Investment overview

I give a buy rating for Tenable (NASDAQ:TENB) as I see the growth momentum continuing into FY24. On a longer-term basis, there is a strong secular tailwind (demand for cybersecurity) that should continue to expand the total addressable market for TENB. More importantly, the business has a massive runway for margin expansion ahead, which should continue to support a premium valuation.

Business description

TENB is a leading player in the Vulnerability Management [VM] end-market. In today’s digitalized world, they offer a solution that is mission-critical: a unified view of the organization’s attack surface. This view helps customers manage and measure cybersecurity risk. Cybersecurity risk exists everywhere, not only in the traditional known areas like network’s services. Cloud computing, IoT devices, and OT systems like Industrial Control Systems are just a few examples of where they can be found today. Through the use of a unified platform that converts vulnerability data into easily shareable business metrics, TENB enables its customers to leverage cybersecurity data for executive-level strategic decision-making and gives security teams the means to prioritize problem-solving.

4Q23 earnings results

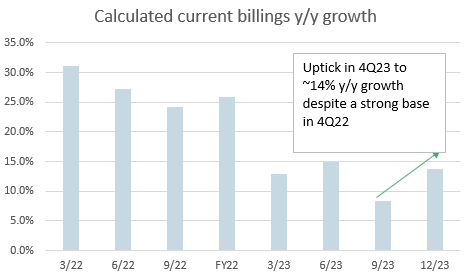

TENB reported 4Q23 results ~2 weeks ago, and for the benefit of those that missed the results: TENB reported calculated current billings [CCB] of $271.6 million, representing a growth of 14% y/y. Revenue came in at $213.3 million, which exceeded the high end of management’s guidance range ($204 million to $208 million) as well as consensus expectations for $206.4 million. TENB continued to show improvements in profitability, where its non-GAAP gross margin expanded by 210bps y/y to 80.6%, sustaining above the 80% threshold. Non-GAAP EBIT also exceeded the high end of management’s guidance, coming in at $36.1 million, mainly due to the strong top-line performance.

Expect growth momentum to continue

My expectation for the TENB growth outlook is positive for both the near-term and the long-term. For the near term, I believe the 4Q23 results showed sufficient proof of ongoing momentum. After failing to meet consensus expectations in 3Q23, TENB showed that 3Q was just a blip and they are back on track in meeting expectations (to reiterate: TENB beat expectations in CCB, revenue, and EBIT margin in 4Q23).

May Investing Ideas

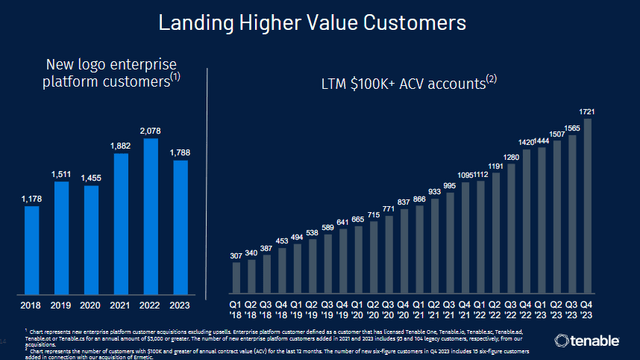

Leading growth indicators like CCB and current bookings growth suggest demand momentum rolling into FY24 as well, where CCB grew 14% and current bookings (revenue + q/q change in remaining performance obligation [RPO]) grew 19%, with the latter indicating the success in improving execution during 4Q23. Positively, the strong 4Q23 growth did not come with a deterioration in unit economics, as the TENB dollar-based net expansion rate [DBNER] remained stable at 111% for the third consecutive quarter. Aside from quantitative metrics, the qualitative comments provided by management also point to a positive growth outlook. Their first encouraging comment was that CCB’s growth was driven in part by the stabilization of their mid-market business this quarter. Gaining traction in the mid-market is important because it is one of TENB’s ways to extend its growth runway through its “land and expand” strategy, which has proven to be successful based on the number of customers with more than $100k in annual contract value [ACV].

