Women’s clothing retailer J.Jill (NYSE:JILL) still has robust valuation support despite a reasonable run in the stock in 2022 and against a less favorable consumer backdrop. The company is now also spending a little more on a new Point-Of-Sale system and a few store openings (though the net impact should be neutral with accompanying store closures), their approach to expenditures remains relatively disciplined.

In recent results, sales declined and the CEO talked of a potentially “weary” consumer into 2023, with guidance for EBITDA to decline mid-single-digits. For Q1 sales fell -5% with comparable sales off -3%. The company has refinanced its debt at lower absolute levels, but the higher interest rate means that interest expense for 2023 will be broadly similar to 2022. Gross margin expanded in Q1 as higher freight costs rolled off, and this should continue for Q2 but not persist into the second half of 2023.

2023 Guidance

If we take 2023 guidance as reasonably accurate, then 2022 adjusted EBITDA was $109.4M, if we assume that then decline 5% per guidance for mid-single digit declines, then that’s around $104M. Here’s what that would look like in terms of FCF to equity.

| Estimated adjusted EBITDA | $104M |

| Interest expense | -$24M |

| Capex (note: guidance is $18M) | -$20M |

| Tax (implied 25% tax rate) | -$15M |

| Resulting FCF (2023 est.) | $45M |

| Implied FCF yield | 19% |

Sensitivities

Of course, that’s all good, but how precarious is that 19% FCF yield? Below are some sensitivities to the above calculations. This holds interest expense and capex constant, but adjusts taxation to 25% of cash earnings.

| EBITDA change | -25% | -15% | -10% |

| resulting EBITDA | 82 | 93 | 98 |

| resulting FCF (2023 est.) | 28 | 37 | 40 |

| FCF yield @$23/share | 12% | 15% | 17% |

As such, it seems we have some margin of safety with JILL unless you are very negative on the U.S. consumer. I would also note that their customer is older, wealthier women that may offer a degree of protection in a recession, though of course clothing is a discretionary purchase.

For further context, note that I found average pre-COVID income to average around $25M in a prior article here. I believe the business is now in a somewhat better position than then with its more optimized store portfolio and more refined omni-channel approach. Though it’s also possible that it could just be over-earning on fashion trends currently.

Risks

- JILL is a small retailer subject to fashion trends related to their styles and fabrics

- At the time of writing the Q1 10-Q has not been released, so I can only estimate cashflows

- In a weak consumer environment operational leverage could cause JILL to underperform

- Capex should be monitored, the company is incrementally investing in a handful of new stores and POS, but cash flow to equity remains consistent

- VC firm TowerBrook owns ~50% of the shares, acquiring 100% in 2015 and selling 50% during the 2017 IPO. If they chose to sell down further this would weigh on the shares, but for now they may currently be broadly break-even on the investment and have held other assets for the longer term.

Conclusion

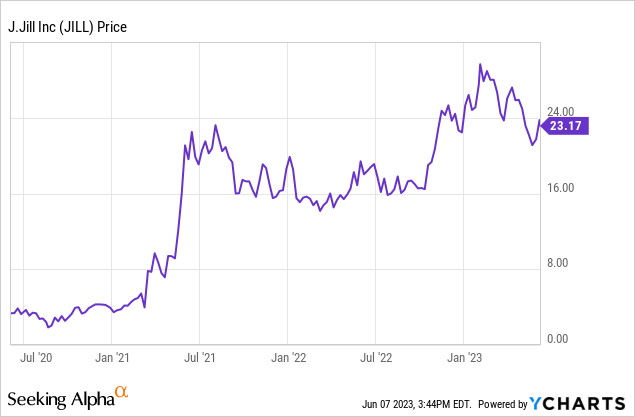

I remain long, though I have trimmed some exposure to JILL after the stock had a strong 2022-2023. The retailer still appears attractively valued and well-managed with the CEO having a material equity stake. I believe the stock has an attractive margin of safety for 2023 despite what may be relatively cautious guidance and a soft U.S. consumer. The company should be able to produce reasonable free cashflow for equity holders in all but the most dire sales scenarios for 2023. If JILL can continue to produce steady quarterly earnings as it has been doing, then maybe Mr Market will re-rate the shares. If the company were to return capital to shareholders, as may now be feasible, that would enhance the story, though private equity ownership does complicate things here.

Read the full article here