PDF Solutions (NASDAQ:PDFS), a differentiated software and engineering services company, is arguably trading at a relatively sustainable valuation at the moment in the near term, despite it being valued higher compared to the wider industry. Given the strong growth for FY25 estimated and a large backlog supporting this, I am bullish on PDFS stock in the near term, with a 12-month to 18-month market cap growth target of around 25%.

Company Profile, Competitive Threats, & Market Shifts

PDF Solutions specializes in software and engineering services, particularly for the semiconductor industry. It is focused on transforming semiconductor manufacturing and test data into actionable insights. It helps companies to break down data silos within their supply chains, leveraging this data to improve key performance indicators. Their solutions are used by over 500 clients, including major industry players like TSMC (TSM), Intel (INTC), and Qualcomm (QCOM), to support the manufacturing and testing of ICs and SoCs. Their services are specifically designed to help clients reduce costs and increase profitability in manufacturing and test environments, and its Exensio platform acts as an end-to-end analytics solution to empower semiconductor engineers and data scientists.

PDF solutions are considered a relatively rare asset in the semiconductor industry, largely because of their specialized focus on yield and process automation software. The company offers open connection and data analysis for various tools, which distinguishes it from competitors that offer more closed systems. However, the company does face direct competitors, including yield management and prediction systems, such as KLA-Tencor (KLAC), Siemens (OTCPK:SIEGY), Onto Innovation (ONTO), and Synopsys (SNPS).

However, perhaps more significantly, PDF Solutions also faces a growing threat from internal teams within IC companies that may develop custom solutions in-house that cater to their specific needs. As tech companies seek to consolidate their moats and become more vertically integrated, I do believe this could become more of a problem for PDF Solutions in the long term. Despite the challenge here, there is the opportunity for PDF Solutions to position itself as a complementary partner rather than a competitor.

PDF Solutions reported a significant backlog of $243.2M as of June 30, 2024, indicating strong future demand for its products and services and laying the foundation for robust revenue growth in FY25. Furthermore, the semiconductor industry is experiencing a shift towards advanced nodes and the emergence of new foundries, which supports the growth potential of PDF Solutions’ innovative tools like Design-for-Inspection (‘DFI’), improving the ability to analyze chips during production for quality control and improved yield.

Q2 Earnings, Valuation Analysis, & Financial Considerations

In Q2, reported on 8/8/24, PDF reported revenue of $41.7M, which is relatively flat YoY and slightly up from the prior quarter. Its EPS was $0.18, an improvement from the $0.15 in the previous quarter. Furthermore, as I mentioned, its backlog increased to $243.2M, up from $229.8M at the end of 2023, reflecting strong future demand and growth potential. In addition, it ended the quarter with $118M in cash and ST investments, down from $123M in Q1, largely due to capex investments in its DFI system.

In the earnings call, management outlined that its DFI system saw high usage from key customers, signaling a strong demand pipeline and the potential for multi-year contracts. In addition, its MLOps product, which leverages AI for testing, is gaining traction, and management is expecting total revenue growth of around 20% YoY in H2. This is largely expected to be driven by continued demand for advanced semiconductor solutions in AI, machine learning, and digital transformation.

In my opinion, the earnings results and call indicate a reason to be bullish on the stock, especially as it beat the non-GAAP EPS estimate by $0.04 and the revenue estimate by $0.22M.

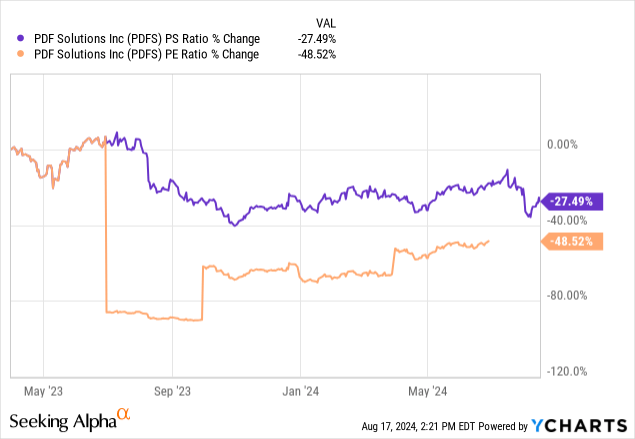

Despite the strength in its recent earnings results, PDFS stock is richly valued, with a forward P/E non-GAAP ratio of 41 and a forward P/S ratio of 6.86, both of which are over 100% higher than the sector median. That being said, both the GAAP P/E ratio and P/S ratio are down significantly compared to 5 years ago.

