Overview and past results

Perdoceo (NASDAQ:PRDO) is a for-profit high-education provider that in the last few years spent many resources to move to an almost totally online university and reduce its effort on physical campuses. Basically, more than 97% of their students are attending online courses, and this allowed Perdoceo to restructure the entire cost base and move the focus away from Capex and more into new acquisitions.

But this created new unrest in the market, which is now left assessing the quality and efficacy of their M&A strategy that is in place. The new acquisitions indeed, not only should increase growth, but they are meant mostly to reduce the overall slowdown that the business is experiencing organically. Eventually we believe that despite some execution and regulatory risk this is an undervalued asset that comes also with plenty of cash attached.

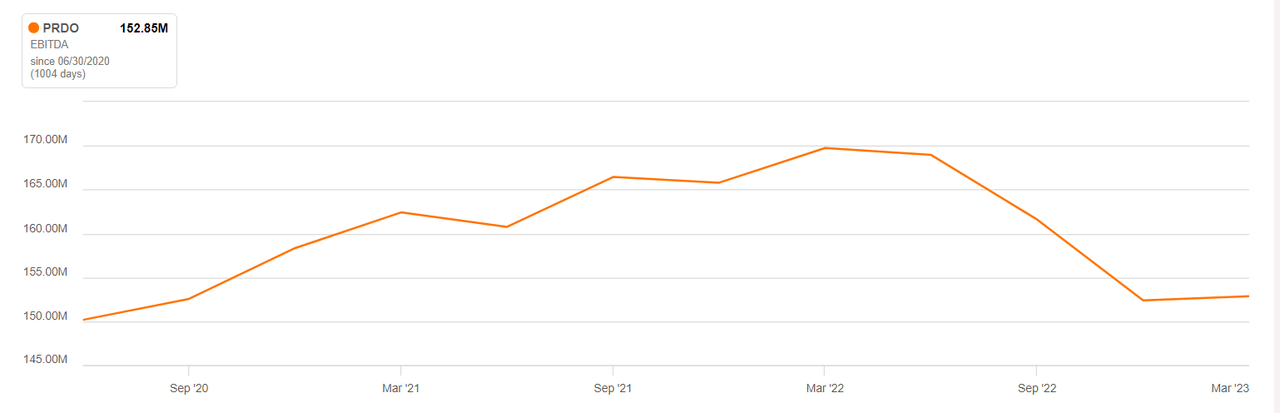

Perdoceo – EBITDA (Seeking Alpha)

In the last 3 years, following the pandemic-related boom of online courses and education, EBITDA started to decline. And while it is still above pre-covid levels, the management will need to find new cash streams quickly.

The uncertainty behind whether these acquisitions will be accretive quickly enough, and most importantly be more valuable in the long run, is weighing on PRDO’s valuation in our view.

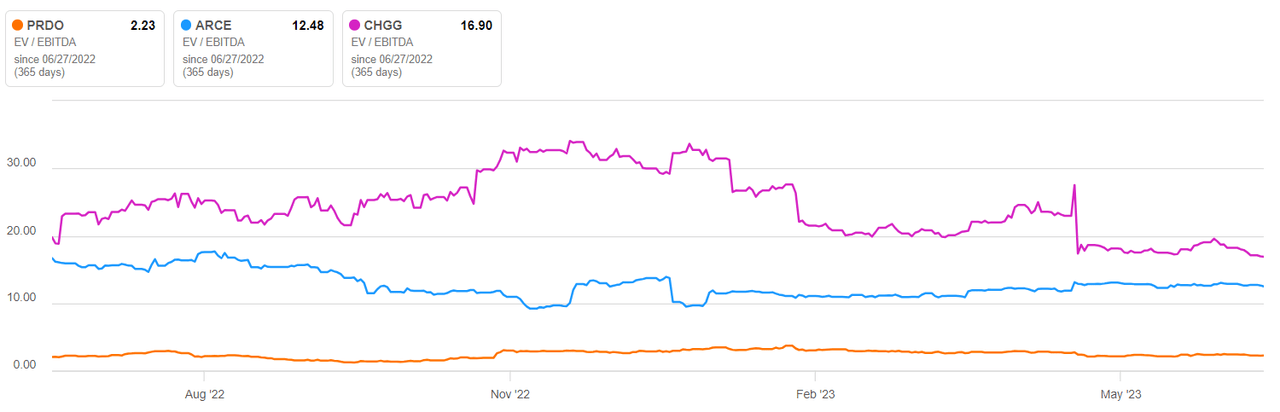

Perdoceo – Multiples (Seeking Alpha)

This shows a deep discount using the EV/EBITDA multiple and two similar comparables. Although it is true that the spread has been reduced by a re-rate of the overall multiples, it is still wide enough to create substantial value if it closes.

