By Ewa Manthey, Commodities Strategist

Steel scrap is key in establishing a circular economy

Global ferrous scrap consumption in steel production is set to rise as efforts to reduce the industry’s environmental footprint are ramped up alongside an expected increase in the share of Electric Arc Furnace (EAF) in the global steelmaking process.

The steel sector accounts for at least 7% of global greenhouse gas emissions. With global steel demand set to increase to around 2.6 billion tonnes by 2050, the transition to a low-carbon economy requires a change in how steel is produced. Part of steel’s decarbonisation path is through the increased use of scrap. Today, around 30% of steel is produced through recycling scrap – and this share is forecast to rise to 50% by 2050.

Steel is predominantly made via two main processes: the blast furnace-basic oxygen furnace (BF-BOF) process, which uses coke to produce iron from ore, and the Electric Arc Furnace process (EAF). These two methods are often referred to as the ‘primary’ and ‘secondary’ processes that melt down scrap and recycled steel. The BF-BOF process is the most common steelmaking process and the most emissions-intensive, with 90% of production relying on coal. Emissions from scrap-based EAFs are mostly indirect. Those emissions are not produced by the steel plant but by the electricity generators that supply electricity to the furnaces. If the electricity used in this process is produced via renewable energy, this production route can have very low CO2 emissions. When using grey electricity as energy input, scrap-EAF steelmaking emits 0.67 tons of CO2 per tonne of crude steel cast, vs 2.32 tonnes in the case of BF-BOF steelmaking. Carbon intensity is far lower when using green electricity.

Scrap not only plays a key role in reducing industry emissions but also in reducing resource consumption. Every tonne of scrap used for steel production avoids the emission of 1.5 tonnes of CO2 and the consumption of 1.4 tonnes of iron ore, 740kg of coal and 120kg of limestone, according to calculations from Worldsteel.

The steel sector also has alternatives to BF-BOF and EAF plants. These include Direct Reduced Iron (DRI) plants which use natural gas, and eventually (once available) green hydrogen made from renewable energy instead of coking coal to reduce iron ore. For now, however, steel-making scrap-based EAF has the lowest carbon footprint across steel making technologies – at least until DRI technology advances to using hydrogen.

Growing global EAF steel output is leading to increasing scrap use

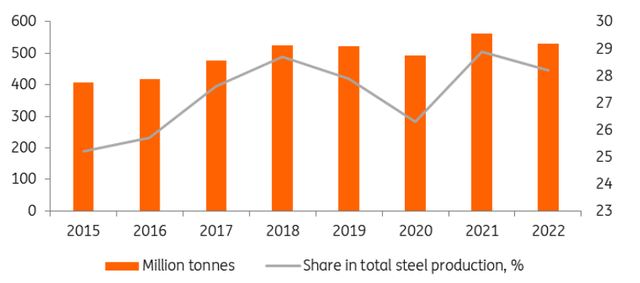

Steel production around the world is increasingly switching to electric arc furnaces. The share of EAF in global steel production increased from 25% to 28% between 2015 and 2022, and is expected to increase further as steelmakers globally are looking to transition to greener steelmaking processes. This holds significant implications for the steel scrap market as competition for the raw material continues to grow.

Global EAF steel output in 2015-2022

Worldsteel, ING Research

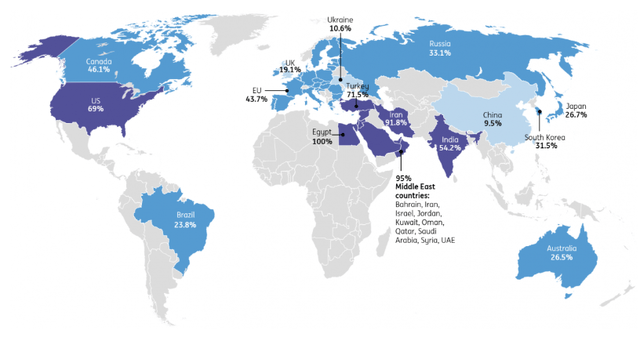

Share of EAF in crude steel output in 2022

Worldsteel, ING Research

Between regions, steel production is the most electrified in the Middle East, where 95% of steel capacity are electric steel mills. In the US, that share was 69% in 2022, while in the EU, it stood at 43.7%.

