The SPDR Blackstone Senior Loan ETF (SRLN) is an actively-managed ETF focusing on senior loans, and the largest fund for said asset class. SRLN offers investors a strong, growing 7.6% yield, and has very low interest rate risk, two important benefits for shareholders. On the other hand, the fund has a high 0.70% expense ratio, high credit risk, and should underperform if the Fed cuts rates aggressively. I rate the fund a buy, but the expenses are a significant downside, and make the fund a sub-par long-term holding.

Senior Loans and SRLN Overview

SRLN invests in senior loans, which are senior secured variable rate loans from non-investment grade corporations.

Senior loans are senior to other debt and secured by company assets.

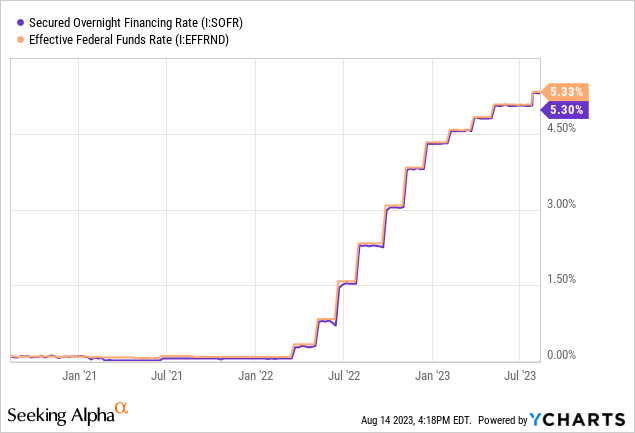

Senior loans are almost always variable rate loans, indexed to specific benchmark rates, and so see higher coupon rates when interest rates rise. Most are indexed to SOFR, a benchmark interest rate which closely tracks the federal funds rate.

Data by YCharts

Rates are reset at specific intervals, generally quarterly.

So, simplifying things a bit, we can say that senior loans see higher coupon rates when the Federal Reserve hikes rates. This differs from most bonds, most of which have fixed rates of interest from issuance to maturity.

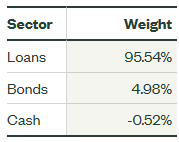

SRLN is an actively-managed ETF heavily focusing on senior loans, with these accounting for over 95% of the fund’s portfolio. Fixed-rate securities account for the remaining 5%, most of which consist of t-bills and other short-term securities used for cash management purposes.

SRLN

SRLN’s senior loan holdings provide the fund and its investors with many benefits and drawbacks. Let’s have a look at these, starting with the benefits.

SRLN – Benefits and Investment Thesis

Good, Growing 7.6% Dividend Yield

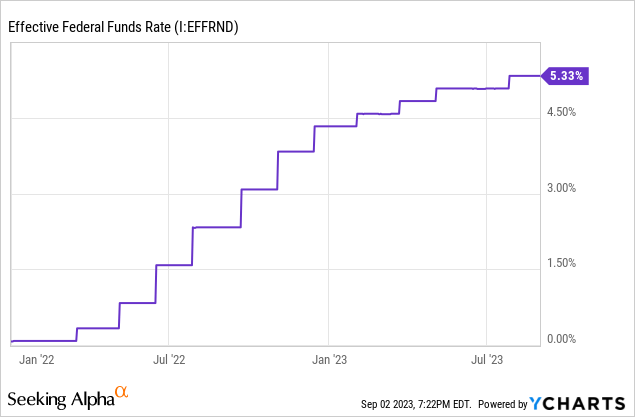

SRLN’s senior loan holdings are variable rate loans, which see higher rates when the Federal Reserve hikes rates. As I imagine all readers are aware of, the Federal Reserve has engaged in an aggressive set of hikes to combat inflation, with the federal funds rate increasing from effectively 0.0% in early 2022, to 5.3% as of today.