A closer look at the acquisitions and the financial position

As much of the value in PRDO is still in their balance sheet and cash generation, it is important to look at both the execution strategy but also the starting point: the cash and financing. In 2022, they acquired Coding Dojo and CalSouthern for a total upfront cash consideration of $84 million, more than half of 2022 cash from operations. Coding Dojo is a provider of cybersecurity and coding courses and education, and although it was not accretive for FY 2022 (given that it closed in December), PRDO is probably expecting some significant topline growth contribution from this asset.

And what about the cash position? The $84 million for acquisitions along with $12 million in maintenance Capex almost burned $100 million in invested capital, leaving cash and short term investments almost unchanged YoY. At March 31, 2023, the latest reporting period, the company is sitting on more than $520 million in cash, or roughly 65% of the entire market cap. This at the moment seems like a sound and solid cash position, that has now been kept at these high levels for more than 3 years. While initially justified for the high uncertainties that were created by the new administration taking over in 2017, the company should probably consider distributing some of the cash. Even if this may be at the expense of topline contribution, it seems unfair to shareholders to have so much cash sitting there.

Understanding the risks and downsides: regulation also weights on the valuation

Along with the much-discussed execution risk, there is also a regulatory concern to bear in mind: the company is operating in a highly regulated sector that proves to be controversial from time to time. And the latest development, the so-called “Sweet settlement” proves it once again. In November 2022 there has been a settlement in the case Sweet v. Cardona, which was a class action against the Department for Education for a subject matter called “borrower defense to repayment”, which dealt with certain ability of borrowers to default on their student loans. As the company stated: “It remains unclear what loan discharge applications the Department may grant in the future and whether they will assert repayment claims against us regardless of the date the student loan was disbursed and the corresponding discharge standards and processes”. So this adds another layer of risk to the execution risk mentioned above.

Valuation: fair price and catalysts for unlocking value

Now the most important point: how much does Perdoceo actually offer in value? And what should we look at to see some of that value unlocking and starting to pay off?

The first question can be answered with some financial modeling and sound assumptions. We now know the company’s approach and strategy: (1) expanding topline growth with M&A; and (2) keeping capex and physical facilities and expenditures limited. So we make the following assumptions:

-

Revenue growth at low single digits to reflect the offsetting effect of declining organic business to the newly acquired topline growth. We should expect growth at 3-5% per year through the next 10 years.

-

EBITDA and cash conversion margins stable at the historical levels given that the transition to online education has already took place, so little improvement expected from here.

-

M&A cash contributions are very difficult to forecast, but we assume they should be close to last years’ levels for the next 2 years (around 15-18% of revenues). Then they will enter a declining path as the company will benefit more and more from past fast-growing acquired companies.

-

Capex is expected to remain at these low levels of around $12-15 million per year.

-

The discount rate is 10%.

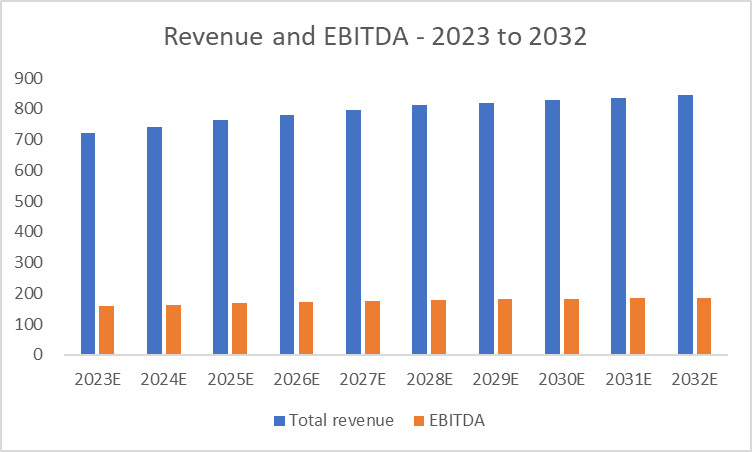

Estimated Revenue and EBITDA (Author’s estimates)

And this is what the forecasted revenue and EBITDA look like. While M&A expenditures will stabilize from 2025 onwards to a mere $30 million per year, we forecasted $70-80 million per year up to 2025. This is in light of the current ongoing strategy.

The final outcome is a fair value per share (after deducing net cash), of around $23, which constitutes an upside potential above 90%.

But how exactly will this value be unlocked? We believe it should be through distributions to shareholders. Indeed, management in the last years has been correctly conservative and retained plenty of liquidity, but now this should be returned back to equity holders. We believe special dividends or buybacks (especially the latter) will increase the attractiveness of PRDO to the market’s eyes and eventually make it too cheap to ignore.

Conclusion

We believe that Perdoceo is a well-positioned company that is set to deliver decent returns in the next years. The strong cash position, the cheap valuation, and the consistent revenues make the company an appealing buy. However, certain risks such as regulation and lack or return of capital to shareholders persist, and need to be considered carefully. We set the target fair value at around $23 per share, for an upside of more than 90%.

Read the full article here