Investment thesis

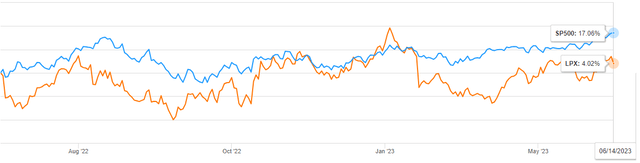

Louisiana-Pacific Corporation (NYSE:LPX) is a high-performance building firm that offers innovative and dependable building products and accessories. Over the last five years, the stock price has been on an upward trajectory. The growing traction of advanced wood grading among consumers catalyzes the global demand for aesthetically appealing homes and prefabricated houses. The share price is underperforming the market, as shown below. The challenging operating environment (material costs, supply disruptions, and labor challenges) and an uncertain housing market (declining housing starts) can account for the trend

Seeking Alpha

While LPX registered a drop in its sales and revenues in Q12023, it is equally important to dissect each business segment by its dynamics, which I will dive into later. While the overall financial performance in Q1 2023 may need to be more satisfactory, investors must understand that the company was heavily tapping into the future by acquiring and expanding its business internationally during that quarter. The strategic investments will leverage growth soon.

Its solid balance sheet amidst the bleak macroeconomic environment is a vote of confidence that the company will rebound. Thus, I’m bullish on the stock and confident the numbers will appeal. I rate it a buy.

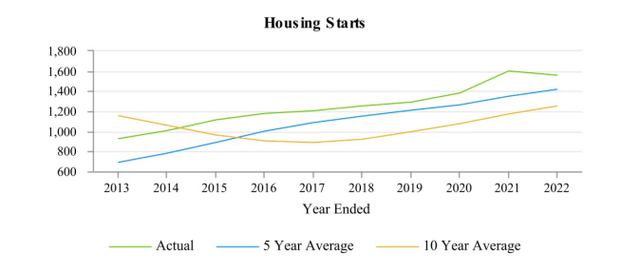

The demand for building products

A rise in the construction of new homes, repairs, and remodeling activity stimulates demand for building materials. The U.S. Census Bureau reported in February 2023 that in 2022, actual single-family housing starts were 11% lower than in 2021. They were about 16%in 2022, higher than in 2021. However, repair and remodeling sectors are termed continuous activities, whose demand is not cyclic and less seasonal.

Seeking alpha

Future economic conditions globally and the demand for homes are uncertain due to inflationary economic impacts, including interest rates, employment levels, hiked material prices, supply disruptions, and labor challenges. Collectively, the potential effect of these factors on future operational and financial performance is uncertain. As a result, the past performance may not indicate future results.

The business segments

Louisiana-Pacific has primarily three reportable business segments: oriented strand board (OSB), siding, and North America. While all are committed to serving customers with luxurious products, each segment’s uniqueness should be analyzed.

a) Oriented Strand Board [OSB]

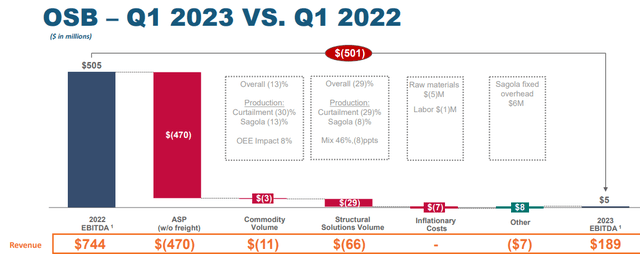

Over time, OSB has accounted for most sales. In 2021 and 2022, it accounted for 52% and 54% of the total net sales, respectively. In Q1 2023, its sales declined to $189 million, a nearly 75% decline, far more than the projected decline of about 20%. The downward trend is due to:

- 470million decrease in OSB prices

- 51 million decline in sales volume

- 27 million decrease related to converting the Sagola mill to siding production.

Adj. EBITDA fell 99% year over year to $5 million due to lower prices and sales volume and increased raw material and wage inflation of $7 million. Since the segment’s products target entirely new construction entities, the unsatisfactory performance is further attributed to the decline in the new house starts above.

LP Website

b) Siding

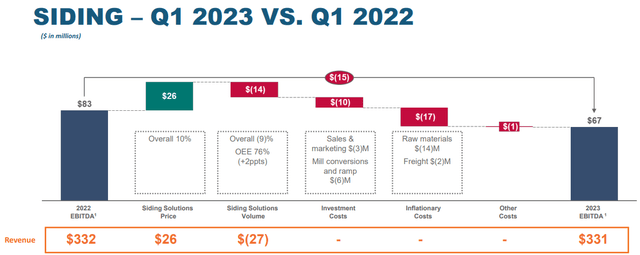

Siding Solutions products include a full line of engineered wood siding, trim, soffit, and fascia. Compared to solid wood, these products offer superior protection against hail, wind, moisture, fungal decay, and termites. Compared to OBS, the segment serves a more diverse end market, including new home construction, repair and remodeling projects, and outdoor structures such as sheds.

