Investment Thesis

Par Pacific (NYSE:PARR) is an oil and natural gas company that owns and manages energy and infrastructure business. The company has recently announced a significant investment in Hawaii Renewable Fuels production, which I believe can accelerate its growth in the long term by strengthening its production capabilities and helping it to penetrate deeper in the Hawaii air travel market.

About PARR

PARR is a Houston-based American company that deals in the production and exploration of oil and natural gas. The company conducts its business into three primary segments: Refining, Retail, and Logistics. The Refining segment owns and runs three refineries, totaling 155 Mbpd of operating crude oil throughput capacity. Its Kapolei, Hawaii refinery produces petrol, jet fuel, ultra-low sulfur diesel (“ULSD”), marine fuel, low sulfur fuel oil (“LSFO”), and other refined products mainly for consumption in Hawaii. Its refinery at Newcastle, Wyoming deals in producing jet fuel, gasoline ULSD, and other refined products largely for the Wyoming and South Dakota markets. Its refinery in Tacoma, Washington, produces gasoline, jet fuel, ULSD, asphalt, and other refined products mainly for the Pacific Northwest market. This segment contributed approximately 79.55% to the company’s total operating income in the previous year. The Retail segment manages 121 fuel retail stores in Hawaii, Washington, and Idaho. Its Hawaii fuel stores provide gasoline and diesel across the islands of Oahu, Maui, Hawaii, and Kauai. It manages convenience stores under its proprietary “nomnom” brand at 34 of its Hawaii retail fuel locations, selling retail merchandise such as soft drinks, prepared meals, and other sundries. In Washington and Idaho, nomnom-branded convenience stores provide diesel, gasoline, and retail merchandise. This segment contributed approximately 10.69% to the company’s total operating income. In the logistics segment, it has a large multi-modal logistics network that spans the Pacific, Northwest, and Rocky Mountain areas. In addition to its terminals, pipelines, and single-point mooring, the company owns and operates trucking operations for the distribution of refined products across the islands of Oahu, Maui, Hawaii, Molokai, and Kauai. It leases out marine vessels to transport petroleum, refined products, and ethanol between the United States West Coast and Hawaii. In Wyoming, it owns and manages a crude oil pipeline gathering system, storage facilities, a refined products pipeline, and loading racks, and in South Dakota, it owns and operates a jet fuel storage facility and pipeline serving Ellsworth Air Force Base. This segment contributed about 9.74% to the company’s total operating income.

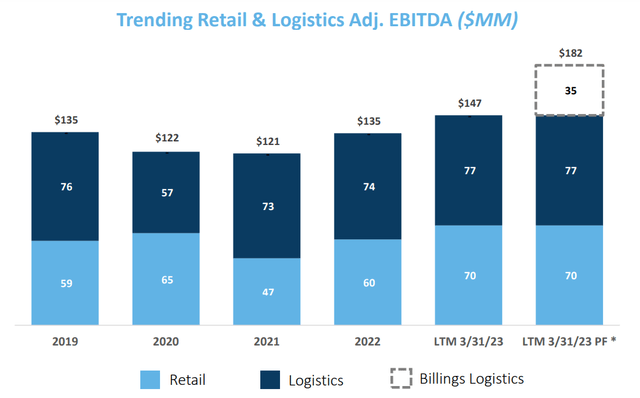

Trending Retail & Logistics Adj. EBITDA (Investor Presentation: Slide No:9)

Investment in Hawaii Renewable Fuels

The aviation industry’s aim of achieving net-zero carbon emissions in 2050 has significantly increased the demand for renewable fuels. Sustainable aviation fuel (“SAF”), renewable diesel, and liquified petroleum gases play a crucial role in reducing carbon emissions. SAF is currently used in commercial aviation to reduce CO2 emissions by 80%. The raw materials used in its production can include waste oils, fats, green and municipal waste, and non-food crops. According to International Air Transport Association, sustainable aviation fuel can contribute about 65% to achieving net-zero carbon emissions in 2050. This estimation reflects the high demand for SAF in the industry. Identifying these demand dynamics, the company has recently announced a $90 million investment to construct the state’s largest manufacturing facility for liquid renewable fuels at its Kapolei refinery. This project is anticipated to be completed by 2025 for less than $1.50 per gallon of annual operating capacity. In a first step towards decarbonizing Hawaii’s large air travel sector, the unit can produce up to 60% sustainable aviation fuel. The renewable fuel manufacturing facility is anticipated to produce roughly 61 million gallons of renewable diesel, sustainable aviation fuel (“SAF”), renewable naphtha, and liquified petroleum gases (“LPGs”) each year. These renewable fuels can reduce greenhouse gas emissions while providing customers in Hawaii with reliable electricity and transportation fuels. I believe this investment can act as a primary catalyst to boost the company’s growth and profit margins as it can help the company to significantly increase its production volumes and capture a huge market share by addressing the growing demand for renewable fuels in the air travel industry. As per my analysis, as this will be the state’s largest manufacturing facility for liquid renewable fuels, it can potentially help the company to create dominance in Hawaii and give it an opportunity to penetrate in Hawaii markets by creating its strong competitive position. In my opinion, the company can sustain this growth in the future as demand for SAF can continue to rise, taking into account the aim to achieve net-zero emissions in 2050.

