ProFrac’s (NASDAQ:ACDC) fourth quarter results were soft, with revenue down significantly YoY and margins continued to drop. This was not particularly surprising given the normalization of US onshore activity in 2023 and ProFrac’s elevated exposure to gas plays, private operators and the spot market. My view of ProFrac hasn’t changed significantly since I last wrote about the company, but recent moves by management provide more clarity regarding the road ahead.

ProFrac plans on increasing utilization levels in 2024 but this will come at the expense of pricing. An IPO of the proppant segment also appears likely at this point. These moves should see ProFrac’s cash flows strengthen and help the company to reduce its debt load. ProFrac’s valuation also now appears more reasonable based on the company’s prospects, but macroeconomic uncertainty still makes the stock risky.

Market Normalization

ProFrac characterized market conditions as challenging in the fourth quarter. While the company has struggled in recent quarters, it should be noted that 2023 represented a return to more normal market conditions following an extremely tight 2022. Absent a deterioration in economic conditions, I don’t think frac demand will necessarily continue to fall, but there is also little reason to expect conditions to materially improve. ProFrac is currently in the process of locking in exposure to longer-term contracts which presumably means the company believes that current conditions are likely to persist for some time or possibly even get worse.

There is also the need to consider how companies adapt to the current conditions, and what impact this will have going forward. In 2022 and 2023, service companies were promoting a new paradigm, where profits were prioritized over activity. This was only ever going to last while the market was under supplied though. ProFrac is now lowering prices to try and take market share, with others likely to follow if conditions remain soft. There is a risk that this quickly escalates into a race to the bottom, with service companies happy just to make a modest margin on variable costs.

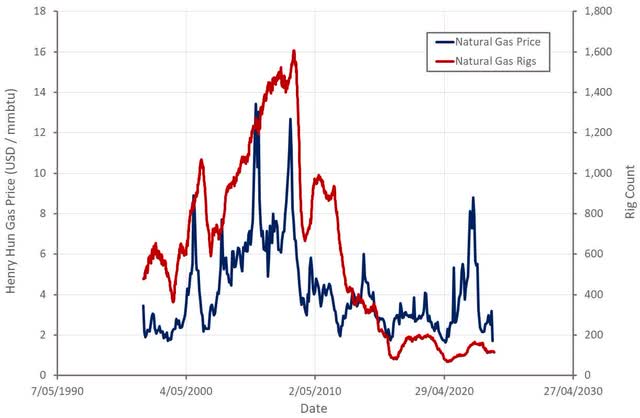

Natural gas is one area in particular where expectations were overly bullish. While the war in Ukraine and growing US LNG export capacity have increased demand in recent years, natural gas remains a fairly fragmented market globally. The US is capable of meeting the demand available to it with modest activity levels, with supply increases quickly undermining any spike in price.

ProFrac is maintaining exposure to gassy plays, as it believes that this will pay dividends in the future. This move is somewhat puzzling though as production continues to meet increasing demand levels with limited drilling or frac activity.

Figure 1: Henry Hub Natural Gas Price (source: Created by author using data from The Federal Reserve and Baker Hughes)

ProFrac Business Updates

ProFrac has taken a number of actions to better position itself for 2024 and has stated that this was already yielding results in Q1. This is primarily based around the fact that ProFrac lost market share in 2023 due to its decision to maintain pricing. Prioritizing pricing over utilization is a strategic blunder for a company that promotes its vertical integration, as vertical integration introduces high fixed costs.

ProFrac has 45 frac spreads, although utilization has been low in recent quarters. The number of active spreads was reportedly in the low 20s in Q3, mid-20s in Q4 and mid-30s in Q1. ProFrac expects to have 41-42 operational fleets towards the end of 2024.

ProFrac expects profitability to revert towards 20-25 million USD per spread, exclusive of profit generated by the proppant segment. This should largely come from activity levels, with ProFrac aiming to improve utilization by at least 30% in 2024. The improvement in utilization is coming from the pivot towards dedicated fleets for larger customers. This will come at the expense of pricing though, with ProFrac hoping that utilization and cost saving measures will offset this.

ProFrac is also trying to diversify its proppant customer base and drive higher utilization levels. ProFrac’s proppant segment is focused on securing term contracts that support utilization with reasonable prices. Due to the impact of weather and low natural gas prices, ProFrac estimates it lost 300,000-400,000 tons of sales in January and February. First quarter utilization was up slightly from the fourth quarter still though and is expected to trend towards 65-75% starting in the second quarter. Proppant pricing is expected to be in the 25-30 USD per ton range in the first quarter. This will presumably put proppant revenue somewhere slightly above 100 million USD quarterly revenue later in the year.

In 2023 ProFrac began floating the idea of asset level financing or an IPO of the proppant segment. ProFrac confidentially submitted draft documentation related to a potential IPO of its proppant segment in February 2024. The number of shares to be offered and the price range are yet to be determined. The IPO is expected to occur after the SEC completes its review process.

