Investment Thesis

Despite pulling back around a third from its highs at around $12, Perma-Fix (NASDAQ:PESI) stock has nonetheless performed extremely well this year. It’s up 117% YTD but appears still to have significant upside ahead. I believe this comes from two main factors. First, the company and wider industry have seen a strong recovery this year after struggling during the pandemic. PESI has recently returned to a comfortable profitability. Second, a couple of significant growth opportunities lay ahead, not least of which is PESI’s unique positioning to assist in the clean-up of the US’ largest nuclear contamination site. All indications are that this clean-up will finally gear up and PESI stands to benefit extensively.

I believe the business to be trading above the value of its existing business, but the valuation seems to severely underestimate multiple contracts that PESI either has in the bag or could win. These contracts should significantly enhance profits over the next couple of years. The main risk at this point would be delays in various projects, though I believe this risk is priced in and mainly affects upside potential rather than downside risk.

Introduction

PESI essentially manages nuclear and otherwise hazardous waste, primarily (at least to date) winning contracts from government agencies. Its core business has been growing well over the past few quarters attributed largely to post-pandemic recovery. Additionally, it has/is bidding for multiple significant projects which would dramatically increase top and bottom lines. Note management’s description of PESI during the Q3 call.

…the way we look at it is the company is really in a position to maintain a pretty sustainable foundation of revenue in the $90 million a year, $100 million a year range from generally from winning projects repeatedly. We may have some down quarters as my quarters, but just generally, that’s kind of our baseload, that we should be able to do with the waste that’s generated out there each year, along with winning a number of projects within our statistical average. Then we have procurements and opportunities that would pull us above that. [These] would provide a plus up or a bump up in revenue in a significant way.

This article will discuss both the core business and the significant projects, attaching a valuation to both aspects.

Core business

As mentioned in the introduction, the core business was hard hit by the pandemic. Note that the effect of the pandemic on the industry was delayed due to contracts already in place and existing backlogs. Thus, revenues reached a peak above $30m in 3Q 2020 but fell almost 50% by 3Q 2021. Recovery remained slow through 2022, but 1H 2023 saw excellent growth.

PESI quarterly revenue graph since 2019 (numbers from company filings)

Q3 revenue was weaker at $21.9m as agencies delayed certain projects. As for Q4, we can expect “pretty flat overall” revenues, as a number of projects both wind-down and start-up. Of course, our show-me-the-money-market appeared unimpressed with the results. However, as the CEO said, it’s normal to “have some down quarters” – choppiness is part of dealing with the government.

Operational profitability dropped in step with revenues during the pandemic. PESI recently became profitable again in 2Q2023, though profitability dropped slightly in Q3. Expenses are fairly steady, so operational income should show strong growth as revenues go up. That is to say, it should exhibit strong operating leverage.

Even excluding the significant growth opportunities, the company seems confident in future growth in the business. I won’t be able to go into each of these individually for the sake of brevity, but I think the below quotes from the Q3 call emphasize the optimism about future growth.

We still have the same momentum and we expect to get back on that trajectory in the near term…

[We are] starting to get some traction on new procurements. But we add to that a list, a long list of bids that we’re working on through the winter that will be likely awarded in the spring and summer of next year, that are very large.

PESI believes $22.5-25 million is a sustainable base for revenues, and seemed confident in its ability to reach that next year. Given how they describe both the positive trajectory and their bids pipeline, I’d even expect revenues of the core business to continue to grow past the $100 million a year in 2025.

Core business valuation

Let’s consider what the company could be worth in 2025. I’m going to be what I consider rather conservative and assume zero growth in revenue for 4Q2023, $95 million in revenue in 2024 and $105 million in 2025. Q3’s gross profit margin was 20.8%. I am optimistic about the company expanding or at least keeping these margins steady given the following comment from the Q3 call.

We’re heavily focused on increasing productivity, and reducing costs to maximize our margins along the way.

That said, I’ll just use the current 21% margin, so we’d expect around $22m gross profit. Since 2018, annual operational expenses have slowly and consistently risen from $12 million to $15 million. This includes periods in which revenues were spiking around 2019 and 2020. We observed then that operational expenses did not exhibit any abnormal growth, so it is clear that PESI has a high degree of operational leverage. As such, I expect operational expenses to continue to show slow growth. We’re on track to hit around $15 million in 2023, and I’ll guess $16 million in 2024 and $17 million in 2025. This would call for around $5m in operational profit in 2025, or an EPS of around $0.37 (ignoring taxes and interest, which I’ll account for later).

I will now go on to discuss what I consider to be additional projects not included in this core growth due to their size or nature (e.g. international). I will give my thoughts on how much EPS they could add.

Hanford

I will first describe the wider Hanford project as a whole before delving into three distinct opportunities for PESI within this larger project.

