Thesis

Much of the commentary regarding the Tesla, Inc. (NASDAQ:TSLA) Q2 earnings release centers around automotive margins, free cash flow, and the Cybertruck. We believe that investors are ignoring the long-term potential of Tesla’s focus on working with vision-based AI systems. Regardless of whether or not autonomous driving is resolved anytime soon, the experience and data collected will help Tesla design robots that utilize a vision-based system to navigate and interact with the world. Tesla has a wide lead in this area of AI and robotics, and we believe it could be a substantial value driver going forward.

Q2 Earnings

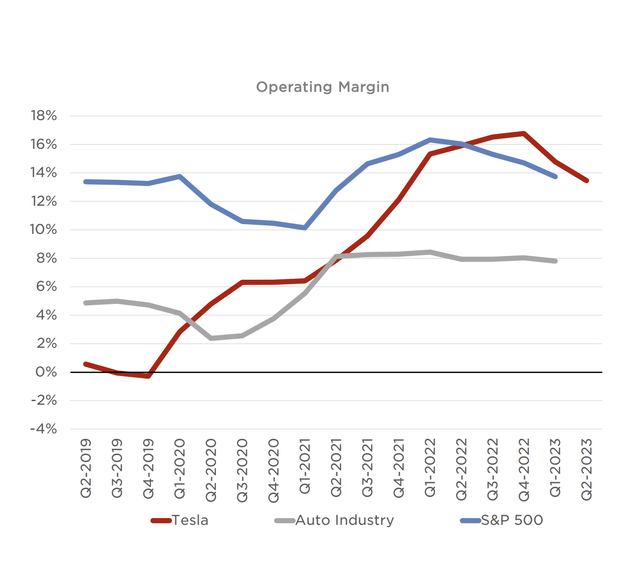

Tesla recently released their Q2 earnings. The stock has sold off sharply in the following days, likely due to investor concerns surrounding margins. Tesla’s operating margins have been declining over the past few quarters. This has led some to criticize Tesla’s price cuts. We believe the price cuts were ultimately a good call and are consistent with their strategic goals and long-term vision.

Tesla Q2 Earnings Presentation

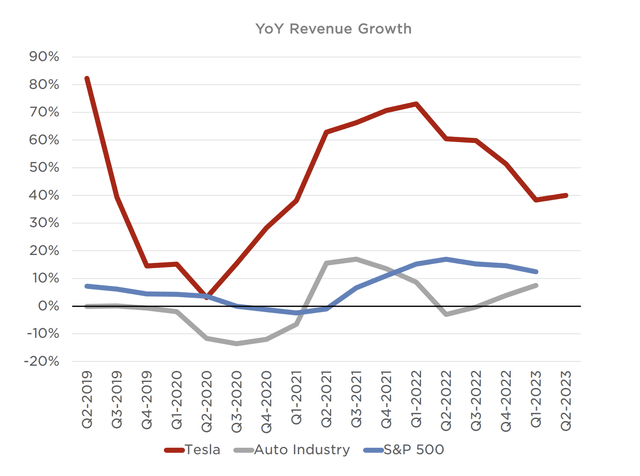

Tesla’s price cuts had the positive effect of allowing Tesla to maintain a high level of revenue growth despite a challenging macroeconomic environment for the auto industry.

Tesla Q2 Earnings Presentation

Rather than focusing too much on short-term results, investors would be better served focusing on the long-term future of the business. Sacrificing margins for volume is in line with Tesla’s strategic vision of getting as many of their cars out on the road as possible. This serves to both increase brand awareness as well as increase the amount of data they are collecting.

Vision-Based Systems

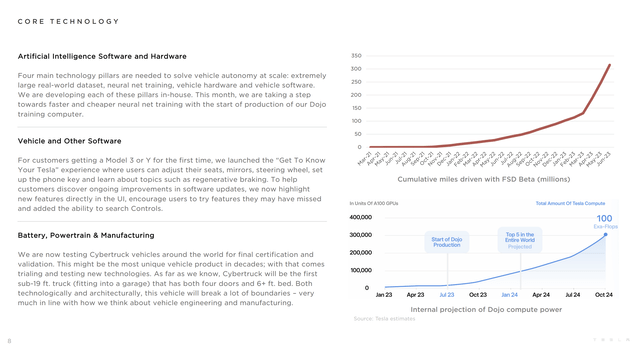

Tesla is collecting a mountain of data through their full self-driving (“FSD’) Beta program. Despite their progress, there are more than a few investors that doubt the future of level 5 autonomous driving and whether or not Tesla will be the first to solve it. In our opinion, this way of thinking misses the forest for the trees. We don’t believe Tesla will technically be the first to solve level 5 autonomous driving, and we don’t believe that Tesla will solve level 5 autonomous driving anytime soon. What we do believe is that Tesla will have the most general purpose and scalable autonomous driving solution available thanks to their focus on collecting and training on vision-based data. An AI navigation system built from the ground up to work with vision-based data can be repurposed for a variety of applications that go beyond driving on roads.

