When it comes to investing, my favorite type of stock to buy over a long period of time is Dividend Stocks, more specifically Dividend Growth stocks.

Today, I am going to show you the TRUE Power of Compounding Dividends and show you how they can increase the value of your account year in and year out. There are a few additional things that you, the investor, can do to speed up this process as well, which we will touch on in today’s piece.

I often say, The Power of Compounding Dividends cannot be denied. After all, Albert Einstein, speaking to the idea of Compounding, he referred to it as the 8th wonder of the world:

COMPOUND INTEREST is the eighth wonder of the world. He who understands it, EARNS IT. He who doesn’t, PAYS IT.”

So with that being said, I am here to show you just how Compounding Dividends can and have worked for investors over the years.

Common Misconceptions About Dividend Investing

When it comes to dividend investing, there are a lot of misconceptions. Far too often, new investors or those unfamiliar with dividend investing, claim that the “yields are too low.” First off, the dividend and its corresponding yield are just part of the total return equation with dividend stocks. Dividend stocks, like any growth stocks, fluctuates in value.

Secondly, there are dividend stocks that pay growing dividends, which help speed up the process of compounding, something I will show you more below. Companies are sharing their profits with you, which you can turn around and use that income to buy more shares.

Dividend investing takes patience, as it is not a get rich quick scheme. I care less about the year 1 dividend income and more about the year 10+ dividend income after years of compounding and increasing my share count along with a growing dividend.

A third common misconception around dividend investing is the thought to chase high yields. Usually stocks with high yields can present a trap. As I will touch on in a second, a dividend yield has an inverse relationship with a stock price, however, if the stock price drops drastically due to something within the underlying business has changed, the yield will skyrocket higher. If something negatively impacted the business, which could result in lower revenues and/or cash flows, this could impact the company’s ability to pay their dividend. This in turn could result in a yield trap, where investors chase high yields that are not sustainable or safe.

The Power of Compounding Dividends

Dividend Stocks are companies that share their operating profits with its owners, which is you the stockholder. When you invest in any business or any investment, you want to get paid back on your investment and more. Dividends is one way to do this.

Management determines the amount of profits they want to share, which they pay out based on a dividend per share. This dividend per share is used to calculate the dividend yield.

Dividend Yield = Dividend per share / Stock Price

As such, a dividend yield has an INVERSE relationship with the stock price. So, when you invest in a dividend paying stock you will receive a dividend, usually on a quarterly basis, but some stocks, like Realty Income (O) pay investors on a MONTHLY basis.

The moment you get paid a dividend, the compounding effect happens when you use those dividends to add more shares, so the next year, you have more shares meaning your dividend income rises.

When you are investing in dividend growth stocks, which are stocks that regularly increase their dividend per share, those subsequent years you have more shares plus a HIGHER dividend per share amount, you can see how that compounding effect and that Dividend Snowball starts building faster and faster in your favor.

The best part, you are adding more shares without having to add more cash to your investing account. You are letting the dividend income add more shares. Yes, it will be small initially, but if you stick with it, it starts growing faster and faster. This is the same approach Warren Buffett has used over the years.

Now, if you are doing this while ALSO adding new money to your accounts, you will put this compounding process into overdrive because the dividend income adds new shares AND the fresh money is adding new shares to go along with growing dividend per share from the company.

Hopefully that makes sense, but for those of you that are visual learners, let’s take a look at some tables I put together with some hypothetical situations first and then a few real life examples.

Example #1 – 10% share growth & 12% Dividend Growth

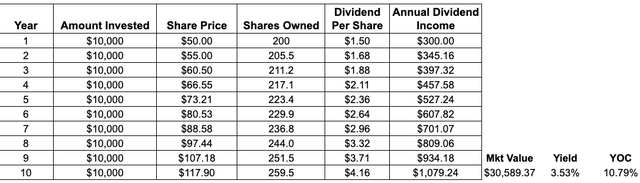

This first hypothetical example we are going to look at will be investing $10,000 in year 1 and then NEVER add another dime to our account except by reinvesting our dividend income for 10 years.

Created by author

We are investing $10,000 into Stock A, which currently trades at $50 per share, so that buys us 200 shares. Stock A pays a 3% Dividend Yield, which equates to $1.50 per share to start, earning us $300 in Year 1 Dividend Income. In this example, for simplicity purposes, we will say the stock grows an average of 10% per year and the dividend grows at a 12% clip. Realistically, stocks will go through peaks and valleys but in this example we will say a 10% average growth rate.

In year 2, the stock price will grow from $50 to $55 and we will use the $300 we earned in year 1 dividend income to buy an additional 5.5 shares, so now we have more shares. In year 2, Stock A increased their dividend from $1.50 to $1.68 per share, so with our 205.5 shares, we will earn a dividend income of $345.

Over the course of 10 years, utilizing this same process, we see our share count grow from 200 in year 1, to nearly 260 shares by year 10. We have added an additional 60 shares without adding any new fresh money to our account. In addition, the company continued to grow its dividend every year and we have gone from earning $300 in dividend income in year 1, to earning $1,079 in year 10 dividend income.

