Author’s note: This article was released to CEF/ETF Income Laboratory members on May 22nd.

I’ve covered the iShares Preferred and Income Securities ETF (NASDAQ:PFF) several times in the past. I’ve generally focused on the fund’s characteristics and fundamentals, but, for this article, thought to do a quick writeup on some of the key differences between PFF and high-yield corporate bonds.

PFF has somewhat lower interest rate risk, stronger dividend growth, lower expected returns, and much higher exposure to financials. In my opinion, due to ongoing weakness in the regional banking industry, high-yield corporate bonds look like the more sensible investment. Some more aggressive, bullish investors might prefer PFF, as the fund could see strong gains if industry conditions improve.

Lower Interest Rate Risk – Floating Rate Preferreds

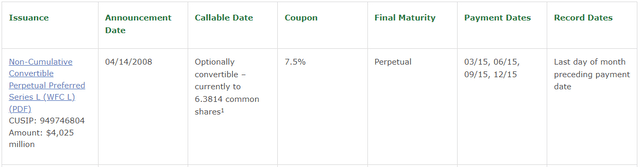

Preferred stock coupon rates are set in different ways. Some preferreds have fixed coupon rates, paying the exact same rate from inception to maturity. As an example, Wells Fargo (WFC), one of the fund’s largest holdings, issued $4B in preferreds with a fixed 7.5% coupon rate back in 2008.

Wells Fargo

Fixed-rate securities, including the one above, have high interest rate risk, and could see sizable losses when interest rates increase. Let’s say the Fed hikes to 10.0%, and t-bills start yielding +10.0%. Investors would start to sell those 7.5% preferreds, crashing their prices, and leading to losses.

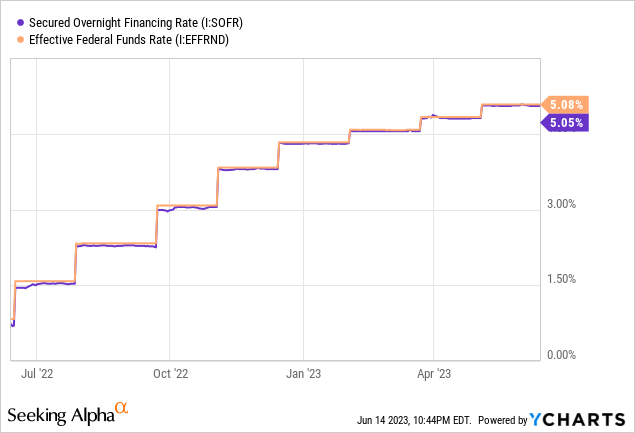

Some preferreds have fixed to flouting coupon rates, in which they pay a fixed rate of interest for a few years at first, and then a variable rate. Said variable rate is almost always a specified benchmark rate plus a spread. Common benchmark rates are LIBOR, which is being discontinued, and SOFR. Both track Fed rates quite closely.

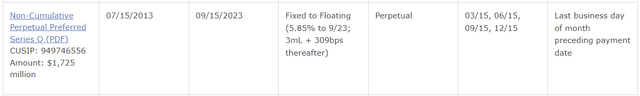

As an example of these preferreds, Wells Fargo issued $1.7B of stock with a fixed 5.85% rate until 9/23, 3M LIBOR + 3.09% after.

Wells Fargo

The preferreds above are, in practice, tied to Fed rates. Higher Fed rates means higher LIBOR (or SOFR) rates, which means higher coupon rates for these securities.

Some preferreds are purely floating rate securities, although these seem much less common than fixed-to-floating.

