A Buy Rating for Osisko Development

This article implies a Buy rating for the stock in Osisko Development (NYSE:ODV), which is a departure from the Sell recommendation in the previous article as this gold stock could benefit greatly from the expected gold bull market given its strong positive correlation with the yellow metal. Meanwhile, the portfolio of mineral projects hasn’t really changed to attract significantly more interest than in the previous analysis, reflected in a generally negative underlying share price performance.

How Osisko Development Performed

In a previous analysis, shares of Osisko Development were given a Sell rating as the stock could come under severe downward pressure due to bearish sentiment on the gold price.

In addition, the portfolio of gold mineral projects appeared as substandard in relation to the company’s ambition to become a mid-tier player in the mining industry.

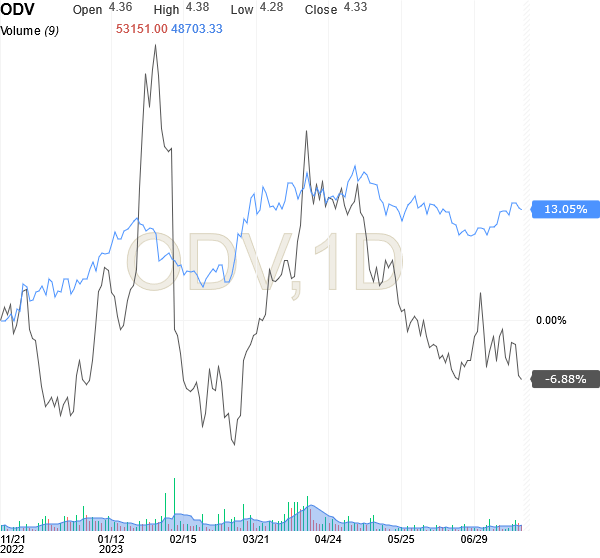

At the time of this analysis, Osisko Development Corp’s asset base, despite some updates, still lacks real bite. While the precious metal benefited from rising expectations of easing interest rate pressures from the US Federal Reserve and from its safe haven characteristics during the regional banking crisis in March this year, shares of ODV fell 6.88%.

Instead, gold prices have been up 13% since the date of the previous article, as shown in the chart below from Investing.com. ODV has paid for the consequences of a portfolio, which does not encourage investors to harbor growth expectations for this company.

This is evident from the chart below from Investing.com, which also shows that while the gold price trend has been more regular, the ODV has been characterized by wide fluctuations.

Source: Investing.com

In terms of recent trends, ODV is down nearly 30% since April 13, around the time confidence in the US banking system recovered following the collapse of Silicon Valley Bank and Signature Bank (OTCPK:SBNY) thanks to reassurances from central bank governors and US Treasury Secretary Janet Yellen. ODV performed significantly worse than the precious metal which in fact lost its appeal as a shield against the potential headwinds of the regional banking crisis on portfolio value if the crisis triggered a major sell-off in US-listed equities.

Meanwhile, ODV rallied after the US Federal Reserve’s pause of June 14 on its hawkish stance on interest rates versus elevated core inflation, but not enough to erase the previous loss, also because shares’ correlation with the metal was slightly negative recently.

Why Osisko Development Stock is a Buy

So, to get the most out of gold price cycles, ODV could well fill this role if, as indicated by the high volatility in the Investing.com chart, it confirms its potential to grow much faster than the price of the precious metal.

This analysis anticipates that gold prices will experience a bull market between late 2023 and 2024 as the economy is expected to enter a recessionary phase of the cycle during this period.

Also, given the possibility of a significant rise in gold prices from the current price of 1,966.70 an ounce, the ODV is looking more conveniently priced today, as evidenced by some comparisons between technical indicators.

Trading Economics analysts are forecasting gold to rise 1% to $1,985.48/oz. and by 4.7% to $2,058.45/oz., respectively, before the end of the third quarter of 2023 and by the end of the next 12-month period.

Therefore, this gold price outlook could tempt investors to buy some shares of ODV and take advantage of current price levels.

The Valuation of ODV Stock

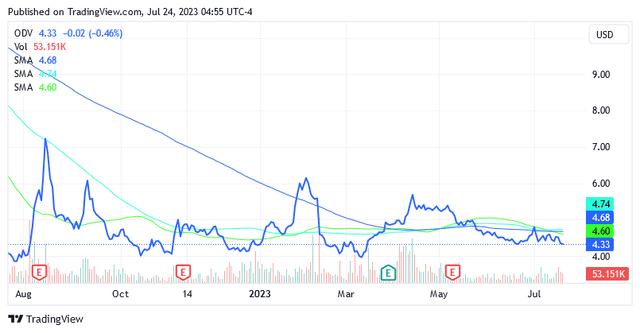

As of this writing Shares of Osisko Development Corp. traded at $4.33 apiece on the New York Stock Exchange, giving it a market cap of $361.73 million.

