I don’t know how many times I have heard the dream of owning a winery from investors of all types over the decades, especially “I want to buy a winery in retirement and live off the proceeds!“

Well, your wish may be granted today, and you can invest a little or a lot into the leading California winery company, The Duckhorn Portfolio Inc. (NYSE:NAPA), which issued shares to the public in 2021. But, unlike trading on the expensive side of the ledger in 2021-23, new capital can be put to work in this diversified, increasing-scale business to start earning a decent rate of return right now. You have partners (other shareholders and management) to run the wineries, while you sit back and wait for capital appreciation (and hopefully a dividend soon) to increase your net worth over time.

It’s really a win-win setup where you can both earn some money and brag to your family, friends and neighbors you are a bigwig winery owner. I purchased a small position this past week. Let me explain why I bought a stake. My summary logic is attractive financial returns on my investment and improving momentum on the trading chart are appearing.

Company Website – Homepage, May 6th, 2024

The Business

According to the company, Duckhorn is North America’s premier luxury wine company, with 11 wineries, 10 state-of-the-art winemaking facilities, 8 tasting rooms and over 2,200 coveted acres of vineyards spanning 38 estate properties. Established in 1976, when vintners Dan and Margaret Duckhorn founded Napa Valley’s Duckhorn Vineyards, today, our portfolio features some of North America’s most revered wineries, including Duckhorn Vineyards, Decoy, Sonoma-Cutrer, Kosta Browne, Goldeneye, Paraduxx, Calera, Migration, Postmark, Canvasback and Greenwing. Retail bottle pricing begins at $20.

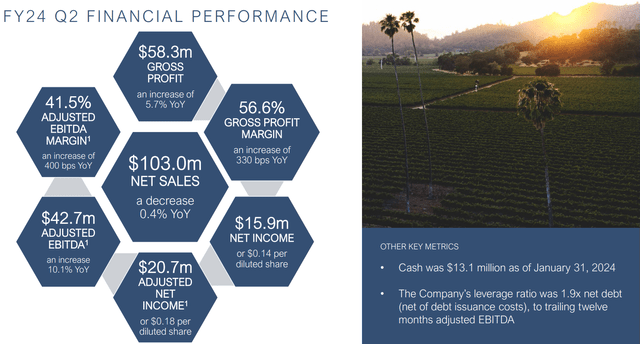

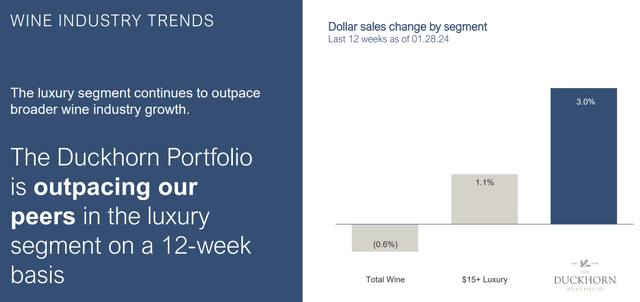

For macroeconomic news, and the main excuse for NAPA’s price slide since 2021, the freewheeling spending spree from pandemic government stimulus has faded. For the wine industry, the boom days of 2021-22 are now returning to normal spending trends. The net effect is industry growth has been flat to negative YoY in 2023 and early 2024.

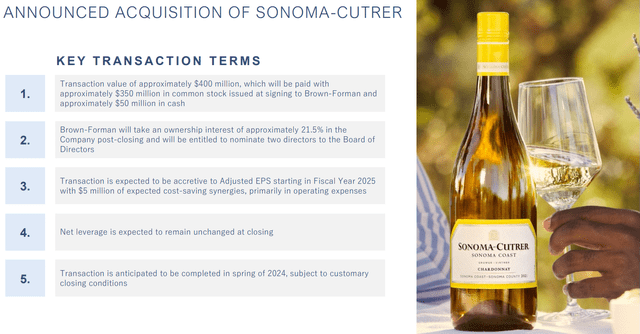

Luckily for Duckhorn owners, management has been able to gain market share, increase profit margins, and just ramped the size of the company through its Sonoma-Cutrer Vineyards acquisition from Brown-Forman (BF.B) (BF.A). Larger economies of scale are projected by management to bring $5 million in cost synergies alongside better pricing leverage with liquor wholesalers.