As the world’s largest steel producer, China is lagging at 9.5% but is also significantly expanding its capacity in this area. The country plans to increase its share of steel from EAFs to 15% by 2025 amid a drive to reduce carbon emissions, increasing its appetite for ferrous scrap. The country aims to achieve carbon neutrality by 2060.

In India, the world’s second-largest steel producer, the share has been growing in recent years; in 2022, over 54% of the country’s steel was produced from EAFs. India’s steel sector has a higher energy intensity compared to the global average. With a national target of net-zero emissions by 2070 and Indian steel demand expected to grow, investment in new blast furnace capacity has surged in recent years.

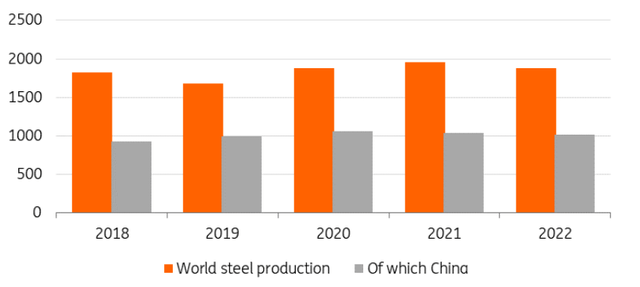

The largest producer of steel is naturally the largest consumer of scrap. Last year, China used 215.31 million tonnes of scrap, 4.8% lower year-on-year, as data from the Bureau of International Recycling (BIR) showed. There was also a decline in the country’s crude steel production (-1.7% to 1018.0 million tonnes) amid weakness in the real estate sector.

World/ China crude steel production (million tonnes)

Worldsteel, BIR, ING Research

Steel scrap for steelmaking in China (million tonnes)

Worldsteel, CAMU, BIR, ING Research

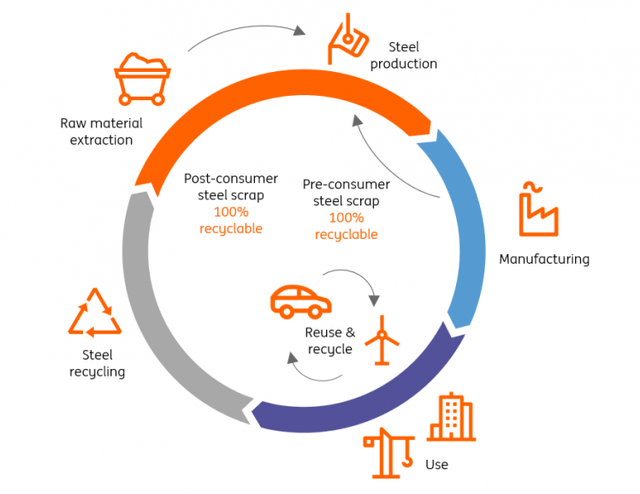

Steel’s lifecycle

Worldsteel, ING Research

Steel is one of the most highly recycled materials in use today, and it can be recycled repeatedly without losing its properties. Today, around 90% of steel products are recovered at the end of their life and recycled to produce new steel. In theory, all new steel could be made using recycled steel, as its properties remain intact during the recycling process. However, this isn’t feasible currently due to a shortage of scrap. Globally, the current production of steel is three times higher than the supplies of scrap available.

Only as more steel products become obsolete can the world produce more recycled steel

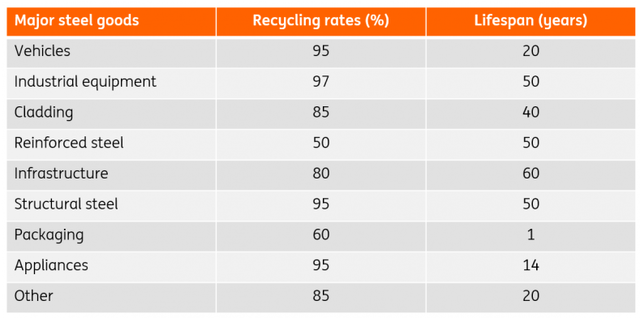

The average lifespan of steel products can vary, ranging from just a few weeks for steel packaging to as long as 100 years for buildings and infrastructure. On average, a steel product has a lifespan of around 40 years. Only as more steel products become obsolete can the world produce more recycled steel.

