Investment Thesis

Company Overview

Whirlpool Corporation (“Whirlpool”), founded in 1911 with headquarters in Benton Charter Township, Michigan, is one of the best global kitchen and laundry equipment suppliers in the world.

Earnings Review

From Whirlpool’s Q2 earnings report, the company’s net sales up by 3.1% QoQ but down 6% YoY. Net earnings were $85 million, better than the negative $179 million losses of Q1 and $371 million losses of Q2 last year. Both its operating cash flow and free cash flow were down by $190 million YoY. Overall, it’s a mixed bag results but tilted to the downside. We will dig into its fundamentals to assess.

Strength

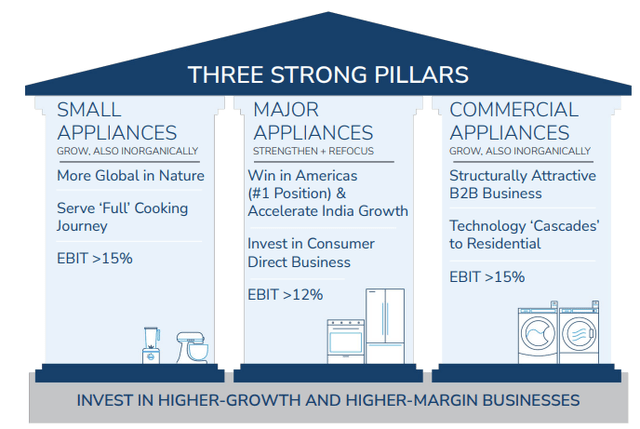

The three pillars of growth for Whirlpool are Small Appliances, Major Appliances and Commercial Appliances in kitchen and laundry capacity.

From Company 2023 Presentation

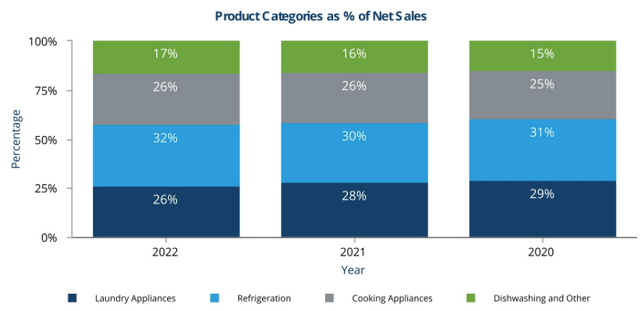

In Q4 of 2022, Whirlpool acquired InSinkErator, the world’s largest manufacturer of food waste disposers and instant hot water dispensers. It hasn’t disclosed all the financial terms yet and expects within a year from the announcement date the financials will be reconciled. But it did report that it has used $2.5 billion from its credit facility to fund this acquisition. This aims at expanding the overall product portfolio while boosting “Dishwashing and Other” from its net sales category. This is the smallest product category for the company.

whr (From 2022 10K)

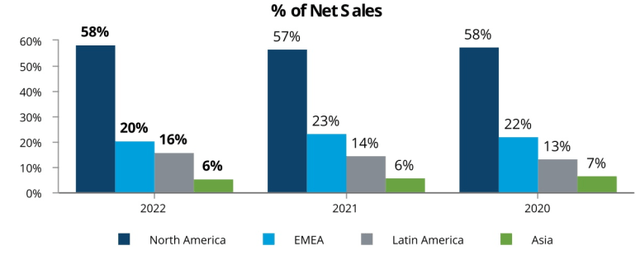

Regionally, Whirlpool continued to see the largest contribution from North America while slight growth from Latin America. The company has divested investments from China and Turkey in 2021 and Russia in 2022. It is also expected to have divesture from major European domestic appliance businesses in 2H of 2023. North American market’s presence in its sales channel will be ever more pronounced. From its Q2 earnings report, the EBIT growth were strongest in EMEA at 750% YoY, but North America was down by 30% YoY. While the net sales has only seen growth of 4.1% in Latin America, with the rest of the regions declined by 4.7% in North America to 15.3% in EMEA.

whr (From 2022 10K)

