Investment thesis

RingCentral (NYSE:RNG) continues to have a leading position in the Unified Communication as a Service (“UCaaS”) market, which is forecasted to grow at a 19.4% CAGR until 2032, reaching a value of $311 billion. Although demand is increasing, the intense competition in the market has put pressure on pricing. RingCentral has differentiated itself versus its rivals mainly due to its reliability and strategic partnerships. Additionally, the company has now launched multiple AI-based products, which it aims to upsell to its large existing client base.

With respect to profitability, the business has shown strong operating leverage with margins rising from 10.4% in Q1 2022 to 21.9% last quarter. The resulting solid FCF generation has reduced the risks related to the company’s upcoming debt maturities. The current valuation, though undemanding versus peers, is not attractive when considering the high level of stock-based compensation (“SBC”) involved. I therefore maintain a Neutral rating on the shares.

Financial highlights and my expectations looking ahead

Q2 Investor presentation

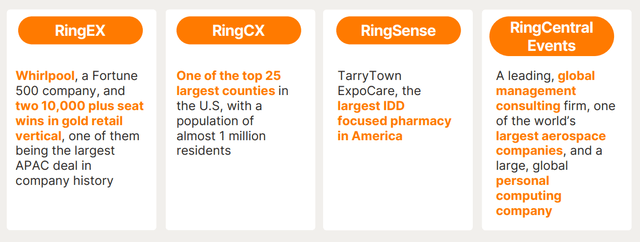

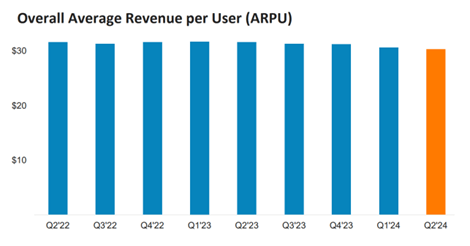

Revenue grew 10% to $593 million in Q2, which was well above management’s guidance. The main driver for the outperformance was the increased traction for the company’s new AI-based offerings, which are shown above. RingCX, its Contact Center as a Service (“CCaaS”) offering showed exceptional quarter over quarter growth of 70%. Additionally, RingSense, which provides customer insights, and RingCentral Events, for managing large-scale events, also experienced strong growth. Though these new products are growing from a relatively small base, management does expect their overall contribution to reach $100 million in Annual Recurring Revenue (“ARR”) by the end of 2025. Given that the company is able to offer these products to its clients at substantially higher prices compared to the current per seat price below $30, I expect this to drive up ARPU in upcoming quarters. Discussing the pricing of these new products, the company’s CFO stated:

And just to remind you on the ARPUs around the new products. RingCX, we live at $65 per month per seat, so way above the corporate average. And RingSense for Sales is about $60 per month.

Q2 Investor presentation

As shown above, ARPU has declined in recent quarters as the company has focused more on enterprise customers, which typically involves large pricing concessions. This has been a headwind for revenue growth until now, but I expect this metric to improve going forward, mainly driven by large upsells. I expect this to support high-single digit revenue growth in the medium term, in line with analyst estimates.

I also expect the company to continue to show operating leverage. In Q2, Sales and marketing expenses declined 150 basis points as a percentage of revenue. Going forward, I expect R&D expenses to also decline as a percentage of revenue given that the new products have already been launched in the market. This should lead to margins expanding by at least 200 basis points each year in the medium term. Investors can therefore expect earnings to outpace revenue growth by this margin going forward.

Q2 Financial report

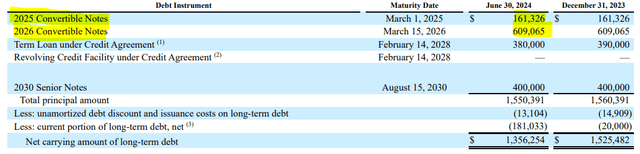

Given the solid FCF generation from the business, which management expects to be close to $400 million for this year, and its cash position of $200 million, I expect that the company will not face major issues in repaying its debt due in 2025 and 2026, as shown above. Excess capital is likely to be deployed towards share repurchases, to offset the dilution from SBC.

Valuation

At the current share price of $33, the company has a market cap of just above $3 billion. Given its net debt position of $1.3 billion, it has enterprise value is $4.3 billion. Based on management’s guidance for FCF this year of approximately $400 million, shares are trading at Price/FCF and EV/FCF multiples of 7.5 and 10.7 respectively.

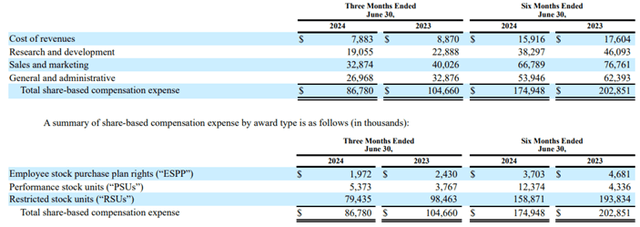

Meanwhile RingCentral’s competitors such as Zoom (ZM) and 8×8 (EGHT) are growing at mid-single digit rates and valued at EV/FCF multiples of 9 and 10.4 respectively. Based on my expectation for RingCentral’s FCF to grow at around 10% in the medium term, I consider this valuation to be relatively attractive. However, a major concern for me is the company’s elevated level of SBC. At an annual run-rate of around $350 million, it is nearly as large as the company’s annual FCF generated. Management has clearly begun addressing this, by significantly reducing the amount of share grants, as explained by its CFO when she stated:

As of the first half of 2024, net new share grants are down almost 60% versus last year, which is ahead of our previously stated goal to reduce share grants by 58% of 2023 level.

Q2 Financial report

The elevated level of SBC makes the company’s valuation much less appealing on a GAAP basis. Besides being valued on par with peers, I would argue that investors are offered reasonable downside protection as the company is an attractive acquisition candidate from much larger players like Cisco (CSCO) or Salesforce (CRM), that are looking to strengthen their offering in the UCaaS space.

Risks to consider

Competition

In addition to competing with major players such as Microsoft (MSFT), Zoom, and 8×8 in the UCaaS market, RingCentral now also faces competition from players like Five9 (FIVN) in the AI-driven CCaaS space. Given its substantial existing client base, I believe RingCentral is well-positioned to achieve greater success by upselling its new products to current customers rather than focusing solely on acquiring new ones.

AI-driven automation

AI-powered chatbots and virtual assistants could drastically reduce the number of humans needed for the job, which in turn would lead to a lower numbers of seats needed per customer. RingCentral is working towards countering this impact by offerings its own suite of AI-based products for its clients.

Debt

The company has a gross debt of nearly $1.5 billion compared to $200 million in cash. The successful deleveraging hinges on the continued strong FCF generation from the business.

Macroeconomic weakness

A challenging economic environment could particularly affect RingCentral’s small and medium-sized business clients. In the event of widespread layoffs, these businesses may reduce their workforce, leading to a decrease in the number of RingCentral seats required.

Conclusion

While AI may pose a significant threat to long-term business growth, management is currently leveraging its AI-based products to drive revenue growth and profitability in the medium term. Although the current valuation seems reasonable, it is not particularly attractive, especially when factoring the expenses related to SBC. Consequently, I maintain a Neutral rating on the shares.

Read the full article here