Lifespan of selected steel products

ArcelorMittal, ING Research

The continued growth in steel demand means that it is unlikely for the industry to be able to transition to entirely scrap-based production during this century, according to Worldsteel calculations.

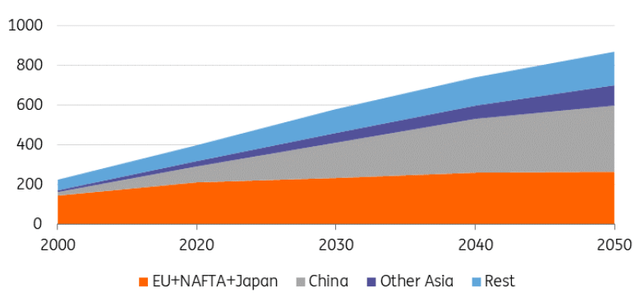

End-of-life scrap availability (million tonnes)

Worldsteel, ING Research

Global steel production experienced significant growth in the early 21st century, primarily driven by China’s expansion. As more steel materials reach the end of their useful lives, the availability of scrap steel is expected to increase from the mid-2020s onwards. According to Worldsteel estimates, global end-of-life ferrous scrap availability was approximately 400 Mt in 2019. By 2030, global end-of-life scrap availability is projected to reach around 600 Mt – and by 2050, approximately 900 Mt.

At the same time, global demand for steel scrap could reach 778 million tonnes by 2030, according to data from the POSCO Research Institute. By 2050, a deadline set by several global steel producers to achieve carbon neutrality goals, global demand will reach 964 million tonnes.

The main potential of scrap resources is in Asian countries. In the EU, North America and Japan, scrap resources will not show significant growth, while demand will continue to rise. This is why the trend of steel scrap export restrictions is gaining traction globally.

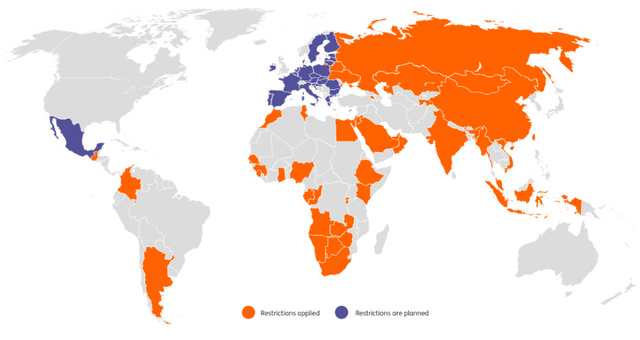

Restrictions in the scrap trade increase amid decarbonisation drive

The growing number of trade restrictions on scrap is a good indicator of its increasing value in the global decarbonisation drive. More countries are imposing export bans to protect this raw material as EAF production is slowly becoming the leading technology in steel production.

Restrictions on ferrous scrap exports

OECD, ING Research

Exports of ferrous scrap are most actively restricted in Africa, MENA countries and Asia, according to data from the Organisation for Economic Co-operation and Development (OECD). These are countries with historically low steel consumption and insufficient scrap resources. Export duty is the most common tool, but export bans are used almost as often as duties, as shown in data from the OECD.

Restrictions in Europe are likely to have significant consequences for the global scrap market

In the EU, the European Parliament approved a proposal to revise the Waste Shipment Regulation (WSR) earlier this year. According to the amendments to the WSR, starting from 2025, the export of safe waste for recycling – of ferrous and non-ferrous metal scrap in particular – to countries outside the OECD will be allowed only if those countries apply for consent and demonstrate their ability to manage waste effectively. The European Commission will also carefully monitor the export of waste to OECD member countries. As a result, the EU can turn from a net scrap exporter to a net scrap importer in just five years, as shown by the International Rebar Producers and Exporters Association (IREPAS) data.

