Thesis

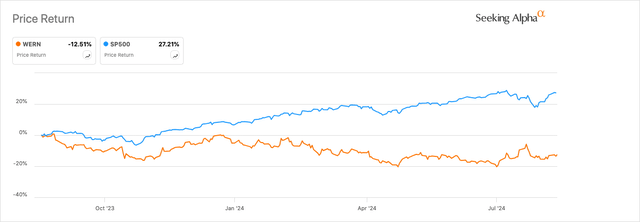

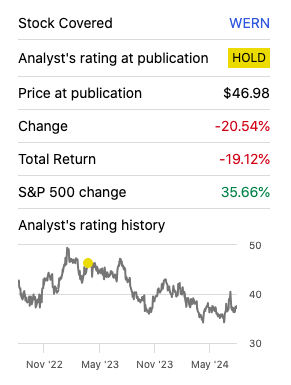

Since I wrote my analysis, “Examining Werner Enterprises 2023 Potential: A Cautionary Outlook,” in mid-April 2023, Werner Enterprises, Inc. (NASDAQ:WERN) stock has notably underperformed relative to the broader market.

Seeking Alpha

In my article, I pointed out several headwinds the company was facing from a shaky freight market that was dragging down income and margins. At the time, it looked like those “rough patches” were likely to stick around for the remainder of 2023. And since my piece, while the S&P 500 (SP500) has rallied 35.66% over this period, Werner shares fell -19.12%.

Grassroots Trading: WERN performance vs. S&P500 (Seeking Alpha)

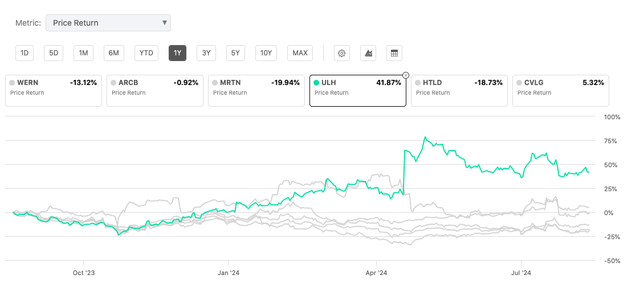

Werner isn’t alone in its struggles; peers like Heartland Express, Inc. (HTLD), Marten Transport, Ltd. (MRTN), and ArcBest Corporation (ARCB) are also lagging the market. The one standout is Universal Logistics Holdings, Inc. (ULH), up 42%

Seeking Alpha

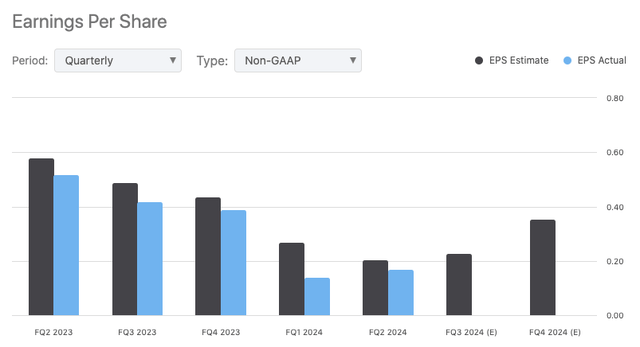

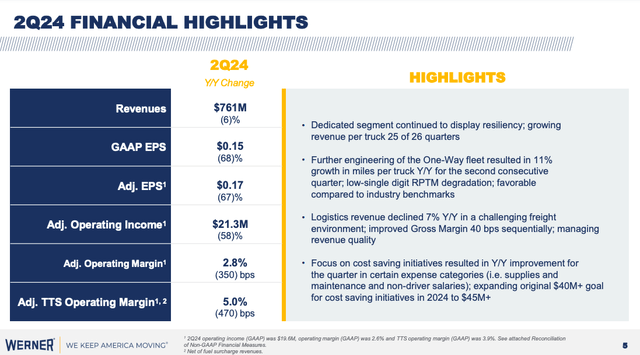

Considering these developments, I’m going back to Werner Enterprises today with a focus on their latest Q2 2024 earnings results. My analysis argues that despite some operational gains in Q2 2024, Werner’s Non-GAAP EPS of $0.17, missing by $0.03, and revenue of $760.8 million, missing by $9.03 million, still showcase those aforementioned difficulties.

WERN Q2 2024 Earnings Highlights

Werner Enterprises’ Q2 2024 results show some gains. Actual earnings improved quarter over quarter.

