Summary

Following my coverage on Phreesia (NYSE:PHR), which I recommended a buy rating after a prosperous 4Q23 and FY23 in which revenue and adj. EBITDA surpassed market expectations. I thought that PHR was being too conservative with its FY24 forecast, which meant there was a good chance the company would beat its own projections and revise them upwards as the year progressed. The company also appears to be on track to achieve its goals for FY25, which include reaching profitability and increasing annual revenue to $500 million (run rate basis).

This post is to provide an update on my thoughts on the business and stock. I continue to recommend a buy rating for PHR as the business continues to execute well with strong logo adds despite uncertain times. The valuation gaps vs peers should close as PHR becomes closer to positive profitability.

Business description

Using PHR, hospitals and clinics have access to a powerful toolkit for managing patient registration. PHR SaaS platform motivates patients to take an active role in their care and provides a safe, convenient experience, all while enabling doctors to boost care quality and efficiency.

Competitive environment

According to Grand View Research, the value-based healthcare services market in the United States will grow from $3.2 billion in 2021 at a CAGR of 7.5% to reach $3.7 billion by 2030. In my opinion, the financial, regulatory, and technological difficulties faced by healthcare payers have been significantly exacerbated by the COVID-19 pandemic. Value-based healthcare services are becoming increasingly popular as a response to the rising costs of healthcare and healthcare delivery as a share of the economy. A patient-centered approach to treatment is the best way to permanently solve these problems.

To facilitate this transition, there will be a greater emphasis on the implementation of digital tools, which will benefit personal health records. Many companies compete for this massive market by providing digital solutions for various healthcare processes. Meridianlink, Oscar Health, Definitive Healthcare, and others are some of the most well-known competitors in the personal health record market.

Investment thesis

As PHR benefited from higher patient volumes, their 1Q24 performance was strong, but I would temper expectations and advise against extrapolating this to the rest of the year. As a result, sales of both payment processing and networking solutions increased. Given that it is still early in the year and the increased volume is due in part to seasonality, I believe it is prudent to proceed with caution.

However, it bears emphasizing that despite PHR’s ongoing addition of new logos, execution remains very strong. In the first quarter alone, PHR grew by 169 logos to a total of 3,309. If PHR continues to add 169 people in the second quarter, that would mean a roughly 25% increase in logos. The addition of new logos has remained robust, and this expansion can be seen at all scales, from local to national businesses. This suggests that interest in PHR is not concentrated in any one area, which bodes well for its long-term viability.

If patient loads do remain high throughout the year, management guidance may seem overly cautious. Even though FY24 has gotten off to a good start, management stuck to its revenue forecast of $353 million to $356 million, which is an increase of 26% year over year at the midpoint. Investors may be let down by the reiteration, but I’m fine with it because it lowers the bar for a possible “beat and raise” outcome.

The current guide assumes a decline in adjusted EBITDA in the 2Q24, which I think is highly unlikely in light of the cost-cutting measures and increased leverage being implemented in the business. Long-term, management remains committed to a revenue goal of $500 million for FY25 and a return to profitability by that same year. I think PHR is on track to meet FY25 targets, given the outperformance on the outlook to date.

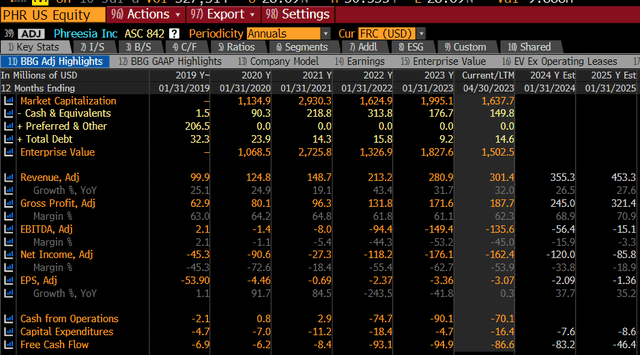

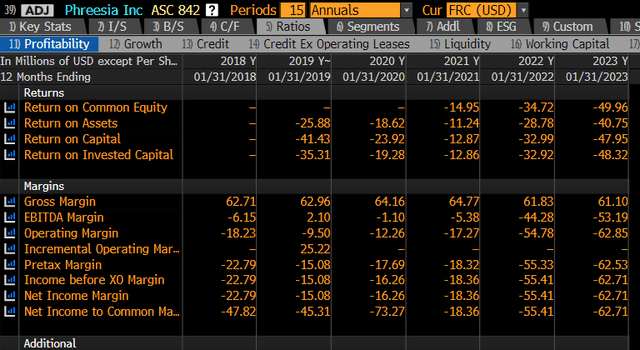

P&L / Balance sheet

Bloomberg

Bloomberg

PHR should be able to continue to grow at a rate of 20 to 30%, as I do not see many structural headwinds to growth. While there may be some slowing due to macro headwinds, I believe the focus should be on PHR execution thus far, as well as the fact that it is adding logos in these uncertain times.

