As an investor, you are always on the lookout for stable and profitable investment options. And with a cycle shift underway given the Fed’s rhetoric pivot, the Vanguard Mortgage-Backed Securities Index Fund ETF Shares (NASDAQ:VMBS) stands out as a potential beneficiary.

Mortgage-backed pass-through securities are a type of investment where investors receive direct payments from a pool of mortgage loans. Here’s how they work:

-

Creation: Financial institutions bundle individual mortgage loans into a mortgage pool. These loans have similar characteristics such as interest rates, maturity, and credit quality.

-

Securitization: The pool is then sold to a government agency or investment bank that turns it into a security. The agency or bank structures the pool into tranches with varying levels of risk and return.

-

Pass-Through: The cash flow from the pool of mortgages—consisting of both principal and interest payments made by the borrowers—is “passed through” to investors. This distribution is done monthly or quarterly.

-

Payments: The payments are pro-rata, meaning that each investor receives a portion of the payments proportional to their investment in the pool.

-

Risks: Investors in these securities bear the risks of prepayment (borrowers paying off their mortgage early) and default (borrowers failing to make payments).

-

Guarantees: Some mortgage-backed securities come with guarantees from government agencies like Ginnie Mae, or government-sponsored enterprises like Fannie Mae and Freddie Mac, which promise to make investors whole even if borrowers default.

Mortgage-backed pass-through securities are an important component of the fixed-income market, offering investors the opportunity to invest in real estate mortgages indirectly and receive regular income, but they do carry risks related to the performance of the underlying mortgage loans.

VMBS primarily invests in U.S. agency mortgage-backed pass-through securities. With an asset base of nearly $19 billion, it offers investors a cost-effective platform with a low expense ratio of 0.04%. The fund provides exposure to a range of mortgage-backed securities issued by government-sponsored entities including Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC).

ETF Holdings

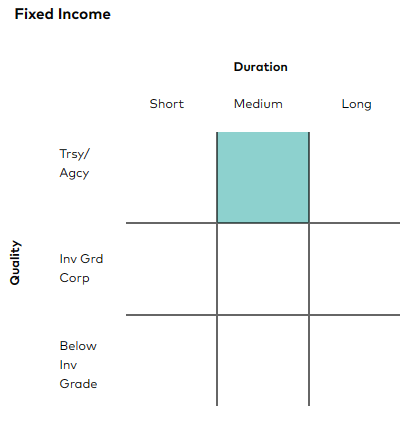

VMBS holds an impressive portfolio of about 1,200 bonds with a portfolio duration of 6.8 years. The fund’s focus on the U.S. agency MBS eliminates credit risks, although it retains interest rate risk due to its moderately high duration.

vanguard.com

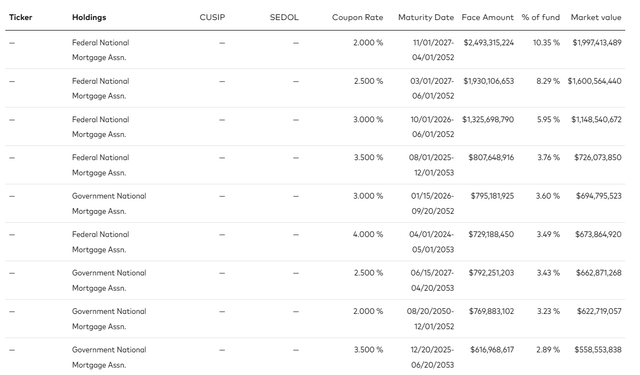

The fund’s top positions are securities issued by various agencies.

vanguard.com

Peer Comparison

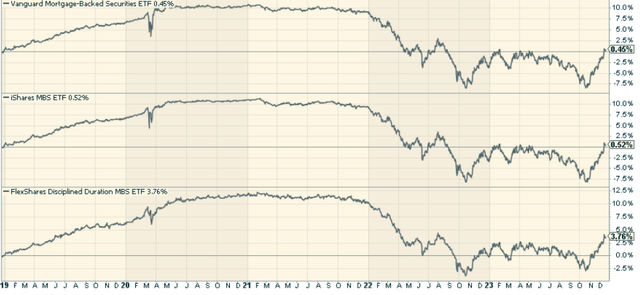

Comparing VMBS to its peers, such as the iShares MBS ETF (MBB) and the FlexShares Disciplined Duration MBS ETF (MBSD), provides further insight into its performance. While all these funds have experienced a decline during the monetary tightening cycle, VMBS demonstrates lower volatility due to its higher quality, government-backed securities.

stockcharts.com

Pros and Cons of the Investment Theme

Investing in the VMBS ETF holds both advantages and potential risks. On the positive side, the fund offers steady income, low credit risk, and diversification benefits. The fund’s focus on agency MBS, which are guaranteed by government agencies, ensures a lower default risk compared to corporate or non-agency MBS.

However, VMBS is susceptible to interest rate and refinancing risks. When interest rates rise, the prices of existing bonds fall, leading to capital losses for bondholders. Furthermore, when rates fall, homeowners are more likely to refinance their mortgages, leading to prepayment of securities and reinvestment at lower rates.

Conclusion

Vanguard Mortgage-Backed Securities Index Fund ETF Shares offers a unique blend of stability and income potential. Backed by the trusted Vanguard brand, this fund provides an effective hedge against equity market volatility. While it carries inherent risks associated with interest rate fluctuations and refinancing, the fund’s diversified portfolio and focus on agency MBS help mitigate these risks.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).

Read the full article here