Charles Schwab overview

July 16th ended up being a rather unpleasant day for shareholders of The Charles Schwab Corporation (NYSE:SCHW). I say this because, after the market opened, shares of the company plunged nearly 9%. This came about even though management exceeded analysts’ earnings forecasts when it came to second quarter earnings data that was released leading up to that point.

The headline news was that this pain was driven by management’s decision to move in the direction of reducing debt over buying back stock. But likely, there were other contributors as well. For instance, revenue came in $10 million lower than what analysts were hoping for. Even more significant than this was the fact that the number of new brokerage accounts the company booked for the month of June, which was also reported with the earnings release, was the lowest the company had seen since November 2023. Add on top of this a continued slide in bank deposit account balances, and I’m not terribly surprised by the market’s reaction.

Despite the problems that Charles Schwab is facing, the company is not a bad one for investors to be interested in. But at this point, it’s no longer a great opportunity. I made this clear to my readers when I last wrote about the company in April of this year. Even though I acknowledged that analysts were predicting weakness for the firm leading into its first quarter earnings release, I argued that the company still made for a “hold” prospect.

Since then, the market has pushed back on this assessment, pushing the stock down now by 0.4%. That stacks up poorly against the 9.6% increase seen by the S&P 500 over time. But when you look at all the good aspects of the company, I do think that this assessment is still logical.

The good and the bad

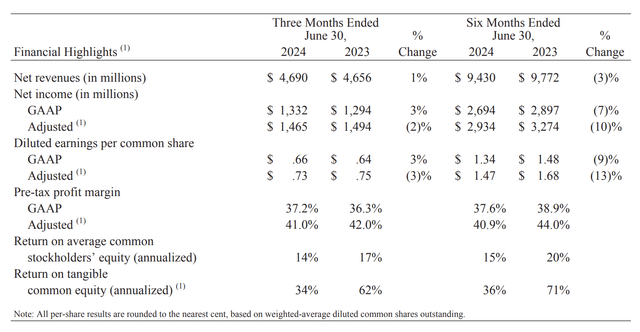

As has been the case for quite a few months now, Charles Schwab continues to be a story of both good and bad. One example of the bad can be seen by looking at revenue reported for the second quarter of the company’s 2024 fiscal year. Although sales increased from $4.66 billion to $4.69 billion, the revenue reported for the second quarter this year came in $10 million lower than what analysts anticipated. Certainly, that weighed on how the market is viewing the company at this point.

The Charles Schwab Corporation

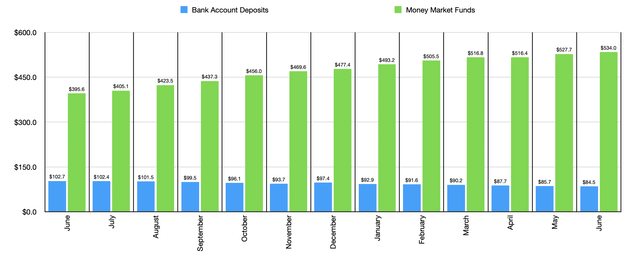

There are, of course, some other negative aspects to the company that warrant attention. Near the start of this article, I mentioned that bank deposit account balances have been on the decline. For the month of June, these came in at $84.5 billion. Although that sounds like a tremendous amount of money, that’s down from the $85.7 billion reported just one month earlier. And it marks a significant decline from the $102.7 billion the company had on its books one year earlier. In fact, in every single month during this window of time, except for the time from November of last year to December of last year, there has been a sequential decline in bank deposit account balances.

Author – The Charles Schwab Corporation

The fact of the matter is that high-interest rates have made it more appealing for depositors to look elsewhere to allocate their capital. Many financial institutions have addressed this by raising interest rates. But that often results in a contraction of the net interest margin. This is not to imply that everything has been bad. Money market funds can be a valid alternative for those looking for higher yields. While they do have some restrictions to them, they also have some similarities to traditional bank deposit accounts. During June, these totaled $534 billion. This was up from the $527.7 billion reported just one month earlier, and it was a significant improvement over the $395.6 billion reported one year ago.

The downside to this is that they also tend to be fairly unprofitable. During 2023, for instance, Charles Schwab generated average fees of only 0.26% each year from these assets.

As I mentioned earlier, another negative, at least according to the market, is the fact that the CFO of the company, Peter Crawford, stated that the business may look at reducing its bank level debt in lieu of stock buybacks. He even went so far as to say that stock buybacks are “on hold.” With interest rates high and $22.45 billion in long-term debt on its books, I would say that this is not terribly surprising.

Even though there were negative aspects to the company, this does not mean that everything was negative. There were some positive things as well. During the quarter, the company generated earnings per share of $0.66 and adjusted earnings per share of $0.73. These stack up against readings of $0.64 and $0.75, respectively, reported the same time last year. Even though adjusted earnings per share fell short of what was seen in the second quarter of 2023, the reading for the company did still come in $0.01 above what analysts had forecasted. Meanwhile, GAAP earnings were $0.02 above what analysts anticipated. While the reduction in adjusted earnings per share brought adjusted net profits down from $1.49 billion to $1.47 billion, official earnings rose from $1.29 billion to $1.33 billion.