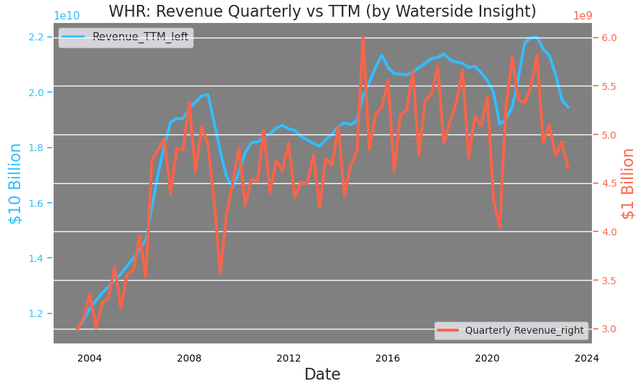

The company’s revenue has been normalized from the pandemic boom. Although it is not in a particularly strong position, the current level is about the average of the past ten years on a TTM basis. It expected InSinkErator will provide $550 million lift in revenue for 2023 fiscal year.

Whirlpool: Revenue (Calculated and charted by Waterside Insight with data from company)

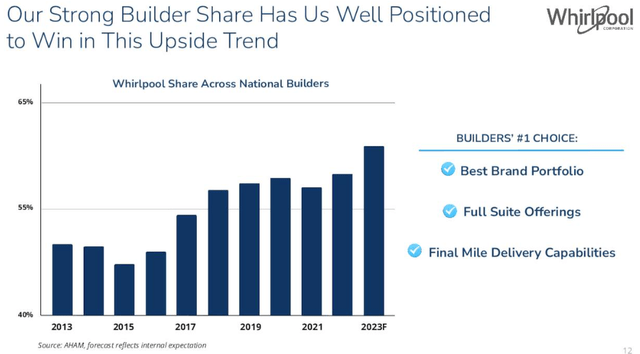

Behind the top-line growth is Whirlpool’s strong shares among homebuilders. It takes over 60% of the total market shares across national builders.

whr (whr)

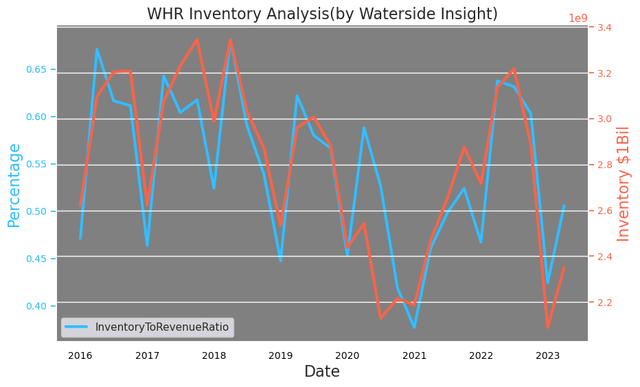

The company has overcome the higher inventory levels from late 2021 to early 2022, and has managed to cut it by almost 30% since then.

Whirlpool: Inventory (Calculated and charted by Waterside Insight with data from company)

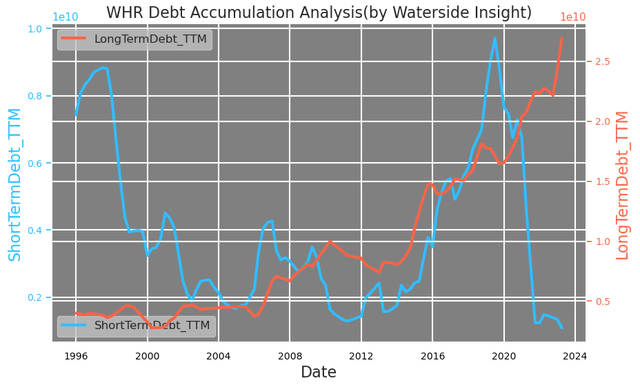

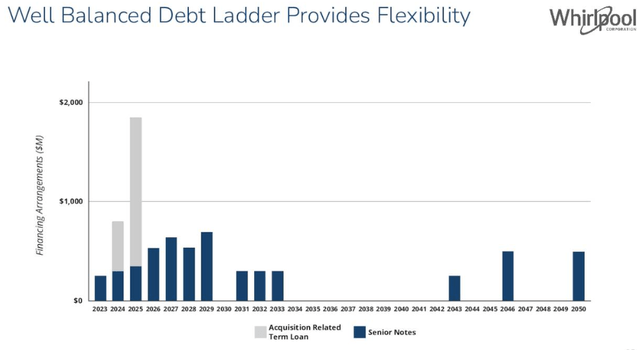

Its debt structure has a major overhaul compared to even just three years ago. Its short-term debt has been greatly reduced, replaced mostly with long-term debt. This is on the heel of its acquisition of InSinkErator.