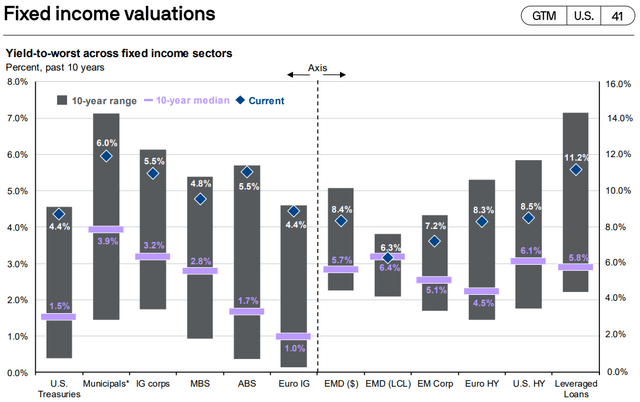

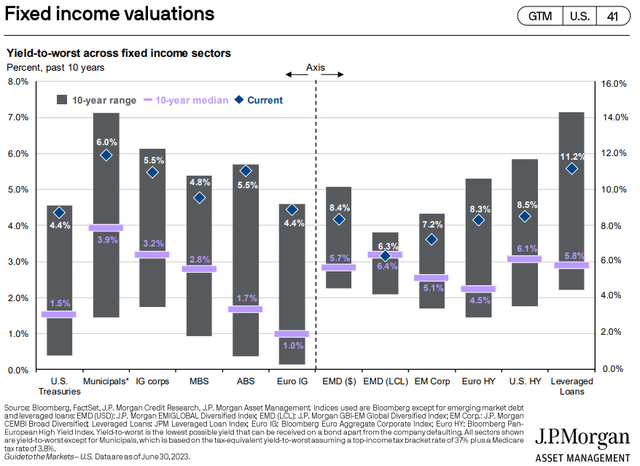

Senior loan themselves have seen their yields increase by 5.4% relative to their long-term averages, in-line with Fed hikes.

JPMorgan Guide to the Markets

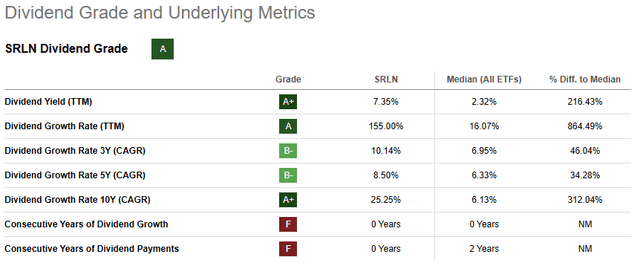

SRLN’s dividends have followed suit, with these increasing by 155% these past twelve months, leading to a 7.6% yield for the fund. Dividends are fully-funded by underlying generation of income, and sustainable under current market conditions, as evidenced by the fund’s 9.2% SEC yield.

Further growth seems likely too, due to recent Fed hikes, and due to the possibility of further hikes later in the year. Growth is, off course, not certain, and strongly dependent on future Fed policy.

Seeking Alpha

As an aside, the J.P. Morgan (JPM) graph above made me change my mind on SRLN from my prior more lukewarm / neutral opinion. Senior loan yields are simply too attractive, in my opinion at least.

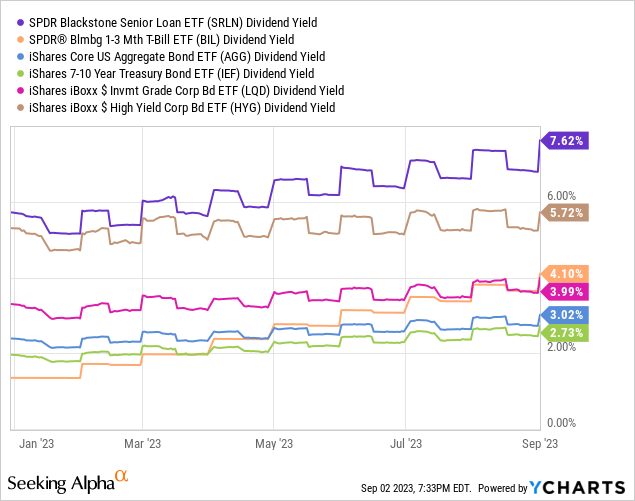

SRLN’s dividend yield and dividend growth are both quite a bit higher than average, and that most relevant fixed-income sub-asset classes. Yields are second to none, excluding niche sub-asset classes like mREITs or leveraged ETNs.

