Introduction

I’m constantly on the lookout for potential gems that could give investors strong upside and long-term potential for many years to come. As a dividend investor, I look for companies with not only attractive yields, but those that can reward investors with nice share price appreciation and growing dividends over time.

BDCs are some of my favorites to invest in due to their higher than normal yields along with their potential to be great, long-term investment vehicles. Deemed as risky investments as a result of their business structures, I think the outlook on the sector will likely change for the better in the foreseeable future.

One BDC in particular, who also has the potential to be a great long-term investment, is Silver Spike Investment Corp (NASDAQ:SSIC). In this article, I discuss the company’s latest earnings, fundamentals, and why their dividend yield is safer than it appears.

Previous Thesis

I last covered Silver Spike Investment in early April in an article titled: This Cannabis BDC Looks Poised For Growth. I discussed the company’s earnings, in which they brought in net investment income totaling $1.07 for the full-year. Total investment income came in at $11.9 million to close out 2023.

I also touched on their dividend safety, covered solidly by their Nll. However, their decline in NAV growth is what cautioned me to assign the company a hold rating instead of a buy. But SSIC has seemingly done well, up more than 30% in comparison to the S&P who is up slightly more than 5% since then.

Latest Earnings

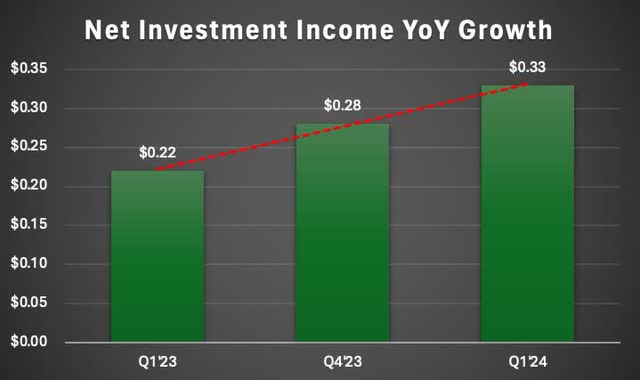

Silver Spike Investment reported their Q1 earnings on May 10th, seemingly not getting off to a great start. Net investment income of -$0.01, or negative $100,000, a significant drop from the prior quarter that saw Nll come in at $0.28. Obviously, this was also a substantial drop from a year ago that saw Nll of $0.22.

I’ll discuss more on the decrease in net investment income later in the article. Their top line came in at $2.8 million, a slight drop from the $2.9 million they saw in Q4. However, this grew 16% from $2.5 million on an annual basis.

As far as investments for the first quarter, it was fairly quiet for SSIC, similar to Q4 that saw no new investments for the BDC. However, they did enter into an agreement with Chicago Atlantic Real Estate Finance (REFI) that I touched on during my last thesis, so I won’t go into it at this time. However, management did touch on this, stating they expect the deal to close mid-2024. So, likely sometime in the next month or so.

The acquisition is expected to enhance SSIC’s scale and liquidity while diversifying their portfolio. SSIC is a small BDC with investments in only 5 companies currently. And even though Chicago Atlantic will remain a separate entity, this will add an additional 27 companies worth approximately $187 million to SSIC. With the acquisition, they are taking over the REIT’s loan portfolio, or holding company, which is expected to positively impact the BDC’s cash flow.

However, it is important to note this will dilute shareholders, as the deal with Chicago Atlantic Real Estate Finance was in exchange for newly issued shares of the company’s stock.

Dividend Is Safe

I think I can speak for most investors when I say it’s likely one reason they choose to invest in BDCs, their higher than normal yields. Which makes them attractive for those in search of income. But investing in a BDC whose yield is not covered by net investment income is something investors should probably avoid. Especially if this is for a prolonged period of time.

With net investment income of -$0.01 investors may be left saying, Why would I invest in a BDC with negative Nll? And that is a valid question or concern. I consistently preach Quality over Quantity. In this case, there is a valid reason for the negative bottom line.

And this has to do with the acquisition mentioned previously. Silver Spike incurred a $2.1 million transaction expense which impacted their bottom line as well as dividend payments.

Excluding this, net investment income would have been $0.33 per management during earnings. This represents a growth rate of nearly 18% from the prior quarter and 50% growth from a year ago.

