The recent IPO of Reddit, Inc. (NYSE:RDDT) started too hot, and the stock isn’t much of a bargain after the recent dip. The social media company has not generated anything impressive over a long history of operations to warrant such investor excitement. My investment thesis is Bearish on the stock with the elevated valuation.

Hot IPO

Reddit’s hot IPO was priced back on March 20. The IPO sold 22 million shares to the public at $34 per share, with the company selling 15.3 million shares and selling stockholders dumping 6.7 million shares.

Along with the 3.3 million over-allotment shares for the underwriters, Reddit will sell ~18.5 million shares and raise gross proceeds of $629 million before underwriter fees.

Following the offering, the stock soared to nearly $75. Reddit has dipped back below $50 now, but the stock is still $14 above the IPO price, just over a month following the IPO.

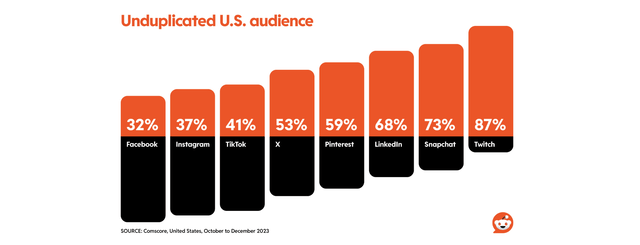

Reddit sees the company as a digital city, with internal communities allowing users to connect on just about every topic possible. According to the S-1, the social site users skew older, with the typical user not on Snapchat or Twitch and correlating with users on Meta Platforms’ (META) Facebook.

Reddit S-1

Big Quarterly Report

Reddit is set to report Q1 ’24 quarterly results post-market on May 7. For any IPO, the first quarterly report is a big event, as investors get to see updated quarterly numbers and start to learn the guidance trends from executives.

The latter is a big key because different executives offer different views, with some always over-promising and not delivering and others under-promising and constantly hiking numbers throughout the year. It’s crucial for investors to understand these trends to gain perspectives on the stock action after quarterly reports, and investors really don’t know until after the IPO reports the first quarterly number.

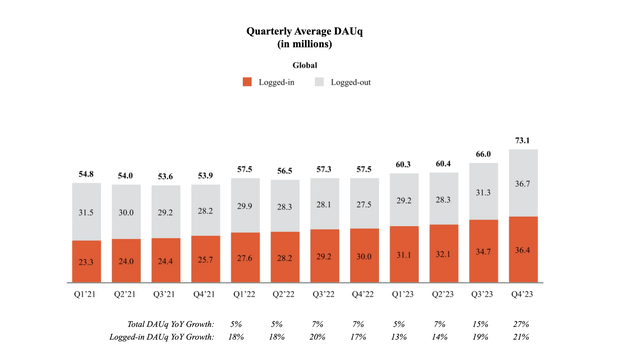

Reddit ended 2023 with a surge in DAUs (daily average uniques). The company reported a jump from 60.4 million in Q2 ’23 to 73.1 million in Q4 ’23.

Reddit S-1

The majority of the growth came from Logged-out users, with growth from 28.3 million in Q2 ’24 (down from Q1 ’21 levels) to 36.7 million in Q4 ’23. Naturally, the Logged-out users have limited value, having come to Reddit based on search results or clicking on links. These casual users have chosen not to create an account to interact on the site, and the Google data is highly inaccurate.

Also, Reddit has a portion of users focused on material where the company doesn’t present ads. CEO Steve Huffman discussed this scenario with CNBC right before the IPO debut of not monetizing NSFW communities.

Another big key to Reddit is that the company was created in 2005 and started selling advertisements all the way back in 2006. The company even started building their own ad technology in 2018.

In essence, Reddit isn’t a new or young company with a massive upside ahead. Social media leader Meta Platforms just reported quarterly sales topping 27%, with guidance towards nearly 20% growth in the current quarter, so strong growth is definitely still possible.

