The Company

MINISO Group Holding Limited (NYSE:MNSO) is a $5.9-billion market cap Chinese retail company that sells lifestyle products worldwide under various brands, including MINISO, WonderLife, and TOP-TOY. They offer a wide range of items, from home decor and electronics to cosmetics and toys. Founded in 2013, the company operates in China, Asia, the Americas, and Europe.

MNSO’s Q2 FY23 results

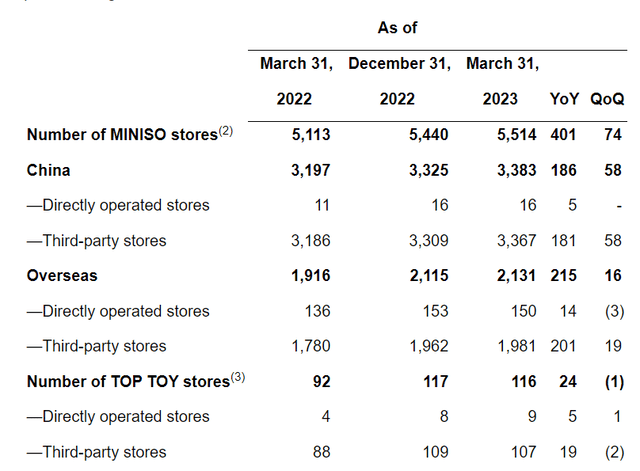

As you can see, MINISO achieved significant growth in its store presence in the 3rd quarter of fiscal 2023 [ended on March 31, 2023]. The total number of MINISO stores worldwide reached 5,514, with an increase of 401 stores compared to the previous year and 74 stores compared to the previous quarter. In China, there were 3,383 MINISO stores [~61% of the total amount], showing an increase of 186 stores YoY and 58 stores QoQ. The number of MINISO stores in overseas markets was 2,131, with a growth of 11.2% YoY and 0.7% QoQ. Additionally, the company expanded its reach to 2 more countries [according to the earnings release], marking its 106th entry into an overseas market. As for the TOP-TOY brand, it had 116 stores as of March 31, 2023, which represented a net increase of 24 stores compared to the previous year [no change QoQ].

The company’s total revenue surged to US$430.2 million, a remarkable 26.2% YoY increase, driven by strong performance in both the Chinese and overseas markets. GMV per MINISO’s China-based store increased by around 50% YoY. Revenue from China reached $313.5 million, growing by 18.1% compared to the same period in FY2022, while revenue from overseas markets reached $116.6 million [a significant 54.6% YoY increase]. The firm’s profitability also saw substantial growth, with gross profit reaching $169.2 million [margin of 39.33%], and the operating profit skyrocketing to $83.9 million, marking an astounding 308.5% YoY growth [margin of 19.5%]. The company’s strategic execution and international expansion efforts were the main driving forces of this remarkable performance, based on the management’s words.

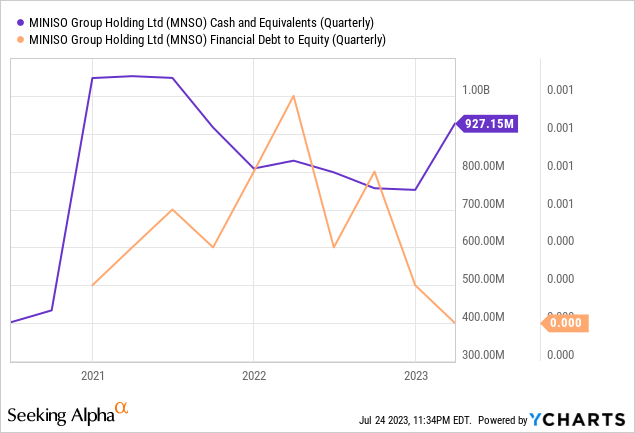

The company’s balance sheet looks healthy. Cash and cash equivalents have increased by 19.3% in Chinese currency [RMB] over the past year. At the same time, the company has gotten rid of long-term loans and looks very solvent to me with a CFO-to-sales ratio of ~14%.

Going forward MINISO’s executives aim to open 350 to 450 new stores in China on a net basis in calendar year 2023 [their previous guidance was to target 250 to 350 store openings this calendar year]. The expansion is focused on Tier 1 and Tier 2 cities, where there are plenty of growth opportunities. Additionally, the company continues to explore opportunities in overseas markets and aims to grow its store network internationally.