Seeking Alpha

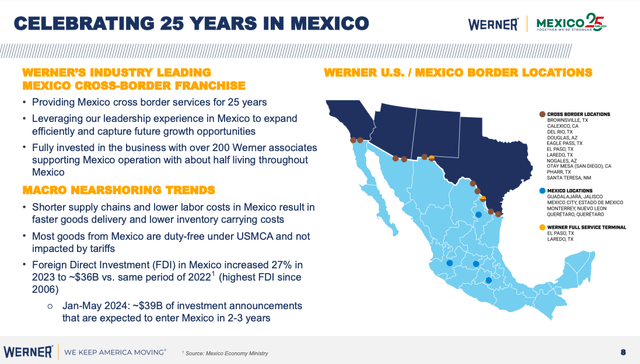

The Mexico portfolio stood out, with volumes up by low double digits from last year. And this July marked 25 years of operations in Mexico.

WERN 2Q24 Earnings Presentation

Werner’s dedicated revenue per truck went up slightly from last year. That makes 25 out of the last 26 quarters with growth.

CFO Chris Wikoff noted that Werner had fewer trucks at the end of the quarter per the company’s pricing strategy, but they’re seeing some improvement in demand and are ready to expand into new areas as the market picks up. He said:

While our per truck production is trending well, the impact from certain fleet losses, as a result of maintaining our pricing discipline, drove fewer trucks at the end of the quarter. We will continue to exhibit discipline and value customers who are looking for the reliability, scale, safety and service of our proven dedicated model.

Although not yet widespread, we have seen demand improvement within some of our existing fleets and with an improving market, we are positioned well to further penetrate new verticals and other hard-to-serve freight opportunities at reinvestable margins.

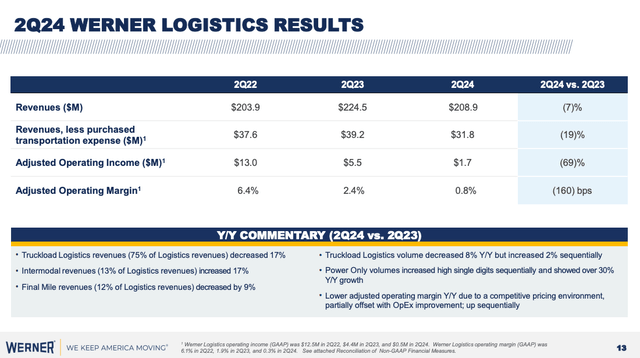

The Power-Only segment also had a strong run, with six straight quarters of growth. Volumes jumped over 30% year-over-year. The company’s truckload brokerage margins have stuck at 15% for four quarters, but pressure’s building. They’re targeting higher-margin revenue, especially from the growing “Power Only” segment, to ease the squeeze. They’re also cutting costs with tech for better efficiency. Looking toward 2025 and beyond, they know 15% will be tough to beat, so they’re working to boost profits through ongoing efficiency gains.

WERN 2Q24 Earnings Presentation

The Logistics segment, representing 27% of total Q2 revenues, bounced back, turning a profit after a rough first quarter. This shows better operational efficiency, but right now, to paraphrase management: it’s tough out there, and their Logistics profits are feeling the squeeze. But, they seem hopeful things will get better later this year because of cutting costs and upgrading tech. Meanwhile, they’re focusing on what they can control, like improving the quality of revenue and strengthening infrastructure.

WERN 2Q24 Earnings Presentation

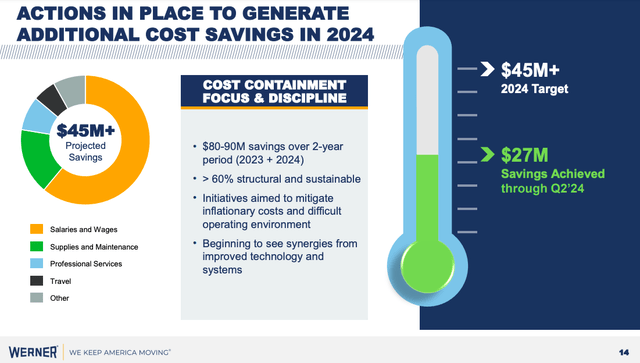

In the meantime, they bumped up their 2024 savings goal from $40 million to over $45 million. So far, they’ve already saved more than $27 million (see above), and sound optimistic that they’ll hit the rest of their target, with sights on planning the next round of savings for 2025.