Source: Seeking Alpha

As Seeking Alpha’s chart shows, the shares are trading below the 200-day simple moving average of $4.68, below the 100-day simple moving average of $4.74, and below the 50-day simple moving average of $4.60.

Over the past year, the stock is up just 6.13%, while the U.S. stock market, represented by the benchmark S&P 500 (^GSPC), is up nearly 15% to print a 52-week range of $3.84 to $7.67.

ODV is currently trading at a premium of 12.8% to the lower bound of the 52-week range and at a discount of 43.5% to the upper bound of the 52-week range.

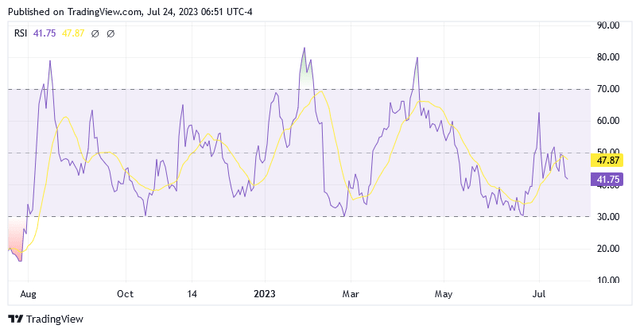

The stock has a 14-day Relative Strength Index [RSI] of 41.75, which, while indicating that the stock is not oversold despite the significant fall since late March 2023, when the company reported its 2022 financial and operating results, also suggests that there is more than enough room during the expected gold bull market for the share price to rise.

Source: Seeking Alpha

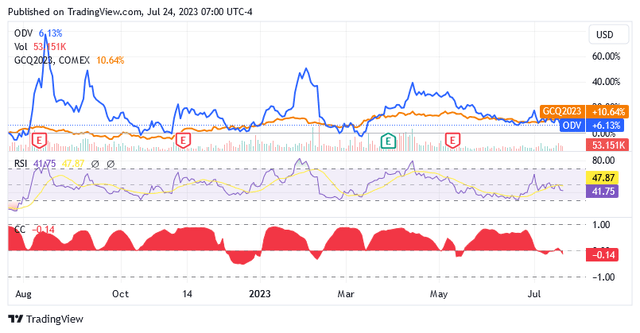

The Buy recommendation in anticipation of a higher gold price is also supported by the strong positive correlation between ODV and the gold price. The Seeking Alpha chart below shows that the red area, which describes the performance of the correlation coefficient, is almost always above the zero line, except for a very small number of cases.

Source: Seeking Alpha

So, if the gold price goes up, the ODV will likely be well above current levels, which as mentioned, looks interesting from a technical perspective.

An Estimate of the Positive Correlation Between ODV and Gold

This analysis has also identified how much the ODV could potentially rise in the event of a bull market in gold prices and the risk of missing out on the uptrend.

For this purpose, the past 82 weekly returns of ODV are combined with the past 82 weekly returns for Gold Futures – August 2023 (GCQ3) according to a linear relationship-based model where ODV is the output while GCQ3 is the input assuming a causal relationship between the two securities.

The last 82 weekly returns cover the period from January 2, 2023, to July 23, 2023, and the results can be used as a basis for forecasts for the months ahead through 2024. The outlook is likely to continue to be affected by the same factors as in the past 82 weeks, such as the impact of aggressive monetary policy, increased core inflation, the risk of an economic slowdown, and the impact of geopolitical tensions.

The model yielded a slope of 1.9, which can be considered as the beta gold coefficient in future forecasts. This states that if the precious metal is up 1% weekly, ODV’s share price should rise 1.9% weekly on average.

The Risk of Buying ODV

The risk is essentially determined by three things:

- The first is that there will be no bull market for gold because the economy will have a soft landing and not a recession, but the analysis in question gives this determinant a medium to low value. Even if economists scale back recession expectations, the chance of a significant slowdown in economic activity could be higher than Wall Street’s consensus estimate of 54% as the Fed’s aggressive policy of ten straight rate hikes before the May decision will still have a significant impact on the economy. Also, core inflation remains stubbornly above the 2% target at 4.8% and is slightly higher on a monthly basis. In addition, the rebound in higher crude oil and natural gas prices over the past week has put upward pressure on the prices of goods and services, including food and gasoline. Overall, inflation remains too high as stable working conditions support consumption, which also continues to benefit from excess savings that households can use after receiving financial support during the period of lockdown and restrictions to block the propagation of the Covid-19 virus. So, all of these trends add up to Federal Reserve officials calling for another 25-basis point rate hike at their upcoming meeting on July 26, and maybe a few more hikes through the end of 2023. Higher borrowing costs do not indicate economic recovery, but rather a recession. Additionally, the introduction of a soft-landing scenario, fueled by optimism in the current Goldilocks situation for the economy, means the impact of a recession could be much harsher than widely believed when the cycle kicks in. The sharp downturn in the business cycle would come as a surprise to many, who expect a happy ending for markets today despite the Fed’s aggressive rate hike.