TENB

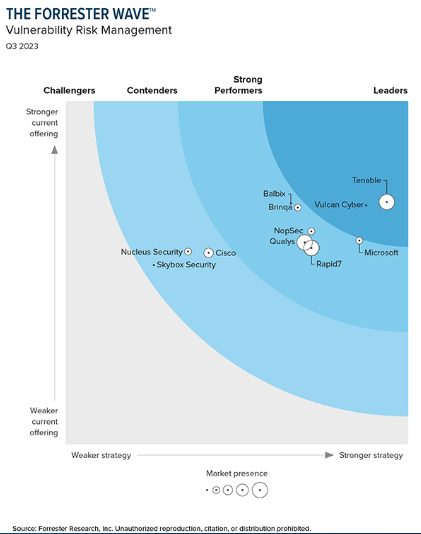

Secondly, it was encouraging to know that TENB is winning share in new markets, suggesting that TENB product’s value proposition and cost resonate with customer demands. This also supports the fact that TENB is the leading player in the industry, outperforming the likes of big players like Microsoft (MSFT), Vulcan Cyber, Rapid7 (RPD), Qualys (QLYS), etc. I would expect market share gains to continue as TENB leverages its recent acquisition of Ermetic to capture cloud security share as it gains exposure to the fast-growing OT security market.

Forrester Research

Between our technology leadership and our significant customer base and distribution, we are winning and taking share in this critical market. We’ll continue to be committed to providing market-leading discrete products to customers.

Continue to feel like we’re winning more than our fair share against both of those in the different market segments. Outside of VM, we’re obviously seeing Wiz and Paolo Alto a lot more on the cloud side as we bring our new cloud security capabilities to market. Company 4Q23 earnings

Finally, the performance of Tenable One is one factor that lends credence to a positive growth outlook. Tenable One reached a 100% growth rate in FY23, according to management comments. It now makes up over 20% of new business and around mid-teens of total sales in 4Q23. I believe there is an attractive opportunity for upselling given the success in other use cases like Cloud, OT, and Identity, which together account for approximately half of TENB’s sales.

TENB

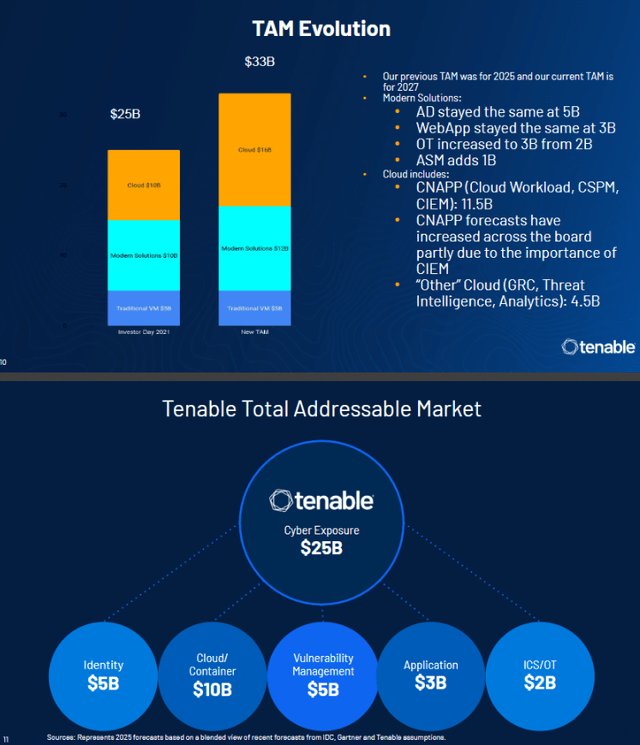

As for the long-term growth outlook, I believe any TAM estimates today are going to significantly underestimate the magnitude of growth. My belief is that the world is going to get more connected digitally at an exponential rate, and with that assumption, there will be more endpoints that are exposed to cybersecurity threats. Take TENB estimates, for instance; in just 2 years, the TAM has expanded by $8 billion, from $25 billion to $33 billion. This suggests that the industry grew ~30% over 2 years, or about mid-to-high-teens percentage CAGR a year. As such, looking ahead, I believe there will be plenty of growth opportunities for TENB.