Whirlpool: Debt Accumulation Analysis (Calculated and charted by Waterside Insight with data from company)

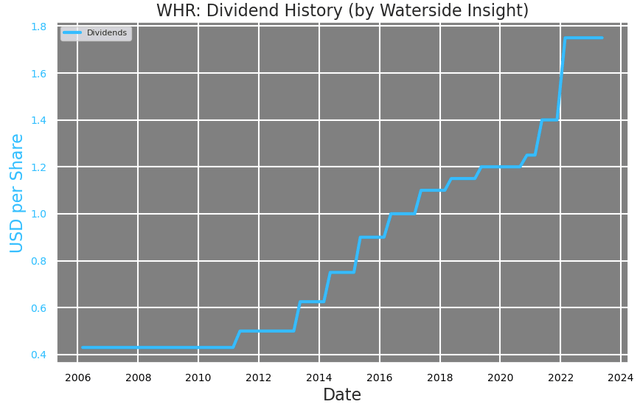

Whirlpool is in its highest dividend payout in the past three decades.

Whirlpool: Dividend History (Calculated and charted by Waterside Insight with data from company)

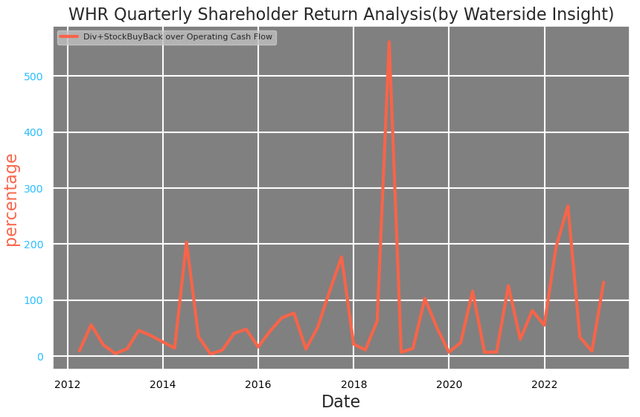

The company has held steady and regular returns to the shareholders over the years, with its dividends payout combined with share buybacks around 100% of its operating cash flow. This ratio was as high as 2.5x in early 2022.

Whirlpool: Quarterly Shareholder Return (Calculated and charted by Waterside Insight with data from company)

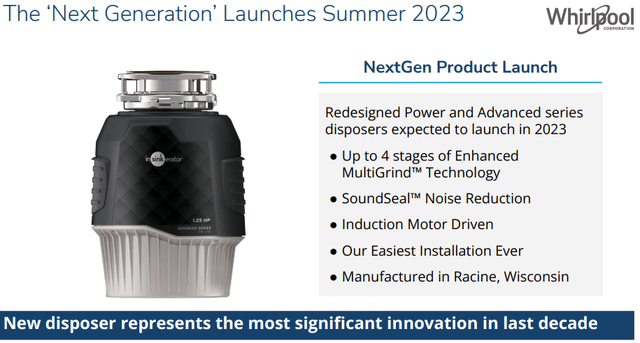

Coming soon this summer is its “Next Gen” disposer launch. We expect the coming earnings report could make an announcement in this regard or set a date.

whr (From Company 2023 Presentation)

Weakness/Risks

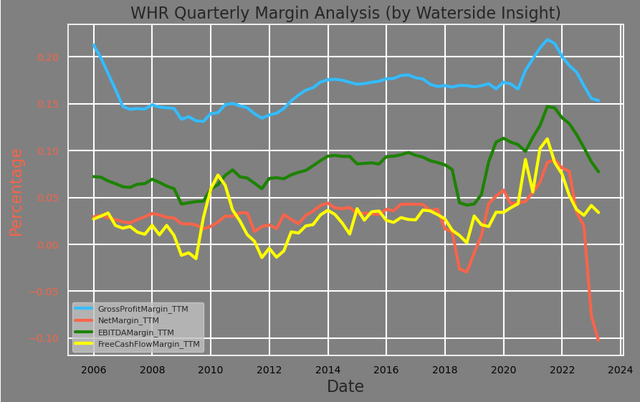

Most of Whirlpool’s margins are normalizing back to their levels in 2019 from the heights they reached in the past two years. But amongst all the margins, its net margin has struck a steep decline. On a TTM basis, its net margin was almost negative 10% in the latest quarter.