- The second risk determinant in buying ODV today is a coefficient of determination called R2, which barely reaches 20%, while to be honest the reproducibility of the phenomenon could have been a little higher. The coefficient implies that weekly gold price returns explain 20% of the weekly ODV return and that there are other forces influencing the stock price, the most important of which is the stock’s high volatility compared to the stock market. By scrolling down to the “Risk” section of this webpage, the stock has a 24-month market beta of 1.57x, meaning that shares tend to emphasize the ups and downs of the stock market. So, while rising gold prices could lead to a dramatic rise in ODV in the event of a recession, the ensuing bearish sentiment for US-listed stocks could create headwinds and negate the positive effect of a bull market for gold and gold-backed assets.

- The third determinant of the risk consists of a portfolio of gold projects that, due to the lack of real strength, would not provide a supportive base on which the expected increase in the price of gold could allow the market value of ODV to flourish. This aspect is explained in more detail in the next section.

The Portfolio of Gold Projects of Osisko Development

Based in Montreal, Canada, Osisko Development Corp. is focused on the effort to develop gold mineral properties that historically produced the precious metal, likely benefiting from high-value operations.

These properties are located in North America and Mexico, mining-friendly jurisdictions, but what makes the market a bit skeptical is their actual potential to be converted in a very short period of time into assets that produce the precious metal at rates worthy of a medium-sized producer – which is the role ODV says it wants to play in the industry.

On March 24, 2023, ODV published its results for the fourth quarter and year-end 2022, without however having had a significant impact on the share price.

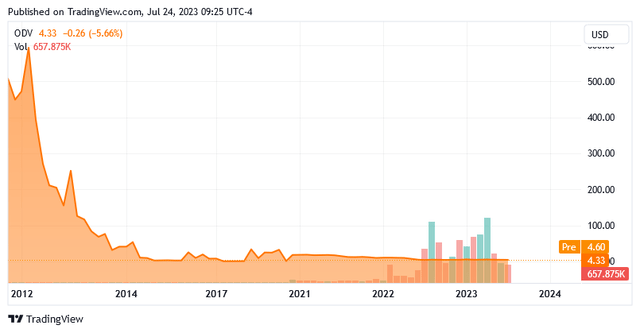

If they had signaled significant progress in the company’s growth strategy, given the speed at which all information is processed, the market would surely have decided the beginning of a different fate for ODV stock, which instead did not materialize, as the chart below shows.

Source: Seeking Alpha

This stock has been used as a way to take advantage of gold price cycles and the intense trading activity is indicated by the bars that show how unusual amounts of shares have changed hands. Around the time of the Fed rate decisions, the regional US banking crisis, and the bearish reversal on easing fears of a banking crisis, trading volumes were reported well above the three-month moving average of 43,980 shares, with peaks of more than 200,000 shares traded daily.

In view of its goal of becoming a mid-tier gold producer, ODV is advancing the following gold mineral projects.

- The 100% interest in the Cariboo Gold Project, located in central B.C., Canada. The property includes the Bonanza Ledge II project, but this asset does not contribute to ODV’s total gold production as it has been undergoing care and maintenance for a year. Bonanza used to produce not more than 7,500 ounces a year. A volume of 7,706 ounces of gold were sold in the fourth quarter of 2022 and 26,875 ounces of gold were sold in 2022 in terms of the company’s total production.

According to the early 2023 feasibility study, the Cariboo Gold Project aims to produce 1.87 million ounces of gold annually over a 12-year mining life from underground mining techniques. The economic section of the technical report indicates an after-tax NPV [Net Present Value] of $502 million [or US$379.6 million, as of this writing] and an internal rate of return [IRR] of 20.7%, according to the base case scenario with a gold price of $1,700 an ounce. The project hasn’t sparked much excitement in the stock market, as the NPV per share of about US$4.5 doesn’t offer a significant premium compared to the valuation the market is giving to this stock. And if you put yourself in the shoes of long-term investors who are reluctant to deviate from a conservative approach, especially in times of great uncertainty, the IRR as it stands is not particularly interesting. Typically, investors use 25-35% to classify a project as financially robust, but in the case of Cariboo Gold we need to go well above $1,700/oz to reach a higher IRR and that price/oz is already a long way from the $1,480/oz which is the average over the last 10 years. The last period is long enough to include both uptrends and downtrends in gold prices.