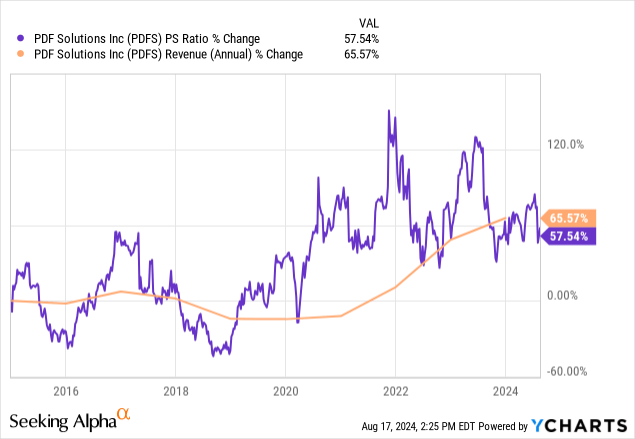

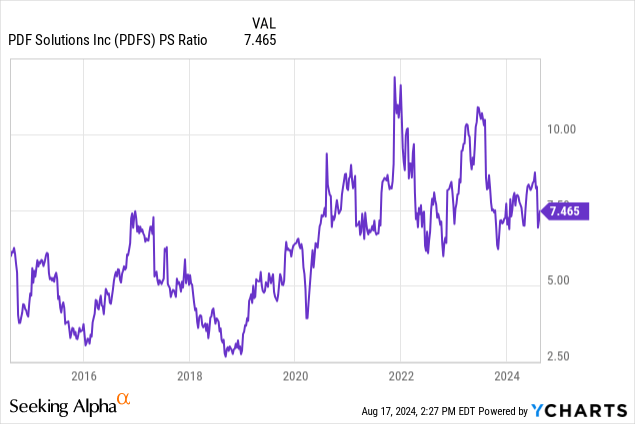

As the company is operating at a loss at the moment, with a net margin of -1.67%, I think that the stock is best evaluated through its P/S ratio. This has increased slightly less than its total revenue in % change over the past 10 years. Therefore, while the stock is richly valued, it is arguably not too expensive, in my opinion.

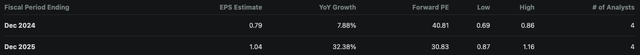

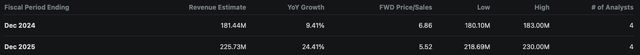

However, because its YoY revenue growth is only 2.28%, which is much lower than its five-year average of ~15%, there is potentially some cause for volatility concern. Despite this, the valuation is reasonable enough at present to allow investors to capitalize on the strong FY25 growth estimates from Wall Street:

Seeking Alpha Seeking Alpha

Based on these estimates and its current P/S ratio, I think that it is likely to reach a market cap of $1.58B at some point in FY25 if Wall Street estimates are realized and the P/S ratio is ~7 at the time. This indicates a potential 26.5% growth in just over a year, based on my analysis.

These strong growth rates are supported by its order backlog, which I mentioned in my operational analysis. Additionally, the company is deploying new systems like its Sapience Manufacturing Hub, in partnership with SAP (SAP) and MLOps, the latter of which is AI-based and is gaining traction among customers. On that note, the demand for semiconductors fueled by the big tech AI arms race is expected to continue to be accretive for PDFS through 2025.

Despite the negative profitability at the moment, PDFS does have strong free cash flow, which, while not historically linear in growth, is currently $0.19 per share. This is largely possible despite its net loss because of its high levels of SBC. This makes its income statement more tolerable, but I still think growth from PDFS stock will be moderate because its earnings are clearly cyclical, and as the valuation is already quite high, while it likely has more room to grow in price over the next few years, I expect a lot of downside volatility following a peak.

Long-Term AI Semiconductor Outlook, Economic Growth Slowing, & Volatility Risks

The integration of AI technologies continues to be a significant driver of demand in the semiconductor industry. As generative AI capabilities continue to expand, the need for high-performance semiconductors increases, benefiting companies like PDF Solutions that provide analytics and process control tools essential for advanced semiconductor manufacturing.

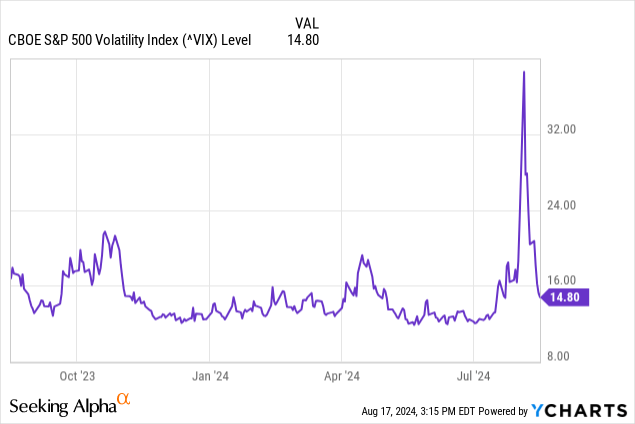

However, this growth curve is not going to last indefinitely, and with the global economy experiencing a slowdown, there are potential implications for companies like PDF Solutions as a result of reduced consumer spending and investment in technology. In addition, the Volatility Index (‘VIX’), also known as the “fear gauge”, had an extreme peak in early August, signifying higher volatility risk, although this has since declined significantly.

There are also now growing concerns about layoffs that big tech companies will be instigating due to concerns of revenue contraction from macroeconomic pressures, including a highly inflationary environment with a lot of federal debt. I believe that we are entering a fragile period, especially with China’s rise, and I believe that if the United States government does not position itself with more budgetary restraint, PDFS could be negatively impacted by a recessionary period in the West. This is especially true as 56% of its operating revenue comes from the U.S.

Conclusion

In my opinion, there is a potential 12-month alpha play here that could deliver around 25% price growth. However, there is also significant volatility risk related to both the company’s high valuation and broader macroeconomic pressure and indications of bearish sentiment entering the market through the VIX. Nonetheless, in the near term, the stock is a Buy, but it must be monitored because it is a cyclical play, and I believe taking profit in FY25 around my market cap estimate could be wise unless, after analysis during that year, its growth prospects look set to continue. I will endeavor to provide follow-up coverage to assess this nearer the time.

Read the full article here