Sometimes the market gives you gifts in the form of volatility. That appears to be the case with Zscaler, Inc. (NASDAQ:ZS), a leading cybersecurity stock which I previously noted risked flying too close to the sun. After a recent bout of underperformance, I find myself returning to the bullish camp.

The company has sustained incredible top-line growth rates while remaining cash generative. The company maintains a net cash balance sheet and I continue to expect an inflection to GAAP profitability over the next 12–18 months.

The stock definitely trades at the higher end among tech peers, but I view this premium to be justified given the higher quality business model, stronger growth rates, and strong financial position. I am upgrading ZS stock to Buy.

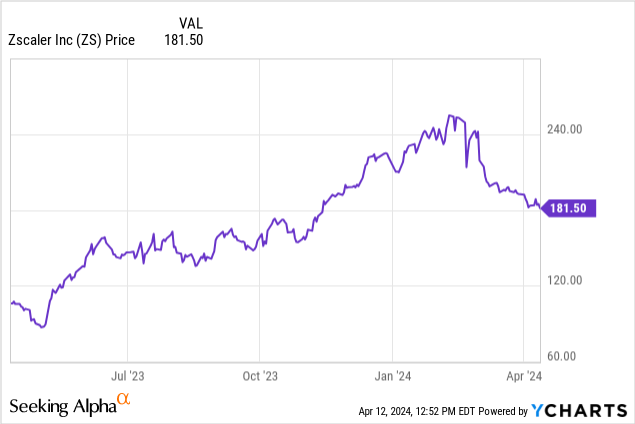

ZS Stock Price

When I last covered ZS in February, I explained why I was downgrading the stock due to valuation despite strong fundamental results. The stock has since underperformed the market index by around 25%.

This underperformance represents a potential buying opportunity.

ZS Stock Key Metrics

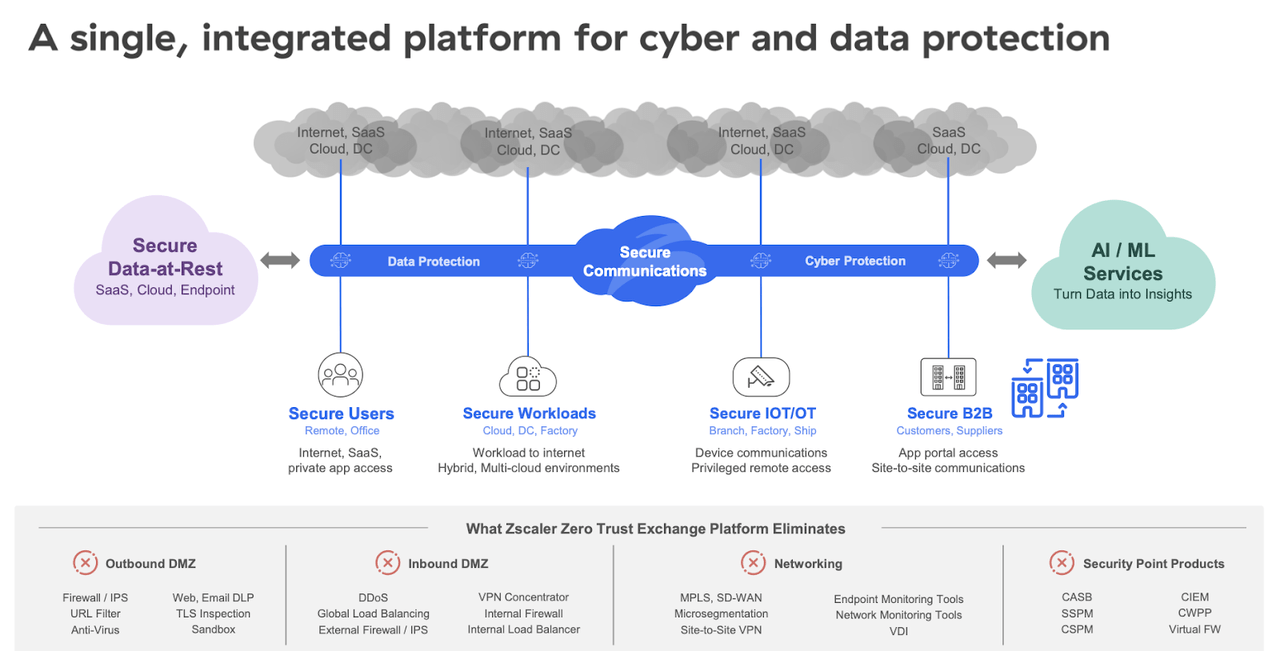

ZS is a cybersecurity company focused on “zero trust security.” I view ZS to be a “platform” company in that it has a wide breadth of products and is not considered a “point product” company. This distinction likely helped the company sustain above-market growth rates over the last 2 years despite tough macro conditions.