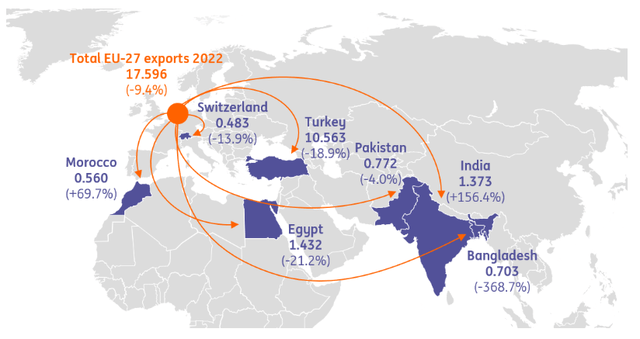

The EU is the largest exporter of scrap in the world. Last year, the bloc maintained its position despite a 9.4% year-on-year decline in shipped volumes to 17.596 million tonnes; the main buyer was Turkey (-18.9% to 10.563 million tonnes), according to the BIR.

Restrictions in Europe are likely to have significant consequences for the global scrap market. Currently, 25% of EU scrap exports go to non-OECD countries, and these export volumes are likely to reduce due to the regulation.

Main flows of EU steel scrap exports in 2022 (million tonnes)

Official Trade Statistics, WV Stahl, BIR, ING Research

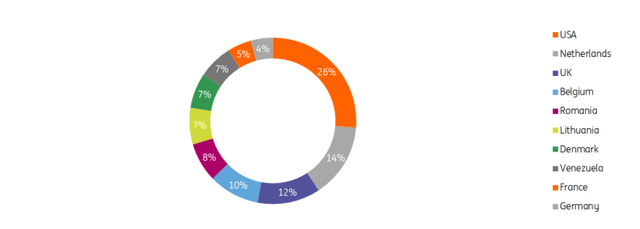

As an OECD member and the largest national seaborne importer of ferrous scrap, Turkey could benefit from the WSR and reduced competition for the material. The country remains the largest national seaborne importer of ferrous scrap, importing over 20 million tonnes last year (down 16.5% year-on-year), with the US as its main supplier (up 4.9% to 3.953 million tonnes), as shown in data from the BIR. Turkey is expected to remain a large net importer of scrap in the long term, given that its domestic scrap supply is too limited to satisfy its EAF production capacity. The country mainly produces steel via the EAF process. In 2022, the country’s share of EAF in crude steel output was 71.5%.

Top steel scrap suppliers of Turkey (million tonnes)

Official Trade Statistics, WV Stahl, BIR, ING Research

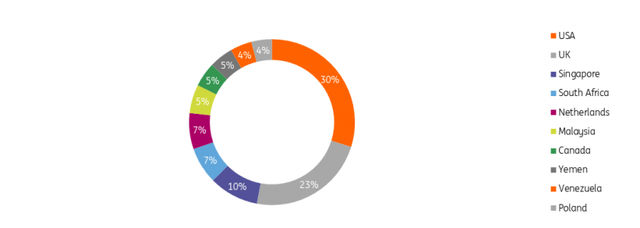

As the second-largest steel scrap importer and a non-OECD member, India aims to become the largest steel producer after China. The country already relies on more than 50% on EAF production and therefore could be severely affected by the WSR. India imported 1.373 million tonnes of ferrous scrap from the EU last year, an increase of 156% from the year before. The country plans annually to import about 30 million tons of raw steel materials by 2030 to meet the government’s vision of achieving 300 million tonnes per year of steel capacity.

Top steel scrap suppliers of India (million tonnes)

Official Trade Statistics, WV Stahl, BIR, ING Research

An amendment to the bloc’s Critical Raw Materials Act (CRMA) could also result in ferrous scrap being categorised as a protected material, along with other strategic materials like lithium, copper, cobalt and nickel – all of which are seen as key to the green energy transition.

The addition of ferrous scrap as a critical raw material would make it highly protected under EU law

The addition of ferrous scrap as a critical raw material would make it highly protected under EU law. If ferrous scrap is added to the final list of the CRMA, it could become challenging to continue exporting the material, including to buyers inside the OECD like Turkey.

