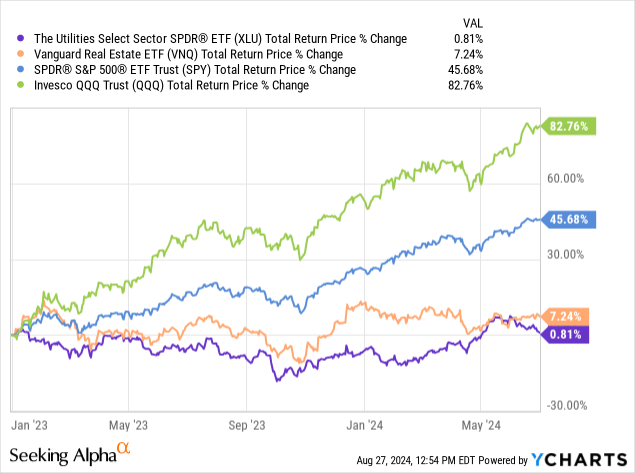

From early 2023 until the beginning of July, big tech stocks crushed the broader market, significantly outperforming high-yield sectors like utilities (XLU) and REITs (VNQ). Over that 18-month period, the AI boom took off. Rising interest rates and persistent inflation caused the market to be concerned about “higher for longer” interest rates, which would weigh significantly on the value and growth potential of bond proxy business models like REITs and utilities.

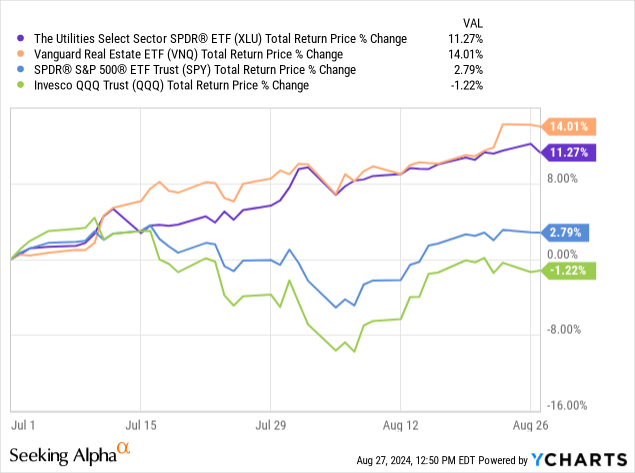

However, since the beginning of July, long-term interest rates have begun to come down as expectations have grown that the Federal Reserve will cut interest rates in the near future. This is due to weakening economic conditions and signs that inflation continues to calm down. As a result, REITs and utilities have significantly outperformed big tech stocks over that period of time.

That said, not all REITs and utility-like businesses have fully participated in this market reversal. In this article, we will discuss two high-quality, high-yield REITs and utilities that have lagged their respective sectors considerably. This provides a rare buying opportunity for investors to access stellar high-yield dividend stocks on a value basis, while the broader sector momentum and macroeconomic conditions are providing significant tailwinds.