FY24 Q2 Presentation

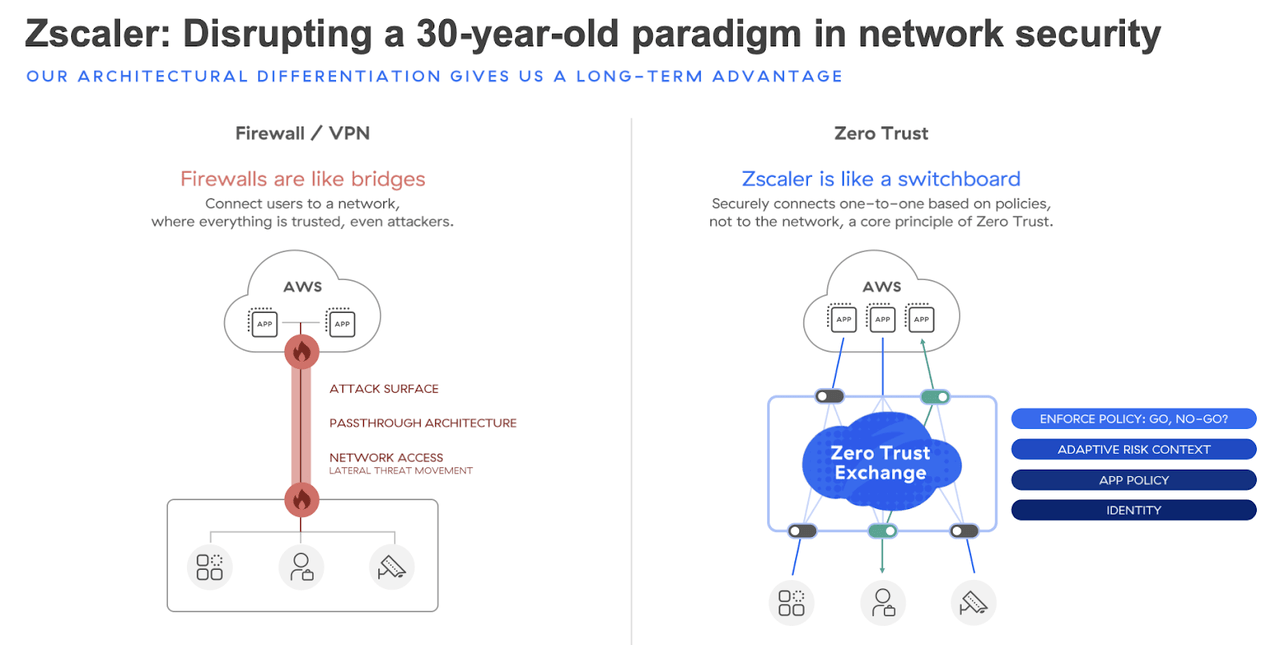

To understand what ZS does, the company explains that traditional firewall mechanisms are insufficient because, once attackers breach the network, they then have access to everything. ZS, on the other hand, secures based on a one-to-one basis, which offers superior protection. ZS can thus be considered to be a sort of disruptor to the traditional firewall product.