As part of the CRMA, the EU has set targets for the region to mine 10% of the critical raw materials it consumes, with recycling adding a further 25% and increased processing to 40% of its needs by 2030. In addition, there should be a substantial increase in the recovery of raw materials present in waste. The political agreement now needs to be formally approved by both Parliament and Council to become law. Meanwhile, the EU has also decided to exempt scrap from the scope of

the Carbon Border Adjustment Mechanism (CBAM), which would prevent barriers to importing the material.

Seaborne ferrous scrap trade likely to fall further

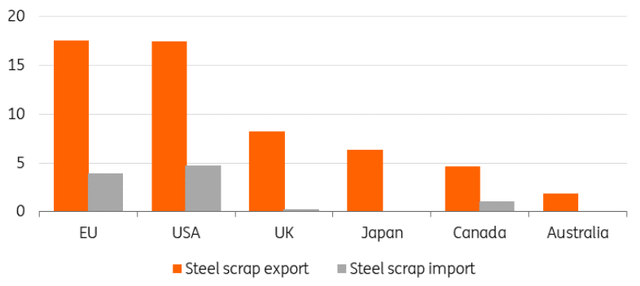

The volume of seaborne ferrous scrap trade is likely to fall further as more and more countries introduce legislation to retain the scrap they produce within their borders for domestic use. Global recycled steel trade – including trade within the EU – amounted to 97.6 million tonnes last year, down 14.9% compared to 2021, as data from the BIR shows.

The recycled steel export trade within the EU totalled 26.445 million tonnes in 2022 for a year-on-year drop of 10.4%. There was also a decline in recycled steel shipments out of the US last year, down 2.4% to 17.476 million tonnes – although it remained the world’s second-largest recycled steel exporter.

Most of the world’s leading exporters are major net recycled steel exporters. Last year’s export surplus, for instance, was 13.7 million tonnes for the EU and 12.8 million tonnes for the US (according to BIR data).

Major net steel scrap exporters in 2022 (million tonnes)

Official trade statistics/ WV Stahl, BIR, ING Research

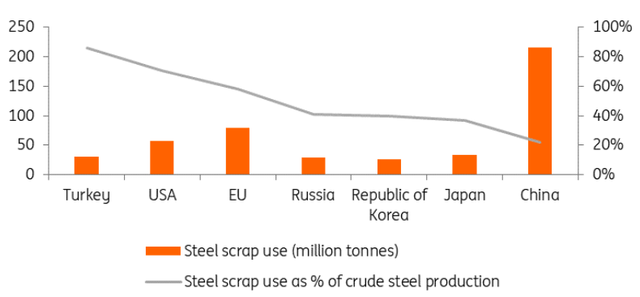

Demand for ferrous scrap will continue to grow globally amid the increasing focus on the material as a key raw material in the low-carbon emissions steelmaking process. Steel scrap has an essential place in the decarbonisation drive toward establish a circular economy. Last year, the proportions of recycled steel used in crude steel production increased to 22% in China, 58% in the EU, 70% in the US and toward37% in Japan.

Steel scrap use in crude steel production in 2022

BIR, ING Research

Steel mills look to secure scrap supply

To deliver low carbon emissions steel, steel mills globally have been acquiring scrap recyclers as part of a strategy to secure access to the raw material as demand continues to rise amid the decarbonisation drive.

In the US, the country’s largest steelmaker, Nucor, has acquired Garden Street Iron & Metal’s assets on behalf of its recycling subsidiary, River Metals Recycling. Last year, Steel Dynamics acquired Roca Acero, a Mexican metals recycling company, as part of its raw materials purchasing strategy. In Europe, ArcelorMittal bought Poland-based Zlomex at the end of last year. The Polish transaction was the fourth scrap metal acquisition ArcelorMittal has undertaken in Europe in 2022. The steelmaker is significantly ramping up its scrap requirement as it seeks to shift the bulk of its European steelmaking capacity from a basic oxygen furnace to an electric arc furnace partially fed by direct-reduced iron by 2030.

We expect vertical integration in the steel industry to continue as steel mills seek to secure access to scrap steel required for low-carbon emission steelmaking, which in turn will drive mergers and acquisitions moving forward.

Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Read the full article here