The Duckhorn Portfolio – Q2 2024 Presentation The Duckhorn Portfolio – Q2 2024 Presentation

The Duckhorn Portfolio – Q2 2024 Presentation The Duckhorn Portfolio – Q2 2024 Presentation

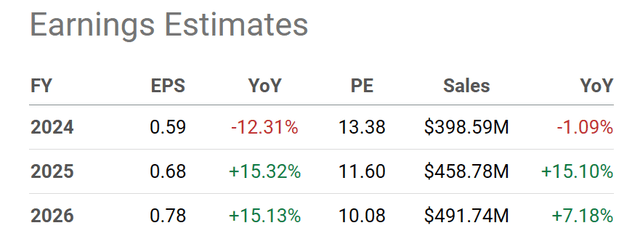

For a forward look at business prospects, analysts are not overly excited about NAPA’s future inside a stagnate wine industry. But, a solid growth forecast is still part of the investment equation. The purchase of assets from Brown-Forman was financed mostly through new stock issuance of 31.5 million units and $50 million in cash. BF now controls about 21% of NAPA ownership.

Seeking Alpha Table – The Duckhorn Portfolio, Analyst Estimates for FY 2024-26, Made May 6th, 2024

Sound Valuation Setup

Despite steadily expanding operating results since the IPO, The Duckhorn Portfolio share quote has declined from its record high of $24 all the way to $7.50 last week. Had you been unfortunate enough to buy in June 2021 and ride it all the way down, the -70% investment loss might have you grumping about ever owning a winery again.

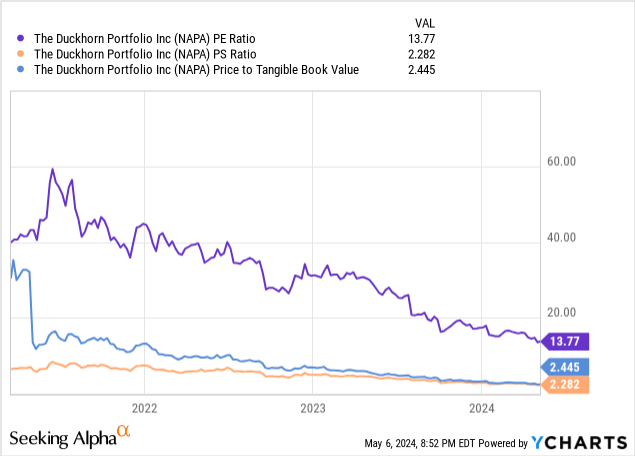

However, the current sub-$8 price is now well worth the price of admission to join the winery ownership club. A trailing P/E of 14x is expected to continue falling toward 10x in 18–24 months (using the analyst estimates above). Plus, a price to “tangible” book value multiple of 2.4x is a uniquely low reading in the distilled beverage sector (pre-asset acquisition), while price to sales of 2.3x is well below both industry benchmarks and overall U.S. equity market averages.

YCharts – The Duckhorn Portfolio, Basic Financial Valuation Ratios, Since 2021

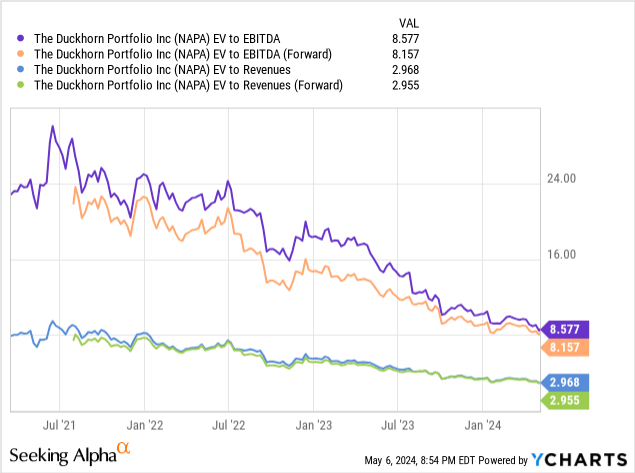

An even clearer bargain setup is found in the enterprise valuation statistics (equity + debt – cash for company worth). In the face of solid underlying business growth, the stock slide from June 2021 has generated a drop of almost 75% in respective EV to EBITDA (8.5x) and Revenue (2.96x) ratios.