FY24 Q2 Presentation

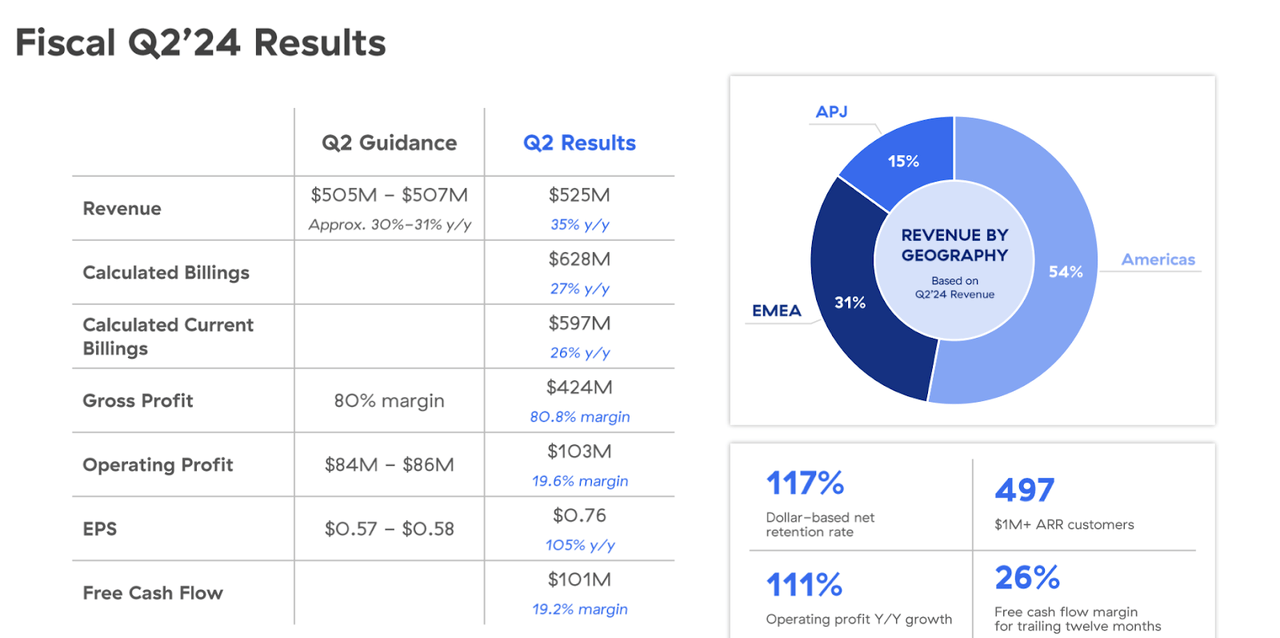

In its most recent quarter, fiscal Q2, ZS generated 35% YoY revenue growth to $525 million, surpassing guidance for $507 million. Billings grew at a strong 27% YoY growth rate, including 26% YoY growth in current billings. I note that this growth rate represents a sequential deceleration from the 34% growth posted in the fiscal first quarter.

