I have been bullish on the iShares TIPS Bond ETF (NYSEARCA:TIP) for the past two years for two main reasons. Firstly, my belief that quantitative tightening will have to reverse to prevent a fiscal crisis due to the extreme level of government debt and high deficits. Secondly, my belief that trend real GDP growth will weaken, driving down real policy rates. Despite a slowdown in growth and a continued deterioration in the fiscal accounts, real yields have continued to rise in part due to a still-strong risk appetite. While the 2.6% real yield on the TIP is extremely high relative to the long-term sustainable rate, the recovery in stocks and credit spreads over the past two weeks has eased financial conditions, reducing the probability of early rate cuts. This posed a near-term risk to the TIP and may result in an even more compelling buying opportunity.

The TIP ETF

The TIP tracks the performance of US Treasury inflation-protected securities, with a weighted average maturity of 7.1 years and an effective duration of 6.5 years, which puts the TIP in the mid-range in terms of duration and volatility across the inflation-linked bond universe. The current real yield on the TIP of 2.6% is what investors should expect to receive per year over the long term after inflation, less the fund’s expense fee of 0.19%. However, a move back to zero real yields over the next two years as I expect would result in total returns of almost 25% after inflation.

There are other inflation-linked bond funds that offer greater upside from a decline in real yields, such as the PIMCO 15+ Year US TIPS ETF (LTPZ) on which I am also bullish, but the TIP is preferable for investors seeking lower volatility. For those looking for lower duration and volatility, there are various short-term inflation-protected ETFs that offer higher real yields but with less upside potential. The TIPS main competitor is the Schwab US TIPS ETF (SCHP) which has a lower expense fee of just 0.03% and is preferable to buy and hold investors but has lower liquidity and a higher bid/ask spread.

Are Bonds Driving Risk Or Risk Driving Bonds?

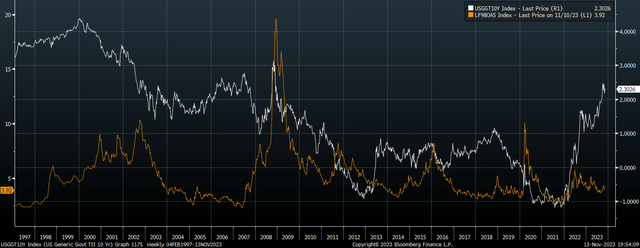

In my most recent article on the TIP from the end of September I argued that declining risk asset prices could start to put downside pressure on rate expectations and real yields, benefitting the TIP. Since then, however, risk assets have largely shrugged off rising yields, and the slight easing in real yields seen earlier this month on the back of the relatively dovish Fed meeting appears to have triggered a breakout in stocks. If risk sentiment remains strong it will make it difficult for the Fed to ease rates as markets expect in H1 2024. As the chart below shows, previous easing cycles have only begun after spikes in credit spreads caused rising fears of deflation and recession.

US 10-Year TIPS Yield Vs High Yield Credit Spreads (Bloomberg)

Even the relatively proactive rate cuts seen in September 2007 came only after a 200bps rise in high yield credit spreads driven by financial sector stress. Furthermore, at that time inflation was running at around 2% compared to 3.6% now.

The Longer Real Yields Stay Elevated, The Longer They Will Have To Fall

As expectations of higher for longer rates have risen, the economy’s ability to withstand high real yields has continued to decline. Despite still-strong headline GDP growth, the fiscal deficit remains above 6% and the debt to GDP ratio continues to rise. Meanwhile, the Conference Board’s Leading Economic Indicator continues to point to a recession in 2024. Even a small downturn would exacerbate the already dire budget balance.

Some analysts have argued that the rising Treasury supply, necessitated by high deficits and rising interest costs, will lead to further increases in real yields as investors apply a risk premium to Treasuries. However, it seems much more likely that continued fiscal deficits and surging interest payments will force a reversal of quantitative tightening, driving down bond yields and driving up inflation expectations.

The longer real yields stay elevated, the larger the ultimate decline will have to be to prevent a fiscal crisis. Even at an effective interest rate of just 3.5%, Treasury interest costs are already almost 20% of Federal tax revenues, and at 5% rates this would rise to 28%. Such high interest costs would necessitate a dramatic decline in real yields to prevent debt and interest costs from spiraling out of control.

The main long-term risk to the TIP comes from an improvement in the real economy which drives inflation expectations further while keeping interest rate expectations elevated. A meaningful decline in inflation expectations would likely require a cut in government spending sufficient to halt the exponential rise in government debt. This would have to be managed without any negative impact on the economy that would drive down interest rate expectations. While not impossible, such a scenario is highly unlikely, and the 2.6% is amply compensation for such risks.

Read the full article here