Summary

This post is to provide my thoughts on the Topgolf Callaway Brands Corp. (NYSE:MODG) business and stock. I recommend a buy rating based on its robust financial performance, ability to withstand inflationary pressures through pricing power, and optimistic growth outlook driven by the aging US population and a new demographic that is seeking unique and unconventional entertainment experiences.

MODG is a prominent company in the modern golf and active lifestyle industries. They provide golf entertainment, produce premium golf gear, and sell golf and active lifestyle clothing and accessories. Over the past four years, MODG has demonstrated impressive growth, with a remarkable revenue CAGR of 24%. In 2022, their reported revenue reached $3.95 billion, compared to $1.7 billion in 2019, reflecting an impressive growth rate of approximately 135%. Furthermore, their EBITDA margin has consistently improved, rising from 12% in 2012 to 14% in 2014. Remarkably, even in the current high-inflation environment, MODG’s higher margin in 2022 has displayed its pricing power, with the ability to pass on increased costs to consumers without experiencing a significant decrease in demand. This exceptional performance sets MODG apart, as they continue to achieve strong double-digit revenue growth despite prevailing uncertain economic conditions.

Investment thesis

The results for the second quarter were strong. In this quarter, sales reached ~$1.18 billion. To break it down further by segments, Topgolf sales were $481 million, Balls contributed $111 million, Apparel added $144 million, Gear accounted for $114 million, and Clubs generated $340 million in sales. The increase in adjusted EBITDA, approximately $206 million, can be credited to revenue growth and improved operational efficiency at Topgolf venues.

MODG’s Callaway brand specializes in golf equipment and operates within an oligopoly golf equipment industry, alongside key players like Callaway, TaylorMade, Mizuno, Titleist, and Ping. This unique position gives it noticeable pricing power in the golf equipment market. This pricing power is further strengthened by the consistent and enduring demand for golf equipment, driven by the aging US population and the increasing number of newcomers to the sport.

Demographic shifts in the US, particularly the aging population, provide substantial support to the golf equipment business. As people age, their interest in golf tends to grow, resulting in a statistically higher number of golf rounds played. This demographic shift creates a larger target market that is also willing to invest more in golf equipment, ultimately increasing demand and boosting revenue growth. The company is well-placed to take advantage of these favorable demographic trends. These advantageous factors, combined with MODG’s strong presence in the market, empower the company with significant pricing influence, which in turn contributes to revenue growth.

TravisMathew, a company specializing in golf attire, is still in the early phases of its growth journey since being acquired in 2017. During this period, the brand has gone through significant expansion, consistently achieving y/y growth rates surpassing 10%. In the year 2022 alone, this segment saw remarkable growth, registering an impressive 29% increase. Over the past four years, its revenue has consistently maintained a robust CAGR of 11%. This underscores the brand’s adeptness at gaining a larger market share and satisfying consumer demand effectively. With such a remarkable growth trajectory and minimal signs of slowing down, the clothing business exhibits its potential to sustain its upward momentum.

TravisMathew had double-digit growth again this quarter. The brand continues to successfully open new retail stores, including five year to date and totaling 46 overall. 2Q23 earnings results call

In addition to their golf equipment and apparel lines, MODG’s Topgolf, a golf driving range game, has experienced substantial growth in off-course participants. This new demographic is composed of individuals who are seeking unconventional and distinct entertainment experiences, moving away from the traditional golf course setting. This strategic expansion has not only broadened MODG’s customer base but has also tapped into a group of individuals who may not have previously identified as regular golf enthusiasts. Consequently, the company has witnessed a remarkable increase in its revenue streams and a significant expansion of its market presence. In 2022, Topgolf reported 42% top-line revenue growth. The consistent rise in off-course participation underscores MODG’s prowess in adapting to shifting consumer preferences and catering effectively to a diverse and ever-evolving audience.

We’ll start by discussing Topgolf. This is a business which is expected to add 3 million to 4 million new off-course golf participants each year for every 11 new venues and thus will help drive growth across the entire modern golf ecosystem. With this growth, Topgolf will soon have more consumers visiting it than exist in all of U.S. on-course golf, including one-half of the total on-course golf population as many now participate in both on and off course golf. 2Q23 earnings results call

Valuation

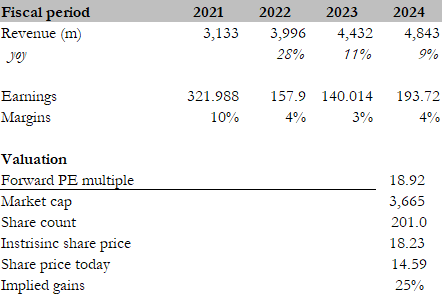

I believe the fair value for MODG based on my DCF model is $18.23. The shifting demographics in the US, particularly the aging population, provide significant support for the golf equipment industry. I believe the broader target market and increased willingness among older individuals to invest in golf equipment will drive up demand and revenue growth.

Additionally, MODG’s Callaway brand holds a prominent position in the golf equipment industry, benefiting from the oligopoly market structure. This advantageous position has given the company substantial pricing influence, contributing to revenue growth. Furthermore, the rising popularity of the golf driving range game has led to a notable increase in revenue and a substantial expansion of its market presence in MODG’s Topgolf segment.

In comparison to peers like Acushnet (GOLF) and Mizuno (OTCPK:MIZUF), the median forward PE multiple peers are trading at is 17.87x, the median expected NTM revenue growth rate is 2%, and the median EBITDA growth is 4%. MODG’s higher valuation can be attributed to its higher NTM revenue growth rate of 13% and EBITDA growth rate of 12%. Therefore, using its current forward PE of 18.92x, my target share price is $18.23. Looking at the strength of its financial performance in the golf equipment, apparel, and range game segments, which is driven in large part by the changing demographics and its strong pricing power, I recommend a buy rating.

Own calculation

Risk

Demand for sports goods in general and golf products in particular due to an aging population may be less sustainable than expected, which could lead to a significant decline in demand for MODG’s products. The return to normal levels of demand for Topgolf may be delayed or negatively impacted for a number of reasons, such as the emergence of new COVID variants, government restrictions related to COVID, or a sluggish return to office, which would likely harm corporate event demand.

Conclusion

In conclusion, MODG reported a strong second quarter result, which was characterized by significant growth in its Topgolf, apparel, and golf equipment segments. The company’s Callaway brand leverages its unique position in the oligopoly golf equipment industry, benefiting from steady demand driven by demographic shifts, particularly the aging US population. Additionally, the oligopoly structure provides pricing power to MODG, allowing them to drive revenue growth.

Furthermore, MODG’s Topgolf segment has experienced substantial expansion, attracting off-course participants seeking distinctive entertainment experiences. This diversification has broadened the customer base and resulted in substantial revenue growth. The prospect of continued growth is promising, as Topgolf is anticipated to draw more visitors than the entire population of traditional on-course golfers in the US, including those engaged in both on-course and off-course golf activities.

Considering these factors, I recommend a buy rating, underpinned by the robust growth and promising future outlook across MODG’s golf equipment, apparel, and range game segments.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here