Most stocks with market capitalizations over $1B trade in tandem, with most rising and falling similarly to the S&P 500 and other major indices. However, those few stocks always stand out with exceptionally strong or poor performance, having little correlation to the stock market as a whole. Usually, in these types of stocks, the best opportunities are found as idiosyncratic trends offer portfolio diversifying potential. Further, such large independent movements often result in stocks becoming too under or overvalued.

One notable example is the smaller architectural glass stock Tecnoglass (NYSE:TGLS). TGLS has seen incredible performance since 2020, rising by around 7X since then and around 140% over the past year. The company is now worth $2.25B, so it is no longer as small as it was years ago. That said, its valuation remains relatively low at a forward “P/E” of 11.3X, boosted by extremely strong sales and EPS growth.

The company owns two brands that manufacture architectural glass in Colombia, with around 95% imported to the U.S. Its end-market is roughly half residential and multi-family/commercial, so it is highly exposed to changes in both key US property markets. Further, its manufacturing position in Colombia offers lower comparative labor and other input costs, granting it favorable competitive positioning in the US. Of course, that fact also exposes the company to potential risks associated with operating in Colombia; however, its political stability has improved dramatically over recent decades, granting the stock undervaluation due to investment biases.

There are many positive and negative factors facing Tecnoglass. On the positive side, it has incredible performance in its stock and fundamentals. Further, it offers diversified value due to its strong trend that is hardly correlated to other building materials firms. That said, evidence strongly suggests that both the residential and commercial (in particular) property markets are due for a sharp decline in construction activity, potentially upsetting TGLS’ bull market. Further, the company faces some problematic allegations stemming from its relative opacity and international operations. While I will avoid digging specifically into those allegations, we must always discount “too good to be true” performance due to the possibility of misrepresented information.

How is Tecnoglass Doing So Well?

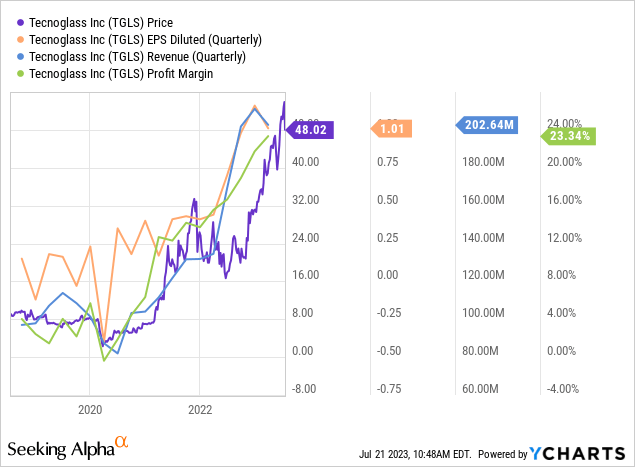

Tecnoglass’ performance over the past three years is nothing short of stellar. Since 2020, the company’s sales have more than doubled while its EPS has risen from near-zero to over $4 annualized. The company’s net profit margin has grown rapidly to 23%. See below:

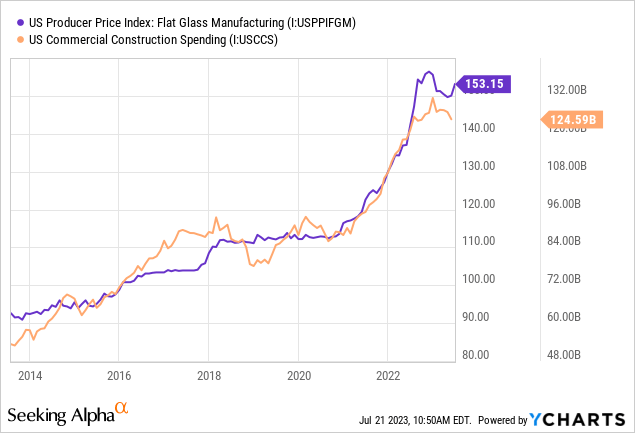

It is very rare for companies of Tecnoglass’ size, in its industry, to post sales and EPS growth this significant over a relatively short period. The construction materials industry is very volatile and cyclical, but it does not usually warrant this rapid growth. That said, the company’s growth pattern generally matches commercial construction spending in the US and prices for glass manufacturing. See below:

The boom in commercial construction spending since 2020 has led to significant shortages, particularly in the glass market, due to its labor and energy intensity. Glass prices have risen by over 40% since then, vastly boosting the net margins for manufacturers. The increase in commercial construction activity has also benefited the firm’s sales. Further, because Tecnoglass produces its products in Colombia, it has largely avoided extreme growth in production costs that have plagued most US manufacturers. Indeed, its total cost of goods sold has only risen by around 50% since 2020, while its sales have more than doubled, indicating its per unit production costs have hardly increased.

The company is also focused on the best markets in the US, with its presence substantial in Florida and Texas to a lesser extent. It also sells to most of the eastern US, with some exposure to California; however, over half its current backlog is in Florida. In general, South Florida has been the standout since 2020, with extremely strong relative construction activity in both the commercial and residential markets. Much of South Florida’s strength is seen in the increase in residents and businesses as people and companies relocate toward cheaper and lower-tax states. Tecnoglass’ dominance in Florida and the “sunshine states” is a significant positive factor facing the company, offsetting risks from the work-from-home trend plaguing the Northeastern property market.

Despite this benefit, investors should set reasonable growth expectations for the firm. While it caters to the strongest aspects of the US property market, no geographical areas will be safe in case of a broader decline in commercial and residential property market activity. Both Tecnoglass’ EPS and sales peaked last quarter, just like total US commercial construction spending and the PPI for glass manufacturing, strongly indicated the macroeconomic growth tailwind will soon become a headwind.

Most construction activity today was planned years ago when ultra-low interest rates allowed for excessively high property market valuations. Today, nearly all US commercial properties are declining in value as higher interest rates compress fair valuations. Recent strains among CRE-lending banks and a sharp increase in distressed properties have caused some major property investors to see a “Category 5 Hurricane” facing the commercial property market. Commercial property transaction volumes have been extremely low in recent months, obfuscating the price trend; however, a large Baltimore commercial office recently sold for less than half of its 2015 price, indicating an extreme market decline. Of course, negative commercial market trends are most extreme in the Northeast US compared to the Southeast, where Tecnoglass is focused. While that offers a fair amount of insulation, I still expect construction activity to fall significantly in the Southeast as builders wait for prices to stabilize.

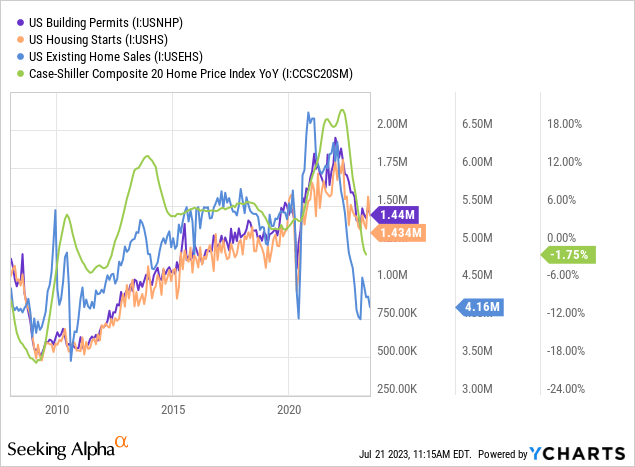

Total US building permits and housing starts have fallen dramatically since the 2021 peak but remain high compared to 2010s. That said, existing home sales are hovering around the post-2008 recession minimums, and home prices are falling consistently. See below:

These data indicate that the residential property market has also made a peak. Home price-to-income ratios are generally higher than in 2006, indicating significant potential overvaluation due to increased mortgage rates. That said, existing home inventories are also near all-time lows, supporting home prices and construction demand significantly, specifically in high-demand markets.

