The first time I looked into SentinelOne (NYSE:S), the numbers were pretty mind-blowing. Revenue growth was in the triple digits, operating margins were negative triple digits, and management discussed holding themselves to the Rule of 60 vice the Rule of 40, where the sum of revenue growth and free cash flow margin is used as a barometer for business performance.

However, some of the shine has come off. Natural comparisons for S will always be the other endpoint security darling, CrowdStrike (NYSE:CRWD). I’m a fan of the company and have owned shares for years. There was a huge delta initially, but as I’ll show you in this article, the metrics no longer support investing in the smaller upstart S.

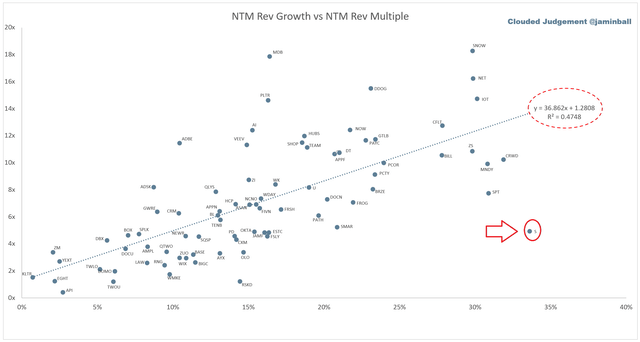

Clouded Judgement Substack

Like I mentioned, S was an absolute outlier. The graph above shows revenue growth against multiple, with a median line of best fit drawn through the entire cloud space. S is the statistical anomaly, with a surprisingly low valuation compared to its growth.

Endpoint security has taken the market by storm, with massive tailwinds from the hybrid work environment, internet of things, and the shift to the cloud. Ultimately, we are looking at solutions that protect more than just the peripheral wall of the network. Singularity, the flagship product for S, is labeled an extended detection and response platform. This allows its customers to shift the security perimeter and protect instances in the internet of things infrastructure, cloud workflows, etc. The company uses artificial intelligence to analyze massive amounts of data allowing the security network to shift to ever-changing threats.

What makes this type of business such a good investment, typically, is the sticky nature of the product. They are selling it B2B, and so long as the product works and protects the workflows, IT departments will be loath to switch and have no reason to. This allows for much more pricing power and significant switching costs. Many investors, when asked, would not consider tech companies to be recession-resistant, but I would argue the enterprise-level cloud software providers are about as recession resistant as it gets. S is making inroads into the larger market, with 917 customers over $100K ARR, up 61% from last year.

Revenue growth has declined precipitously into this year, however. Triple digits is definitely in the rear-view mirror now, as revenue growth on the quarter came in at 70%, with forward guidance of 41% on the full year, and 34% over the next twelve months. This brings revenue growth down to more in-line with CrowdStrike’s expectations of 32% revenue growth. You’re getting the growth cheaper, with forward sales multiples for S at 4.9X versus 10.2X, but CrowdStrike’s market position is better, and it carries a GAAP operating margin of -8% (well into positive free cash flow) vice -90% for S.

With this decline in revenue growth, S now misses on the Rule of 40, with a forward value of 20% versus 62% for CrowdStrike, and stock-based compensation as a percentage of revenues is well above the median at 39%. Lastly, net revenue retention is in decline, as well. This metric shows how well the company is landing and expanding with its customers, and incorporates churn. S is now down to 125%, which is still a great number, but its moving in the wrong direction. The company carries no debt and $1.1B on its balance sheet, so there’s time for them to bring expenses in-line and start to generate free cash flow.

I think management said the right things on the call. They’re paring back headcount by 5%, pacing hiring going forward with an eye on expense management, and looking to continue their progress in margin improvement. Operating margin today is already much better than it was in the past few years and gross margin in the high 60% range has plenty of room for expansion to bring it in-line with peers. However, I think it’s prudent to wait to see this progress come to fruition with a stabilization of revenue growth before pulling the trigger.

In all, S still has the opportunity to become a great company. The space is a great one to invest in, but there’s not really any aspect of the company that makes me want to invest in S over CrowdStrike today. The G2 Grid shows CrowdStrike with higher customer satisfaction and a way stronger market position than S, along with several other competitors’ offerings. Just being cheaper on a sales multiple isn’t going to move the needle for me. I’m in a Missouri frame of mind with S going forward, the “show me state”. I’ll continue to monitor, for now it’s a hold.

Read the full article here