economy was still struggling to recover.

This also kept gains in Hong Kong’s in check, with the index rising 0.6%. The three indexes traded just above six-month lows hit in May, as sentiment over a Chinese economic recovery turned sour.

Read the full article here