Investment Thesis

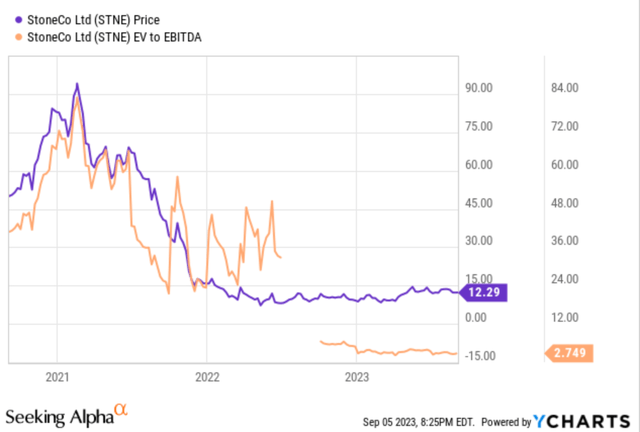

StoneCo’s (NASDAQ:STNE) stock price has been range-bound for most of the past couple of years. However, the business has continued to grow, albeit at a slower pace than heady early days, with an expected deceleration to 22.6% in 2023Q3 — the result is a stock that no longer looks particularly expensive, at less than 4x EV/EBITDA. A couple of major fiascos with the credit registry debacle and the Banco Inter investment (which it exited in February) look to be in the rearview, and one can hope that management and the Board have learned some lessons and won’t repeat past mistakes.

The payments space has faced slowing momentum and competitive pressures, globally, with sector leaders like PayPal (PYPL) down significantly. These sectoral challenges could explain part of StoneCo’s own stock price malaise. But StoneCo’s continued ability to grow and take market share, as well as being on the “path to become the only end-to-end integrated software and financial services provider for Brazilian merchants” arguably well-positions it to navigate this situation.

Seeking Alpha and YCharts

Stabilized, Not Expensive, and Growing

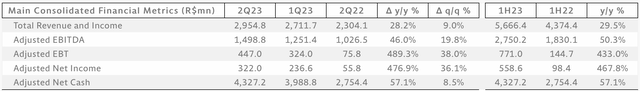

Revenue growth in 2023Q2 was 28% yoy, while Adjusted EBT and Adjusted Net Income have rebounded sharply from last year’s depressed levels. Adjusted net cash finished at R$4.3B (~US$0.8B) for the quarter.

StoneCo 2023Q2 results (StoneCo 2023Q2 press release)

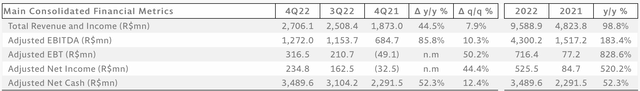

For additional context, I’ve included a snapshot of the results from the 2023Q4 press release, which give a glimpse of full-year 2022 and 2021. Relative to a market cap of $3.92B and an enterprise value of $2.85B, with a Real-USD exchange rate of 0.20, this appears to give EV/Sales of ~1.3x, EV/EBITDA of ~3.4x, and a P/E of ~14.5x over the trailing twelve months (Seeking Alpha’s calculations are a bit different).

StoneCo 2023Q4 results (StoneCo 2023Q4 press release)

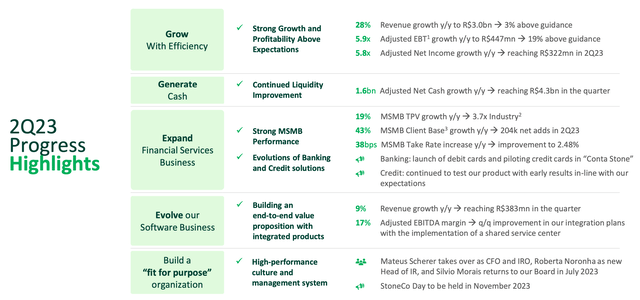

While these kinds of measures can move around a lot with volatile denominators, the broader context here suggests to me that this isn’t a long-term peak-of-cycle moment for earnings. The Brazilian economy is faring well enough, and StoneCo clearly has a lot of growth plans ahead of it, in the form of product expansion (e.g., financial services and the software business), integration of services, and cross-selling (see 2023Q2 progress highlights below). They haven’t even gotten to the point of looking beyond the Brazilian market, with enough opportunity to address domestically.

StoneCo 2023Q2 highlights (StoneCo 2023Q2 slides)

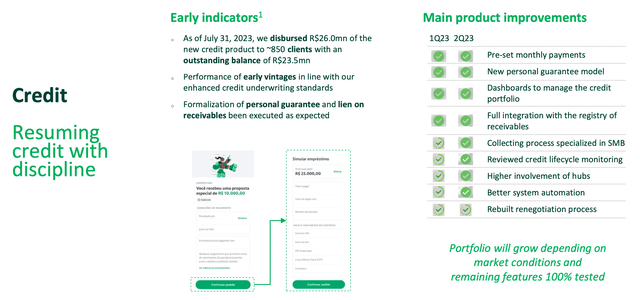

The following slide shows a summary of improvements on their re-launched credit product. They are resuming slowly, but credit performance is “in line with enhanced underwriting standards” and presumably they are better integrated with the registry of receivables, this time around.