Whirlpool: Quarterly Margins (Calculated and charted by Waterside Insight with data from company)

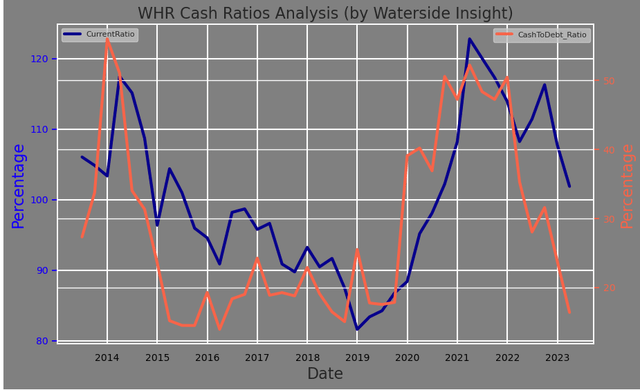

Its current ratio is still above 1x, but its cash-to-debt ratio has fallen to only 20%. It has been here before, for almost 5 years before 2020. But still, given the different interest rate environment, it is not the best position to be in for the company.

Whirlpool: Cash Ratios (Calculated and charted by Waterside Insight with data from company)

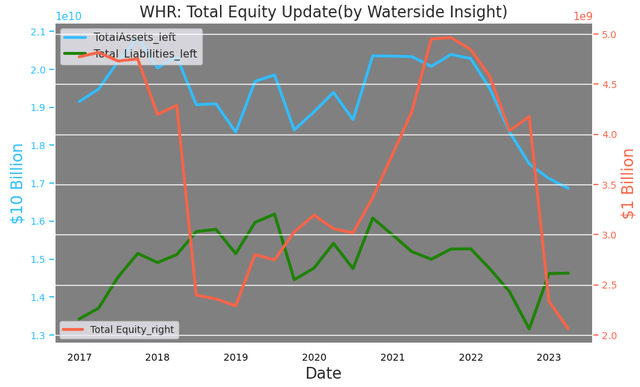

Total equity has fallen to about $2.2 billion, some of the lowest levels. As we alluded to earlier that its debt structure was revamped and reflected a better composition of short and long-term debt, but no doubt the acquisition still increased its total liabilities. On the other hand, its declining total assets have begun since early 2022, from $20.8 billion down to last quarter’s $16.8 billion.

Whirlpool: Total Equity Update (Calculated and charted by Waterside Insight with data from company)

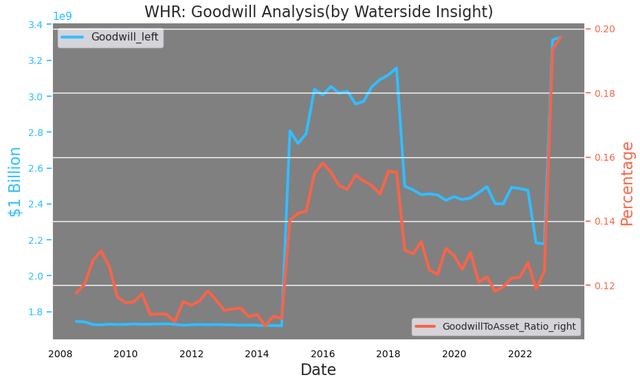

And Whirlpool’s goodwill now accounts for 20% of its total asset. According to its 2022 annual report, this increase in its goodwill is primarily driven by the InSinkErator acquisition, after a partial offset from the full impairment of EMEA goodwill in Q2 of 2022. Whirlpool has a strong brand reputation, but this addition has brought its goodwill to the highest level historically. Future impairment could be expected.

