Investment Thesis

The offshore drilling sector has undergone significant changes in recent years, with the number of drillships cut in half since 2015. This shift created a better situation for suppliers, who now benefit from higher rental rates as demand resumes.

Noble Corporation plc (NYSE:NE) is a drilling service company managing a fleet of 19 drillships and 13 jackups leased on a daily basis under multi-month contracts.

The connection between fewer ships and increased rental rates isn’t proportional since the market has structurally become smaller in the past few years. Had the industry operated with the same number of ships we have today eight years ago, we’d be in a state of sheer panic. This contrasts with today’s “Can you see the ship rentals price bump?” conversations among industry pundits.

Despite the current demand momentum, we maintain a ‘hold’ rating on NE due to its high valuation (18x Price-to-Earnings ‘PE’), oil price risk (due to soaring US supply), and long-term demand uncertainties.

Noble Corp

Rising and Falling Tides: Nature of Industry

NE reached its peak in 2014, marking the height of its success in the offshore drilling sector. However, the landscape shifted dramatically with the onset of the shale oil boom-bust. The subsequent plunge in oil prices led to a scaling back of oil production and exploration by integrated oil companies – the likes of Exxon (XOM), Shell (SHEL), Chevron (CVX), and Total (TTE), etc., pushing offshore drillers into fierce competition for projects. This competition drove day rates down, severely impacting NE’s profitability. While many drillers succumbed to these pressures, NE managed to stay afloat but only crawled back to profit in 2019.

This recovery was short-lived, as the pandemic in 2020 led to another downturn in oil prices. This time, NE didn’t withstand the blow and filed for Chapter 11 restructuring in July 2020 after missing interest payments. During this process, bondholders assumed control, effectively wiping out common equityholders.

The company remerged in the summer of 2021 as a revitalized entity, relisting on the NYSE with almost no debt and under new ownership, marking a new chapter in the company’s history.

NE’s journey underscores an important lesson: Offshore drilling contractors lack a competitive moat. Attributes like customer relations and reputation hold little weight in downturns. They serve as industry workhorses, with their services reduced to mere commodities when economic tides turn. Despite their vocal warnings during the years after the 2015 downturn about the unsustainability of prevailing day rates of drillships and jack-ups, major oil players like XOM and Shell remained unmoved, opting instead to capitalize on the price war that was sending drillers into oblivion one by one, as opposed to adopting a modern approach to supply chain management more rooted in a partnership spirit. This resulted in a landscape where even the largest entities at the time, such as Diamond Offshore (DO) and Seadrill (SDRL), succumbed to bankruptcy before NE. Thus, given the industry’s history, NE’s current stature as a sector’s current leader in terms of size and market share offers little assurance.

Thus, investors eyeing NE should understand that offshore drilling is perhaps the most precarious, capital-intensive, and uncompetitive sector in the oil & gas industry.

Offshore Drilling: Supply/Demand Dynamics

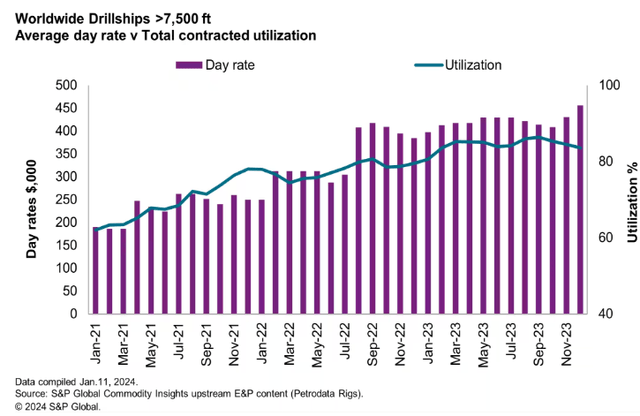

As profits declined, offshore drilling contractors halted investments in fleet expansion or even to replace retired ships. Today, the number of drillships worldwide is nearly half what it was in 2015. Much of the bullish case for NE rests on these tighter supply dynamics, especially in light of the rising offshore activity in the past few quarters, increasing demand for the company’s services. Last year, NE had fewer idle drillships, and those who were active, commanded higher day rates on more extended contracts. These dynamics, combined with the Maersk acquisition, supercharged its growth.

Still, the predictability of demand remains a concern. Last week, Saudi Aramco (ARMCO) announced it was shelving capacity expansion plans, citing worries over supply/demand imbalance risks as US shale producers go on full throttle. Oil prices have declined in recent months, which is noteworthy, especially considering a backdrop of increased demand (albeit incremental) and geopolitical risks.

Thus, although the reduction in drillships supply is a clear trend, future demand for these vessels is less certain. Earlier last month, the International Energy Agency predicted peak oil demand as early as 2030.

Financials: Flat YoY Revenue Growth in Q4.

Last October marked the one-year anniversary of the Maersk acquisition. Thus, investors should note that YoY growth rates are expected to normalize as we await Q4 2023 earnings release on February 27, 2024. The fourth quarter of 2023 is also likely to witness a temporary decline in the utilization of the company’s drillships, following a peak utilization rate of 77% in Q3 2023. This is primarily attributed to Noble Faye Kozack, Viking, and Voyager being in transition between contracts, sitting idle for most of Q4 2023.

