History doesn’t repeat itself, but it does rhyme.”― Mark Twain.

I started investing in the mid-1980s. It didn’t take long to get a lifelong lesson on what happens when investors get far too complacent about the markets. Less than 18 months after I started buying stocks regularly, October 19, 1987, shocked the markets to their core. That was the day, known as Black Monday, that the Dow Jones Industrial Average (DJI) crashed by over 22% in one day.

The markets had already been weakening a bit in the weeks leading to the crash, after the DJIA had nearly quadrupled from August 1982 to August 1987. Equities were clearly overvalued at the time, but investors put their faith in an automated risk management and hedging strategy called portfolio insurance. These failed to deliver the backstop to losses that fund managers and their investors had counted on. In fact, this strategy ended up accelerating losses.

Since then, I have witnessed myriad major selloffs in the market, all precipitated by bouts of over-complacency and/or by investors being blindsided by risks they did not anticipate or understand. There was, for example, the steep sell-off in equities in the summer of 1990 following the Iraqi invasion of Kuwait. That was a black swan event few, if any investors, had on their radars even a few weeks earlier.

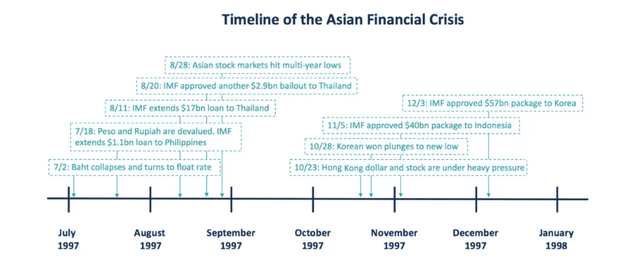

In the late 1990s, we had the Long-Term Capital Management L.P. (LTCM) fiasco where a hedge fund run by the “smartest guys in the room” had to be bailed out by a banking consortium put together by the Federal Reserve on the fly to avert a significant financial catastrophe. Investors also had to deal with the Asian Financial Crisis of 1997-1998.

CFI

Both these events triggered pullbacks in the stock market and should have been a sign that equities were overvalued. However, since stocks quickly rebounded, investors soon dropped those concerns and bid the market substantially higher, driven by the frenzy around the birth of the internet. This in turn led to the Dot-Com Bust which was compounded by the 09/11 tragedy a year and a half later. By the time the market finally found a floor in October 2002, the NASDAQ had lost more than 80% of its value, from peak to trough.

Good times quickly returned to the economy and markets. This was largely due to a huge housing boom that started to bust in 2007 following an age of “liar loans” and no/little money down mortgages. This then triggered the Great Financial Crisis of 2008-2009 that facilitated the greatest U.S. recession to hit the country since the Great Depression. Since then, market volatility has seen spikes due to the European Sovereign Debt Crisis that soon followed our nation’s financial calamity of 2008-2009. Spoiler Alert: Little has been solved on that front other than kicking the can down the road, as a piece in Barron’s recently highlighted.

Here at home, investors had to muddle through the taper tantrum of 2013 and the fears of a similar event in 2018. As recently as 2022, the S&P 500 (SP500) lost 20% of its value for the year and the NASDAQ (COMP:IND) fell by a third as the Federal Reserve started to implement the most aggressive monetary tightening since the days of Paul Volcker. And yet here we are with the market sitting at all-time highs even as profits for the last four quarters from the S&P 500 are slightly less than they were from the second quarter of 2021 through the first quarter of 2022.

The market is currently priced at nearly 22 times forward S&P 500 earnings per share. Taking out the seven largest tech names from the index, profits have fallen across the index on a year-over-year basis for the last two quarters, as I highlighted in this recent article. Nvidia Corporation (NVDA) has accounted for more than a third of overall gains in the market so far in 2024 and the AI juggernaut has added an incredible over $1 Trillion in market capitalization in less than 40 trading days. Market breadth has rarely been this narrow. While the tech-heavy NASDAQ has gained over 18% so far in 2024, the small-cap Russell 2000 (RTY) is almost exactly flat for the year. Nvidia has more than $1.2 trillion worth of market capitalization above that of all the energy companies in the S&P 500 combined, including Exxon Mobil (XOM) and Chevron (CVX).

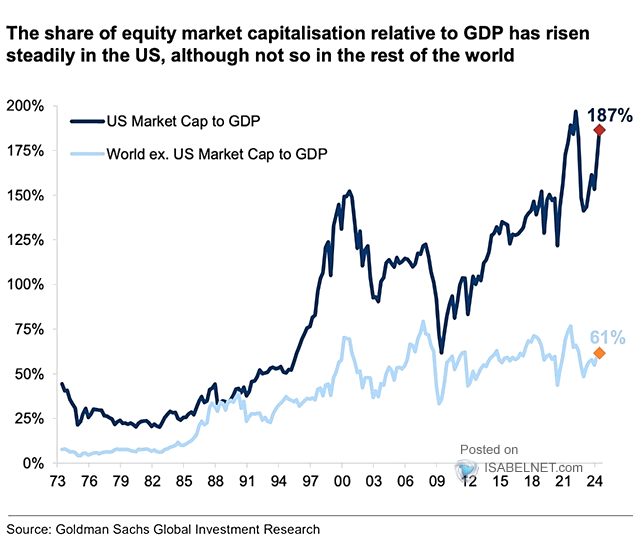

Never in the history of the U.S. stock markets have valuations been this high compared with the nation’s annual GDP.

