This is a guest post by Landlord Investor

State Street Corporation (NYSE:STT) recently issued a par $1,000 preferred stock with a coupon of 6.7% that is attractive. Below are the key details of this fixed-reset preferred.

CUSIP: 857477CH4.

Coupon: 6.7% until March 15, 2029.

Reset: On March 15, 2029, and every five years thereafter, the coupon will reset to 5-Year US Treasury plus a spread of 2.61%. For example, if the 5-Year is 4% at reset, the coupon will be 6.61%.

Rating: Baa1 (negative) / BBB / BBB+ — Moody’s / S&P / Fitch.

Taxes: Qualified dividends (15% rate).

Dividend Frequency: Paid quarterly.

Call Date: March 15, 2029, or any dividend payment date thereafter.

Maturity: None (perpetual).

Issuance Size: $1.45 Billion.

Prospectus

State Street Bank Overview

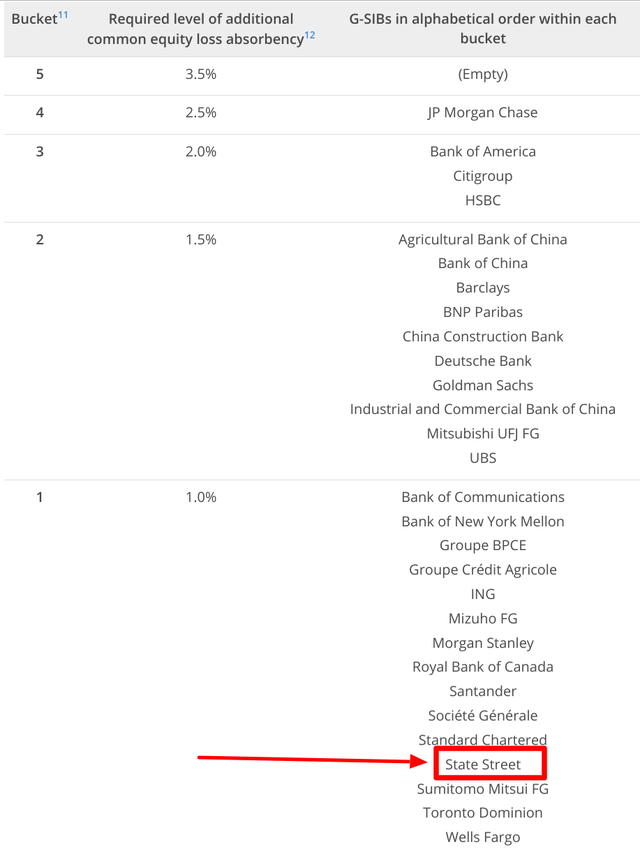

While State Street has a modest common stock market cap of $22B it’s a Global Systemically Important Bank (GSIB), which is colloquially known as a “Too Big To Fail” bank. There are different buckets of GSIBs and STT is in the lowest rung along with Wells Fargo and Morgan Stanley.

FSB.org

Source

GSIBs are safer than ordinary banks because they’re subject to tighter regulations that limit the amount of risk they can take. They’re also safer because there’s an implicit backstop from central bankers who will bend over backwards to keep them solvent. For example, by lending them money in the event of a liquidity crisis.

The reason State Street is a GSIB despite its relatively small size is the important role they play in the financial system. STT’s primary business is asset custody – the safekeeping of securities such as stocks. Back when State Street was founded in 1792, asset custodians stored physical stock certificates in bank vaults. In today’s digital world, STT’s role is to keep track of who owns what stock as they are bought and sold. It’s similar to Bitcoin’s distributed ledger but imagine if the ledger was not distributed and owned by a single bank instead. As the owner of that ledger for the $40 trillion of assets in their custody, you can see why STT is a globally important bank.

From the viewpoint of an individual investor, I like STT’s business model more than traditional banks that take credit risk. Even with Too Big To Fail traditional banks, when a crisis unfolds, you are left wondering if your investment is exposed. This is especially true with preferred stock which is not as safe as senior unsecured bonds. For example, Credit Suisse was Too Big To Fail and while it didn’t fail, preferred stockholders were wiped out when CS was purchased by UBS (the legality of which is being hashed out in court). As an individual investor, I favor investments that are not in cyclical businesses and that I don’t have to spend extra time monitoring when a recession or crisis strikes.

