A month ago, I entered UiPath (NYSE:PATH) as my selection in Seeking Alpha’s Top 2024 Long/Short Pick investment competition, writing that the stock was set to benefit from seeing reaccelerated growth and more efficient sales and marketing. With the stock up nearly 40% in the past month before we even get to 2024, let’s catch up on the name and its most recent earnings that came after my initial write-up.

Company Profile

As a quick reminder, PATH offers an AI-powered automation platform that allows its clients to build automation that uses software robots to perform a variety of business tasks, such as logging into applications, updating information fields & databases, filing forms, and document understanding. Its platform has three primary categories. The Discover category revolves around task mining; Automate is centered on low and no code to create apps; and Operate centers around test suites and analytics.

The company offers a number of industry and department-specific solutions that are sold both through a subscription model and well as through term licenses. Its solution can be deployed either via SaaS or on-premise.

Q3 Results

PATH saw its shares skyrocket shortly after my write-up when the company reported strong Q3 results at the end of November. Following its report, the stock rose 26.0% in the next session.

For the quarter, PATH grew revenue by 24%, or 23% excluding currency impacts, to $325.9 million. That easily topped the analyst consensus calling for revenue of $315.5 million.

Subscription revenue climbed 29% to $167.5 million, while license revenue jumped 25% to $148.1 million. Professional service revenue fell -28% to $10.3 million.

Annualized Renewal Run-rate (“ARR”) increased by 24% to $1.378 billion. The company added $70 million on new ARR in the quarter. The company’s ARR came in above its guidance of $1.359-1.364 billion.

Dollar-based net retention came in at 121%, or 123% excluding FX. This is similar to the 121%, or 125% excluding currency impacts, it reported in Q2 and 122%, or 127% excluding currency impacts, it reported in Q1.

PATH ended the quarter with 10,865 customers. That was actually down from 10,890 in Q2, although customers with $1 million or more in ARR were 264 versus 254 in Q2 and customers with $100,000 or more in ARR increased to 1,974 from 1,930 a quarter ago.

Remaining performance obligations (“RPO”) jumped 31%, or 29% excluding currency, to $995 million. The current RPO was $599 million.

Gross margins came in at 84.7%, up 100 basis points. Subscription and license gross margins were 90.0%, down -40 basis points.

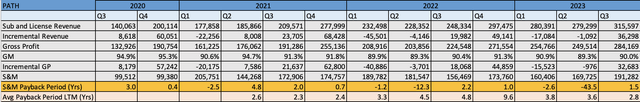

Looking at Sales & Marketing efficiency, PATH continued to lower its last twelve-month payback period on its S&M spent back toward its 2021 levels. This is a strong and continued improvement.

PATH Sales & Marketing Efficiency (Filings & Self)

Turning to the balance sheet, the company ended the quarter with $1.8 billion in cash and marketable securities. It has no debt.

PATH generated $42 million in operating cash flow in the quarter, while adjusted free cash flow, which excludes some one-time items, was $44 million.

Looking ahead, the company guided for Q4 revenue of between $381-386 million, which would be a 24.3% increase at the midpoint. It projected ARR to be between $1.450-1.455 billion. It is looking for an adjusted operating income of $78 million.

Discussing the company’s reaccelerated growth earlier this month at Barclay’s conference, CFO Ashim Gupta said:

“Our growth rate reflects really the tangible strength and technological strength of our platform as well as the execution by the entire UiPath team, especially go-to-market. When you peel that back, again, our ability to take the strategy and execute, whether that’s bringing the conversation to the C-level, several marquee deals in the quarter, continuing to drive strong customer growth, particularly at the top end of $1 million-plus and $100,000-plus customers. And then seeing the leadership changes that we made early, especially in certain verticals, like public sector, seeing those take root. That really is there. So execution is really a large part of our quarter. When you look at the macroeconomic environment, we continue to see it as variable. It’s been consistently variable. As much of the oxymoron as that may sound, [there has been a] disproportionate impact on the lower end of the market, meaning small and midsized companies in our emerging enterprise segment, but we have seen strength in enterprise. And that strength is also where there is ROI. Feedback from our customers is they’re willing to invest where there’s an ROI, and we’ve demonstrated that as a company.”

This was a great quarter from PATH that once again showed accelerating growth. After only growing revenue 6.5% in Q4 of 2022, PATH has now accelerated its growth each quarter in 2023 so far, and if it just hits the top end of guidance, it will have accelerated revenue growth each quarter of 2023.

While that is impressive, what is more impressive is that it also comes with much better sales & marketing efficiency, strong cash flow, and lower G&A expenses. With the company still in the early days of its SAP (SAP) partnership and an increasing interest in AI, I’d expect the company to have the potential to settle into a low to mid 20% revenue growth range in 2024.

Valuation

SaaS companies are generally valued based on a sales multiple given their high gross margins and the companies wanting to pump money back into sales and marketing to grow. PATH has gross margins in the mid-80% range.

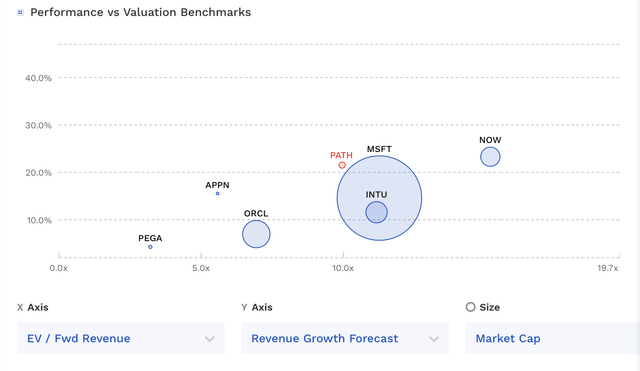

On that front, PATH is valued at an EV/S ratio of about 8.2x based on the FY 25 (ending January) consensus for revenue of $1.53 billion. Based on the FY26 sales consensus of $1.79 billion, it trades at an EV/S multiple of 7.0x.

Revenue is projected to grow 18.9% in FY25 and 17.4% in FY26.

From an EBITDA perspective, it trades at 45x the FY25 consensus of $279.2 million and 36x the FY26 consensus of $349.6 million.

PATH Valuation Vs Peers (FinBox)

If PATH can achieve the low to mid 20% revenue growth I think it can achieve in 2024, that would push its revenue to around $1.58 billion. A 10-11x multiple of that, which would be appropriate given its growth, and another $200 million in additional cash on the balance sheet from its strong FCF generation, would equal $31.50-$34.00 fair value.

Conclusion

When a stock pick goes up nearly 40% in a month, it’s a great thing but also a dilemma. As an investor, I’m usually looking for a slow march toward a price target, which eventually grows with time and execution as well. When much of the gains come suddenly, you have to decide to lock in quick profits or hold onto a stock where in this case the multiple has expanded. I never think it’s a bad idea to bank some profits, and that is a prudent investment strategy, especially in a tax-friendly account like an IRA.

As for PATH, I’m going to keep my “Buy” rating and boost my price target slightly from $30 to $31.50. You don’t see many growth stocks that are experiencing re-accelerating revenue growth in the current macro-environment that are also doing it in a more efficient manner. To me, that deserves a premium in this market. The company has done a great job of growing within customers, and I think with some recent new partnerships new customer growth should also begin to pick up, which would be a nice combination to power growth.

The biggest risk to the stock would be a slowdown in growth, which can cause the multiple of high-growth stocks to greatly compress. Quickly changing technology is both an opportunity and a risk, while PATH is not completely immune to the macro-environment, as well.

Read the full article here