Goldman Sachs Global Investment Research

Meanwhile, the S&P VIX Index (VIX) is hovering right at its lowest levels of the decade as if the evolution of AI will usher in a new technology utopia and most of the nation will soon become skinny thanks to the proliferation of GLP-1 weight loss drugs like Wegovy and Zepbound. I will go on record taking the other side of that bet.

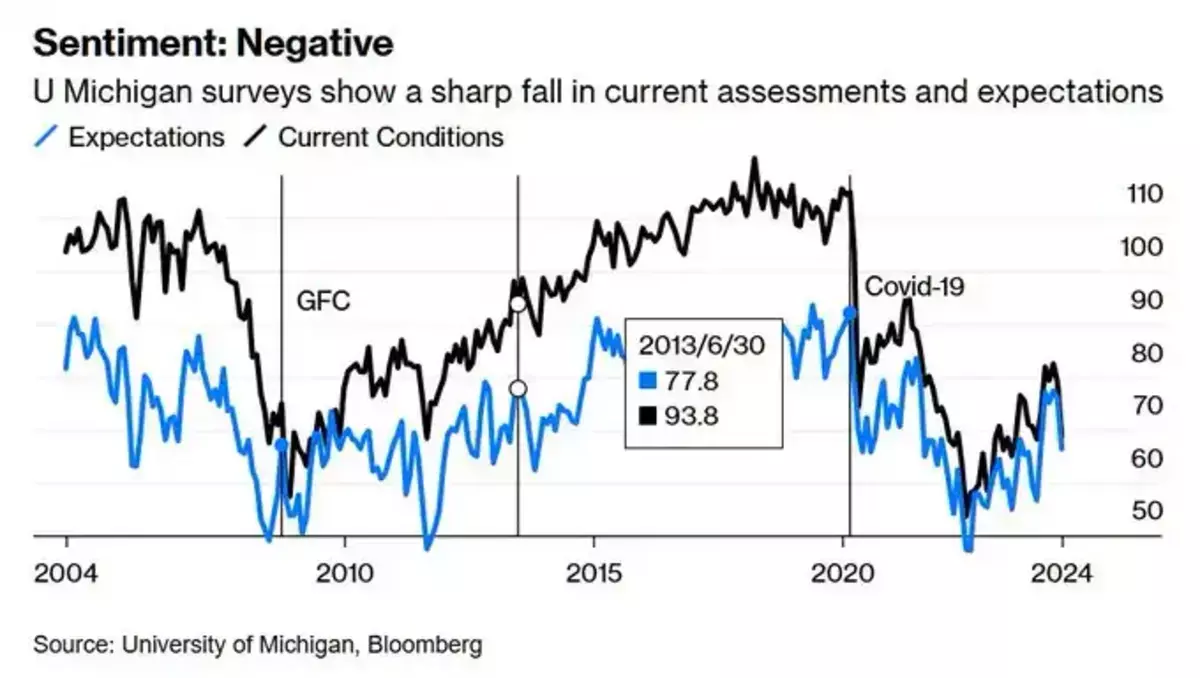

University of Michigan, Bloomberg

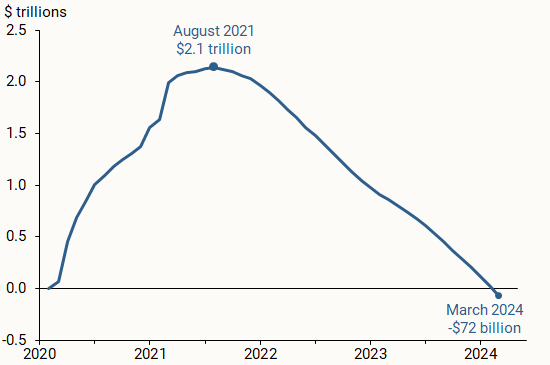

The consumer is crumbling a bit as excess savings from the Covid stimulus programs have all been spent. Consumer sentiment is also lousy compared to where it was before the pandemic. We saw another sign of a weakening consumer on Tuesday when May retail sales came in significantly lower than expected. Big ticket items are particularly seeing ebbing demand. The unemployment rate has just ticked up to four percent and will likely trigger the Sahm Rule over the next few months; that has accurately predicted every recession since 1948.

U.S. excess personal savings (Bureau of Economic Analysis)

Overseas, the conflict in Israel looks like it will escalate to soon include Iranian backed Hezbollah in Lebanon. The Houthis in Yemen are still blocking shipping in the Red Sea, using a ship drone for the first time to nearly sink a Greek cargo ship over the past week. The proxy war with nuclear-armed Russia continues in Ukraine, even as the NY Times admitted this week that peace was potentially on hand in April 2022 and the cost in lives and treasure since was preventable.