PHR is still in the growth stage today, so I believe it is fine to continue reinvesting cash for growth. The company is also exhibiting signs of gross margin expansion, which bodes well for the company’s long-term margin profile. As PHR grows its topline, I don’t see any reason why EBITDA margins won’t improve and eventually meet the FY25 target.

The fear of all businesses in the growth stage is the need to raise capital. PHR is in a net cash position, which I believe favors investors’ investment appetite today as they seek to avoid high-debt companies (given the risk of rising interest rates). Given the expected burn rate of $10 to $50 million over the next two years, I believe the $150 million in cash is adequate.

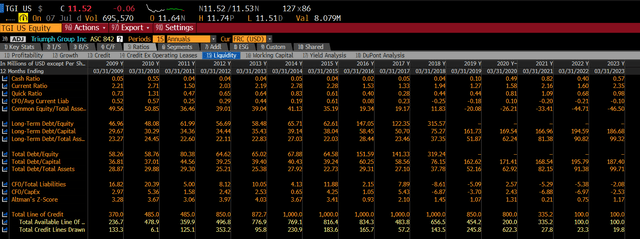

Bloomberg

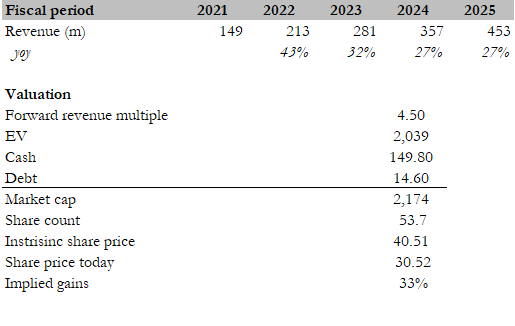

Valuation

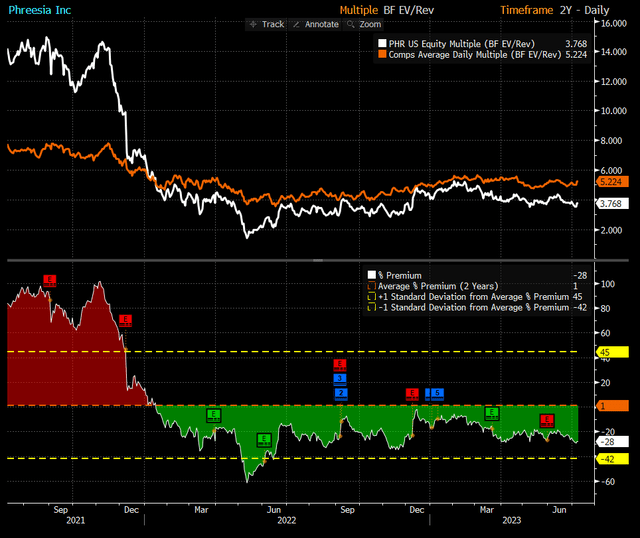

Based on my revenue growth model, I believe PHR is worth $40.51. According to my model assumptions, revenue should continue to grow at a slightly slower rate as PHR continues to face headwinds from the broader macroeconomic environment. This will result in $450 million in revenue for the company in FY25. PHR is expected to trade at 4.5x forward revenue, which is slightly lower than the peer average given that it is not yet profitable (burning significantly more cash than peers).

Author’s revenue growth model

Bloomberg

Risks

Registration and billing for medical services are examples of highly competitive markets. The basic barriers to entry for patient intake services are low. The market share of PHR providers could be at risk if a large EHR provider with comparable features entered the market.

Conclusion

I maintain a buy rating for PHR due to its strong execution and consistent addition of new logos, despite the challenges posed by the current uncertain environment. PHR’s conservative forecast for FY24 suggests the potential for exceeding expectations and revising projections upward. The company is on track to achieve its goals for FY25, including profitability and increased annual revenue. While there may be macro headwinds, PHR’s execution and logo additions remain strong. The company’s financials show growth potential, and its net cash position is favorable.

Read the full article here