Introduction

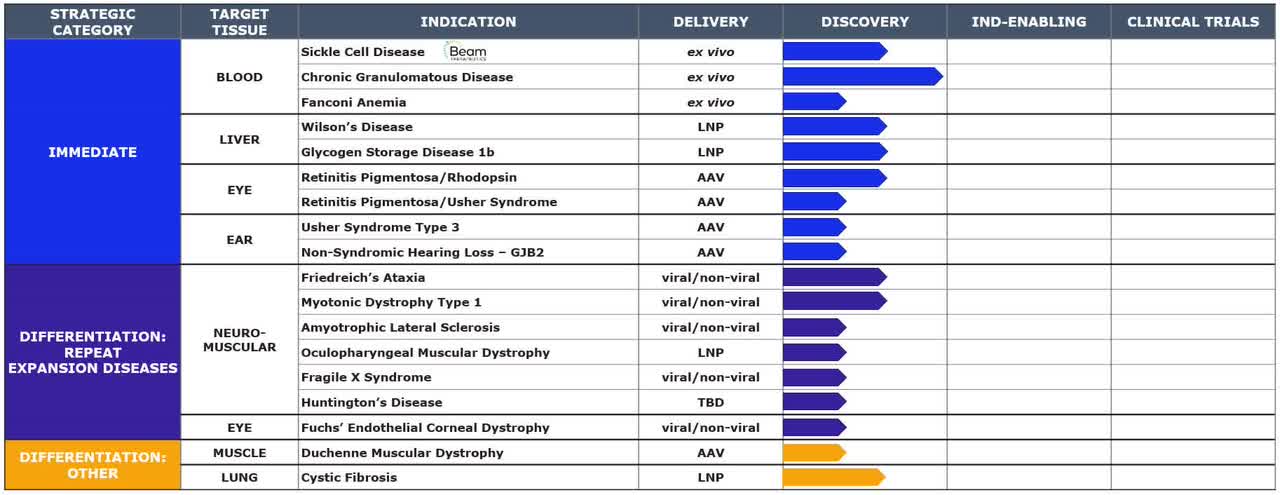

Prime Medicine (NASDAQ:PRME) is a biotech firm pioneering the use of Prime Editors, revolutionary genetic therapies that offer precise, efficient and broad gene editing potential. Capitalizing on the groundbreaking advancements in genetic medicine, Prime Editing goes beyond the current genetic therapies by facilitating the correction of a diverse range of mutations at their genomic roots, thereby promising a high therapeutic impact on diseases. The technology, while still under development, has been validated extensively in labs and holds the potential to treat approximately 90% of known disease-causing mutations. Currently, the firm focuses on 18 therapeutic programs, using Prime Editors to create permanent modifications in the genome, like a “word processor” for genes.

Prime’s pipeline (Prime Medicine 10-K)

This article presents a brief introduction to Prime’s preclinical ambitions and offers guidance to potential investors on how they should assess the prospects of investing in PRME stock.

Q1 2023 Earnings

Prime Medicine’s Q1 2023 financial report indicates a rise in both R&D and G&A expenses as the firm expands. R&D expenses jumped from $13.7 million in Q1 2022 to $30.9 million in Q1 2023, mainly due to increased lab supplies, personnel, and facilities costs. G&A expenses increased from $6.2 million to $9.2 million over the same period, largely owing to facility and professional costs. The company’s net loss was $39.4 million, a significant increase from $23.8 million in Q1 2022. Cash and equivalents were reported at $263 million. Despite the losses, Prime expects its current financial resources to cover anticipated expenses and capital expenditure till 2025.

Prime Medicine’s Promising Preclinical Progress: Towards a Breakthrough in Genetic Disease Treatment

Prime Medicine’s platform has demonstrated promising preclinical potential, achieving in vivo proof-of-concept in their partnered sickle cell disease program. Their Prime Editors have precisely corrected the disease-causing mutation in human CD34 cells engrafted in mice. The firm has also shown high levels of correction in chronic granulomatous disease and has a development candidate, PM359, on track for IND-enabling studies. High throughput methods have been developed for efficient Prime Editors, which achieved over 75% precise removal of pathological expansion repeats in five different diseases.

