I have had a lot of questions from natural gas (BOIL, NYSEARCA:UNG) traders around the world regarding the upcoming winter forecast.

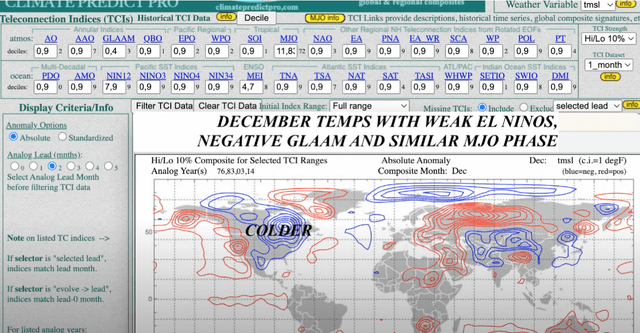

Colder winters tend to have weaker El Nino events (WeatherWealth newsletter)

This video describes how the different strengths of El Nino, coupled with something we call the MJO index and a developing warm block over Alaska (negative EPO), can influence late fall and early winter weather.

In a nutshell, given huge supplies of natural gas, both in the United States and Europe, it would take extraordinary, consistent cold for weeks on end to eat into natural gas stocks.

For years, natural gas prices often reacted positively to cold early winter weather forecasts. The difference this year is that supplies are quite a bit above the 5-year average. Without a severe winter, prices would head back below $2.50 later this year or in early 2024. This price scenario is more likely during strong vs. weak El Nino events, as my video above explains.

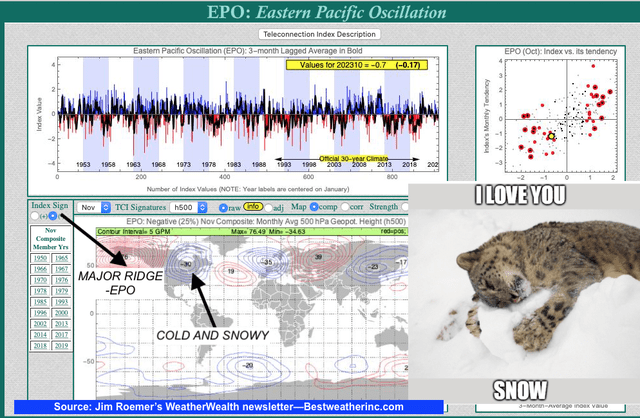

The key to whether the U.S. and Europe have a consistently cold winter is a weather phenomenon we call the EPO index. When it is negative, a warm block develops over the Gulf of Alaska and can create cold and snow for at least the eastern half of the U.S. The problem is that the Arctic has warmed so much over the last 20 years, that the severe winters witnessed in the 1970s and 1980s are just a distant memory.

A negative EPO index = a strong ridge over the Gulf of Alaska (www.bestweatherinc.com)

Conclusion:

A cold late November and possibly early December is in store for much of the eastern half of the U.S. Expect at least one major snowstorm before the beginning of December. However, if you are hoping to make money trading natural gas on a cold winter, trading on futures will remain volatile due to the see-saw type of winter I expect, and large global supplies. The best method to trade natural gas this winter will likely be using what we call “option strangles” to capture market volatility.

Read the full article here