The Hanford Site is a decommissioned nuclear production complex located in the State of Washington. Between 1943 and 1987, more than 60% of the plutonium used for the US nuclear weapons program came from Hanford. These operations led to a significant build-up of hazardous nuclear waste; around 56 million gallons of waste stored inside 177 single-layered tanks buried underground. These tanks present a significant and continued risk of leakage into both the local groundwater and the nearby Columbia river posing serious health, ecological and environmental risks. The Department of Energy (DOE) is commissioned to manage the waste and oversee the complex clean-up. Estimates for the clean-up are around $500 billion and the process could take until the end of the century.

The clean-up will take place under a phased approach, starting with the relatively simpler Direct-Feed Low Activity Waste (DFLAW). This phase targets the easier and more liquid waste. To do so, a process known as vitrification will be used. Vitrification is an established industry process that turns liquid waste, mixed with some additive materials, into a much safer form – glass (also known as immobilization).

The waste will be pumped out of the single-shelled tanks to the Tank Side Cesium Removal System (TSCR) for some pre-treatment. It will then be stored in more effective double-shelled tanks at the AP tank farm ready for vitrification. The waste is then sent via pipeline to the imaginatively named Low Activity Waste Facility which is a part of the wider Waste Treatment and Immobilization Plant.

In the LAW facility, two 300-tonne melters will be used to heat the mixture of waste and additives to 2100 degrees Fahrenheit before the solution is poured into steel containers, cooled, and finally stored at the Integrated Disposal Facility pending its ultimate disposal. Importantly, the LAW facility generates a ‘liquid effluent’ which is effectively wastewater and makes up the bulk of the plant’s ‘secondary waste’ discussed below.

Secondary waste

The glass columns stored in steel containers are the intended or primary waste of the vitrification process. Thus other by-products of the vitrification process are classified as secondary waste. Most of this is wastewater as described above, but it can also include other miscellaneous items such as PPE. Though unlikely, a treatment facility for this secondary waste might be constructed onsite in around 10 years at the earliest. Until then, alternative treatment facilities have been considered.

In January 2023, the DOE released a report (known as a Final WIR or a ROD Amendment) outlining the treatment plan for secondary waste. The report explicitly states that the secondary waste will be transported to PESI’s Northwest facility (PFNW). This has since been confirmed during several PESI conference calls. The calls also kindly even gave us an expected annual revenue and EPS for the work at roughly $70 million and $3 million respectively. The vit plant is currently scheduled to begin processing waste by late 2024 and ramp up over a year or so to full production. Shipments to PESI could well be extended indefinitely if the DOE optimizes to reduce capital costs and risk which I consider likely. This is hugely significant; attach a 10x PE multiple and the stock could be worth $30 from this contract alone once the work gets moving. Therefore, I believe the current stock price of <$8 must have serious doubts about when this work gets started.

The nearest competition is located at a considerable distance and would require waste to be transported via truck. The costs and risks of transportation associated with using competitive facilities make these alternatives practically untenable. There is also little chance of new competition entering the market. Constructing a facility would require lots of upfront capital (in an environment where capital is expensive), would take a long time, would be challenging to acquire the necessary permits and workforce, and there would be no guarantee the facility would win the work and be utilized, especially since PESI will have already gotten started. This work is in the bag for PESI, with plausible risks being limited to project delays.

So how likely is the delay? Stakeholders are effectively aligned in wanting to get started ASAP, as confirmed during multiple calls. The longer waste is untreated, the larger the risk of catastrophe. The main vitrification cannot proceed without a way to manage the secondary waste. One of the VIT plant furnaces is already hot and momentum is building. While minor delays are to be expected, I believe the chance of significant delays to be low.

Test-Bed Initiative (TBI)

Given the huge volume of waste that needs treating and the long horizon until completion, the DOE is incentivized to find alternative or complementary options to speed up the process and thereby reduce ongoing risk. Arguably the best complementary option (per the FFRDC report) is known as the TBI. This process treats the waste in its current form, removing the need for vitrification, and hence does not produce the effluent wastewater as a secondary waste either. The process effectively involves moving some of the LAW to an offsite commercial facility, and there turning the waste into grout or concrete which could then be stored off-site.

PESI is the only viable option for this method once again due to its technical capabilities and location. It’s risky to carry the waste further afield. That means if the option goes ahead, PESI will get the work. I should note that PESI’s facilities would need little to no capex to process the full production, at least before further ramp-ups.