FY24 Q2 Presentation

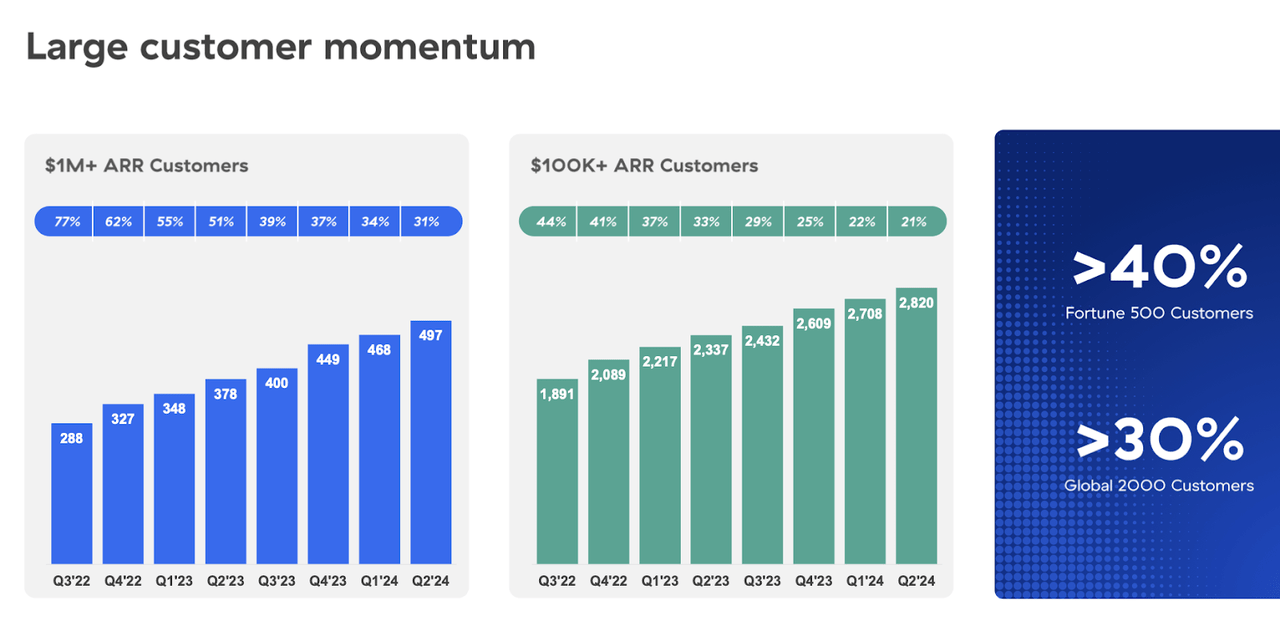

The company continues to show rapid growth among its larger customers and boasts a 117% dollar-based net retention rate.

FY24 Q2 Presentation

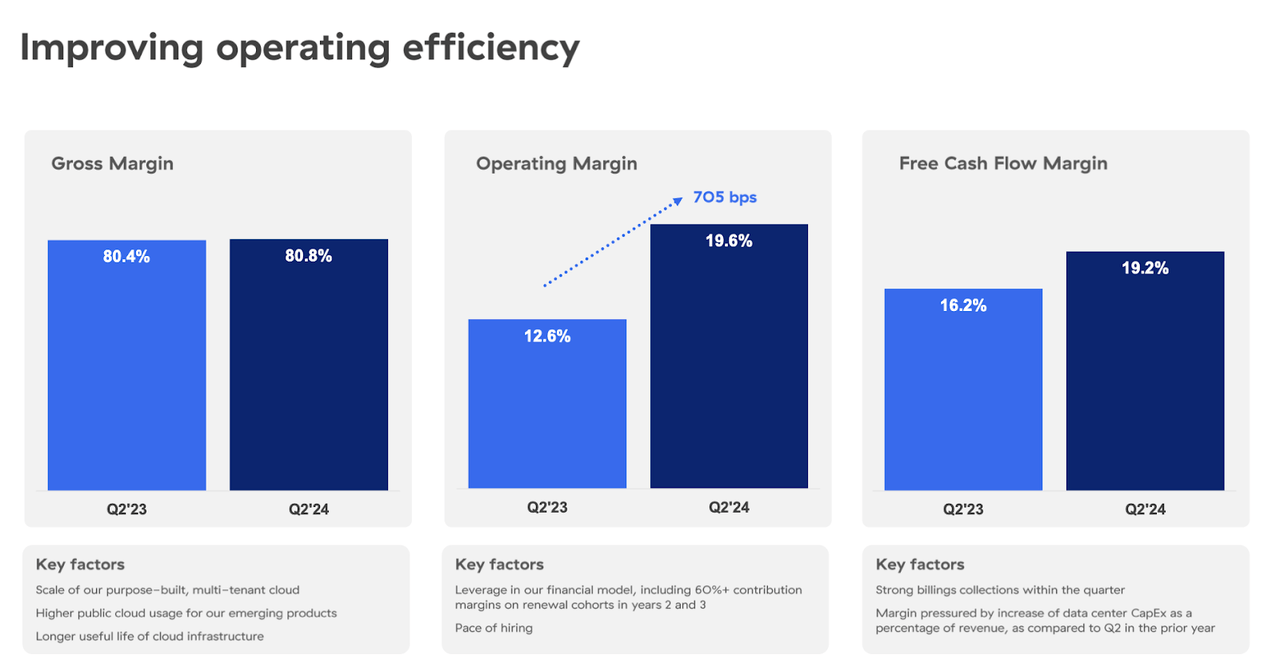

The company showed material operating leverage, with non-GAAP operating margins jumping 705 bps to 19.6%. The company generated $101 million in free cash flow, representing a 19.2% margin.

FY24 Q2 Presentation

ZS ended the quarter with $2.4 billion of cash versus $1.1 billion of convertible notes. Because these convertible notes carry a miniscule 0.125% interest rate, this creates the temporary benefit of “free financing.” However, these notes mature in 2025 and are already convertible. The company had previously entered capped call transactions to reduce the potential dilution from conversion of these notes. My prediction is that the company ends up redeeming these notes for a combination of stock and cash (to maintain a net cash balance sheet).

