Overview

My recommendation for The Cooper Companies (NYSE:COO) is a hold rating as I believe the valuation is too high today, and the downside for missing expectations might be huge as multiples compress.

Note that I previously rated buy rating for COO due to my belief that the contact lens industry as a whole remains strong, and will continue to grow at a steady rate for the foreseeable future thanks to factors such as upgrading to a better product and exposure to fast-growing end markets like myopia management. I am now downgrading to hold due to the high valuation.

Business

COO creates, produces, and distributes product offerings spanning across the healthcare spectrum, from contact lenses for eye doctors to diagnostic kits, surgical tools, and obstetrical supplies. Contact lenses represent the largest part of the business with 88% of profits coming from it.

Industry

Based on a report by Fortune Business Insights, the global contact lens market size is valued at $9.9 billion in 2022 and is expected to reach 14.4 billion by 2030, a 5.8% CAGR over the period. I believe the rising prevalence of myopia is the main driver for this growth, which coupled with younger generations preference for better “looks” will prefer contact lens over spectacles. COO competitors includes key players like Bausch + Lomb (BLCO) and Alcon (ALC).

Investment highlights

The COO presented solid 2Q23 results, which led to optimistic revisions to the FY23 forecast. Sales were $877.4 million, up 8% year over year thanks to a phenomenal performance by CVI. The increase in gross margin to 80% contributed to the increase in earnings per share of $3.08, which was $0.06 more than consensus expectations. The fact that management increased their expectations, in my opinion, suggests the strong 2Q23 wasn’t caused by demand being pulled forward (consumers stocking up on necessities ahead of potential price increases). Instead, it is an indication of growing demand.

CooperVision stands out since its growth was consistent with the previous quarter and was relatively robust overall. In particular, CooperVision’s $589 million in revenue represents an organic growth of 10%. Although China’s rebound did not arrive until late in the quarter, the underlying economic strength was visible across the board, demonstrating a wide base recovery. For FY23, I expects CooperVision to continue its growth strength as management is confidence enough to raise organic growth guidance from 8 to 9% to 8 to 10%, a 100bps increase at the midpoint.

Overall, I think COO has done very well. What might be a little disappointing is that CooperSurgical’s sales of $288 million rose only 5% organically, which was slower than the previous quarter. In addition, management has revised their volume projections for PARARGARD down to flat growth over the next three years from low single digits. Hence, while this segment is a small profit contributor, it might cause a swing in earnings, leading to potential miss in expectations.

Financials highlights

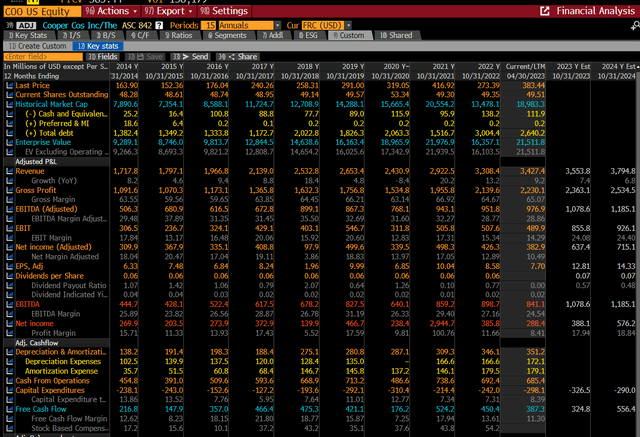

Bloomberg

COO has grown steadily during the last decade, with the exception of FY2020, which was adversely hit by the covid crisis (lockdowns). Given the strong Cooper Vision momentum, I expect COO to continue growing somewhat faster than the industry. I’d like to remind investors that Cooper Vision has been growing steadily for the past nine quarters. This plainly suggests that the management strategy is working, and it is working extremely effectively.

I anticipate that EBIT margin will rebound to pre-covid levels in the near term as increases in gross profit owing to increased revenue flow through to EBIT with strong additional margin. Looking at the numbers, COO OPEX has risen by $600 million (LTM vs 2019), which I assume is attributable to greater R&D and marketing for new product releases (such as MyDay Energys). We should see fixed cost leverage as new items generate income.

COO’s net debt is $2.5 billion, or 2.5 times FY23 EBITDA. I believe this leverage poses no concern because COO is highly cash producing (FCF positive over the last ten years).

Valuation

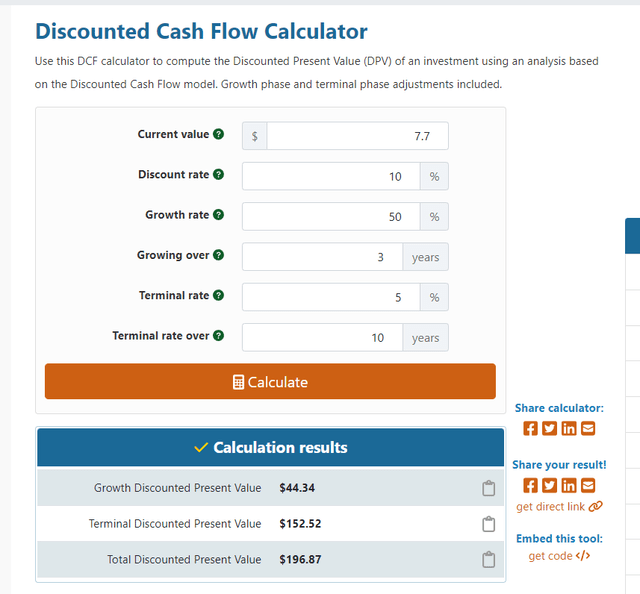

Gigacalculator

COO is worth $197 according to my DCF model, a decrease from the current share price. This target price is based on my 50% growth prediction over the next three years, as I expect margins to rise swiftly due to high incremental margins, followed by a 5% growth rate over the next five years.

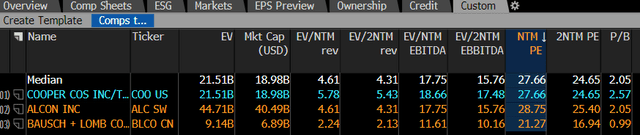

COO is currently selling at 27x NTM PE, which is much higher than the 10-year average of 22x. While I expect EPS to expand at a rapid pace in the near term, I am concerned that multiples may compress, reducing profits if EPS does not match expectations.

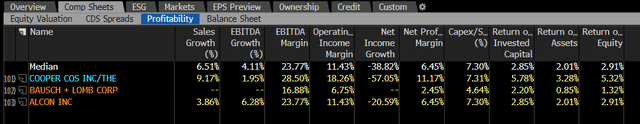

When compared to rivals, COO deserves to trade at a premium due to its stronger growth rate and margin profile. However, the risk of falling short of expectations persists.

Bloomberg Bloomberg

Risk

Competition in the contact lens industry is rising, and it’s difficult to differentiate product on the technical level because consumers can’t tell the difference. As a result, maintaining visibility and staying in the forefront of consumers’ minds will be an uphill battle.

Conclusion

I recommend a hold rating for COO due to the high valuation. While the contact lens industry is expected to grow steadily, with COO positioned well, the current multiples are concerning.

Read the full article here