Since I last covered alternative streaming company Rumble Inc. (NASDAQ:RUM) in November, we have two quarters of fresh performance metrics and corporate moves to assess. In addition to attempts at bringing content diversity to what has been dubbed a right-leaning streaming platform, Rumble also purchased Callin, a live podcast streaming company. In this update, we’ll go over recent trends and announcements. We’ll also look at the Rumble balance sheet and company valuation.

Company Performance

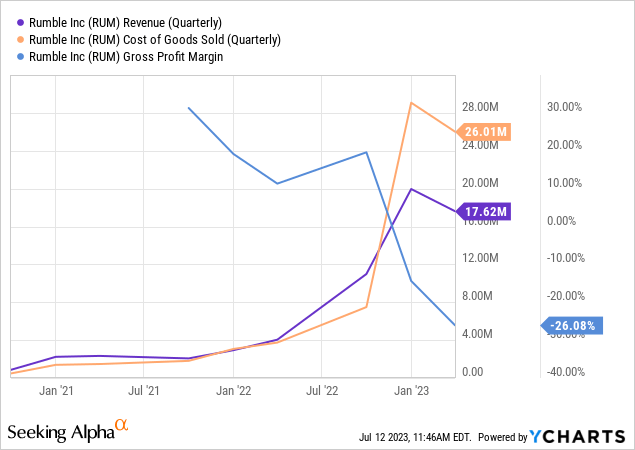

In Q1 2023, Rumble recorded $17.6 million in revenue and $26 million in cost of revenue. These represented sequential declines and year over year gains in both metrics. The quarterly decline in revenue was attributed to dips in engagement following the mid-term elections. Notably, the pace of cost of revenue grew faster than revenues, and the result was a negative gross profit figure for the second straight quarter.

The increase in cost of revenue is primarily due to $21.1 million in content costs. From a corporate strategy standpoint, the company has taken steps to diversify its content offering on the Rumble platform. This is a good thing in my view, but it does necessitate outreach to non-political content creators.

Popular Twitch (AMZN) and YouTube (GOOG) streamers Kai Cenat and IShowSpeed recently launched a joint show exclusive to Rumble – there have been just two episodes as of article submission. Acquiring these kinds of content creators will likely continue to be expensive, as Rumble doesn’t yet have the viewership level of competitors and the high value creators who come on need an incentive to create exclusive material for Rumble.

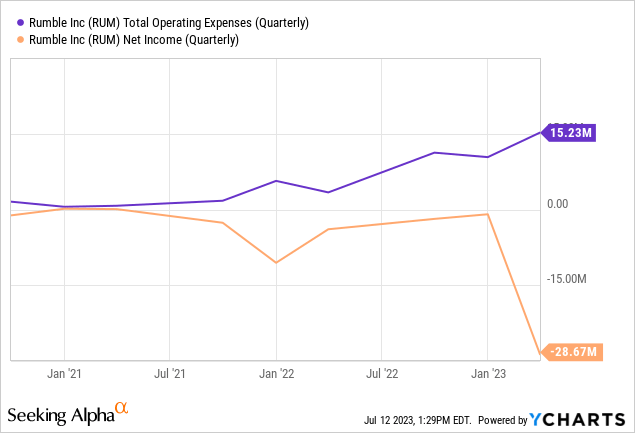

Opex also increased roughly in line with revenue of the prior year from $3 million to over $15 million. Approximately $2.3 million of that difference was due to share-based compensation (“SBC”). Revenue for the company is broken out into two different segments: advertising and licensing/other.

| Quarter ended March | 2023 | 2022 | YoY Growth |

|---|---|---|---|

| Advertising | $14,336,450 | $2,509,526 | 471.28% |

| Licensing and other | $3,278,925 | $1,535,239 | 113.58% |

| Total revenues | $17,615,375 | $4,044,765 | 335.51% |

| Ad share of rev | 81.4% | 62.0% |

Source: Rumble.

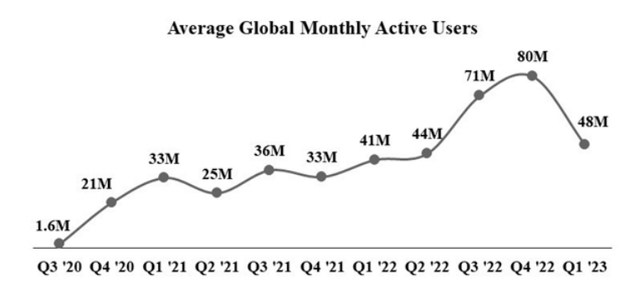

There has been a growing dependence on ad spending over the last year, with year-over-year ad growth of 471% versus licensing/other revenue growth of 114%. From a usage standpoint, the company currently boasts 48 million monthly active users (“MAU”) against 41 million in the first quarter of last year:

MAU Trend (Rumble)

However, it should be noted this 48 million figure is a 40% reduction from Q4-22. The company attributes this decline to mid-term elections ending and to the multi-month hiatus of Steven Crowder, one of the platform’s top creators. In addition to the 17% year-over-year change in MAUs, Rumble generated a 3% increase in minutes watched over Q1-22.