In March 2023, the DOE outlined its three-staged approach for using the TBI. Currently, in the second phase of testing, they plan to test two thousand gallons of waste 2H2024. Assuming this goes well, the DOE could either conduct a larger test of 300 thousand gallons or could simply move to full production estimated to be around one million gallons per annum (with the potential to expand). Thus we could reach full production in 2025 or 2026 depending on the need for a phase 3 test. Once full production is reached, from the Q1 call we know that annual revenue and EPS should be in the region of $70m and $2 respectively for one million gallons.

After completing phase one of testing in 2017, the project saw significant delays. Despite the DoE supporting the project, key stakeholders including unions and the State’s Department of Ecology have been opposed. However, in the past few months, stakeholders seem to have aligned on supporting the project. In a public meeting in June, Washington’s Department for Ecology gave their public support for the TBI and in particular the grouting methodology. Ecology is still working through the permit which is taking longer than expected. Furthermore, in July, PESI signed a partnership with a union to supply a skilled labor force for the TBI project. I believe the removal of these roadblocks should limit the risk of delay.

One sidenote is that on the recent Q3 call, we heard that the DOE is considering using the TBI amongst other options for a batch of 700,000 gallons of waste that essentially was contaminated during the TCSR process and is currently no longer fit for DFLAW processing. It was said that this would not affect DFLAW processing or the secondary waste stream, but if it was treated through TBI it would suddenly expedite TBI reaching full production.

Integrated Tank Disposition Contract (ITDC)

Simply put, this contract is for managing the day-to-day operations of the Hanford facility. The total contract value is worth an impressive $45B for a 10-year period. However, it’s a huge contract, and the PESI was only part of one of the two primary consortia bidding for the contract. While we don’t know precisely how much of the total PESI might have been awarded, it should be noted that PESI is certainly a junior partner in the bidding team. I’ve heard annual revenue estimates for PESI in the region of a couple of million dollars. While this revenue amount is large, it should also be noted that the margins are expected to be comparatively low.

As it happens, PESI’s consortia did not win the contract, and it was instead awarded to the competitor (BWXT) in April. This was likely a key factor pushing down the stock price rapidly from $12 to $8. However, in May, PESI’s consortia led by Atkins sued the DOE for improperly awarding the contract, citing “numerous material and prejudicial evaluation errors” and including a technicality – that the winning party was not properly registered in a required database. As such the awarded contract was invalidated by a federal court judge in June. Both parties have since submitted various filings. It’s unknown how things will go from here. There are two main options. First, the DOE could again try to award the contract to either party. Second, it could go back to a bidding process. The DOE seems to want to put this process behind them. While I can’t say precisely what happens from here, it is certainly plausible that PESI’s consortia may win some or all the contract in the end.

Furthermore, even if for whatever reason PESI’s consortia still don’t win, PESI still stands to gain. This is because the contract demands the winning consortia employ “small businesses” to take on up to $200m of the work. According to the 4Q 2022 call, aside from PESI, there really aren’t many small businesses that have the technical capabilities. Factor in PESI’s geographic advantage and PESI is an obvious potential candidate for this work no matter which side wins in the end. I like PESI’s positioning here. Based on the stock price reaction, the market seems to assume no revenue for this contract. Since I believe PESI is likely to get at least a portion of the work after all, it’s likely to positively surprise the market.

If we assume $150 million in revenue (to be conservative), around a 15% operating margin, we could see around $22.5 million drop to the bottom line, or around $1.65 of EPS.

Since this contract is not yet awarded, the main risk is obviously that PESI is not awarded the contract. The process is also complicated now and further delay in awarding the contract is possible.

Other significant opportunities

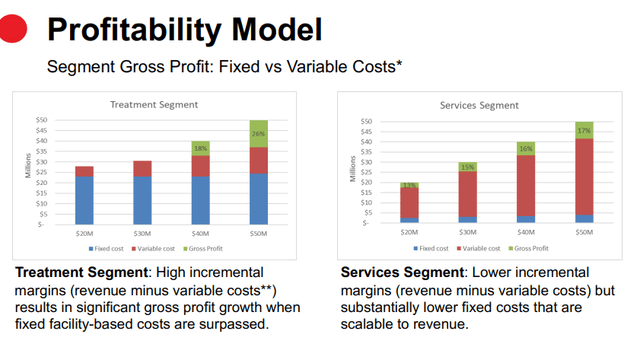

PESI has not stated what margins we might expect for the other opportunities, so I’ll be using the below charts from the latest investor presentation to estimate them.

Profitability model (Company presentation Jun 2023)

Both revenue streams are currently at around $45m run rates, so I believe gross margins should normalize around 21% for treatment and 17% for services. Since all additional revenue is incremental and would increase these revenues which would in turn increase the margins, the margins I have chosen are conservative.