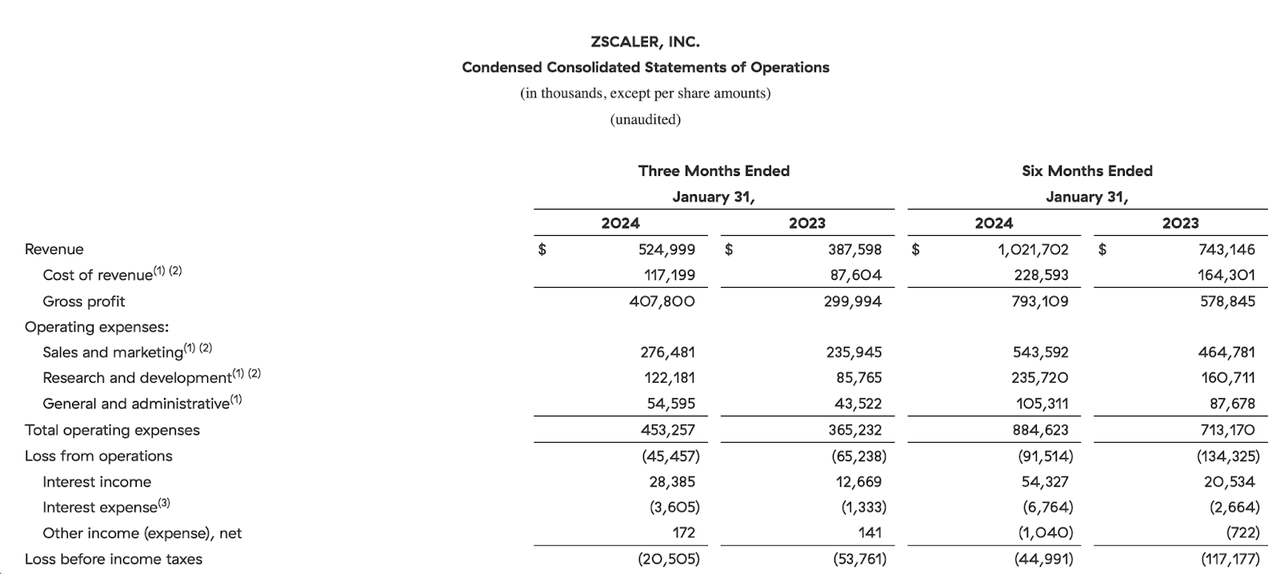

The company continues to move closer to GAAP profitability. The higher interest rate environment has helped the company generate significant interest income, with $28.4 million of quarterly interest income making up more than half of the GAAP operating loss.

FY24 Q2 Press Release

I continue to believe that these high quality tech companies can boost profit margins “at will” but instead choose to invest in growth through ramping up headcount. I note that operating leverage alone could easily push the company into GAAP profitability at any moment.

