Investment Thesis

Lululemon Athletica Inc.’s (NASDAQ:LULU) brand continues to have a strong presence both domestically and internationally, presenting untapped opportunities. The company’s robust growth is supported by various factors, including untapped international markets, significant growth in the men’s segment, expansion into new product categories like personal care and footwear, and the continuous growth of the e-commerce business alongside its core North America business. I expect LULU to post mid-teens revenue growth and high-teens earnings growth until FY26, with a moderate increase in operating margin driven by gross margin improvements.

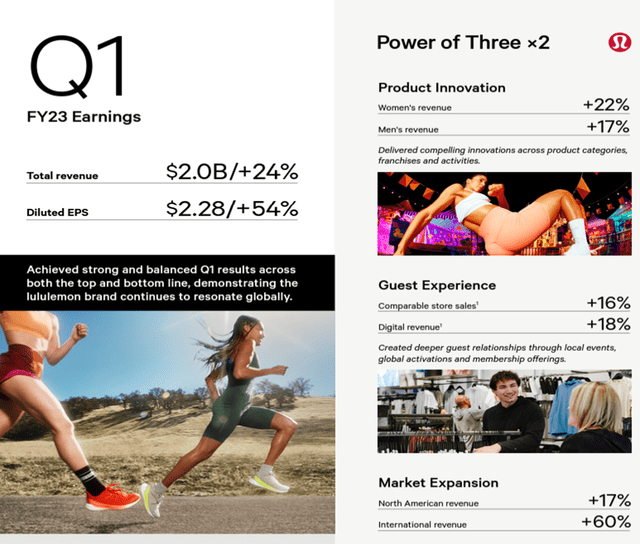

Q1 Review and Outlook

LULU achieved impressive results in the first quarter of 2023, surpassing expectations in various key metrics, including sales, gross margin, promotions, operating expenses, earnings per share, and inventory management. The company remains a leader in the athletic and athleisure category, even amid a challenging consumer environment. The company’s success is attributed to its focus on product innovation, the introduction of new categories, expansion into new geographic markets, and effective brand awareness initiatives, which have helped attract new customers and establish strong connections with its community-based approach.

The company’s international performance, especially in China, was outstanding, experiencing a 79% significant growth. Both men’s and women’s products, as well as sales through physical stores and digital channels, saw double-digit growth. Looking ahead, LULU expects its growth to be fueled by increased customer traffic and the acquisition of new customers through the introduction of new product categories. The company has effectively managed its inventory through a diverse product mix, including new colors and innovative products, such as golf, tennis, footwear, and accessories, introduced in February, which have resonated well with customers. With a strong presence in China, I expect LULU to generate robust sales and margin growth throughout the year. Its strategic positioning makes it well-prepared for both challenging economic cycles and periods of recovery, making it an attractive investment option.

Company Presentation

International Expansion Remains an Opportunity

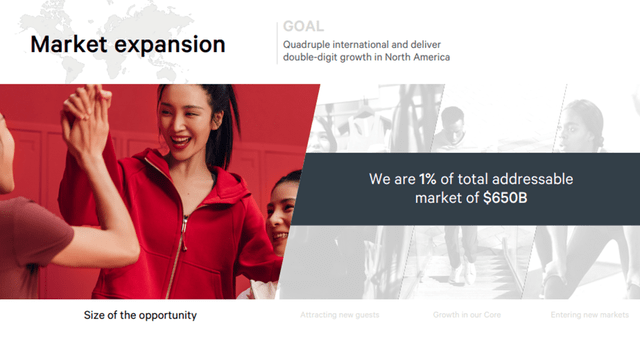

Lululemon’s core markets abroad — Australia, South Korea, the UK and Germany — will remain key to driving growth as the brand doubles down on product diversification, men’s and e-commerce in its four most mature markets. Leveraging its local-ambassador program can boost engagement and awareness in these regions. Building on community with its city ambassador program, launched in 2021 in nine global cities, including Seoul, Shanghai, London and New York, could bring local relevance to the brand and drive greater engagement. The profitability of LULU’s international business turned slightly positive in FY18, as the profits from Asia and Australia more than offset losses in Europe. Despite international sales currently accounting for only about 17% of the total and the international segment being marginally profitable, there is a significant growth opportunity for LULU outside its home market.