Safety First

State Street has the highest credit rating of any US-based GSIB. Its credit ratings are higher than JPMorgan, Bank of America, Citigroup, Goldman Sachs, Morgan Stanley, and Wells Fargo. While credit ratings aren’t always accurate, in this case, STT’s best-in-class credit rating is well deserved.

Credit risk is only part of the equation. A source of risk that was often overlooked during the 40-year bond market bull run was interest rate and inflation risk. This is the risk that the price of a security goes down as rates go up and that the purchasing power of your income decreases as inflation rises.

Compared to traditional fixed rate preferreds, this fixed-reset preferred greatly mitigates rate risk. If interest rates rise, the coupon will rise commensurately. If rates fall, the coupon also will decrease but should still be competitive with the alternatives available at that time. Therefore, the price should remain close to par after the reset. The exception is if a recession causes spreads to increase. But once spreads normalize after the recession is over, the price should gravitate back to par.

The strong points of this preferred are:

- Balanced protection from credit and rate risk.

- Lower price volatility.

- Likely to be trading close to par 10, 15, or 20 years from now (outside a recession).

- Eligible for preferential tax treatment (qualified).

The biggest risk to “set it and forget it” for this preferred is reinvestment risk from the security being redeemed, but redemption is unlikely given the modest reset spread.

STT Preferred Is Modestly Undervalued

STT is a good value relative to comparable alternatives. One alternative is the par $25 preferreds from JPMorgan, B of A, and Wells Fargo. Those yield 5.4 to 5.8%. So, the STT preferreds are giving you at least 0.9% more than those GSIB preferred stocks (although without the upside to par).

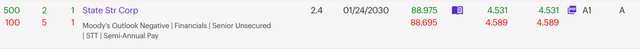

Another alternative is the STT bonds which yield around 4.5%. For example, the Jan 2030 unsecured bond yields 4.55%.

Schwab

The extra 2.2% of yield provided by the STT preferreds is an attractive spread to their A1/A rated unsecured bonds. Typically, anything over 1.5% is attractive.

The STT preferreds with their Baa1/BBB rating also trade at an attractive spread to the BBB corporate bond market at large. BBB bonds yield 5.55% on average or 1.15% less than the STT preferreds. Generally, a BBB-rated preferred is attractive when it yields at least 1% more than BBB-rated bonds.

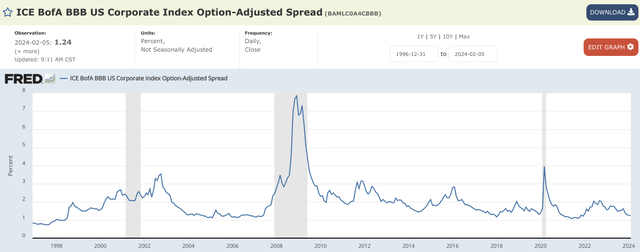

Another comparison to make is to the average spread of BBB bonds to Treasuries. The average BBB spread is 124 bps while the STT preferred provides a spread of 261 bps, or 137 bps more. Typically, anything over 100 bps is attractive when going from a medium-term maturity to a very long or perpetual maturity for the same rating.

The 124 bps average BBB spread is at the lower end of the non-recessionary range of 100-200 bps. If spreads simply got to the upper end of that range, STT would be providing a slightly unattractive spread of only 61 bps over the BBB average.

As the below chart shows, during recessionary periods, BBB spreads can get to 300 bps and beyond, at which point I would expect STT preferreds to trade significantly below par.

FRED

So, while STT preferreds are modestly undervalued today compared to alternatives, they could drop below par in a less favorable environment. They could go significantly below par in a recession, but eventually, I would expect them to recover to par, barring a change to STT’s fundamentals.

STT preferreds are only modestly undervalued in today’s market. That, along with the likely reversion of today’s exuberant market conditions, makes the STT preferreds unlikely to ever be called.

How To Buy This Preferred

This preferred stock only trades by CUSIP, not a ticker symbol like par $25 preferreds. Unfortunately, it is not easy to buy at all brokers.

It’s easy to buy at Interactive Brokers where $250K was offered today February 6 at 99.23. I got into this preferred too early at 100.42 but have averaged down more than once, as low as 99.25.

Schwab

I’ve heard people have bought it successfully at other brokers such as Schwab, Etrade, and Merrill by calling the CUSIP into the bond desk.

Read the full article here