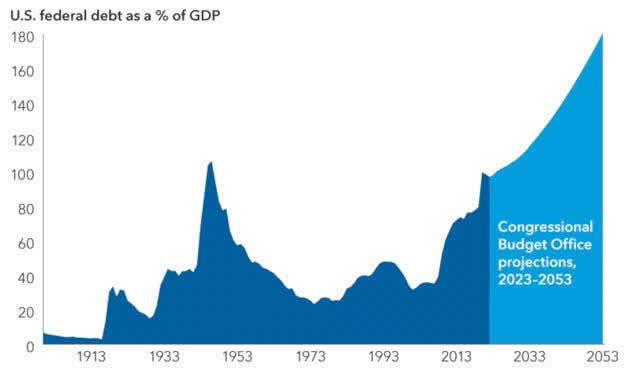

CBO/Capital Economics

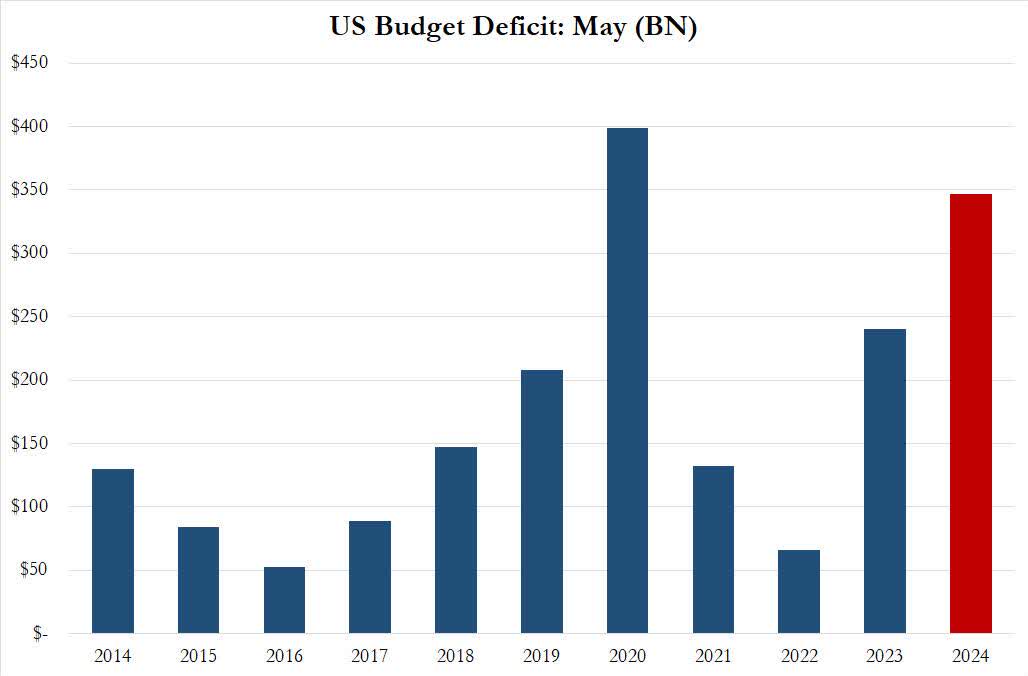

However, the greatest risk to the economy and the market on a longer-term basis is the unsustainable situation around the massive and fast-growing U.S. federal debt. The debt to GDP ratio is the highest in the country’s history and moving up at an accelerating rate. This week, the Congressional Budget Office revised up their estimate of the federal government’s FY2024 deficit by $400 billion to $1.9 trillion (6.7% of GDP). This comes after a $2 trillion fiscal deficit in FY2023, even as the U.S. experienced an economic expansion in both years. The nation just incurred a $348 billion deficit for the month of May alone as federal spending rose 23% on a year-over-year to $672 billion while revenues only gained five percent to $324 billion. Outside the Covid year of 2020 when the country was mostly locked down, it was the largest deficit for the month of May in U.S. history.

ZeroHedge

In summary, the market is clearly overvalued and extremely top-heavy by historical standards. Investor complacency is also measurably substantial. The only thing missing is the event needed to trigger a major decline in equities. Will it be something predictable like a recession if the Federal Reserve once again fails to deliver a “soft landing” or will the bond market finally have a significant hiccup due to the amount of new debt the Treasury department is issuing? Or maybe an accelerating collapse in the commercial real estate sector that pushes a good portion of the regional banking system into bankruptcy? Perhaps something more exotic and unexpected, like an invasion of Taiwan or a mass outbreak of Bird Flu?

Frankly, your guess is as good as mine at this point. However, given how stretched equity valuations are and how complacent investors have allowed themselves to become, it won’t take much to put the markets on “tilt.”

So, whether investors want to admit it or not, the market is “living on borrowed time.” Unfortunately, for so many, that revelation will only come in hindsight.

Read the full article here