At just a mid-teens percentage of sales, Lululemon has plenty of room to growth its revenue from international sales, driven by gains in China and growing core markets and entering new countries across Asia, Europe, the Middle East and Africa. Though Lululemon has gained market share rapidly, it only captures 1% of the $650 billion global premium athletic-wear market and has a retail presence in just 18 countries. In 2022, it entered Spain, the first new market in Europe since 2019. The company is also planning to expand into Italy and Thailand.

China is at the forefront of Lululemon’s almost $4 billion international-sales opportunity, with gains to be driven by increased investments in digital, curated local marketing content and region-specific assortments. LULU envisions China becoming its second-largest market outside the US by 2026, and the brand has been steadily adding around 20-30 new stores in the region each year. In China, yoga’s rising popularity offers sizable opportunities and accounted for 53% of international sales in 2022. In 4Q, international sales rose 35%, driven by a more than 30% gain in China. China represented 8% of sales in 2022.

Company Presentation

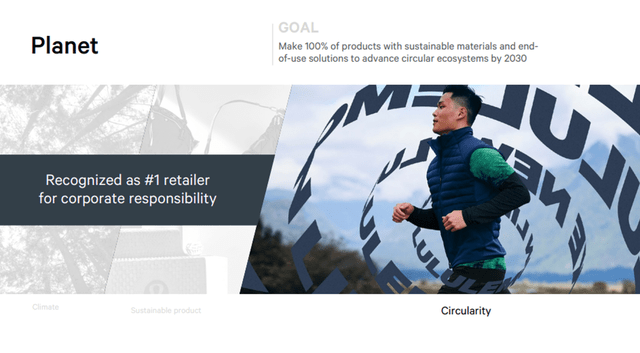

Unique Appeal Due to Sustainability

Driving a sustainable pipeline of products through raw-materials innovation could help Lululemon entice customers that prefer brands that resonate more closely with their personal views for more sustainability in my view. The company is seeking to significantly change the way it sources and manufactures products across all its key raw materials — polyester, nylon, cotton, animal-derived and forest-based materials. In 2021, Lululemon made an investment in Genomatica to create lower-impact plant-based nylon, with the ultimate goal of replacing conventional nylon, one of the largest raw materials used to make Lululemon products. Nylon is a $22 billion industry, and the ability to craft a sustainable replacement will reduce the use of non-renewable fibers and its waste and emissions in the process.

Shoppers seeking to connect with brands that have a more eco-friendly approach is forcing many retailers and brands to embrace sustainability. Millennials and Generation Z consumers tend to be more environmentally conscious than other generations when shopping for apparel. PwC’s 2021 Global Consumer Insights Pulse Survey revealed that Millennials are most likely to be thinking about sustainability during shopping, while Gen Z may be mostly aspirational about eco-friendly behavior, though their ideals translate less into spending compared with Millennials. As more brands make more meaningful connections with these shoppers, I think there will be a sizable opportunity to convert digital browsers into potential buyers.

Moreover, Lululemon’s leap into the more than $30 billion resale market provides it an outlet to participate in the circular economy, reach a more value-focused shopper and gain sustainability-minded consumers. In 2021, Lululemon launched Lululemon Like New, the first program to recycle lightly used apparel, where shoppers can give clothing another life and earn a credit with the brand. The program was rolled out to all stores digitally in mid-2022. Lululemon isn’t the only retailer testing resale. Nike accepts gently worn sneakers, and Levi Strauss has a buyback program for its jeans called SecondHand. Gap, Macy’s, J.C. Penney and Walmart are among many others testing resale through a third party or on their own.