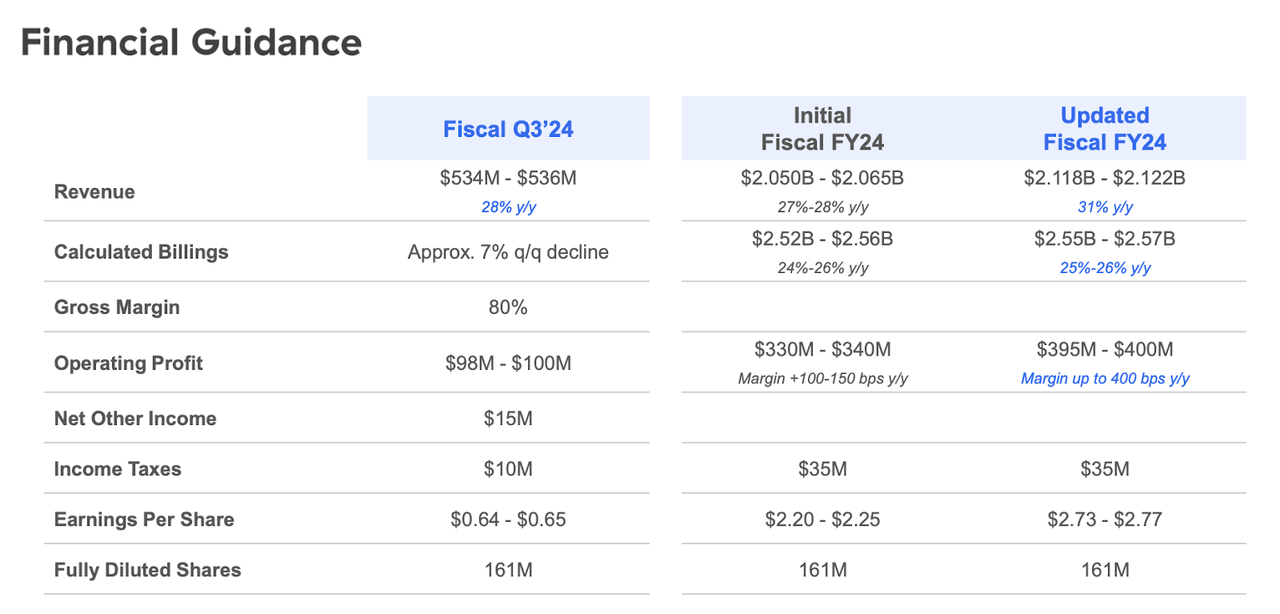

Looking forward, management has guided for the fiscal third quarter (expected to be released around May 24th) to see 28% YoY revenue growth to $536 million and 18.7% non-GAAP operating margins, and the full year to see up to 31% YoY revenue growth to $2.122 billion. Consensus estimates call for $536 million and $2.12 billion for the third quarter and full year, respectively. I expect the company to at least narrowly beat both of these numbers as they come due.

FY24 Q2 Presentation

On the conference call, management fielded questions about potential “cyber spending fatigue” in the cybersecurity sector, likely inspired by poor results from firewall competitor Palo Alto Networks (PANW). Management denied any such headwinds, and took the opportunity to tout the technological advantages of their product versus firewall peers, going as far as saying that:

“the role of firewalls is diminishing and the demand for Zero Trust security is growing and this is bound to impact sales of firewall vendors and this naturally puts the legacy vendors in a defensive position.”

At the same time, management appeared to right-size expectations, stating that they have seen increased success in “selling multiple pillars from the start,” which may reduce their dollar-based net retention rate moving forward. I suspect that many investors may have missed this point, as consensus estimates also do not appear to be factoring in much deceleration moving forward.

Is ZS Stock A Buy, Sell, or Hold?

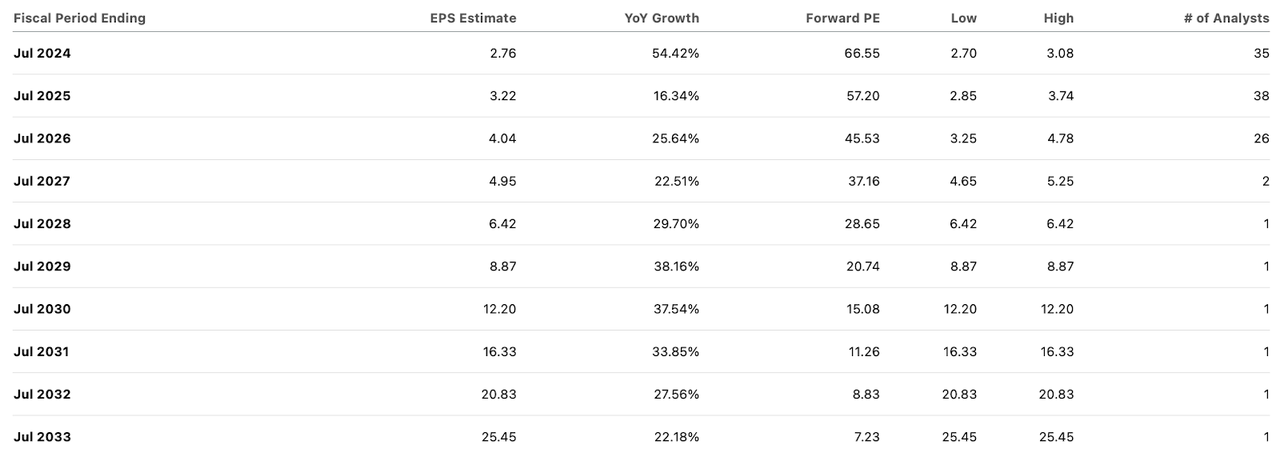

ZS stock might not look cheap at 67x non-GAAP earnings, but earnings are expected to grow rapidly over the coming years, in part due to operating leverage.