Only t-bills have seen higher dividend growth, and that is a technicality, due to starting from a much lower base. SRLN’s dividend growth compares very favorably to that of high-yield corporate bonds, their closest analogue by credit risk.

Fund Filings – Chart by Author

SRLN’s strong, growing 7.6% dividend yield is a significant benefit for the fund and its shareholders, and an important advantage of the fund relative to its peers.

Outperformance When Rates Rise

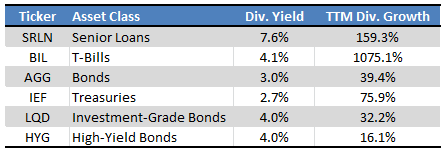

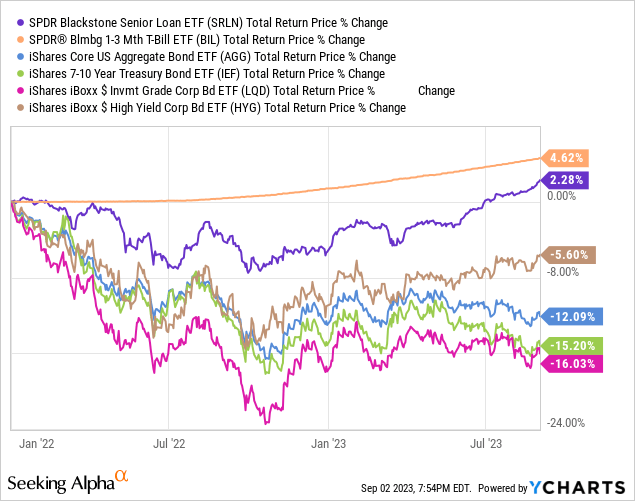

SRLN’s senior loan holdings see significant, swift increases to their interest rates / dividends when the Fed hikes, as can be seen above. Strong dividend growth leads to higher investor demand for these securities, reducing any potential capital losses from higher rates.

As an example, SRLN’s share price is down 8.3% since the Fed started to hike in early 2022, much lower losses than average, although higher than for t-bills.

Lower capital losses and stronger dividend growth means that SRLN outperforms when rates rise, as has been the case since early 2022. T-bills performed even better, however.

SRLN’s outperformance when rates rise is an important benefit for the fund and its shareholders. It is, however, a smaller, less impactful benefit than expected: SRLN still saw losses when rates rose, and total returns have been quite low. From what I’ve seen, fund underperformance was partly due to negative investment alpha, and partly due to widening credit spreads. Which brings me to my next point.

SRLN – Downsides and Disadvantages to Peers

High Credit Risk

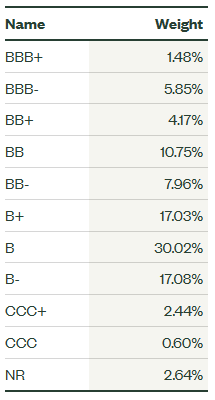

SRLN’s senior loan holdings are generally issued by non-investment grade issuers, with these accounting for almost 90% of the fund’s portfolio.

SRLN

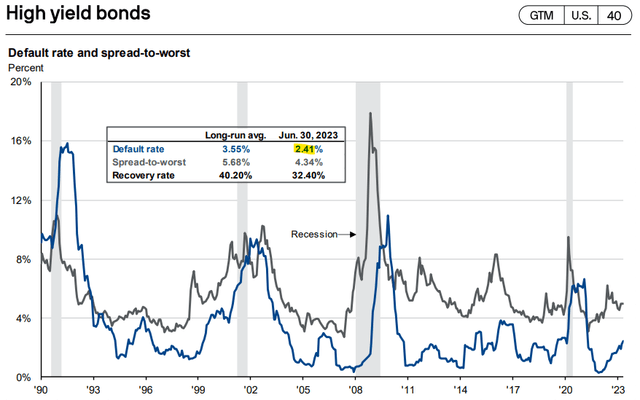

As can be seen above, the fund focuses on securities rated B, a very low credit rating, and indicative of very risky issuers. Default rates are higher than average, as are losses during downturns and recessions.