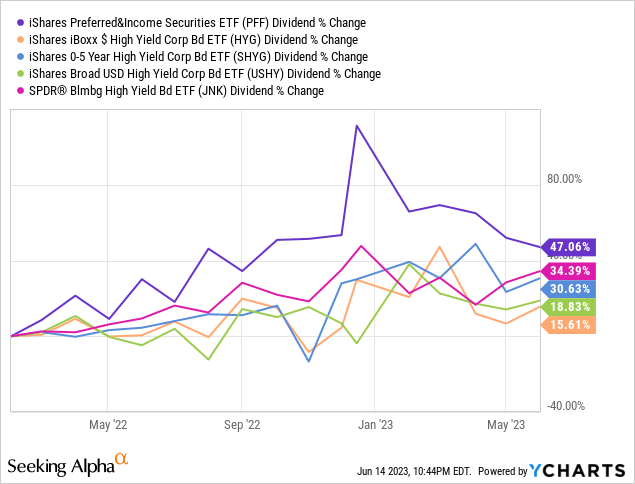

PFF includes both fixed and fixed-to-floating preferreds, while most bond funds exclusively invest in fixed rate bonds. Due to this, PFF should see somewhat stronger, smoother dividend growth when the Fed hikes rates, as has been the case since early 2022.

In my opinion, and notwithstanding the above, PFF’s strong dividend growth was also partly the result of dividend volatility, which is quite common in ETFs. The fund’s dividend growth was simply too smooth, and too high, for a fund with only some floating rate securities.

Floating rate securities also have reduced interest rate risk, as their coupon rates are tied to Fed rates. Investors might sell those 7.5% Wells preferreds if the Fed hikes to +10.0%, but they would likely refrain from selling the 3M LIBOR + 3.09% preferreds, which would yield 13.1% in this scenario. As most floating rate preferreds are fixed at first, the situation is quite complicated, and there will undoubtedly be some selling pressure, but less so than for purely fixed-rate securities.

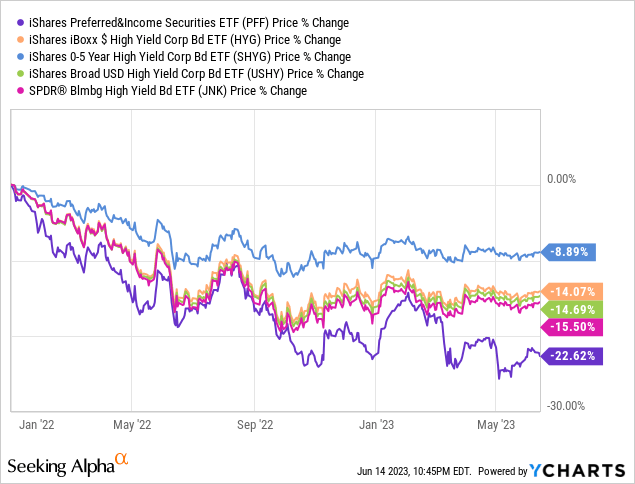

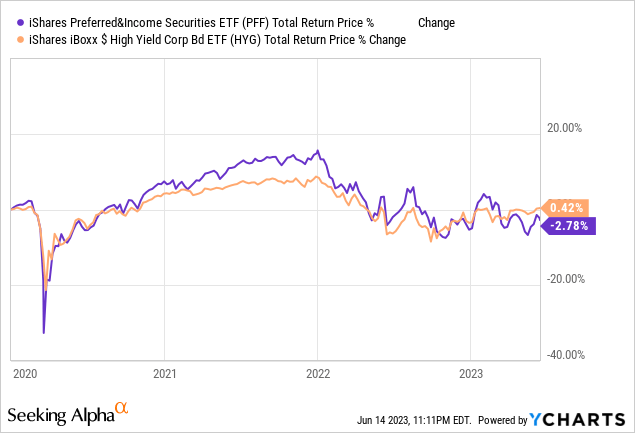

As PFF invests in some floating rate preferreds, the fund should see below-average capital losses / reductions in share price when interest rates are rising. Importantly, this has not been the case during the current hike cycle, with PFF seeing higher losses than most high-yield corporate bond ETFs.

Higher Financials Exposure

PFF’s recent losses have a simple explanation: the fund is significantly overweight banks and other financial institutions, which have seen above-average losses due to the regional banking crisis. Bond funds generally have more balanced industry exposures, including most high-yield corporate bond funds, so are less exposed to individual industry issues.