More broadly, the 2010s era of immense urbanization appears to be reversing as more people look to move out of increasingly high-crime cities toward safer and cleaner suburban areas. Miami, a key market for Tecnoglass, has been among the few to see a slight decrease in crime activity since 2020, encouraging significant immigration of wealthier people (primary buyers for Tecnoglass’ residential products). Once again, I believe this data indicates Tecnoglass is well-positioned geographically in the otherwise very precarious US property market.

Future Outlook For Tecnoglass

Fundamentally, I do not believe Tecnoglass will continue to benefit from the solid macroeconomic trends that have helped US construction demand. Most data points to a sharp decline in residential and commercial construction demand. Construction spending levels significantly lag market fundamentals due to the years of planning required for such projects. Last year, Tecnoglass’ solid sales and margins were primarily based on excessively cheap and stimulative financing rates artificially created via Q.E in 2020.

Today, the exact opposite is true, where the Federal Reserve is acting to limit property market activity by selling mortgage-backed securities (raising mortgage rates) and maintaining high speeds in general. Indeed, this is necessary to quell the significant inflation created in 2020, as seen in the 40% increase in manufactured glass prices. In the future, I expect a very sharp decline in commercial and residential construction activity, likely causing glass and aluminum product prices to decline as that market may fall into a glut due to a rapid decline in sales. The company’s positioning in Florida and the Sunbelt limits negative exposure, but not entirely because it is still competing on the national market, and activity should still fall (albeit to a lesser extent) in Sunbelt states.

Colombia’s high inflation rate of around 12-14% today and its trade deficit generally benefit Tecnoglass. Accordingly, the Colombian Peso has generally lost value against the US dollar, improving Tecnoglass’ gross margins (because it sells in USD but pays in COP). However, the Peso has had improved strength in 2023, rising by around 16% against the dollar this year due to the general weakening of the dollar. Ongoing threats from BRIC nations to end US dollar hegemony are a risk factor for Tecnoglass because its strong performance largely stems from the strong US import power. Of course, extreme currency volatility in either direction can weaken Colombia’s economy and promote instability, a potential risk today as the country elects less commercially focused leaders.

The Bottom Line

Overall, I expect Tecnoglass to face a decline in its sales and EPS over the coming quarters through ~2025-2026 as US construction activity falls from its previously high levels. Further, risks associated with the company’s trade and position in Colombia may warrant a valuation discount compared to its US peers. This discount is further supported by the significant allegations made against the company by Hindenburg Research in 2021.

Since I generally avoid delving into such matters, I will avoid commenting on them but encourage investors to do their own research on the issue, as those allegations could prove significant. That said, specifically regarding the company’s tremendous sales and EPS growth, I believe those figures are supported by the extremely strong construction environment in recent years. Of course, whenever I see a company post such immense results, I think it is reasonable to be cautious, as solid growth can signal excessive cyclical exposure. While the company’s geographical focus (both in production and selling) partially offsets its cyclical risk, that risk remains significant. It will likely bring about a sharp decline in sales and income associated with lower construction spending levels.

For these reasons, I am not bullish on TGLS and would not buy it at its current price. I expect TGLS will see a moderately significant sales decline of around 20-30% due to the reversal in construction activity, likely pushing its profit margins back to a more reasonable ~15%. Thus, I believe TGLS’ EPS should fall to around $1.90 annually and potentially lower if a recession occurs. Due to the other stated risk factors, I would not buy the stock at a forward “P/E” over 12X, equating to a price target of ~$23 or around half its current level. The stock traded at this price around the end of 2022 amid much stronger cyclical conditions, so I do not believe this target is unreasonably low.

Overall, I am moderately bearish on TGLS and believe it is due for a significant decline as investors brace for a negative cyclical shock. That said, I would not bet against TGLS because it has powerful positive momentum and could continue to rise as momentum-focused speculators continue to buy the stock. Further, my view is based on shifting macroeconomic trends that should hamper its EPS significantly. However, the company’s focus on superior property markets may offset those trends more than I currently expect. Thus, while the firm appears significantly overvalued, a more bullish economic outlook could easily cause TGLS to appear undervalued today.

Read the full article here