Balance Sheet and Valuation

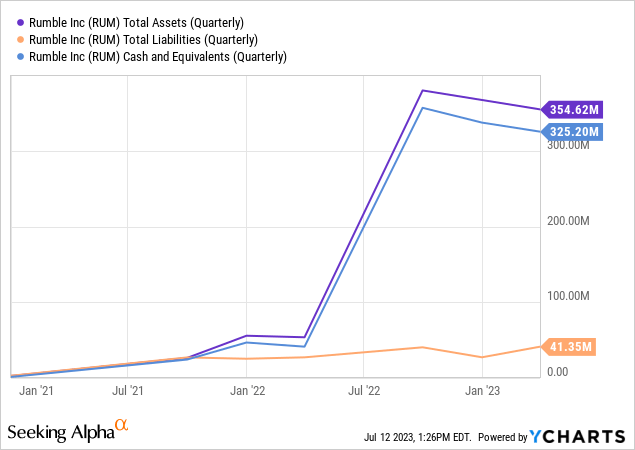

Purely from a balance sheet standpoint, company Rumble has a lot of runway to build a robust platform:

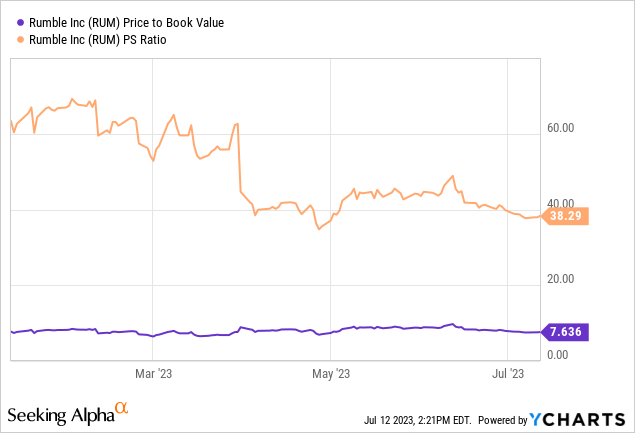

The overwhelming majority of the company’s $354.6 million in total assets is cash and cash equivalents. Total liabilities remain small at just $41.4 million. From a valuation vantage, RUM shares have improved from where they were when I last wrote about the company in November. But valuations are still elevated to say the least:

At a $2.4 billion market cap, RUM is trading at nearly 8 times book value and 38 times sales. The company is clearly priced for growth, and I think generating that growth is going to be a challenge.

Risks

Even though Rumble already has a glut of politically-driven content, not landing Tucker Carlson after his departure from Fox News (FOX) was unfortunate given the obvious synergy between Rumble’s typical viewer and Carlson. It also goes to show that Twitter is quickly becoming a viable competitor in the long-form streaming space since the Elon Musk purchase. This is not an insignificant risk, as Twitter has a robust user base and claims to be a platform that respects speech freedom. This gets us back to content acquisition.

Without the organic migration of content creators to Rumble from other distributors like YouTube, Rumble is going to have to continue to spend cash to bring on new creators. On the last conference call, the company’s CFO Brandon Alexandroff mentioned there is $164 million committed to programming and content, the majority of which will be paid over the next 12 to 48 months:

Of that amount as of March 31, 2023, we had entered agreements with a minimum contractual cash commitment of $62 million. Subsequent to the end of the quarter, we entered into additional agreements with a minimum contractual cash commitment of $102 million.

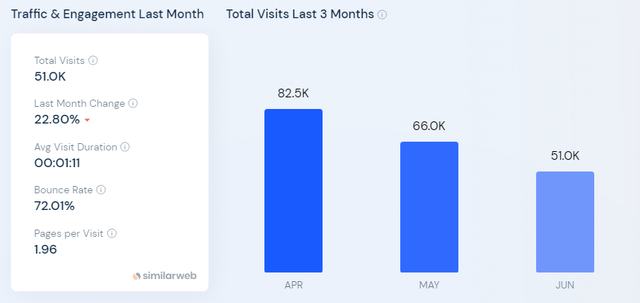

We also don’t yet have financial specifics pertaining to the Callin purchase. According to SimilarWeb, Callin is ranked 923,547 in global web traffic as of June and has experienced engagement declines in recent months:

Callin data as of June (Similarweb)

With just 200k estimated site visits in the second quarter and declining engagement, I assume this acquisition is driven more by technical IP than userbase value. But again, that’s a guess, and we need to see some color from management on the specifics of the deal.

Finally, I suspect we are inching closer to an economic slowdown. In a slowdown, it is almost a certainty that advertising spend will go down. This is possibly a problem for Rumble, since the company’s main area of revenue growth over the last year has been in advertising rather than licensing. In the first quarter last year, 62% of the company’s revenue came from ads. That figure was up to 81.4% in the last quarter. In my view, RUM shareholders probably want to see licensing and subscriptions generate more cash for the company going forward.

Investor Takeaways

The existence of Rumble is a good thing. I believe competition in UGC streaming is very needed, and YouTube has invited insurgents due to what I personally believe to be poor content moderation policies. Rumble has grown compared to last year, but that growth is coming with a cost. While there is still quite a bit of cash on the balance sheet, a lot of that capital has already been committed to growing content and programming.

Rumble needs organic growth in UGC or it is likely going to continue to need to pay creators to distribute content on the platform. Organic growth wasn’t necessarily a problem during COVID/lockdowns when there was justifiable fear of de-platforming in the creator economy. Unfortunately for Rumble, people seem to have short memories and that fear appears to be less intense now. Leadership clearly recognizes the problem with being a one-trick pony when it comes to content subject matter. I still think Rumble Inc. stock is a hold at this point.

Read the full article here