Business going to get more profitable

Over the past few quarters, TENB has shown significant incremental margin performance, where the adj. EBIT margin expanded from 7.8% in 1Q22 to 16.9% in 4Q23. Based on my calculation (change in adj EBIT/change in revenue), in FY23, incremental adj EBIT margin trended at more than 50% for the last 3 quarters of the year, indicating massive margin expansion potential ahead. If we look at the closest peer, Qualys (QLYS), the business has an adj. EBIT margin of ~42% as of 4Q23, which is more than double what TENB is generating today. The key variance between the two is that TENB is spending more on sales and marketing [S&M] and research and development [R&D] vs. QLYS. For reference, in FY23, TENB spent 42% of S&M and 15% in R&D, while QLYS spent 14% of S&M and 4% in R&D. Suppose TENB were to stop investing in growth and start farming for profits and cash. I see an easy path for TENB to reach similar levels of profitability as QLYS. That said, given the opportunity set available, I think it is better for TENB to invest in growth while expanding margins gradually. On this aspect, I believe management FY24 guidance has set the expectation right in that TENB is going to continue expanding margins; they guided for adj. EBIT margins north of 17% in FY24, which is above the consensus estimate of 16.5% for FY24. This speaks to management’s willingness to optimize the cost structure and improve efficiency.

Valuation

May Investing Ideas

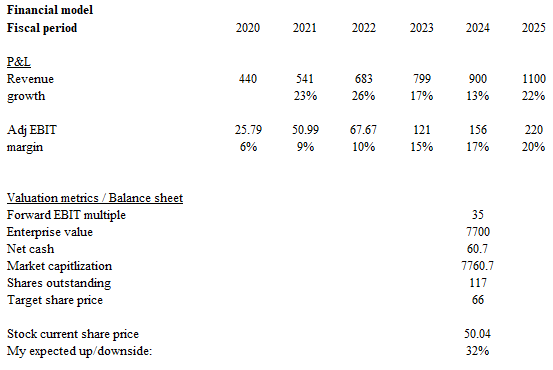

Based on my research and analysis, my expected target price for TENB is $66.

- Revenue should at the bare minimum be able to grow as per guidance for FY24 by 13% given the momentum that TENB is seeing today (note that I believe management’s guide might be overly conservative here), followed by an acceleration to 22% to achieve management’s >$1.1 billion revenue guide for FY25.

- Adj EBIT should continue to expand given the high incremental margin that the business has. Using management guidance, I expect TENB to achieve $156 million in adj EBIT for FY24 (17% margin), followed by further a similar margin expansion trend to 20%.

- The stock should trade at a 35x forward EBIT multiple, a premium to peers, as it is expected to grow much faster than peers (QLYS is expected to grow low-teens for the next 2 years) and is expanding its margin (QLYS margin appears to have peaked already).

Risk

TENB has been acquiring assets to improve its product offerings recently, acquiring five over the past three years. This strategy is useful in reducing time to market; however, if not well integrated, it could result in a decline in product quality, which will impact R&D efficiency as TENB needs to spend more time reconfiguring its product in the future. In addition, should TENB choose to pursue more margin-dilutive M&A to bolster platform capabilities, profitability upside may become harder to realize.

Conclusion

My recommendation for TENB is a buy rating as I believe the business will continue to see growth momentum with margin expansion. In the near-term, TENB performance in the mid-market segment, successful upselling, and the strong performance of Tenable One support growth. As for the long-term growth outlook, I also think it is promising, considering the evolving digital landscape and continuous expansion of the cybersecurity market. On profitability, TENB’s strong incremental margin performance and the rate of expansion so far indicate a path towards better margins.

Read the full article here