Investment Thesis

The US dollar has been underperforming recently, including against the EUR, GBP, and CHF. The DXY index is down over 2% so far this year, experiencing a drop of up to 3.5% in the last seven months. Various factors contribute to the dollar’s weakness, such as slowing US inflation, increased hawkishness from the ECB and BoE, speculation on the BoJ’s yield curve control changes, and global economic softening. However, I believe the dollar offers an attractive value proposition at current levels. Recent economic data suggests the dollar is not as overextended as it was in September 2022, particularly in relation to the EUR and GBP. The eurozone’s and UK’s weaker economic data compared to the US will make it challenging for the ECB and BoE to maintain higher interest rates for longer, while the Fed is well positioned to out-hawk other central banks in the process.

About USDU

The WisdomTree Bloomberg U.S. Dollar Bullish Fund ETF (NYSEARCA:USDU) is an exchange-traded fund that offers investors exposure to a strategy designed to benefit from a bullish outlook on the US dollar. The fund aims to track the performance of the Bloomberg Dollar Total Return Index, which measures the value of the US dollar against a basket of major global currencies.

Investors can utilize USDU in their portfolios in several ways. Firstly, the fund can act as a hedge against currency risk for those who hold foreign investments. During periods of US dollar strength, USDU’s performance can offset potential losses in foreign investments due to adverse currency movements. Secondly, USDU can serve as a tactical play for investors who anticipate a strengthening US dollar. Lastly, investors can use USDU as part of a diversified strategy to manage overall portfolio risk.

It’s important to note that like any investment, USDU carries inherent risks. The fund’s performance is directly linked to the US dollar’s movements, which can be influenced by factors such as changes in interest rates, economic indicators, and geopolitical events. Additionally, currency markets can be volatile and subject to sudden shifts, which may impact USDU’s returns.

For more details on USDU, please check the fund’s factsheet.

From Floundering to Flourishing: Bullish USD Flags

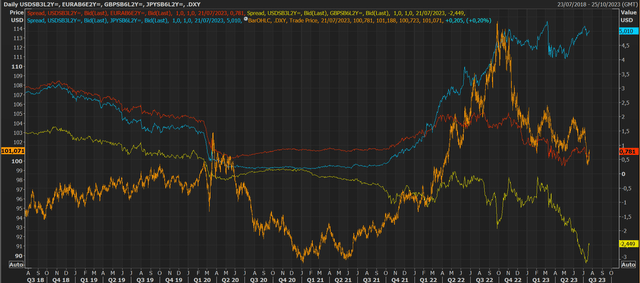

The US dollar has been underperforming against a basket of developed market currencies, including the EUR and the GBP since the beginning of the year. At the time of writing this article, the DXY index is down slightly over 2% and has experienced a drop of as much as 3.5% in the first seven months of the year. However, the loss is much higher if accounted for from the Q4 highs. Various factors have contributed to the dollar’s weakness, such as slowing inflation in the US, increased hawkishness from the European Central Bank (ECB) and the Bank of England (BoE), speculation surrounding the yield curve control changes at the Bank of Japan (BoJ), as well as softening economic growth around the world.

Refinitiv Eikon

While the dollar might have been overextended back in September 2022, I don’t think the same thing can be said of it today in light of the most recent economic data coming out of the rest of the world. The eurozone’s economic data has been weaker than expected compared to the US, which has been exceeding expectations. As a result, the Eurozone is in a weaker position to maintain higher interest rates for longer in my opinion. On the other hand, the Fed is in a better position to pursue a more hawkish stance in the coming months, which will ultimately have negative repercussions for the EUR relative to the USD.

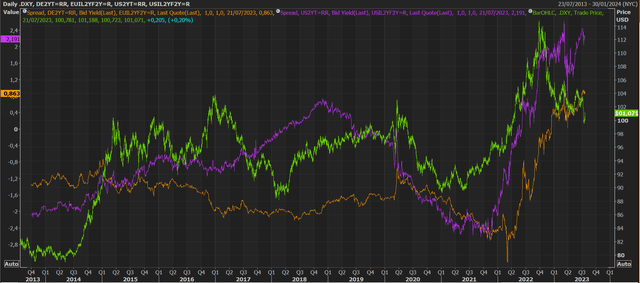

Bloomberg

Regarding the GBP, the market reaction to stickier-than-expected inflation prints in the UK has turned out to be another headwind for the dollar in the short term. However, the two-year interest rate swap differential between the USD and GBP recently reached its lowest level in decades, which suggests a positive signal for a short-term bottom in the dollar. I don’t believe that the Bank of England will be able to outpace the Fed in terms of hawkishness during this cycle due to the UK’s precarious fiscal position. Similar movements, although not as significant, have been observed in the EUR and CHF, and I anticipate both currencies will follow a similar path to the GBP. Meanwhile, the Bank of Japan has consistently disappointed traders who were betting on a more restrictive approach to their yield control policy.

Refinitiv Eikon

Adjusting for inflation, the spread in the reels between the USD and the EUR has increased in favor of the USD recently, which is something that will put a lot of pressure on EURUSD bulls going forward. The USD selloff provides a good entry point to add to some long USD exposure and unless we’re about to see a meaningful divergence in reels where the EUR outpaces the USD, I believe that the USD is attractively valued at recent levels.

Refinitiv Eikon

Key Takeaways

The USD index dollar has been underperforming so far this year, particularly when compared to the EUR, GBP, and CHF. Since the start of the year, the DXY index has experienced a decline of more than 2% and has dropped as low as 3.5%. The dollar’s weakness can be attributed to various factors, including a slowdown in US inflation, the ECB and BoE adopting a more hawkish stance, speculation surrounding the BoJ’s yield curve control adjustments, and a softening global economy. Despite these headwinds, I believe that the USD holds an appealing value proposition at its current levels. Recent economic data indicates that the dollar is not as overextended as it was in September 2022, particularly when compared with the EUR and GBP. With weaker economic data in the Eurozone and UK, the ECB and BoE may struggle to maintain higher interest rates, while the Fed is well-positioned to out-hawk them.

Read the full article here