Seeking Alpha

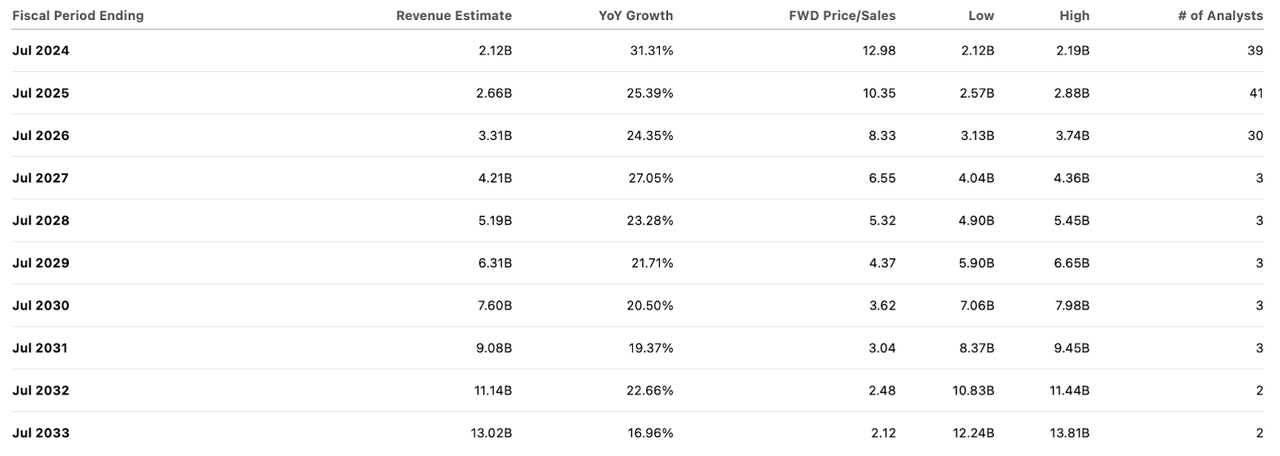

Consensus estimates call for 20% top-line growth for a long time.

Seeking Alpha

Given the company’s attractive positioning within the cybersecurity sector as well as the strong balance sheet and profitability metrics, I consider a 30x long-term earnings multiple to be appropriate. This would be in-line with names like Microsoft (MSFT) and Apple (AAPL). Based on 33% long-term net margins, that might equate to around 10x sales. With the stock trading at around 13x sales, I see solid upside ahead, especially considering that the stock arguably deserves to trade at multiples exceeding that 10x long-term estimation due to the higher near term growth rates.

We can also value ZS based on a price to earnings growth ratio (‘PEG ratio’). Assuming 25% forward growth, a 1.5x PEG ratio, and 33% long-term net margins, we arrive at a fair value of around 12.4x sales, implying a stock price of around $218 per share over the next 12 months.

What are the key risks? The stock trades at a premium valuation relative to tech peers. That premium might lead to greater volatility, especially if the tech sector overall sees a re-rating downward. Top-line growth might slow faster than expected. ZS has managed to sustain incredible growth rates even following the pandemic, and it is unclear if any future slowdown will prove gradual or drastic.

I would expect management to seek to offset top-line deceleration with significant margin gains, but it is unclear if the market will continue to reward such actions moving forward. It is unclear if generative AI will prove to be a friend or foe – if it ends up leading to long-term job reductions, then it may end up getting in the way of long-term growth rates.

Conclusion

I view Zscaler, Inc. to be one of the higher quality stocks in the highest quality cybersecurity sector. Recent volatility has brought the stock back down to earth, offering yet another buying opportunity for growth minded investors. I like the strong top-line growth rates, net cash balance sheet, and ongoing margin expansion. I am upgrading Zscaler, Inc. stock to Buy.

Read the full article here