In terms of operating momentum over the last quarter, I like the fact that the China store closure rate has dropped from 1.4% in March 2022 to a historic low of 0.6% – the reopening of the country is reflected much more clearly in MINISO’s stores than in other companies in China that I can think of.

The development of partnerships with various brands provides more and more traffic to the stores, which are now operating at an incomparably greater capacity than before. In my opinion, the continuation and addition of new IPs and also the direction management has taken should keep MNSO’s operations growing for the foreseeable future. Logically, the stock should follow. That is, of course, if the valuation allows for it. Let us talk about that now.

The Valuation

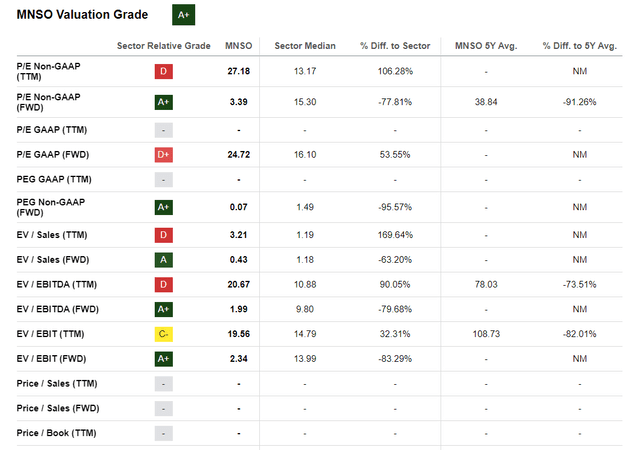

The valuation of MNSO is somewhat controversial because China had strict lockdowns until recently. The firm’s TTM valuation multiples are many times higher than those of FWD:

Seeking Alpha, MNSO, Valuation

Currently, the stock is trading at less than 2 times next year’s EV/EBITDA ratio despite the rapid recovery growth we are seeing in both the number of new stores opening and the decline in store closures, recent rapidly improving financials, and plans for the future. At the same time, let me remind you that the debt on the MNSO balance sheet is meager, with net debt of negative $929 million based on the latest data.

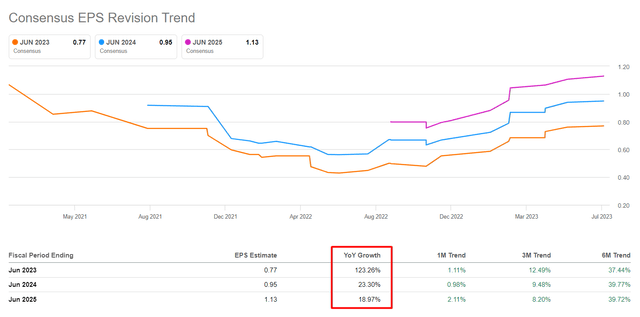

If we look at the revisions to the earnings numbers and YoY EPS forecasts for the next 3 years, we will see that analysts are very optimistic about MSNO’s growth for the foreseeable future. If MINISO’s EPS numbers are really going to grow that fast [or probably even a little slower], I think the stock is severely undervalued today.

Seeking Alpha, MNSO’s Earnings Revisions [author’s notes]

The Bottom Line

The “China factor” cannot be excluded as one of the serious risks for investors in MNSO stocks. Politics plays a key role in asset allocation and stock selection in many ways today, and I have long held the view that it makes no sense to seek value plays in countries with dubious political systems [especially if those systems are authoritarian in nature]. The slightest hint of an escalation in the geopolitical situation between China and the U.S. or China and Taiwan could lead to a hard sell-off in MNSO stock, no matter how rosy the outlook for future growth may seem.

Moreover, this has been talked about and written about for a long time, but there is a risk of a discrepancy between the factual data and what we see in Chinese companies’ financial reports. Without evidence, I cannot blame anyone, but the risk is worth at least mentioning.

Despite these risks, however, MNSO seems to me to be the most comprehensible recovery story in China and perhaps the most promising stock to invest in because of its development strategy, financial stability, and favorable valuation.

Therefore, I rate MNSO as a “Buy” for those who are not afraid to touch Chinese stocks. For those who have decided to avoid companies from that country, I recommend taking a look at my other articles.

Thanks for reading!

Read the full article here