While the BDC did not cover the current dividend of $0.25 during its latest quarter, SSIC’s coverage excluding the transaction expense would be 132%. Comparing them to those with a similar market cap, SSIC beats both peers Great Elm Capital Corp (GECC) & Logan Ridge Finance (LRFC), who both had similar dividend coverage of 106%.

Comparing them to larger peers Golub Capital (GBDC) & Ares Capital (ARCC), SSIC beats both as both had dividend coverage of 130% and 115% respectively. So, despite the seemingly negative earnings report, SSIC’s dividend coverage remains safe.

Additionally, if need be the BDC could continue funding their dividend should Nll remain impacted in the short term as they currently have no debt and $33.2 million in cash & cash equivalents on their balance sheet.

Author creation

Potential Catalysts

According to Silver Spike’s 10-K, the cannabis industry grew double-digits to $31.6 billion last year. And with this expected to continue its trend of strong growth this year to $35 billion & nearly 50% over the next six years, SSIC and its peers could capture some of this growth.

Additionally, optimism surrounding Section 280E could serve cannabis companies well if this is amended. With more states likely to legalize cannabis in the coming years, and the fact that the schedule of the drug could be downgraded, this will likely benefit businesses within the industry.

Additionally, this could support the tax code change, as cannabis could be on the road to federal legalization. Giving it another look at the Supreme Court level. If so, this could give those like SSIC tax credits & deductions, thus positively impacting their cash flows.

Moreover, as the only publicly-traded BDC that directly lends to the cannabis industry currently, SSIC is well-positioned as this would mean improved liquidity and additional lending opportunities. Currently, the BDC lends to one of the largest publicly-traded cannabis companies, Curaleaf (OTCPK:CURLF), who would likely become more profitable as the industry grows in the future. Ultimately benefitting the BDC in the process.

SSIC investor presentation

Why A Hold And Not A Buy?

Readers may be left wondering if you see positivity for the company and their dividend yield is safe, then why not rate them a buy? As a newer company and the only public BDC focused on lending to the cannabis sector, I would like to see more from Silver Spike Investment before upgrading them. Particularly, by the way of sustained NAV growth and how their Nll will be impacted from the recent acquisition in the coming quarters.

During Q1, SSIC saw their NAV decline from $13.77 to $13.60. Year-over-year, this declined nearly 5% from $14.29. When investing in BDCs, a stable or growing NAV is crucial. For those with steady declines in their NAV, this could suggest a fundamental problem for the company. Especially since SSIC is smaller and a newer BDC.

In 2022 when the BDC went public, their NAV stood at $13.73 and $13.91 at the end of 2022. Not a huge drop in comparison to those like Prospect Capital (PSEC) whose NAV has seemed to be in a free fall over the past few years.

I discussed this in an article you can read here. SSIC’s NAV decline hasn’t been significant over the past two years, however I would like to see more stability and/or growth while watching how their financials fare in the coming months/years.

Risks & Valuation

With a market cap of less than $100 million and a small portfolio with a fair value of roughly $55 million, SSIC is a very speculative play. Currently, they have only 5 borrowers, but to be fair, all of their investments are in first-lien loans. At quarter’s end, they had 0 companies on non-accrual status.

But with so much uncertainty surrounding the cannabis industry and the higher interest rate environment, this could change if interest rates aren’t cut as quickly as anticipated. Furthermore, if the economy falls into a recession, SSIC’s borrowers could face bankruptcy challenges, impacting their ability to repay their loans.

With the recent run-up in share price, Silver Spike Investment seems to be overvalued currently, with Wall Street seeing downside with a price target of $11.40. At the time of writing, SSIC is trading 5% above this at $12 a share. However, Wall Street still rates them a buy, likely due to the suspected growth of the cannabis industry. Although the BDC could see further upside, I think they are likely fully valued here and could see a pullback in price.

Seeking Alpha

Conclusion

Silver Spike Investment is a unique and speculative investment, being the only BDC within the cannabis industry. Their fundamentals seem solid, and they have performed decently in the current macro environment with zero non-accruals, which is impressive considering they are a very small company.

Furthermore, they have a strong balance sheet with no debt and ample liquidity in cash available. Moreover, SSIC’s dividend yield is well-covered even as they incurred a $2.1 million charge related to the recent acquisition expected to close in the coming weeks/months. However, due to their somewhat unstable NAV, I continue to rate Silver Spike Investment Corp. a hold.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here