Example #2 – 8% share growth & 8% Dividend Growth

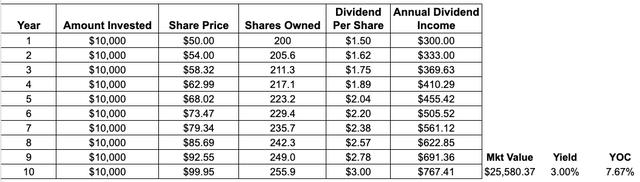

Now, let’s look at a more conservative hypothetical example and do 8% average annual share growth, which is around the average growth of the S&P 500 and then only 8% dividend growth per year.

Created by author

We start with the same $10,000 investment and add NO FRESH money throughout the 10 year period. We start year 1 by earning the same $300 in dividend income but with the stock growing at a slower pace, our compounding adds 5.6 shares the following year and we earn $333 in dividend income by year 2

Fast forward to Year 10, we will be earning $767 in Passive Income with a market value of $25,580.

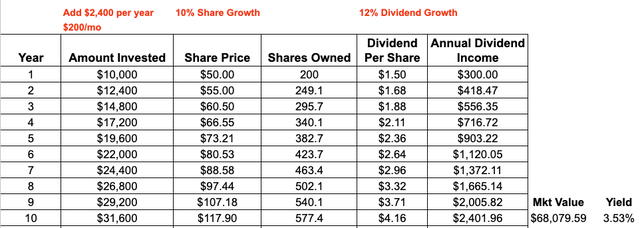

Example #3 – 10% share growth & 12% Dividend Growth & Adding $2,400 in fresh money per year

So now our FINAL hypothetical we will go back to the first situation of 10% share growth and 12% dividend growth, but instead of just the initial investment of $10,000, we are going to add $2,400 per year, which is equivalent to $200 per month.

We are now using dividend income and fresh money to add more shares and put the compounding process into overdrive.

Created by author

Year 1, we will earn the same $300 in dividend income on 200 shares, but that $300 will add 5.5 more shares by compounding our dividend income, but then the additional $2,400 we add will increase our share count by nearly another 44 shares bringing our total to 249.1 shares in year 2. This will generate $418 in year 2 dividend income, up from $300 the prior year.

This will continue year in and year out and you can see in the right column how that dividend income grows at a much faster pace than we saw in other examples. We go from earning $300 in year 1 dividend income, to earning $2,400 in year 10 dividend income with 577.4 shares that have a market value of $68,080. That is the Power of Compounding.

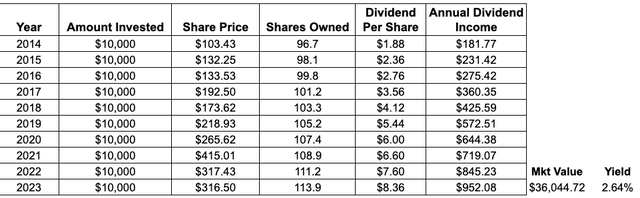

Example #4 – Actual date from The Home Depot (HD)

So those were of course hypothetical examples to kind of show you the concept of compounding. The data shown in the table below, is actual data related to The Home Depot over the past decade.

The Home Depot is a GREAT Dividend Growth stock that not only has offered investors share price growth but also strong dividend growth as well, so investors have enjoyed the best of both worlds. Over these 10 years, HD has an average annual dividend growth rate of 18%.

Created by author

If we were to invest $10,000 and ONLY reinvest the dividends you can see we would receive $182 in year 1 dividend income, which would add 1.5 shares going into year 2 and with the dividend growth our year 2 dividend income jumps to $231. By year 10, you can see our dividend income is $952 and our original $10,000 investment now has a market value of more than $36,000.

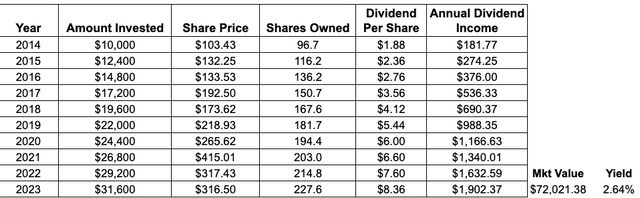

Now, let’s add $2,400 per year to our Home Depot investment and see how things shake out.

Created by author

We start with the same $182 in year 1 dividend income, but you see our shares jump from 96.7 to 116.2 between reinvesting our dividend income and adding shares with FRESH money which has our annual dividend income jump from $182 in year 1 to $274 in year 2 as our share count went from 96.7 to 116.2.

We do this continuously for 10 years and we will be earning $1,900 just from this one SINGLE investment and the investment has a market value of $72,000.

Investor Takeaway

The Power of Compounding cannot be denied. It is a very powerful and proven form of investing.

However, the problem most investors have is being patient enough to let it play out. As long as you are investing in high-quality companies or ETFs that have shown their ability to grow their free cash flow over the years, the compounding effect will take care of itself.

However, it is important to keep up with your investments because if there is an underlying issue with the business and the stock continues to fall, the market value of your entire investment is going to falter. Remember, dividends are just part of the equation when it comes to total returns.

Disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

Read the full article here