Simplify Volatility Premium ETF (NYSEARCA:SVOL) is one of the most interesting income funds out there. Most income-oriented funds have much simpler strategies, like diversifying into dividend stocks or writing covered calls. Similarly, their yields are usually in the high-single digits or the low-double digits. Yielding over 16%, many might think SVOL is a yield trap at first glance. Yet, I think its strategy is a sound one that can command such a yield over time, so I’ll give my own rundown as to why SVOL is a great Buy for long-term, income-focused investors.

Concept of the Fund

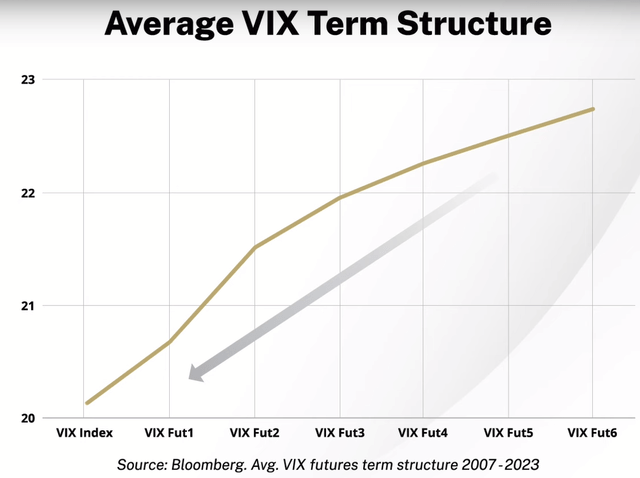

SVOL is an actively managed fund that seeks to provide distributable income to its shareholders. A signature part of its strategy is its relationship to the Volatility Index (VIX). It generates part of its income by committing between 20% and 30% of its portfolio to short positions on VIX’s future contracts (basically writing calls on VIX).

Fund Manager Offical YouTube

SVOL will short these futures as they are multiple months out from expiration. As the graph above shows, contract prices decline as they approach the present. This is the same as how calls for stock options lose time value as they near expiration. Using this dynamic, SVOL can buy back these contracts for a profit, with gains that they can either roll into new positions or distribute, which they typically do across staggered expirations. Over time, I expect this will be a mostly durable source of income.

The rest of the portfolio is diversely invested into various fixed-income assets that contribute to and help to “smooth out” SVOL’s yield during periods the short strategy on VIX can disappoint (more on that to come).

Holdings

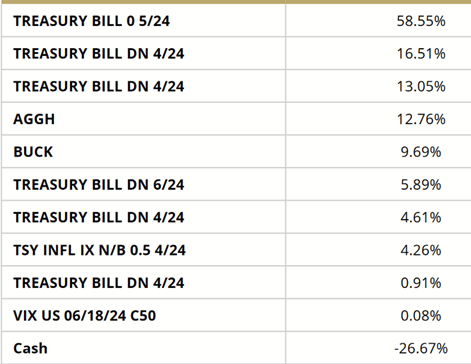

In the most recent fund fact sheet the managers provided, the holdings are like so:

March 2024 Fact Sheet

Clearly Treasury Bills, with their yields near 5%, are attractive for the managers right now. Yet, about 24% of the portfolio is allocated toward Simplify Aggregate Bond ETF (AGGH) and Simplify Stable Income ETF (BUCK). What about those? Well, BUCK is similar to T-Bills, being primarily invested in those, while yielding slightly higher (hence “Stable”).

AGGH, meanwhile, is also primarily invested in Treasury securities, but much of that portfolio is invested in iShares Core U.S. Aggregate Bond ETF (AGG), which in turn is a fixed-income fund in Treasuries, Agency issues, and investment-grade corporate issues.

All of this to say – I think the fixed income side of the portfolio is sound and of dependable credit quality.

Performance So Far

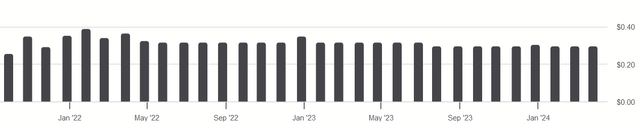

The Fund hasn’t been around a terribly long time (spring of 2021), but so far, it has executed well. First, let’s look at the dividend history.

SVOL Dividend History (Seeking Alpha)

Since its first distribution in late 2021, the fund has successfully paid monthly dividends in the neighborhood of $0.30 per share, often more.

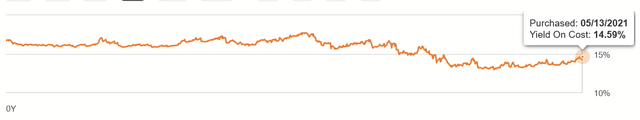

Yield On Cost (Seeking Alpha)

Consequently, the fund has enjoyed an attractive yield on cost, whatever the entry price one might have had during its lifetime. These yields come in around 14% – 15%.

SVOL Total Return vs. S&P 500 (Seeking Alpha)

Intriguingly, the fund has beaten the S&P 500 since its inception almost three years ago. We might debate if this is a long-enough term period of time to compare the two, while also remembering that it’s capturing a period of historically quick interest rate hikes, but it’s still good to note.