S&P Global

Naturally, there is a delay between market rate prices and the actual realized prices by NE, given the fact that the majority of the drillships operate under multi-month contracts. These ships will benefit from the recent dayrate increase only after their contract ends. The silver lining is that four of NE’s ships are tied to market prices, which means immediate benefit from dayrate increases.

Between slightly lower utilization and higher dayrates, we expect NE’s Q4 earnings to fall on par with the previous year. We expect these dynamics to impact Quant Scores, which currently mirror an +A rating.

Lowest Leverage At The Highest Cost

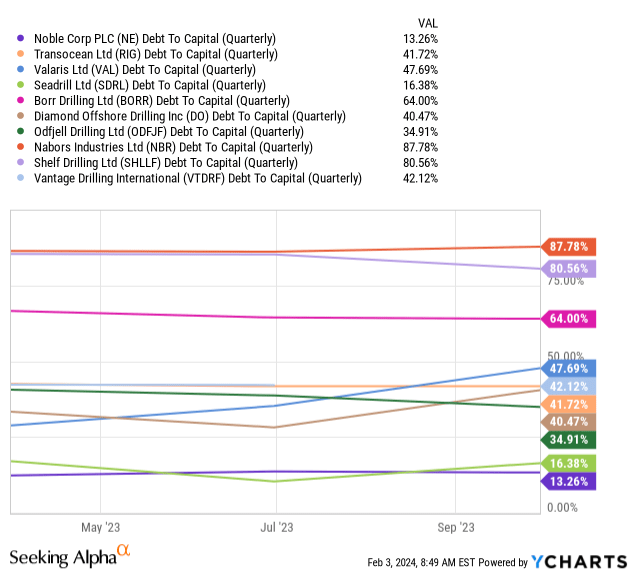

When evaluating potential investments within the Oil & Gas drilling service sector, including offshore drilling contractors, it is important to select companies with a robust balance sheet. A strong financial foundation is key to ensuring a company’s survival in the face of swings in energy prices impacting demand.

NE emerged from bankruptcy with a solid balance sheet, boasting the sector’s lowest debt-to-capital ratio. However, it is crucial to remember the steep price paid by common shareholders to achieve this financial reset, a reminder of the risks involved.

Fairly-Valued?

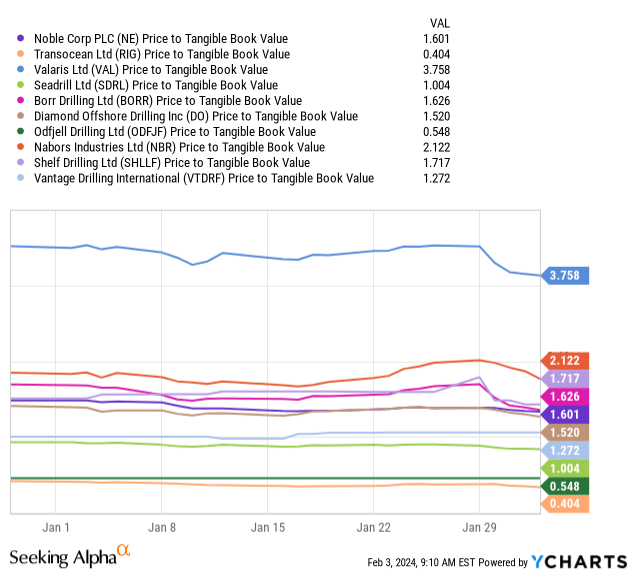

Currently, NE’s valuation hovers around the mid-peer average, as mirrored in its Price-to-Book ratios shown below. With a superior balance sheet and modest peer-to-peer valuation, NE, at first glance, appears undervalued.

However, its 2024 PE ratio of 10x suggests it might not be undervalued, especially when considering NE’s vulnerable position within the Oil & Gas supply chain. We believe that investors can find more compelling valuations in midstream Oil & Gas companies, those involved in transportation and storage, who also, are less oil price-sensitive. For example, Enterprise Products Partners (EPD) increased dividends during the shale bust and COVID-19 pandemic, while offshore drillers filed for bankruptcy. Despite its more resilient business model, EPD trades at a PE ratio similar to NE.

Given the precarious nature of the sector, we believe that a PE ratio in the mid-single-digit is more reasonable. These rates are common in energy stocks facing secular challenges, ensuring that investors are compensated quickly for their capital, offsetting market uncertainties, especially as the world approaches the point of peak oil demand within the next few years.

Summary

NE presents a complex investment case within the volatile offshore drilling sector. While the company emerged from bankruptcy with a strengthened balance sheet, with the lowest debt-to-equity ratio in the sector and the largest market cap, investors need to be careful of losing their guard. The offshore drilling industry is characterized by its narrow competitive moat and high sensitivity to energy price fluctuations and capex decisions by major oil players.

The bullish case largely hinges on the tight supply of drillships and demand recovery in recent quarters. If these dynamics continue, we might see a continuation of the company’s stock upward trend. However, we see worrying signs in the oil supply/demand market.

With a Forward PE ratio of 18x, we believe that investors looking for opportunities within the energy sector might find more stability, higher dividends, and better valuations in the midstream segment. Nonetheless, we acknowledge the growth potential in the offshore market in the short run as NE day rates, ship utilization, and possibly fleet size growth with higher demand.

Read the full article here