WERN 2Q24 Earnings Presentation

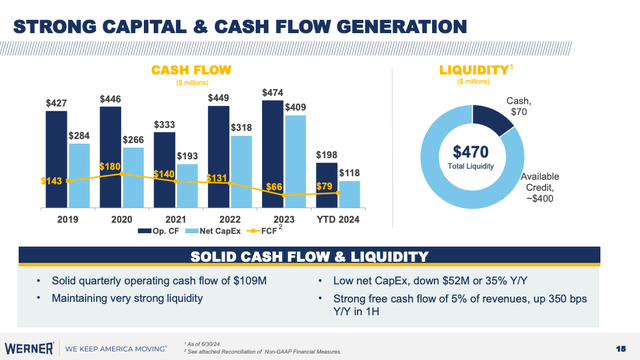

Financially, the company pulled in $109 million in operating cash flow (see above).

Finally, Werner’s fleet is young, with trucks averaging 2.1 years and trailers under five. This’ll help keep things more efficient and helps cut maintenance expenses. They’ve got a fair financial footing, too, with $70 million in cash and $470 million in total liquidity. Their low net debt-to-EBITDA ratio of 1.4 times shows stability; plus, it’s a good sign to stockholders with the purchasing of $60 million in shares this quarter.

Valuation

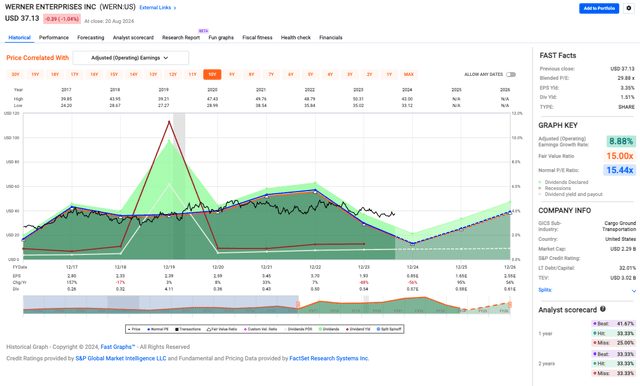

WERN’s (blended) P/E ratio is high: 29.88x — nearly double its fair value ratio of 15.00x and way above the normal P/E of 15.44x. This immediately tells me that the stock might be overpriced, especially with an 8.88% earnings growth rate that doesn’t seem to justify such a high multiple. Like my previous analysis, I think that the market might be too optimistic here.

Fast Graphs

An earnings yield of 3.35% adds to my concern with a dividend yield of just 1.51%. And with a long-term debt to capital ratio of 32.01%, their leverage is something to watch. This is especially true if interest rates climb or the economy hits a rough patch, which could squeeze cash flow and make it tougher to manage debt without cutting into growth or dividends. Looking ahead, there’s reason to be cautious on valuation. If Werner doesn’t hit the high growth the market seems to be expecting here, the price could drop. Overall, I’d say investors should rethink the risk-reward here, especially if there are better-valued stocks out there with less risk.

Risks & Headwinds

The company hit some bumps despite the good news. Q2 revenues dropped 6% from last year, and adjusted EPS fell by $0.35 to $0.17, showing the freight market’s tough spot.

WERN 2Q24 Earnings Presentation

Adjusted operating margins took a hit too, sliding 350 basis points to 2.8%, while the Truckload Transportation Services (TTS) margin dropped 470 basis points to 5%. These numbers show the pressure I mentioned earlier that Werner’s under. The TTS fleet shrank 8% from last year, which might limit its ability to bounce back if the market improves. Moreover, the One-Way trucking rate per mile dipped 2.7% year-over-year in Q2, with the first half of the year seeing a 4% drop compared to last year, showing pricing struggles.

Gains from selling property and equipment dropped over 78% to $2.7 million. Lower equipment values are expected to continue in Q4. Werner’s debt went up by $73 million sequentially and $30 million year-over-year, raising my concerns about higher financial leverage, I noted in “valuation.”

On the earnings call, management admitted market conditions are uncertain, and it’s too early to predict a market rebound. Werner is dealing with lower gains on used equipment sales and pricing pressure in its One-Way and Logistics segments. And lastly, Final Mile revenues also fell by 9%, showing weakness in that area. So while Werner expects slight improvement, predicting the market’s recovery pace and timing remains tough.

Rating

I’m calling Werner Enterprises, Inc. a “sell” here because the stock continues to lag the market. And even with some gains I mentioned earlier in this article, it’s still overpriced, revenues are down, and debt’s piling up. With the freight market still looking shaky, and with better options out there, I think it’s time to cut losses before things get worse.

Read the full article here