Operations and Site Mission Support Contract (OSMS)

The US Navy is ramping up the construction of new submarines, and in parallel is decommissioning several older submarines. PESI has bid for one of the smallest projects, Ohio-Kentucky which would be worth around $40-50 million in revenue (Q2 call). This project isn’t a one-off. Over the next decade or so several more projects are coming down the pipeline which PESI could win. Each of the new projects is probably worth around $50-200 million in revenue, so we could see revenues here ramp up if PESI wins work on bigger projects.

Even if PESI’s group doesn’t win this contract, it is plausible that PESI could still win some of the work. In a similar fashion to TBI, the contract requires a certain proportion of the work to go to small businesses, which PESI is one of few who could realistically qualify.

In July, we saw the OSMS’ sister project awarded by the DoE. These projects were expected to be announced in close proximity to each other, especially considering the already on-site labour force (currently working on a previous project) needs to be assigned between the pair of projects. We should see a decision in the near future.

Since I don’t know the timeframe for the project, I will assume around 3 years, meaning the annual revenues will be closer to $15m. The work would be a mixture of service and treatment revenue, I’ll assume a 50-50 split and hence use a margin of 19%.

Joint Research Centre (JRC) & Other European opportunities

The JRC project in Italy involves the disposal of around 6100 drums and is expected to generate $40-50m in revenue over a few years. Based on the management commentary on the Q2 & Q3 call, it seems likely that PESI has been awarded the JRC project. The award was expected to be announced already, but it seems we are waiting on official sign-off at the EU level. This seems to be a formality, however, and I expect this to be awarded imminently.

However, even more significantly, the project could act as a bridge into Europe. PESI has already been receiving waste shipments from Europe for treatment. If Europeans are already shipping waste to the US for treatment, it is evident that PESI provides an important service. To capitalize on this large potential market, PESI plans to construct a waste facility in Europe, specifically the UK, which would reduce the costs and risks of cross-ocean shipping. Markets PESI mentioned they are bidding for in Europe include Italy, Croatia, Slovenia, Mexico, Canada, the UK and Germany. To estimate revenue, let’s use the following quote from the Q2 call.

We should be able to assume the $10 million to $20 million a year revenue stream internationally which will ramp up in the next year or two.

And from the Q3 call.

So we remain optimistic on that, and really feel that. But by the end of ’24, the annualized, we should be close to $10 million a year in revenues from Europe.

They expect to hit $10m by the end of 2024. Due to the volume of projects and low amount of competition (as mentioned under JRC), the company seems confident in winning a few of these at least to hit around $15m in revenue.

Though JRC is mostly treatment revenue, we don’t know the mix of the other European opportunities, so I will assume an overall 50-50 split and a 19% margin.

Valuation

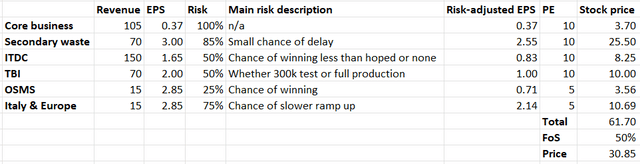

Let’s value the company as a sum of the parts. To do so, I break down each of the projects by revenue and expected EPS (these I noted above). I assign a relative probability that PESI will actually win the work and will start the work no later than the end of 2025. I assign a PE of 10 for all projects that are confirmed to last 10 years or more once started, and 5 for projects which require ongoing bidding to stay involved. This gives me a relative stock price for each project. After tallying the projects, I applied an additional 50% discount as a factor of safety, which should account for tax and interest I ignored, errors on my part, unforeseen events, and the like. That brings us to a share price of $30 by the end of 2025. Needless to say, that would be a terrific return.

Simple valuation model for PESI (based on my own estimations)

Overarching risks

As I’ve mentioned many times, the biggest risk across the board would come in governmental delays. I don’t think government delays would surprise many people, however, I think there’s also a limit to how far governments could push these projects. We’re talking about waste that has ongoing serious risks to the environment and lives. It can’t be left indefinitely. Governments and other stakeholders are incentivized to get moving sooner rather than later. I also see this as a recession proof given the urgency and given government spending often increases through recessions.

One should note a risk with much less likelihood, but perhaps worse consequences would be a risk of poor waste management leading to a disaster of some sort. Personally, I find this risk is well managed given PESI’s strong history and reputation.

Conclusion

PESI has an excellent risk-reward profile for a patient investor. The core business, combined with the already confirmed secondary waste project is worth multiples the current valuation. We might see delays, but I can’t see these being so substantial given the circumstances. Additionally, TBI and the JRC seem practically in the bag. ITDC and OSMS provide further upside potential, though these have much more risk. While investors appear cautious of delays, I don’t mind waiting. PESI is profitable, and it should remain so until the bigger ticket projects come in. While the market seems to want to see the money come in before believing it, I am happy to buy high-probability future earnings at what I see as a huge discount.

Read the full article here