Momentum is a well-known market phenomenon that has been studied and proven to exist not just in several academic studies, but also in actual portfolios. Everyone knows it, and plenty of traders trade based on it. So why not actually own an ETF that focuses purely on a defined rule for identifying high momentum stocks, which does that exposure for you? That’s precisely what the Alpha Architect U.S. Quantitative Momentum ETF (NASDAQ:QMOM) does.

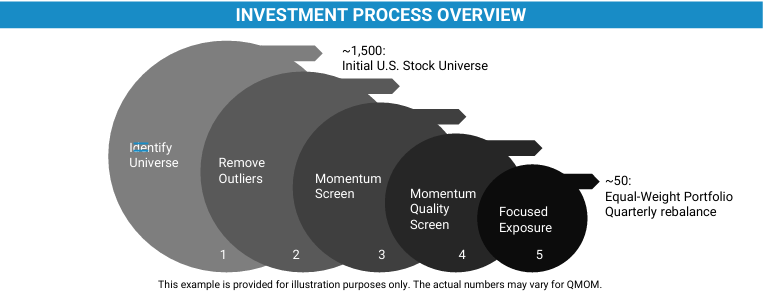

This fund offers a systematic approach to harnessing momentum. The idea here is that the fund exposes itself to stocks which have high momentum through a screening process that gets to an equal-weighted portfolios, which is rebalanced quarterly (to factor in new momentum names and take out those stocks no longer showing high momentum).

alphaarchitect.com

QMOM has been around since 2015 and is considered actively managed, given the continuous adjusting to new momentum dynamics. At the center of QMOM’s investment process is a multistep screening system that seeks to harness the momentum premium while, at the same time, avoiding stocks with higher valuations, higher risk and momentum-damaging attributes.

Starting with a universe of about 1,500 US stocks, the process whittles down the universe to 300–500 securities by removing illiquid issues. The final contenders are then ranked by their 12-month trailing returns, dropping the most recent month. A proprietary ‘momentum quality’ score is also included in this process, which is intended to identify stocks with sustainable momentum characteristics. The portfolio is then populated with the top-ranked equities, equally weighted.

I know the academic studies well here, and this fits with what I’ve seen, all in the elegance of an ETF.

A Look At The Holdings

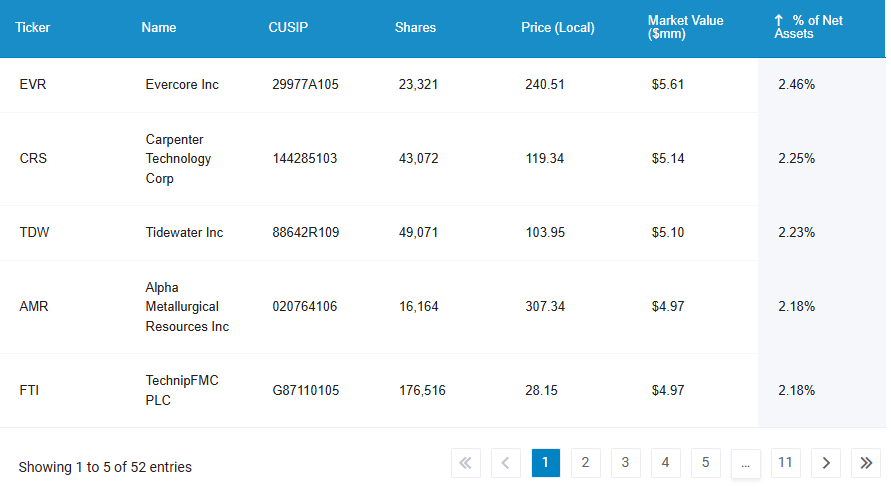

The thing with factor-based funds like this is that the holdings in some ways don’t matter. You’re not buying the fund because of what the underlying companies it invests in do. You’re buying the fund for the factor exposure.

alphaarchitect.com

I do like the equal weighted approach here. Since this is purely about playing momentum, the equal weighting resets holdings and allows relative outperformance to drive results into the next rebalancing.