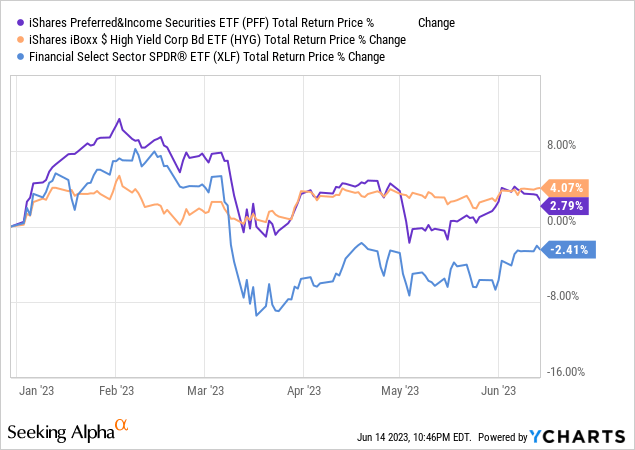

PFF’s returns YTD tell the whole story, the fund collapsed as soon as financials did, while high-yield bonds kept trudging along.

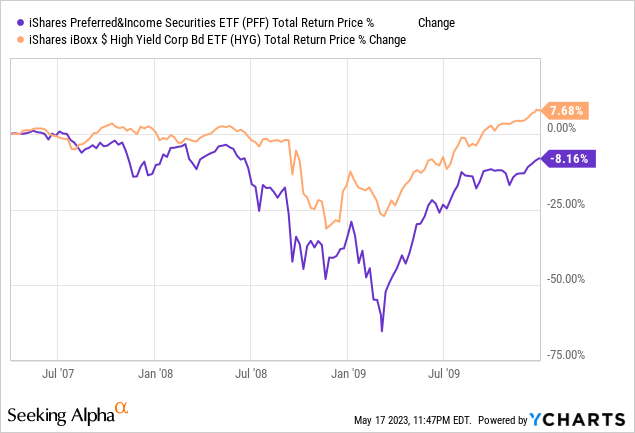

PFF’s significant financials exposures increase risk, volatility, and the potential for outsized losses and underperformance. Losses could mount if industry woes continue. As an example, PFF saw peak to through losses of around 60% during the past housing bubble / financial crisis. It took years for the fund to recover.

Data by YCharts

In my opinion, PFF’s significant financial position is incredibly risky under current economic conditions. I don’t think it’s a deal-breaker, but I would definitely keep position sizes small if I were invested in the fund.

High-yield corporate bond funds had significant exposure to energy issuers in 2022, which outperformed as energy prices recovered.

Higher Yields, But Lower Underlying Generation of Income

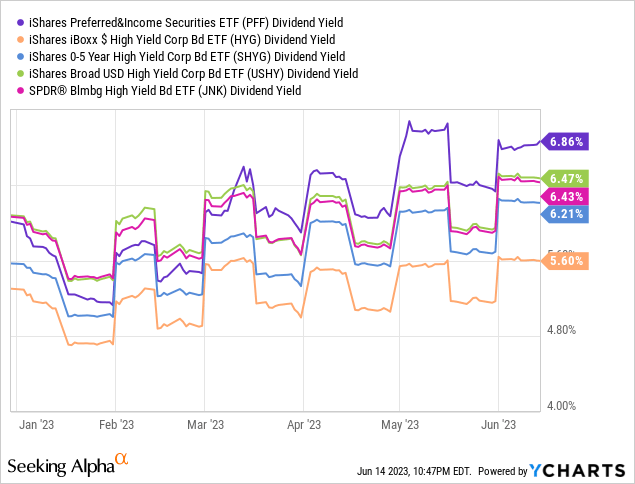

PFF currently sports a 6.9% dividend yield, higher than that of most bonds, bond sub-asset classes, and high-yield corporate bond funds.

PFF’s higher yield is at least partly the result of higher dividend growth since the Fed started to hike. In my opinion, the higher yield is also partly due to dividend volatility, quite common for ETFs.