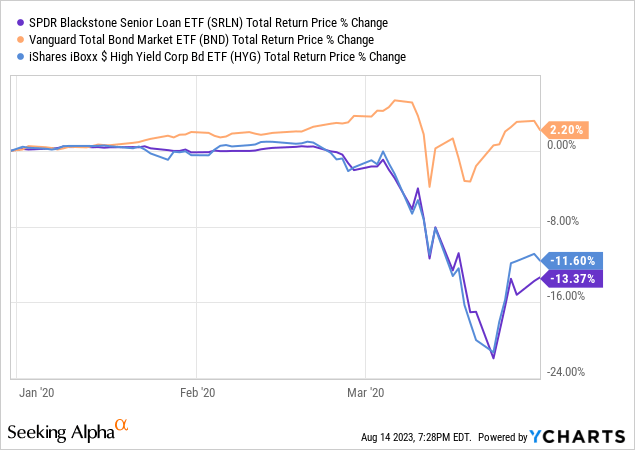

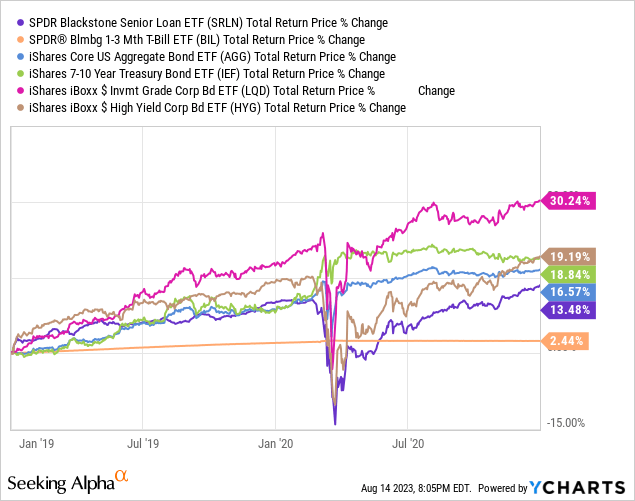

As an example, the fund saw losses of 13.4% during 1Q2020, the onset of the coronavirus pandemic. SRLN significantly underperformed relative to broader bond index funds during said time period, but only slightly underperformed relative to high-yield corporate bonds.

Data by YCharts

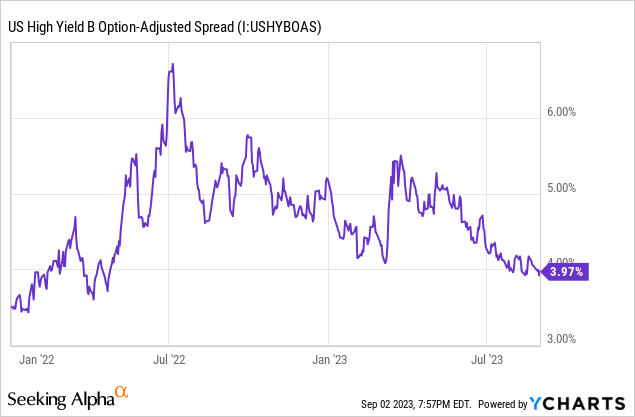

SRLN’s high credit risk also leads to above-average losses when spreads widen, which do not necessarily track underlying economic or industry conditions. As an example, spreads for B-rated securities spiked from 3.5% to over 6.5% during the first half of 2022, even though market conditions were more or less fine at the time (at least concerning defaults and recovery rates, inflation was another matter).

Spreads spiked at the time due to fears of inflation, and a possible recession, perhaps caused by higher Fed rates. Conditions did worsen a bit, but default remain quite low at 2.4%, and lower than their long-term 3.6% average.

JPMorgan Guide to the Markets

Going back to my previous point, SRLN’s lower interest rate risk has been less impactful than expected, as widening credit spreads coincided with lower Fed rates, leading to unexpected losses.

SRLN’s high credit risk is a negative for the fund and its shareholders, and might make the fund a broadly inappropriate choice for more risk-averse investors.