Author – The Charles Schwab Corporation

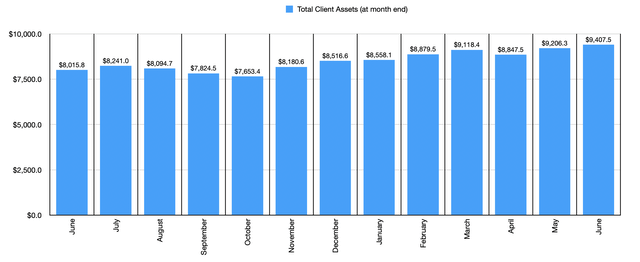

Outside the income statement, there were some other interesting developments that investors should be aware of. For starters, total client assets on the company’s books hit $9.41 trillion. That’s an astronomical amount of money, and it represents a sizable increase over the $9.21 trillion reported in May. It also happens to be 17.4% above the $8.02 trillion reported for June 2023.

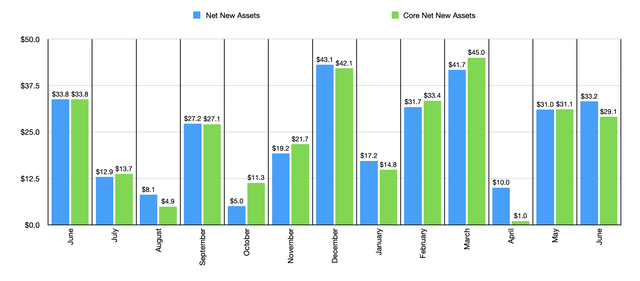

Most of this increase (month-over-month) can be attributed to $168 billion of net market gains as market indices reach fresh new highs. However, the company did benefit from $33.2 billion in net new assets, with core net new assets rising by $29.1 billion. These numbers are well within the historical range that the company has experienced. In fact, net new assets seen in June were higher than all but three of the last 12 months. And core net new assets were higher than all but five of the last 12.

Author – The Charles Schwab Corporation

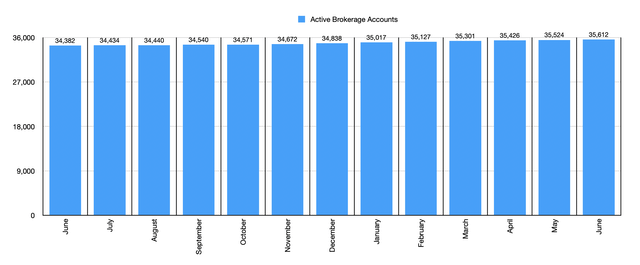

This growth was made possible in part by a rise in active brokerage accounts to an all-time high of 35.61 million. That’s 88,000 above what was seen just one month earlier. It also represents an increase of 1.23 million, or 3.6%, over the 34.38 million reported in June of last year.

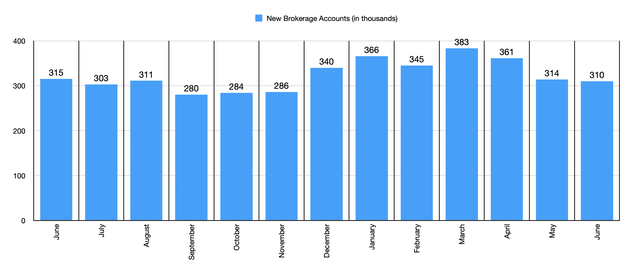

To be clear, this is different from the number of new brokerage accounts. Total new brokerage accounts, including those that are both active and inactive, grew by 310,000 for the month. While this is also within the historical range for the company, it did represent the weakest showing since the 286,000 reported in November of last year. That is a slight negative in my book.

Author – The Charles Schwab Corporation Author – The Charles Schwab Corporation

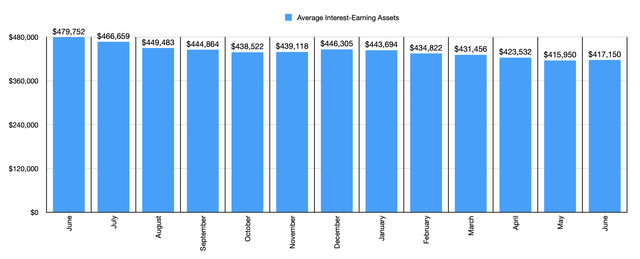

The last thing I would like to touch on here involves average interest earning assets. These are the assets that actually earn interest revenue for the company. These do fluctuate from quarter to quarter. And in general, there has been a decline over the past year or so. From June 2023 through May of this year, there was a drop from $479.75 billion to $415.95 billion.

Even though this downward trend is a net negative for the company, it is worth pointing out that there was an improvement to $417.15 billion in June. That represents the first sequential increase since we saw an improvement from November of last year to December. Given how these amounts can bounce around some, it’s too early to say that this marks the start of a turnaround for the company. But investors should take with they can get.

Author – The Charles Schwab Corporation

Takeaway

I understand why the market was unhappy with the data that came out from management. However, I do think that Charles Schwab is a solid and healthy company that, eventually, should do quite well for itself.

This does not, however, make the company an attractive investment in my book. While that was once the case, I do think that some deterioration in parts of The Charles Schwab Corporation business have impacted value.

That is why I have the company rated a “hold.” And even after seeing the most recent data provided by management, I don’t think the picture has changed enough to warrant any change to that assessment.

Read the full article here