Much fun has been poked at Tesla’s “humanoid” robot. Regardless of what form factor Tesla’s robots eventually take, the point is that their AI can be repurposed to fit form factors other than a car and navigate environments other than roads.

An important factor to consider is the more life-threatening an application of AI is, the lower the acceptable error rate. The consequences of ChatGPT making a mistake are far lower than the consequences of an autonomous driving system making a mistake. For this reason, it’s entirely possible that Tesla unveils fully functioning industrial or residential robots before solving level 5 autonomy.

Investors focused on short-term noise regarding quarterly results may not realize that autonomy is not the end all be all of Tesla’s AI ambitions and capabilities. Tesla’s Dojo initiatives and data collection capabilities have the potential to generate significant value beyond autonomous driving applications. While difficult to quantify the value of this potential, completely ignoring it would fail to incorporate one of Tesla’s key assets into their intrinsic value.

Tesla Q2 Earnings Presentation

Price Action

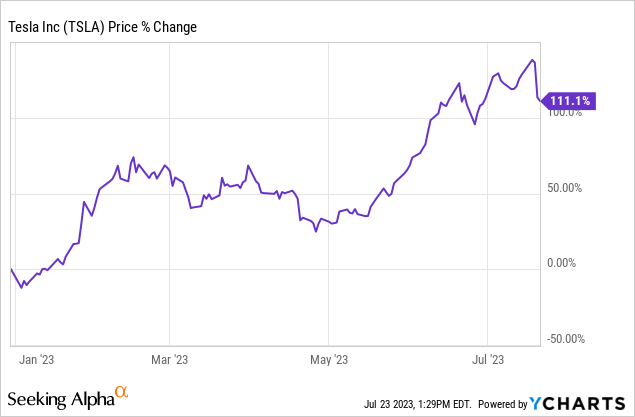

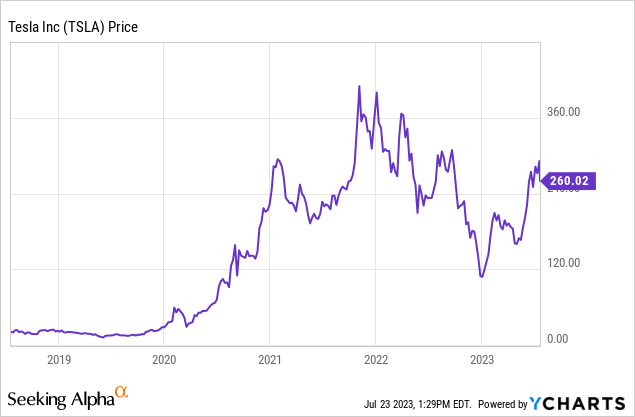

Tesla’s stock has been on a tear this year but has recently dipped after their Q2 earnings release. This could be viewed as an overreaction based on short-term concerns surrounding margins. Investors who are bullish on Tesla could view this as a buying opportunity, but should also be aware that the company must continue to innovate in order to justify the current valuation.

Over a five-year timeframe, the stock has seen a large amount of appreciation and is still well below its all-time high.

Valuation

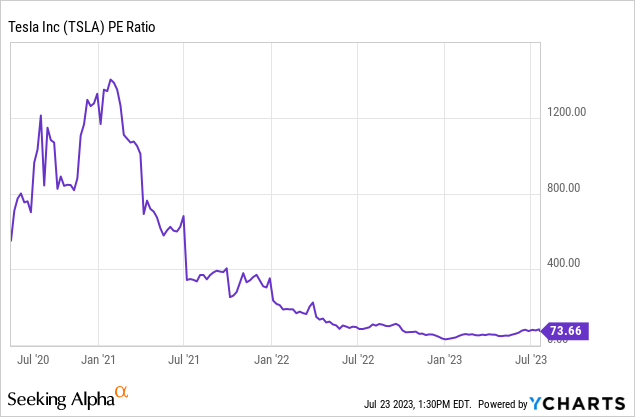

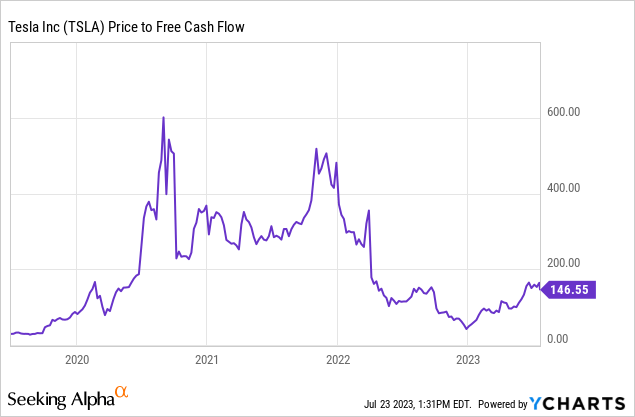

On a P/E basis, the company is trading at the lower end of their recent history, mostly because the company only became GAAP profitable over the past few years. On a price to free cash flow basis, the company is cheaper than they were during much of the pandemic era. As has pretty much always been the case, Tesla needs to continue to innovate and expand their earnings and revenue much faster than competitors in order to justify their valuation and prove that they are more than “just a car company.” It remains to be seen whether the company will be able to deliver over the long term, but if we had to pick between legacy auto or Tesla, we would pick Tesla.