Whirlpool: goodwill analysis (Calculated and charted by Waterside Insight with data from company)

Big Picture

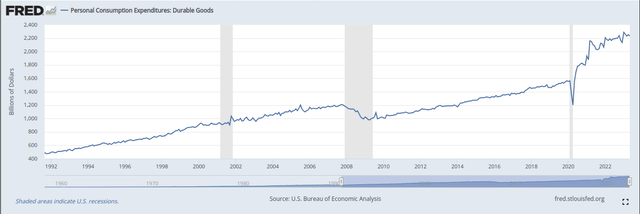

From the macro perspective, the growth of personal consumption expenditure of durable goods has stalled since the beginning of 2022, although it is currently at one of the highest levels and almost 50% higher compared to the end of 2019.

Personal Consumption Expenditure: Durable Goods (From FRED)

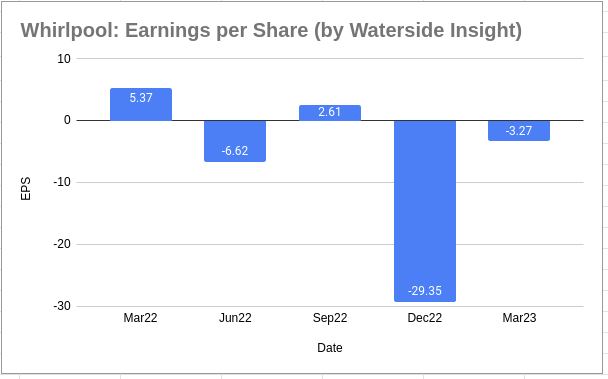

In the meanwhile, Whirlpool’s earnings-per-share were already showing signs of stress during this time. Its full-year earnings-per-share of 2022 were negative $27.18. If the big ticket item spending is going into decline, the company is in a vulnerable position to defend its earnings and financials.

Whirlpool: Earnings-per-share (Charted by Waterside Insight with data from company)

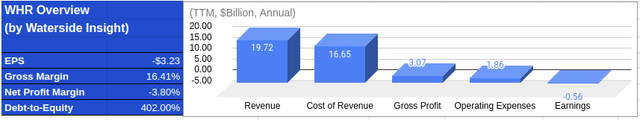

Financial Overview

Whirlpool: Financial Overview (Calculated and charted by Waterside Insight with data from company)

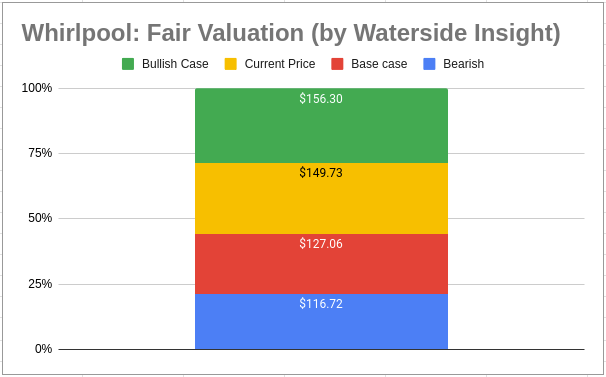

Valuation

Based on our analysis above, we use our proprietary models to assess the fair value of Whirlpool by projecting its growth ten-year forward. We assumed Cost of Equity to be 7.95% and WACC to be 8.54%. In our base case, Whirlpool has double-digit declines in the free cash flow in ’23 and ’24, followed by a normalized growth path similar to its pre-pandemic era; it was priced at $127.06.

Whirlpool: Fair Valuation (Calculated and Charted by Waterside Insight with data from company)

In the bullish case, less decline compared with the base case was expected in the near term while everything else is the same; it was priced at $165.37. In the bearish case, more volatility down the road than the base case was expected due to the long-term debt payment’s structure, although the growth path remains stable; it was priced at $116.72.

Whirlpool: Debt Ladder (Company Presentation Q2 2023)

Conclusion

Whirlpool has strong brand recognition in households and commercial spaces. The past three years residential property booms have brought its revenue and earnings to new highs. But the normalization of this cycle has begun in 2022, with both its toplines and margins seeing a decline. Its recent acquisition aiming at expanding its kitchen portfolio with a strong brand addition will create more growth opportunities in the long term, but with the decline in net income, total equity and with tepid cash flow, we see more downside risks than upside at this point. The recommendation will be a hold at the current levels.

Read the full article here