Rare Buying Opportunity #1

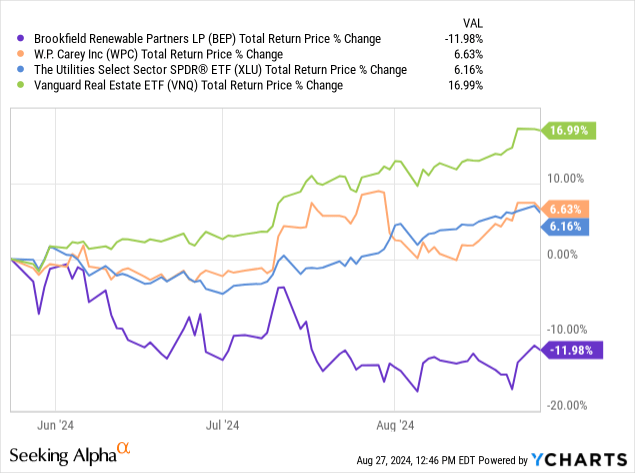

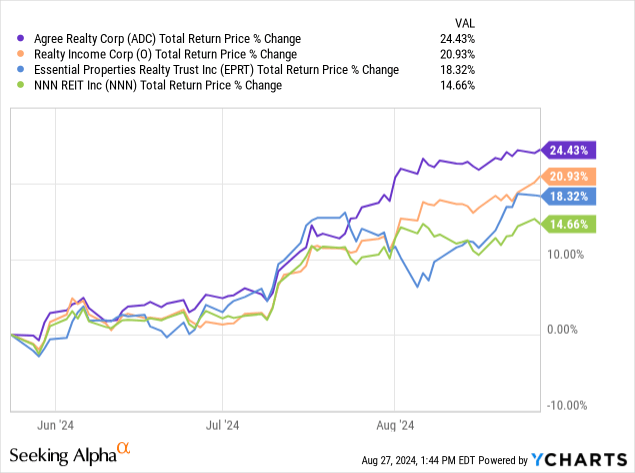

As the chart above illustrates, W. P. Carey Inc. (WPC) has underperformed the broader REIT sector by over 1000 basis points over the past three months. This underperformance has created a significant opportunity for WPC to meaningfully outperform moving forward. In fact, as the chart illustrates, WPC has underperformed its fellow triple-net lease peers by even more over the past three months than it has the broader REIT sector. As a result, it now trades at a very compelling discount relative to its peers, offering a 5.8% next 12-month dividend yield. This is compared to Realty Income’s (O) 4.2% dividend yield, Essential Properties Realty Trust’s (EPRT) 5.2% dividend yield, and National Retail Properties’ (NNN) 5% next 12-month dividend yield, among others.

Moreover, WPC’s BBB+ credit rating and significant liquidity after recently exiting the office space give it arguably as strong of a balance sheet as most, if not all, of these peers. Additionally, its portfolio, which is increasingly concentrated in industrial real estate, enjoys CPI-linked leases that bring in the majority of its rental income. This sets it apart from its peers by providing attractive and dynamic growth verticals and resistance to an elevated inflation and interest rate environment that its peers do not enjoy. Perhaps most importantly, while its peers are trading at premiums ranging between 10% and 30% to their net asset values, WPC trades at a mere 4% premium to its consensus estimated net asset value. As a result, we see little reason for the market’s considerable pessimism, viewing WPC as far and away the most attractive risk-adjusted opportunity in the triple-net lease REIT space today.

Rare Buying Opportunity #2

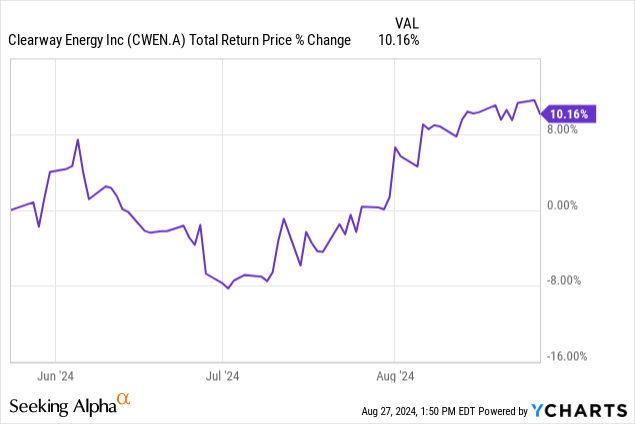

On the utilities side of things, Brookfield Renewable Partners (BEP)(BEPC) has also meaningfully underperformed, with a negative 12% total return over the past three months, compared to a 6.16% total return for the broader utility space. When compared to peers like Clearway Energy (CWEN, CWEN.A), the performance gap becomes even wider, as its fellow renewable power yieldco has generated total returns of over 10% during that period.

This has created a situation in which BEP is now an extremely compelling buy. Its BBB+ credit rating sets it head and shoulders above Clearway’s junk credit rating. BEP’s longer weighted average term to maturity on both its corporate and asset-level debt, along with immense liquidity, also gives it a significant edge over CWEN.A. Moreover, its large hydropower portfolio, substantial development pipeline, and growing battery and nuclear exposures further distinguish it from renewable power yieldco peers like CWEN.A, which are primarily focused on wind, with small exposure to solar and gas assets.

BEP offers a 5.8% next 12-month dividend yield compared to CWEN.A’s 6.3% yield. BEP’s growth is likely going to be meaningfully stronger as analysts and management both guide for about a 10% per unit CAGR over the coming years, while CWEN.A is projected to deliver a CAGR of only 5% to 6% over that span. When you combine BEP’s only slightly lower dividend yield with its much higher growth potential, higher quality, better-diversified portfolio of assets, and significantly stronger balance sheet, BEP appears to be a much more attractive opportunity right now. This is even before considering the fact that BEP recently signed a multi-billion-dollar deal with Microsoft to help power their AI investments. It also has indicated a strong probability of signing similar agreements with Microsoft and other tech powerhouses that could fuel its growth even further.

BEP is competitively positioned to win these deals relative to peers like CWEN.A due to its large size, scale, and its relationship with its parent, Brookfield, one of the world’s leading alternative asset managers with over a trillion dollars in assets under management. As a result, we view BEP as an outstanding opportunity in the renewable power yieldco and even broader utility and infrastructure spaces right now.

Investor Takeaway

As you can see, while REITs and utilities have made a strong comeback recently and appear headed to continue outperforming. This is given that interest rates are likely to be cut by the Fed in the near term, concerns over an economic slowdown are increasing. This is driving greater demand for defensive assets like triple-net lease REITs and contracted and regulated utility and power production assets. WPC and BEP have largely been left behind in the recent market reversal, which gives them even greater upside potential moving forward. As a result, we view both as very attractive buys right now and have been allocating significant capital to both of these holdings.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here