Underperformance When Rates Decrease

SRLN’s lower interest rate risk or exposure means swifter dividend growth and better share price performance when rates rise, but sharp dividend cuts when rates go down, and no capital gains to boot. Due to this, SRLN should underperform when rates decrease. This was the case the last time the Fed slashed rates, starting from early 2019 to 2020. Rate cuts coincided with the coronavirus pandemic, so it is not trivially easy to cleanly separate the impact of these two events on the fund’s performance, but SRLN did underperform, as expected. T-bills performed even worse, however, due to their low yields, at the time.

Data by YCharts

SRLN’s low interest rate exposure could lead to significant dividend cuts and underperformance if the Fed were to aggressively cut rates. Emphasis on aggressive: the market is expecting, and pricing-in, significant rate cuts already. As per JPMorgan (JPM), senior loans tend to yield around as much as high-yield corporate bonds, but currently yield around 2.7% more. Meaning, the Fed would have to cut by 2.7% for senior loan rates to match the yield on fixed-rate high-yield bonds, by +3.0% or more for spreads to be negative.

JPMorgan Guide to the Markets

I want to emphasize the figures above. If the Fed cuts rates by 1.0%, senior loans should still yield more than high-yield corporate bonds. Same situation if the Fed cuts rates by 2.0%. If the Fed cuts by 3.0%, senior loans should yield a bit less, consistent with long-term averages. Fed would have to cut by +3.5% for senior loan yields to be meaningfully lower than those of high-yield bonds. This all assumes no other changes to market conditions, however.

Point being, senior loan rates would go down if the Fed were to cut rates, but spreads are wide enough that rates and dividends are likely to remain competitive after. Assuming no aggressive, sharp cuts, at least.

In my opinion, senior loan spreads are wide enough that the possibility of future Fed rate cuts does not excessively concern me. More dovish investors might disagree.

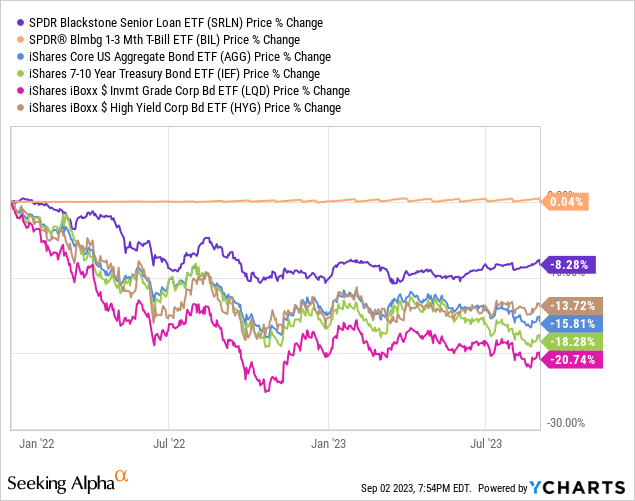

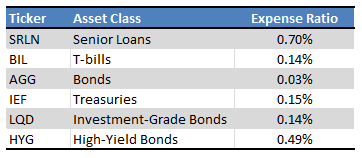

High Expense Ratio

SRLN sports a 0.70% expense ratio. It is high on an absolute basis, high for an ETF, significantly higher than average for a bond ETF, moderately higher than most high-yield corporate bond ETFs.

Seeking Alpha – Chart by Author

In my opinion, and based on my knowledge and experience with ETFs, SRLN’s expense ratio is not high enough so as to be a deal-breaker, but it is close. That 0.70% eliminates a sizable chunk of the fund’s dividends and returns, and investors get nothing in return. With so many low-cost ETF options available, it is difficult for me to give an expensive ETF a buy rating.

Notwithstanding the above, senior loans seem so strong as an asset class right now, with their comparatively low level of risk, strong dividends, and healthy spread against high-yield bonds, that I’m willing to overlook the expenses. Other investors might prefer to focus on cheaper funds, and I will definitely update my view on SRLN as economic conditions continue evolve. For now, the fund seems like a buy to me. Do remember that SRLN’s dividends are net of fees, so investors receive strong dividends even after accounting for these expenses (dividends would be higher if the fund were cheaper, however).

As an aside, I’ve yet to find a simple, cheap senior loan ETF available to retail investors. It seems like the asset class was not all that popular when rates were declining, for obvious reasons.

Conclusion

SRLN’s strong, growing 7.6% yield and very low interest rate risk make the fund a buy.

Read the full article here