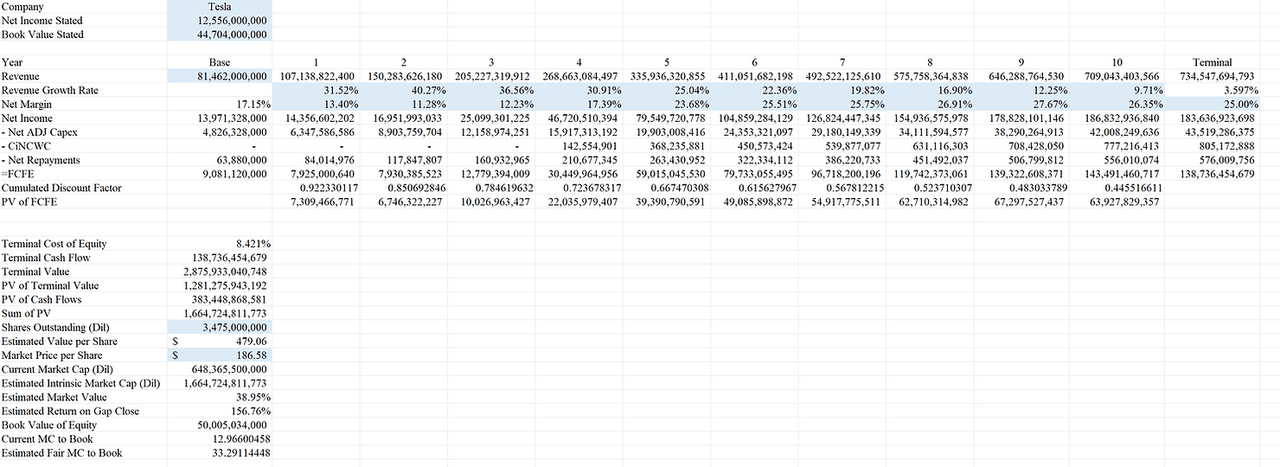

Below is a discounted cash flow (“DCF”) model which we created in April of this year. We don’t like to update these too frequently because quarterly results can introduce short-term noise. Our current fair value still sits at $479.06, and we view Tesla as being fundamentally undervalued at these levels.

Author

Risks

A big risk to Tesla is if they are unable to continue to innovate and compete at an elite level. Significant cracks in the armor would likely result in the stock being re-rated lower and cause the company to trade more in line with other auto manufacturers.

Another risk is if Tesla’s autonomous driving technology is shut down by regulators. This would severely limit the amount of data Tesla could collect and drastically lower the value proposition of the company.

Another risk is if geopolitical tensions between the U.S. and China continue to escalate and China decides to retaliate against chip export restrictions by going after Tesla. If Tesla’s supply chain in China is impeded, the company would experience many short-term difficulties that would likely send the stock lower. That being said, an event such as this would not hurt the company nearly as much as a similar action taken against Apple would damage that company. We believe Tesla would be able to adapt over the long-term thanks to their geographically diversified production base.

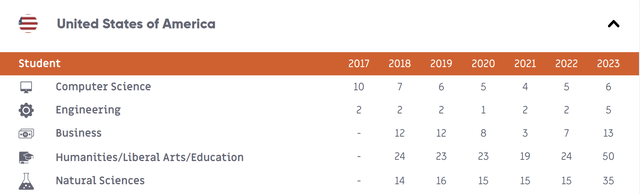

We view the overall risk/reward to be reasonable at these levels, mostly because of the high amount of optionality present within the company. The number of potential fundamental catalysts is numerous. Tesla remains a top destination for engineering and computer science students. We believe that human capital is the number one resource of a company over the long term, and Tesla appears to have a human capital pipeline that is sufficient enough to sustain their capacity for innovation.

Tesla’s Rank as Potential Employer by Type of Student (Universum)

Key Takeaway

Tesla, Inc. investors would do well to ignore the short-term noise around margins and focus on the long-term. We believe Tesla’s focus on vision-based AI systems will be value-generative beyond autonomous driving applications, regardless of when level 5 autonomy is achieved.

Read the full article here