StoneCo resumption of credit product (StoneCo 2023Q2 slides)

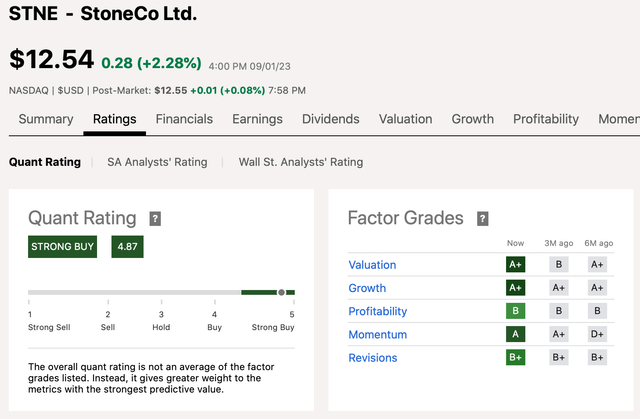

For what it’s worth, Seeking Alpha’s quant rating system now also gives STNE high scores:

Seeking Alpha’s quant rating of STNE (Seeking Alpha)

A Decent-Enough Outlook for The Political and Macroeconomic Backdrop

Lula has been back in power for six months, and despite initial market concerns, the Brazilian economy under the leftist politician has not collapsed — instead, recent economic results have been reasonably good, with 3.4% yoy growth, despite double-digit interest rates. His approval rating is also high, at around 60%. It’s hard to see how Brazil would necessarily be better off with Bolsonaro, with the elections riots in 2023 and his bizarre pandemic-related posturing.

The new government has appeared to show a willingness to strike a balance between market concerns around fiscal responsibility, and support for social programs. The macroeconomy presents no shortage of challenges, both domestically and globally (e.g., China, a major trading partner for Brazil, is facing its own downturn), but Brazil’s economic outlook for now seems reasonably positive. Notably, Brazil’s inflation rate has fallen from a peak of around 12% a year ago to 4% in July, and interest rates are expected to follow suit.

Competitive Landscape Shows Less Itch for Growth than in 2021

If StoneCo has moved on from its own self-sabotage, then the biggest threat to be wary of is likely competition, whether from existing or new entrants. Management reported that “dynamics that we saw this quarter is very similar to what we had seen in the past quarters”, with legacy providers losing market share at a slower pace, but still losing market share.

Some competitor comments appear to corroborate that payment providers are not currently looking to aggressively pursue market share at the expense of profitability. In the context of the SELIC, i.e., the Brazilian federal funds rate, falling from 13.75% to 13.25%, PagSeguro (PAGS) management stated on their 2023Q2 earnings call:

As we said before, we don’t plan to be the first one to keep decreasing prices. We try to keep the prices alive that we have as long as we can. But, of course, we’re going to evaluate and look what the competitors are doing. But at this point, we didn’t see pressure.

[…] Competition seems to be similar to levels that we had before. And answer to your question about how we can benefit about the SELIC went down, as I was saying before, we don’t plan to be the first one who — to pull the trigger and decrease prices.

So we — we try to offer better services for our clients in such a way they can use us and they are not that price sensitive.

[…] After these two years of pandemic and the SELIC with 13.75%, companies are not looking for growth at any price as they used to do in 2021. So every — everyone is more rational looking for profitability.

STNE, PAGS, and other Brazilian stock prices are much lower now than they were in 2021 –– to a large extent, it makes sense that companies would pursue growth when the market is rewarding growth, and would pursue profitability when the market is rewarding profitability. This lends some additional credibility to the idea that the sector won’t be eager to chase after profit-nullifying growth this time around.

For almost any company, there is never going to be a situation where there isn’t competition. At the very least for StoneCo, valuation has fallen to a reasonable level, the company is in a net cash position, there are good prospects for continued growth, and the macroeconomy is finding its way after a turbulent few years.

Risks to be Mindful About

It wouldn’t be feasible to comprehensively discuss all of the risks to STNE in one article. But here are a few to be mindful of, a couple of which I have already alluded to:

- Exposure to Brazil, an emerging economy known for macroeconomic and political volatility.

- Elevated industry competition from traditional players, more recent upstarts, and potential future entrants (domestic or foreign).

- Decelerating growth.

- Potential regulation around revolving credit cards and interest-free installment payments or potentially other issues.

- Execution challenges with the integration of the Linx acquisition.

- Resumption of the credit product comes with risks.

Given the above, an investment horizon of 5 years or more might help to allow some of the larger macro moves to play out, but of course, there are no guarantees.

Conclusion

The combination of StoneCo’s robust growth and no-longer-expensive valuation metrics make me wonder if either I am missing something, or if the market is oblivious. Perhaps a bit of both. It is indeed always possible that competition will re-intensify or a new entrant, e.g., some foreign tech behemoth, will come in and take over the small business technology landscape in Brazil.

Brazil also presents additional risks, with macroeconomic volatility and political uncertainty seemingly the rule rather than the exception, but even if the honeymoon of Lula’s return to the presidency doesn’t last indefinitely, then businesses will still need tech solutions. Most countries are still dealing with the fallout of the pandemic, in the form of inflation and high interest rates, so Brazil is not alone in grappling with these issues.

Comments welcome, thanks.

Read the full article here