Financial Analysis

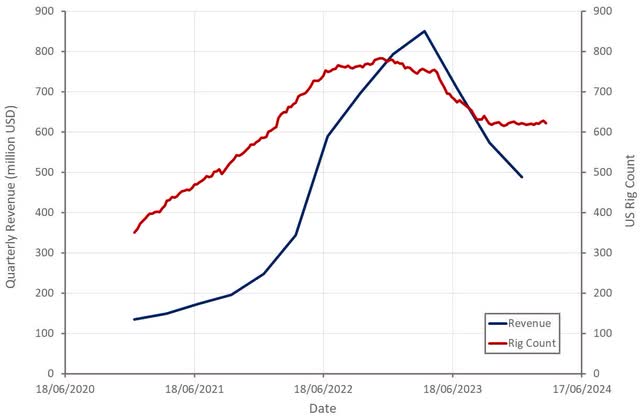

Stimulation services revenue was 403 million USD in the fourth quarter, down close to 50% YoY. The majority of this decline was attributed to lower fleet numbers, with the remainder due to lower pricing.

The proppant segment generated 93 million USD revenue in the fourth quarter, a decrease of 6% from the third quarter, which was attributed to pricing. Approximately 75% of sales were to third parties during Q4. ProFrac continues to supply around 30% of its fleets with materials.

The Manufacturing segment generated 34 million USD revenue, down 33% YoY, with 17% of that due to third-party sales.

Figure 2: ProFrac Revenue (source: Created by author using data from Baker Hughes and ProFrac)

Stimulation services adjusted EBITDA was 58 million USD in Q4, which was impacted by a 10 million USD shortfall payment in relation to ProFrac’s supply agreement with Flotek. Proppant adjusted EBITDA was 44 million USD and manufacturing adjusted EBITDA was 1.8 million USD.

ProFrac has suggested that it is generating mid to high teens EBITDA per fleet at the moment. It wants to increase this to 20-25 million USD primarily by improving utilization.

If ProFrac can meet its utilization and profitability targets, adjusted EBITDA could be around the 250 million USD per quarter range later in the year. This will ultimately be heavily dependent on pricing and how tight the market is though.

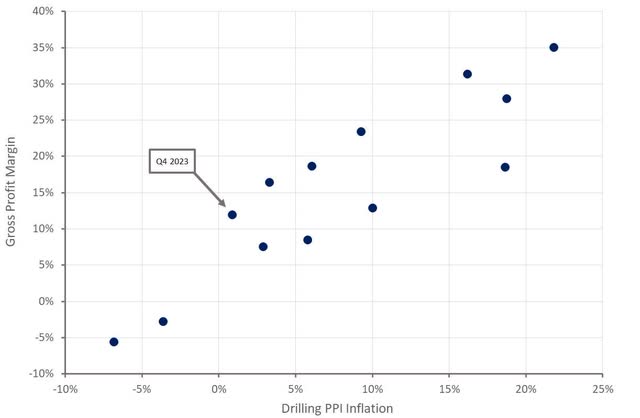

Figure 3: ProFrac Gross Profit Margin (source: Created by author using data from ProFrac and The Federal Reserve)

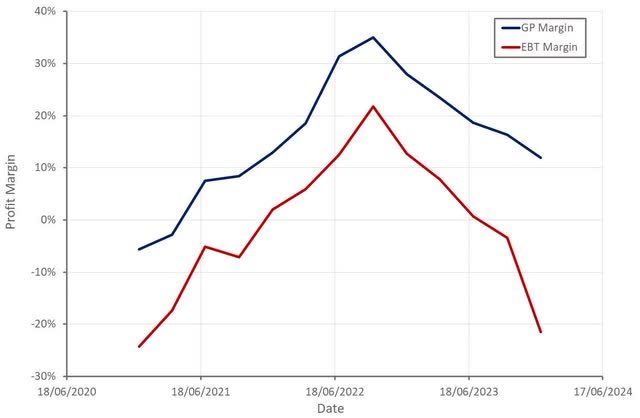

Figure 4: ProFrac Profitability (source: Created by author using data from ProFrac)

ProFrac’s operating cash flow was only 42.7 million USD in Q4, although cash flows have been aided by a reduction in working capital in recent quarters due to lower activity levels. Working capital is likely to become a cash flow drag in 2024 as ProFrac reactivates fleets.

Q4 CapEx was only around 33 million USD, an unsustainably low level. ProFrac has suggested that maintenance CapEx is around 150-200 million USD per year. The company also plans on spending around 100 million USD on growth investments (fleet upgrades and mine optimization) in 2024.

ProFrac restructured its debt in late 2023, which seems to have been aimed at extending loan terms and positioning the company for the proppant IPO. At the end of 2023, ProFrac had roughly 1.1 billion USD debt outstanding, most of which doesn’t mature until 2029.

ProFrac has suggested it could reduce its debt by half in 2024, but it is difficult to see how this is possible from operations. Presumably this would refer to using proceeds from the proppant IPO to reduce debt.

Conclusion

Increased activity levels should see ProFrac’s revenue and margins stabilize or move higher in 2024, although this will depend on the extent to which pricing comes under pressure. An IPO of the proppant segment should also enable ProFrac to significantly reduce its debt position and interest payments. The combination of these two factors could see ProFrac’s bottom line materially improve in 2024, provided that macro conditions remain stable.

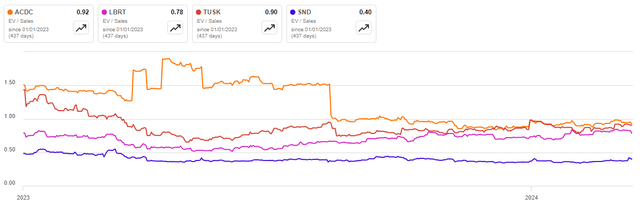

Figure 5: ProFrac EV/S Multiple (source: Seeking Alpha)

Read the full article here