Financials

The company recently reported its strong first-quarter results. It reported revenue of $1.68 billion, up 24.80% compared to $1.35 billion in Q1FY22. This growth was mainly driven by increasing operations in all three segments. The refining segment generated an operating income of $263.1 million, a 322.40% YoY increase compared to an operating loss of $118.3 million in the same quarter of the previous year. This growth was fueled by a significant rise in throughput in all three refineries. Operating income for the retail segment jumped 237.5% from $4 million to $13.5 million compared to the prior year. This growth has resulted from an increase in sales volume. The logistics segment generated an operating income of $12.6 million, up 27.27% compared to $12.6 million in Q1FY22. It reported a net income of $237.8 million, a 273.57% YoY growth compared to a net loss of $137.05 million. Increased net income resulted in diluted earnings per share of $3.90, compared to a net loss of $2.31 in Q1FY22. Adjusted EBITDA stood at $167.6 million. The company ended its first quarter with liquidity of $750.5 million. The company has performed well in the first quarter and delivered strong financial results outperforming market expectations. I believe we can expect strong coming quarters as a result of its significant expansion in Hawaii’s renewable fuel production.

According to seeking alpha, the company’s revenue for FY2023 might be in the range of $6.38-$8.89 billion, which is a -12.8% to 21.4% growth. In a recent conference call, the company’s management stated that they are experiencing a growth in product demand compared to FY2022. The company is experiencing strong demand in all markets, and I think the demand might increase in the coming quarters as the Chinese market opens up. However, the management has also stated that product prices are declining, which can offset the effect of rising demand. Therefore, to keep my estimates conservative, I estimate that the company’s revenue might be $7.63 billion, the average of seeking alpha’s estimated range and 4.23% YoY growth. The company’s 5-year average net income margin is 1.63%. I think the company’s net profit margin for FY2023 is significantly higher than the 5-year average net income margin, as the demand and product prices are considerably higher than those in FY2018-FY2021. The net income margin of FY2023 should be lower than last year’s 4.97%, as currently, product prices are lower than the FY2022. Therefore, I estimate the company’s net income margin for FY2023 to be 4.5%. The revenue estimate of $7.63 billion and 4.5% net income margin give the EPS of $5.75.

What is the Main Risk Faced by PARR?

The company’s business is highly seasonal. Due to cyclical increases in highway traffic, demand for gasoline in the Rockies and Northwest United States is often higher during the summer months than during the winter months. Because of this seasonality, the Wyoming and Washington refineries’ financial and operating results for the first and fourth calendar quarters of each year may be lower than those for the second and third calendar quarters. In contrast, demand for the products that the Hawaii refinery refines and sells, as well as the Hawaii refinery’s financial and operating outcomes, are often highest in the first and fourth calendar quarters.

Valuation

The company has recently reported its strong first-quarter result and outperformed the market expectations. I believe it can sustain its growth in the future as it is increasing its production capabilities and penetrating in Hawaii air travel market by investing $90 million. The company is experiencing strong demand, and I think this demand might continue to grow in the coming quarters as the Chinese market opens up. These positive factors can push the stock upwards, and we can expect a long-term upside. I believe the revenue estimate of $7.63 billion perfectly captures the impact of the above-mentioned growth factors. The revenue estimate of $7.63 billion and 4.5% net income margin give the EPS range of $5.75. In the case of rising industry demand and the company’s production capabilities, I am estimating EPS of $5.75 for FY2023, which gives the forward P/E ratio of 3.61x. After comparing the forward P/E ratio of 3.61x with the sector median of 6.08x, I think the company is undervalued. In my opinion, the company might gain significant momentum due to the rapidly rising demand for SAF and its recent expansion activities in the Hawaii air travel industry, which can help it to increase its capabilities and help it to trade at its sector median P/E Ratio. That is why I estimate the company might trade at a P/E ratio of 6.08x with EPS of $5.75, giving the target price of $35, which is a 68.43% upside compared to the current share price of $20.78.

Conclusion

The company has been experiencing massive demand due to high growth in the oil and natural gas industry. It has recently outperformed market expectations in its first-quarter financial results by performing well. It is exposed to the risk of seasonality which can contract its profit margins. It has recently made a significant investment to build a renewable fuel production facility which can help it to increase its production levels and address the increasing demand for SAF. The company is currently undervalued and we can expect a strong 68.43% growth in the stock from current price levels as the company is expanding its business in the Hawaii air travel market which can induce its growth in coming years. After analyzing all the above factors, I assign a buy rating to PARR.

Read the full article here