Company Presentation

Financial Outlook & Valuation

Lululemon tracked ahead of targets in its first year of a five-year plan, positioning it to reach $12.5 billion in ahead of its goal, especially as the athleisure category grows and momentum builds in China. LULU’s revenue rose 30% in 2022, ahead of the 15% CAGR target for 2022-26. Sales can rise in the mid-to-high teens in 2024 as new stores accelerate growth in China. The launch of its fitness app this summer, where users can sweat with Lululemon without a MIRROR, adds a new revenue stream and can propel membership. New spring products or colorways in its hike, golf, and tennis collections, coupled with the launch of its Blissfeel Trail shoe this summer, are also catalysts for the academy.

The company is showing strong momentum with robust revenue and earnings growth, driven by an effective digital strategy that continued to yield substantial growth even during the global shutdown. Additionally, LULU has made enhancements to its supply chain processes, enabling the company to efficiently manage inventory in the current economic downturn. Furthermore, the company’s brand has been gaining popularity among the younger millennial and Gen Z consumers, further contributing to their success in the market. Longer term, I remain optimistic on Lululemon’s ability to meet its financial targets, aided by its “Power of Three x2” strategy and the essential-membership program that already drew in more than 9 million members.

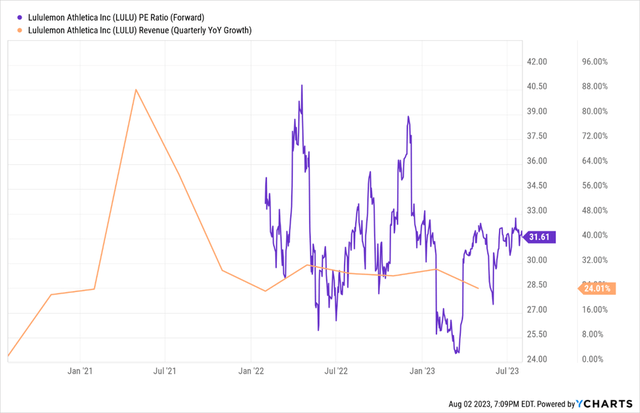

LULU’s multiples have come down despite the business continuing to post solid earning beats. For context, LULU’s forward PE multiple has hovered in the 40/25x area for the past 2 years. The stock recently troughed to 24x but has rebounded to trading at 32x currently. The deteriorating macro environment has weighed on the stock, in my view, as LULU is not immune to repercussions of prospects of a possible U.S. recession; however, I view it as a resilient brand due to its expansion into new geographies, particularly China, which is expected to recover in FY23. LULU is one of the bestcomping apparel retailers today, with strong traffic online and in-stores and relative resilience to the rest of retail seeing more volatile results. Hence, I remain positive on the company’s long-term prospects and view the stock’s current valuation attractive for an entry.

Ycharts

Investment Risks

Despite significant growth opportunities in both domestic and international markets, LULU faces challenges related to efficiently expanding its square footage while maintaining mid-single-digit comparable growth through product innovation. The management envisions improving gross margins from their current levels in the mid/high-50s and targeting a mid-20% operating margin. The company needs to continue investing in the supply chain and supporting international/omnichannel efforts and brand building, which could put pressure on margins and hence on the stock, especially if the overall business environment remains uncertain. Moreover, the retail industry is highly competitive in nature, and competitors may be able to compete more effectively, resulting in a loss of LULU’s market share.

Conclusion

LULU is a prominent player in the athletic apparel industry. I believe the company possesses various strategies, such as expanding its stores, entering international markets, and introducing new product categories, which can sustain strong revenue growth. Lululemon has substantial potential for international sales growth driven by strong performance in China, expansion in core markets, and entry into new countries across Asia, Europe, the Middle East, and Africa. Lululemon currently only holds 1% of the $650 billion global premium athletic-wear market, leaving plenty of room for growth. I am bullish on the long-term prospects of the company and view the stock as a buy.

Read the full article here