The project’s discount rate is 5%, but if that rate were raised to better reflect the increase in the cost of the loan needed to fund the project, Cariboo Gold would have a lower NPV. Frankly, there are companies in the mining industry that take an 8% discount for the economic assessment of future production of metals.

Permits are required before gold production begins in order to ensure the compatibility of future mining operations with the area from an environmental sustainability perspective. These should not be issued by the competent regulator before the first quarter of 2024.

- The 100% mineral interest in the Tintic Project, located in the historic East Tintic Mining District of Utah, USA. The Tintic Project is an advanced brownfield project that was acquired by ODV at the end of May 2022. The company used a portion of the $255.5 million in gross proceeds previously raised from private placements of common stock and warrants to fund the acquisition of the mineral asset.

Following the acquisition, ODV defined an initial mineral resource at Trixie, an underground deposit that was reopened two years ago. During the fourth quarter of 2022, a volume of 3,951 ounces of gold was sold for a total of 7,558 ounces of gold sold since ODV acquired Tintic.

The development at Trixie is currently focused on expanding mineralization beyond known zones and the company plans to launch a deep drilling campaign as it sees additional mineral potential on the property. The development at Trixie includes drilling sampling results indicating high gold grades, but the impact these exploration activities may have on production and costs is not yet clear.

- The San Antonio Gold Project in Sonora, Mexico. A volume of 3,755 ounces of gold was sold in the last quarter of 2022 and 11,863 ounces of gold was sold in 2022 as a result of stockpile heap-leach processing. The company has announced an initial mineral resource, but recovery of the precious metal at the San Antonio Gold Project requires a series of permits from the Mexican government, first for land use change and then for the environmental sustainability of the project. For now, however, the Mexican government seems reluctant to issue any more permits, which is likely to result in a bottleneck of permits in the future. In fact, as the Financial Times reports (see it via Twitter), Mexico is experiencing a regulatory change that could seriously complicate obtaining the various mining concessions. Major precious metals producers are deeply concerned about Mexico’s new regulatory framework for natural resource exploitation, believing the reform could hurt many growth opportunities. Due to changes in the mining law that the central government believes would make mining and exploration activities significantly more sustainable, many North American gold and silver producers in Mexico may choose to significantly reduce investment in new mineral projects and slow down mining activity in already-producing deposits. As such, ODV wants to wait until the situation is resolved before resubmitting the paperwork to obtain the necessary approvals.

The Financial Condition

Financial condition is another concern for investors that also does not benefit the share price. According to Seeking Alpha (scroll down to the “Capital Structure” section of this page), Osisko Development Corp. has approximately $90.39 million in cash on hand while total debt is $16.37 million. However, Seeking Alpha also states that the Altman Z-Score is 0.05, indicating a high probability of bankruptcy within a few years (scroll down to the “Risk” section of this page).

The Altman Z-Score measures the likelihood that a company will face bankruptcy problems, depending on the value it takes on. If the value is less than or equal to 1.8, the balance sheet is in distress zones, which means a high probability of bankruptcy within a few years. When the ratio is between 1.8 and 3, the balance sheet is in a gray area, which still implies a risk of bankruptcy, albeit moderate. While a score of 3 or higher means that the risk of financial insolvency is extremely low or non-existent.

Conclusion

With regard to Osisko Development Corp., investors can probably imagine themselves struggling in a situation where the balance sheet is in distress zones and the company’s project for future gold production worthy of a mid-tier producer gives feelings of lagging behind.

Meanwhile, the stock is being used as a means of profiting from gold price cycles due to its strong positive correlation with the precious metal.

A probable economic recession in late 2023 or sometime in 2024 should revive interest in gold as a safe haven asset against the headwinds of the negative business cycle and gold should experience a bull market. Osisko Development Corp. stock price, which is currently technically low, could potentially benefit greatly from higher gold prices.

As such, investors may need to consider a Buy rating for this stock, while being aware of the following risks. Risk of weak financial position/delay in growth strategy pipeline. Plus, the risk that no recession triggers bullish gold sentiment, or that headwinds from bearish sentiment in US-listed stocks in the event of a recession will counteract the positive effects of gold as a safe-haven asset. The latter aspect could be of greater influence for ODV since a significant part of the share price development is also explained by the sentiment on the US stock market.

Read the full article here