Looking ahead, Prime will continue to expand its preclinical proof-of-concept in vivo. In 2023, rodent and non-human primate studies are expected, potentially leading to the first IND filing as early as 2024, with more filings potentially coming in 2025. Additionally, they are improving their non-viral and viral delivery systems, aiming for meaningful delivery of Prime Editors to target tissues in animal models and demonstrating a superior “off-target” profile.

While the platform shows significant promise, it is important to approach the future with cautious optimism. Developing new technology is inherently challenging and time-consuming. The company is building key capabilities and infrastructure to meet these ambitious goals, including bolstering R&D and CMC resources, and strengthening translational medicine and clinical development capabilities. As it stands, the potential for Prime’s platform is enormous, but the path to clinical application remains a journey filled with scientific and regulatory hurdles.

My Analysis & Recommendation

In conclusion, Prime Medicine is positioning itself as a significant player in the field of genetic therapies with its Prime Editing technology. Investors should pay close attention to Prime’s ongoing expansion of preclinical proof-of-concept in vivo and look forward to potential IND filings in the coming years. The promise of their technology, capable of correcting a broad range of disease-causing mutations, cannot be ignored.

Yet, their increasing R&D and G&A expenses, coupled with a net loss in Q1 2023, might cause some apprehension. It is also critical to keep in mind the inherent uncertainties and time frames associated with developing and validating new biotechnologies for clinical use.

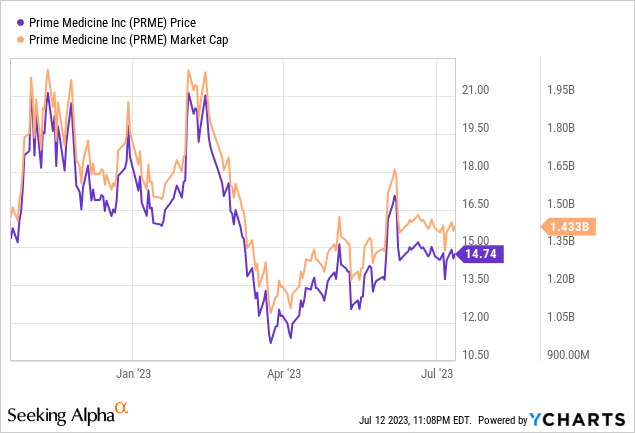

With a valuation of $1.4 billion, the risk/benefit profile of Prime seems reasonable given the revolutionary potential of Prime Editing technology and its prospects of transforming the landscape of genetic therapies. However, the risk associated with the long development cycle and regulatory hurdles should not be overlooked.

As it stands, investing in Prime can be likened to purchasing a lottery ticket, highlighting the high-risk, high-reward nature inherent to the early-stage biotech sector. Down the line, the company could potentially mirror Moderna’s (MRNA) success, transforming from a budding company to a biotech behemoth valued at tens of billions of dollars. Conversely, it could follow the path of bluebird bio (BLUE), which, despite achieving significant scientific milestones, saw its stock value plummet by approximately 96% in just five years. Essentially, Prime’s trajectory is unpredictable. With significant investments in research and development, the company could potentially revolutionize genetic medicine, driving a surge in value. However, the scientific and regulatory challenges could delay or derail these aspirations, affecting the company’s market value. As such, investments in Prime should ideally be part of a balanced, diversified portfolio strategy.

Given these considerations, the recommendation for Prime would be a ‘Hold’. While the firm’s technological potential is vast, the current financials and the considerable time before any possible commercial product present risks. Hence, a ‘Hold’ position would allow investors to monitor the firm’s progress towards IND filings and other significant milestones without being overly exposed to the inherent risks of biotech investment. Once these milestones are achieved, the recommendation could be revisited based on the updated risk/benefit profile.

Read the full article here