YCharts – The Duckhorn Portfolio, Enterprise Valuations, Since 2021

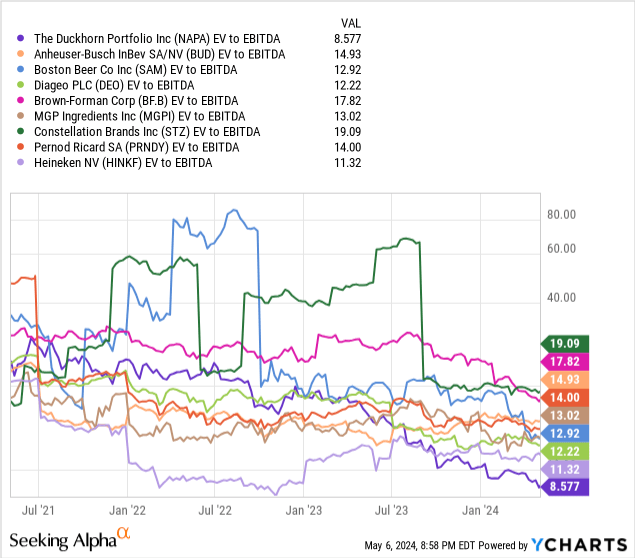

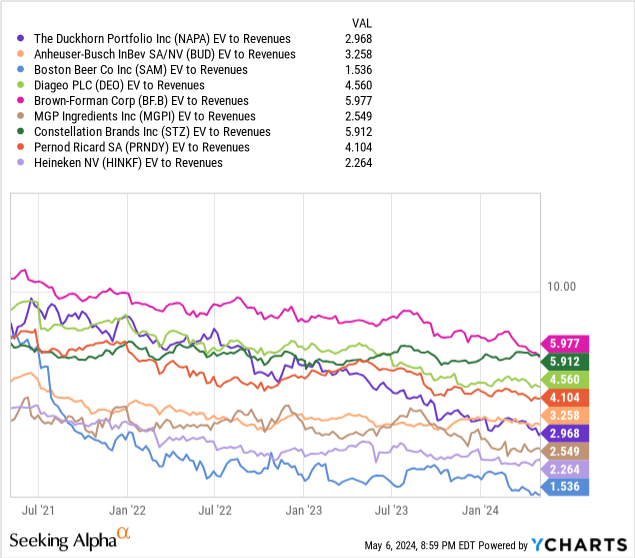

How do the EV readouts compare to peers and competitors? Quite well, thank you. Compared to beer brewers, hard liquor distillers and other wine-maker names, NAPA is becoming a standout buy idea. Below I am comparing EV to trailing EBITDA numbers with Anheuser-Busch InBev (BUD), Boston Beer (SAM), Diageo (DEO), MGP Ingredients (MGPI), Constellation Brands (STZ), Pernod Ricard (OTCPK:PRNDY), Brown-Forman, and Heineken (OTCQX:HINKF). While not an exhaustive list, NAPA has declined from one of the more expensive sector picks to one of the cheapest over the last three years on EBITDA, and from an extended valuation on sales at its IPO to the bottom half of the peer group today.

YCharts – Leading Brewery & Distillery Names, EV to Trailing EBITDA, Since 2021 YCharts – Leading Brewery & Distillery Names, EV to Trailing Sales, Since 2021

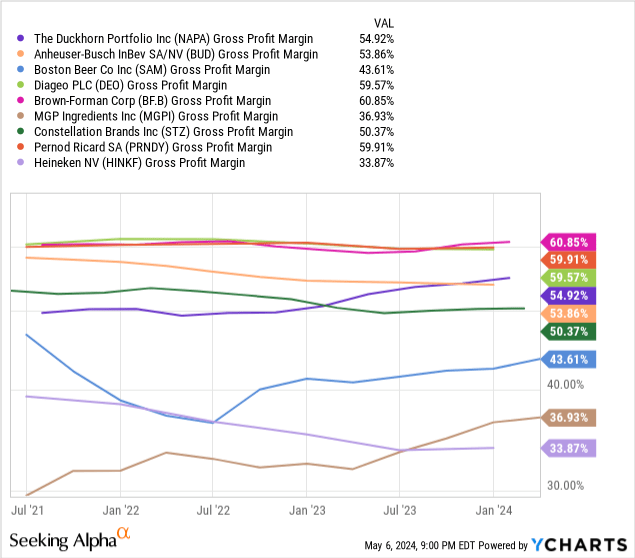

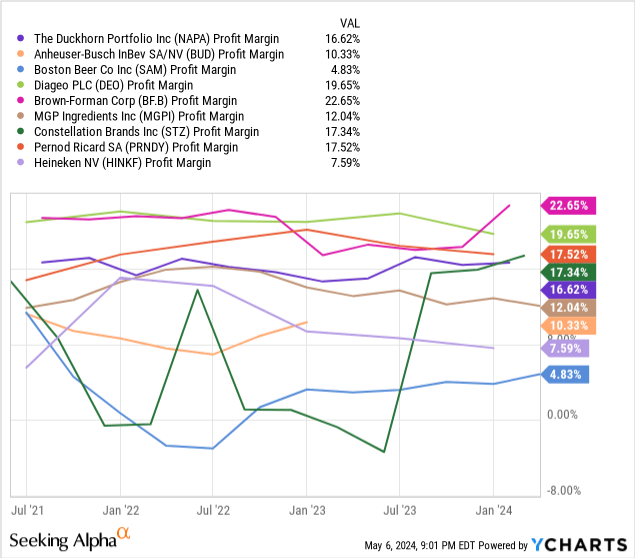

Another positive to contemplate is NAPA profit margins are running on the high end of the industry group, with further improvements expected on the Sonoma-Cutrer acquisition (earnings accretive in the first year, according to NAPA management vs. a more expensive SC price to sales valuation than pre-existed on the asset transfer).