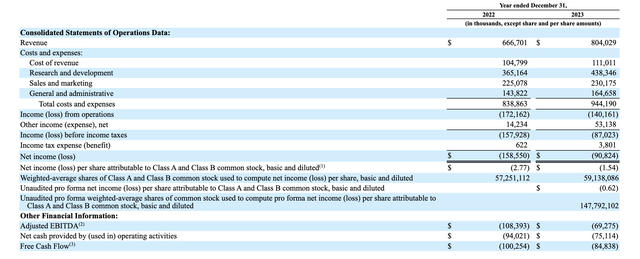

The reason the stock is too loved is that Reddit still generates adjusted EBITDA losses and burns cash despite going on nearly 20 years of selling advertisements. The company just isn’t ready for prime time, yet the stock market has already assigned a premium valuation.

For 2023, Reddit still produced an adjusted EBITDA loss of $69 million on revenue of $804 million. Revenues did grow over 20% and the EBITDA loss improved by $39 million YoY, but the social media company still has a large loss after all of these years.

Reddit S-1

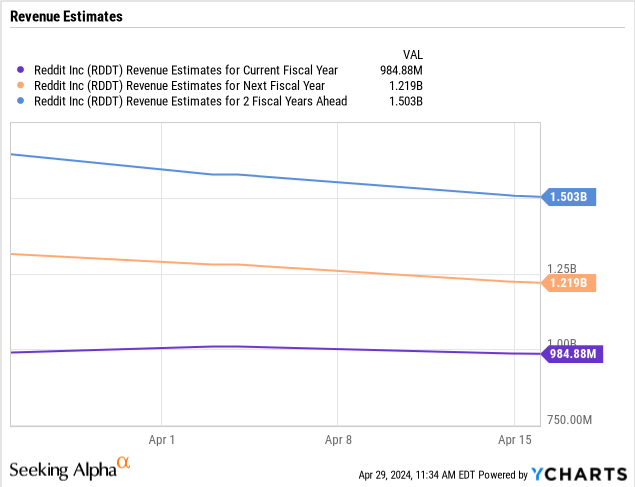

The stock should have 162 million shares outstanding plus another 40 million fully diluted shares for stock options and RSUs after the IPO. The stock has a market cap of $7.7 billion, with a fully diluted valuation of closer to $9.7 billion. Reddit trades at ~7.5x the current 2024 revenue estimates of $985 million.

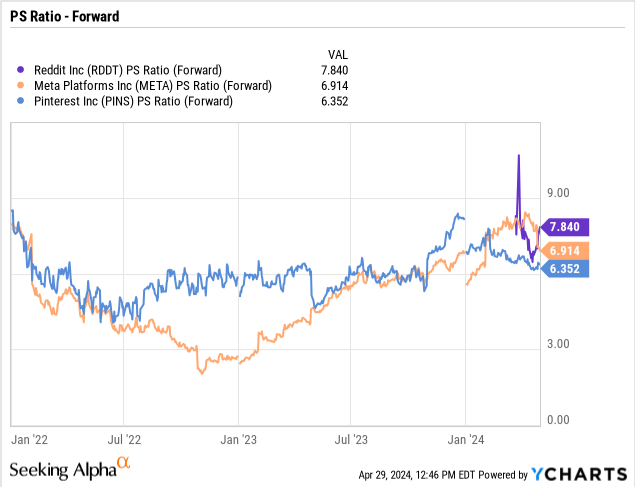

The stock trades at a similar multiple to Meta Platforms and Pinterest (PINS), though both stocks have more proven business models and catalysts. The consensus analyst estimates don’t even forecast a profit for Reddit until 2027 while the other social media plays will throw off tons of cash during this period. Not to mention, Reddit trades close to 10x sales when considering the fully diluted share counts.

Reddit is far too expensive for a stock still burning $85 million in free cash flow and competing with the likes of Facebook for advertising dollars.

Takeaway

The key investor takeaway is that Reddit is still far too expensive here, trading far above the IPO price. The social media company has improved growth rates recently, but Reddit still has a 19-year history without generating profits.

Investors in the IPO should use the current price to exit the stock on strength.

Read the full article here