Future Risks

So I’ve given a lot of hints about what’s good about this fund, but a couple of things could weaken returns going forward and are important to keep in mind.

Interest Rates

If interest rates drop again, this can reduce the possible yield from the fixed-income portion of their portfolio. As they are more invested in T-Bills than securities with longer durations, they are also not poised to see much capital appreciation and thus a rise in NAV per share from this. While management can reallocate accordingly to benefit from such at any time, we have to trust that they would move accordingly.

Peculiar VIX Events

While I mentioned before that the depreciation of VIX futures is usually a given as time value is lost, there can be scenarios in which returns are hurt by its inverse-VIX approach. Lest we forget, VIX and the S&P 500 are negatively correlated in most cases, and a sufficiently volatile market environment could exceed the gains from the shorts on VIX futures. A short strategy that is on the wrong side of the market also has the potential for heavy loss of upside as well.

Dan Caplinger discussed this in a 2018 piece about the decline of pure inverse-VIX ETFs:

Yet in the end, all it took was a single day to bring inverse volatility ETFs to their knees. With the VIX having been at extremely low levels, it didn’t require too big of a rise to represent a 100% daily boost in volatility. That’s what happened on Feb. 5, when February VIX futures rose from their opening level of 16 into the low 30s by the afternoon.

He isn’t exaggerating when he says they were brought to their knees. These funds were wiped out. Since some of SVOL’s portfolio will be deployed like this (20% – 30%), there is room for it to take a hit.

Mitigating Factors

Yet, it is out of these lessons that wisdom is gained, and it’s not accidental that this fund was launched after those events, so let’s talk about the ways the fund is set up to mitigate risk.

Nearer-Term Futures

In periods where the VIX rises (volatility climbs), management can roll the profits from its closed-out positions into nearer-term futures. This is an approach they discuss in their deep dive video on their official fund page. This has the benefit of allowing them to capture a higher contract premium in a shorter span of time, which will also free up the position sooner to readjust to the more typical allocation (of farther-term contracts) when favorable. Again, we depend on management being proactive enough to seize on this.

Other Options Strategies

The fund also hedges some of its risk by participating in some other derivative positions. Management discusses this in their Prospectus (pg. 154):

The option overlay is a strategic, persistent exposure meant to hedge against market moves and to add convexity to the Fund. If the market goes up, the Fund’s returns may outperform the market because the adviser will sell or exercise the call options. If the market goes down, the Fund’s returns may fall less than the market because the adviser will sell or exercise the put options.

This will often involve purchasing market puts since market declines are correlated with VIX gains that consequently harm inverse-VIX positions. Similarly, management opportunistically trades options on some of its fixed-income positions. These things can also help to smooth out distributable cash flows and are good examples of this fund’s flexible approach.

Positive Relationship with Stocks

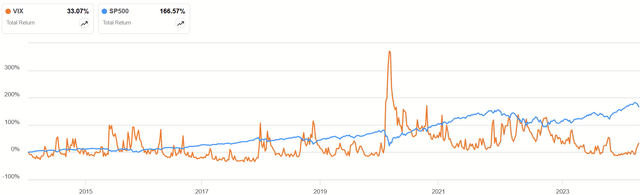

Now, this is the part that I think deserves the most attention for the long-term investor: SVOL’s positive correlation with stocks. I’ve mentioned it here and there, and the total returns chart I showed earlier displays it, but I also want to show VIX versus the S&P 500:

Total Returns Last 10Y (Seeking Alpha)

Now, the relationship between the market and VIX isn’t perfectly negative; both have had positive total returns over the last decade. Sharp peaks of VIX’s rallies usually accompany declines in the S&P 500. At the same time, these peaks decline as the market begins to recover. VIX’s total returns only beat the S&P 500 during very brief moments, but across most environments stocks pull ahead, and I believe the SVOL is positioned to benefit in a similar way.

I believe this distinguishes it from other income/yield funds. Fixed income can benefit from declining interest rates like stocks can but with much less upside. The reason is obvious: fixed income is debt, and debt’s full upside is repayment. Similarly, with covered call ETFs, the call contracts typically cap the upside. In SVOL’s case, they aren’t directly exposed to capped upside like this.

Long-term, I think it is very possible that SVOL can be both a high-yield ETF with more room for long-term compounding than you get from similar funds. It’s a new fund, and time will be the ultimate test of active management, but these are assuring signs.

Conclusion

Income funds with high yields are often enticing but dangerous. Those who have dipped their toes in and been bitten before learn to look at a 16% yield and ask, “Okay, what’s wrong with it?”

Yet, I think very little could be said that is wrong with this one. With a fixed-income portfolio of reliable credit, generally consistent trends of VIX futures pricing, and active management that can adjust at moments where the norm makes no sense, I have a hard time seeing where the yield trap is. Even disappointment would produce a high yield with this type of fund.

The more likely bad scenario, in my eyes, is that VIX has one of those spikes that causes a brief dip in the monthly distributions. In which case, that’s a reason to diversify across multiple income sources. For the long-term investor who can handle the intermittent aberration, however, SVOL comes across as one of the best yield funds one can buy.

Read the full article here