YCharts – Leading Brewery & Distillery Names, Gross Profit Margins, Since 2021 YCharts – Leading Brewery & Distillery Names, Final Profit Margins, Since 2021

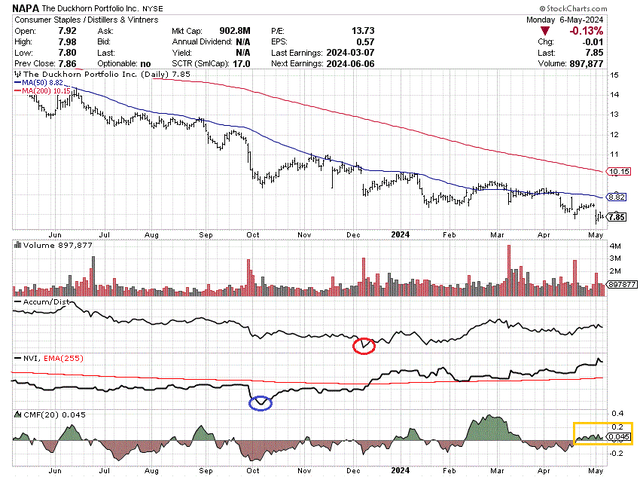

Technical Chart

Believe it or not, much improved (less bearish) momentum is developing on the latest dip to new lows in the share quote. My sense is aggressive selling has ended, while some intentional buying is appearing on the 12-month technical chart of daily price and volume changes.

We have to go back to October to find the peak of selling pressure in NAPA, measured by both the bottom in Negative Volume Index (blue circle below) and extreme 20-day Chaikin Money Flow calculations. Then, the Accumulation/Distribution Line bottomed in December (circled in red). What has me really intrigued and interested in a possible bullish reversal in trend during early May is the total absence of selling pressure as measured by the CMF indicator (boxed in gold), despite two minor price selloffs to all-time price lows since April.

StockCharts.com – The Duckhorn Portfolio, 12 Months of Daily Price & Volume Changes, Author References

Final Thoughts

My conclusion is if ever you wanted to own a winery in California (or elsewhere for that matter), here’s your opportunity. Don’t let the gold-laying goose fly away while you watch idly. Do some research into The Duckhorn Portfolio and start buying.

For a purchase plan, investors can buy a starter stake now, and add to it on weakness over time (if it appears). If sales and earnings continue to climb for the company as currently predicted by Wall Street analysts, generous rewards are coming for long-term shareholders entering under $8 for price.

What could go wrong? I suppose a deep and prolonged recession would be the worst-case scenario for NAPA. If personal incomes zigzag lower, while the stock market and real estate markets rollover, definite growth headwinds for wine sales will become reality.

However, with current assets from cash to inventory of $470 million at the end of January (pre-acquisition) and $340 million in vineyards and distilleries owned using cost-depreciation accounting vs. just $450 million in total liabilities, flat to slightly lower operating results from The Duckhorn Portfolio can be survived.

Absent a recession, I am modeling the bearish potential for weaker earnings than currently expected is largely priced into shares. If NAPA brand sales lag wine industry trends overall (instead of leading them) and the Sonoma-Cutrer transaction proves not as accretive as hoped, EPS of $0.40-45 annually are one possibility (vs. today’s Wall Street projection of $0.60-0.70 for 2024-25.). Even so, putting a still below-average 15x P/E on this total (measured against NAPA’s trading history and present industry valuations) only brings the share quote target down to $6.00 to $6.50, about -20% to -25% lower than $8 quotes now.

On the plus side of the equation, continued growth above industry trends may deserve a premium valuation vs. competitors. If 2025 EPS surprises on the upside with EPS of $0.80, and we put a 20x multiple on this number, $16 a share for a bullish target seems fair (+100% in price appreciation over 12-18 months).

In terms of my advice to management and now permanent CEO Deirdre Mahlan, please begin a minor dividend payout. A 10 cent to 20 cent annual cash distribution (good for 1.5% to 2.5% in yearly yield) would make the stock dramatically more appealing to all types of investors. For this asset in particular, drawing income off the vineyard grapes, fermenting product, and barrels of fine wine in storage round out the investment dream. You have a chance to complete the circle.

I rate NAPA stock a Buy below $8 a share, with Strong Buy territory in the $6 range, should a major bear market play out the rest of 2024 on Wall Street. I, personally, own a small position for now, with winery bragging rights coming as a bonus.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here