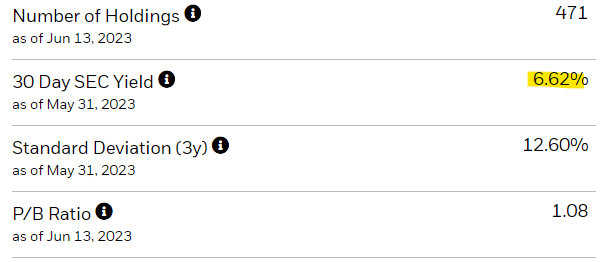

On the other hand, PFF only sports an SEC yield, a standardized measure of a fund’s short-term generation of income, of 6.6%.

PFF

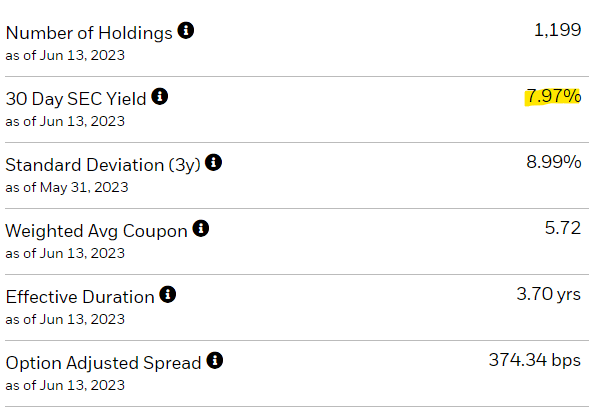

The figure is a bit lower than the fund’s actual dividend yield, and quite a bit lower than that of most high-yield corporate bonds. For reference, the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), the industry benchmark, sports an SEC yield of 8.0%.

HYG

The gap between dividend yields and SEC yields is due to ETF dividend volatility, delays between bonds paying income and funds making dividend payments, and differences in time frames. SEC yields are monthly figures while dividend yields are generally based on trailing twelve month dividend payments, and interest rates / dividends were much lower in prior months.

As PFF sports a lower SEC yield than most high-yield corporate bond funds, PFF should see lower dividends and returns than these other funds moving forward. Much will depend on how interest rates change moving forward, however.

Junior to Bonds, But Good Credit Ratings

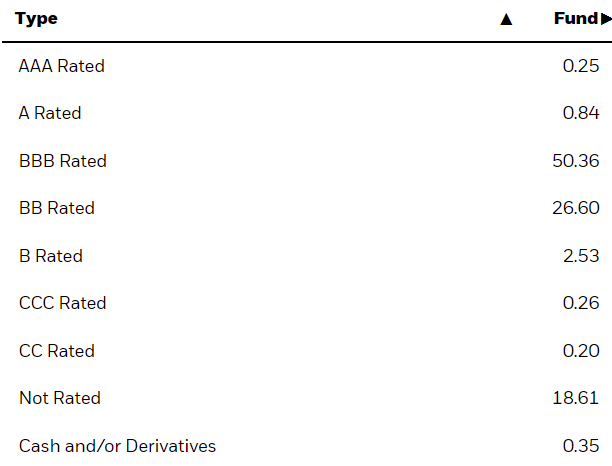

PFF’s preferreds are junior to most bonds, which increases credit risk, default rates, and potential losses during downturns. PFF focuses on investment-grade preferreds, which has the exact opposite effect.

PFF

Comparing PFF to high-yield corporate bonds and bond funds, it is unclear which of the two effects above predominates, and I was unable to find detailed default rates for preferreds. I would have guessed being junior to bonds is key, but the credit ratings obviously matter, and financials have comparatively low default rates (although perhaps not this very moment). PFF saw somewhat higher losses than HYG during early 2020, the onset of the coronavirus pandemic, but these were short-lived, and volatility was high.

Conclusion

Compared to high-yield corporate bonds, PFF has somewhat lower interest rate risk, stronger dividend growth, lower expected returns, and much higher exposure to financials. In my opinion, due to ongoing weakness in the regional banking industry, high-yield corporate bonds look like the more sensible investment.

Read the full article here