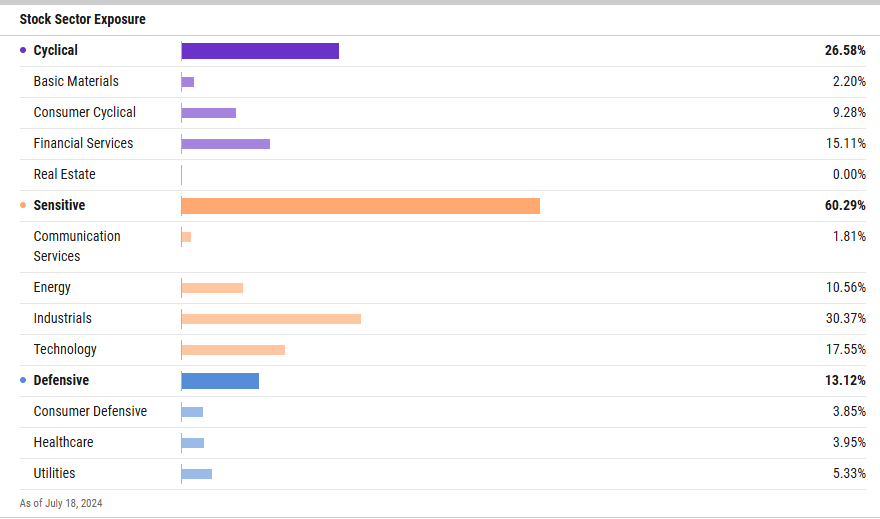

Sector Composition

The same line of thinking applies to sector allocations. Even though currently Industrials have the strong momentum and make up the largest allocation at 30%, that doesn’t mean a year from now Healthcare for example might have the largest allocation should momentum surge there. You’re not buying a static allocation with QMOM.

ishares.com

Peer Comparison

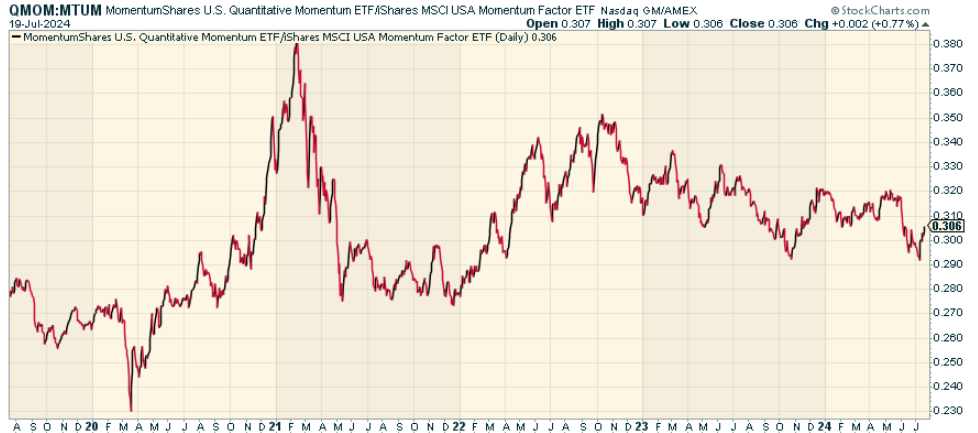

One fund that also focuses on the momentum factor is the iShares MSCI USA Momentum Factor ETF (MTUM), which admittedly has an awesome ticker to boot. MTUM has more holdings at 124, and is NOT equal weighted the way MTUM is (a negative in my view going forward). When we look at the price ratio of QMOM to MTUM (momentum to momentum!) we find that QMOM and MTUM have performed roughly in line with each other since late 2020. I’d give the edge to QMOM because it’s done that by being equal weighted in a cycle that has been hard for equal weighting to outperform.

stockcharts.com

Pros and Cons

On the positive side, with momentum you can benefit from a factor that has been well documented and which possesses good persistency – meaning enhancing returns are likely. The quantitative nature of the screening process QMOM follows means the fund is continuously rolling holdings into new momentum names and getting rid of old ones. This is done without you need to worry about it as a fund owner.

But momentum investing isn’t completely without risk. Momentum is trend-based, and periods of more sustained reversals and market rotations can, in fact, record some pretty serious draw-downs (declines of stock prices). And while the equal weighting approach isn’t concentrated, one could argue only having 50 names in the portfolio makes it somewhere more concentrated than what others would prefer from a diversified basket of stocks.

Conclusion

I like Alpha Architect U.S. Quantitative Momentum ETF overall, and I think that if you’re a fan of momentum and want a close pure play to the factor itself, the U.S. Quantitative Momentum ETF is worth considering. Personally, if I were to allocate here, I’d probably wait for a broader market pullback before buying in (just given the risk of a sharp reversal in momentum stocks), but after that volatility this would be one that could be a big winner.

Get 50% Off The Lead-Lag Report

Get 50% Off The Lead-Lag Report

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Get 50% off for a limited time by visiting https://seekingalpha.com/affiliate_link/leadlag50percentoff.

Read the full article here