The segment’s net sales of $331 million were on par with the previous year, better than LPX’s forecast decline of nearly 5%. Additionally, its realized revenue of $329 million was flat YOY. The trend is due to the impact of a 9% decline in volume, which largely offset the 10% rise in average net selling price from the prior-year level. Volume decreased due to a challenging new home construction market and elevated channel inventory levels compared to the prior period-lower volume and raw material, freight, and labor inflation of 17 million partially offset price growth. To grow the segment, LPX is increasing the value-added products by adding new plants, expanding our capacity at existing siding facilities, and converting existing OSB plants to siding manufacturing plants such as Sagola, Michigan, and LPX’s Houlton, Maine mill.

LP Website

c) North America

The segment manufactures and distributes OSB structural panel and siding products in South America and specific export markets. The segment thus drives sales for wood-based construction products in South America since it distributes and sells related products to encourage the region’s transition to wood frame construction.

Its net sales of $55 million declined 17%, mainly due to lower OSB sales volumes and pricing. The drop is due to the earlier-mentioned headwinds and higher raw material costs.

The opportunity lies here

1. Expanding the siding segment

LPX is expanding its possible addressable geographies and market categories, introducing new products, and focusing on venturing into the less volatile all-in-all market segment, Siding. As a result, LPX will continue to invest in expanding its capacity. In early 2023, LPX safely completed the initial phase of Sagola’s conversion to a siding mill, culminating in pressing the mill’s first siding board in March 2023, exactly one year after breaking ground on the project. At total capacity, LPX Sagola will be able to produce approximately 330 million square feet of SmartSide siding annually, bringing the company’s total siding production capacity to approximately 2.3 billion square feet.

Further, the company will close yet another acquisition; Forex’s Wawa OSB facility. Which, when completed, will serve the rising demand in North America, and the mill will add approximately 400 million square feet of capacity. Thus, the LPX’s total siding capacity will be 2.7 billion square feet annually.

I believe that boosting the production capacity of a segment less volatile to cyclic demand in the industry and serving a wide range of target markets will soon enhance the company’s financial position. Additionally, the capital expenditure is estimated to decline in the subsequent quarters by about $20 million, which will again shape LPX financials on an upward trend.

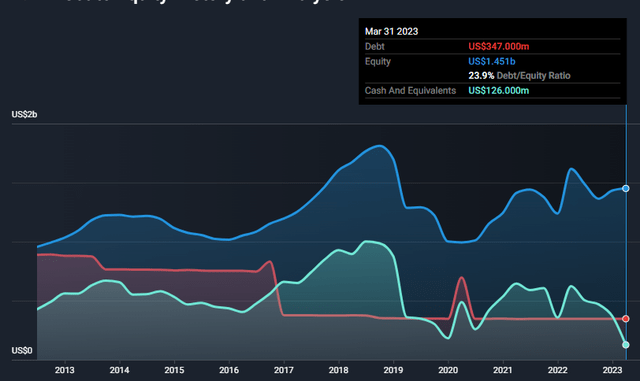

2) At the end of the first quarter of 2023, LPX had approximately $675 million of liquidity. As of March 31, 2023, the company had cash of 126 million, compared with 369 million at the end of 2022. Long-term debt was $347 million, flat, with the 2022-end level bearing a nearly 24% debt-to-equity ratio. LPX’s debt level is reasonably low, and this is a green shoot for the company to use the strong balance sheet to invest when opportunities arise using debt if it hits rock bottom.

Balance sheet analysis

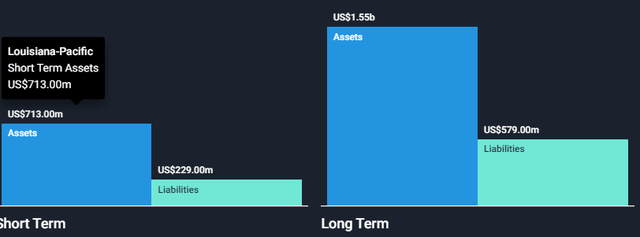

Moving onto LPX’s balance sheet, assets exceed liabilities both in the short and long term, as shown below. To mean the company’s assets can easily cover its financial obligations without utilizing debt financing. Let’s now discuss its debt level.

Simply Wall Street

LPX’s debt has been decreasing since 2013. The total debt is significantly low at $347 million. On the other hand, the company has cash and cash equivalents of $126 million, which can partially offset its debt. LPX’s net debt is thus approximately 121 million, which I’m confident can be covered by its equity of $1.451 billion, as shown below.

Simply Wall Street

The low-leveraged company has a heartening market capitalization of 4.6 billion to benefit from its aggressive and breakneck expansion strategies.

Valuation

With a PE GAAP [TTM] ratio of 9.86x compared to the industry median of 13.67x, it appears that this company is trading at a discount. Further, the company has a very high forward PE, which is 24.8x; this high forward PE, in my view, signifies that the company is likely to experience significant growth in the future. I am confident that the company awaits significant growth given its strong fundamentals, as discussed in the preceding sections. Further, a DCF model by FinBox lends credence to my undervaluation and future growth potential as it estimates a fair value of $69.98 and an upside potential of about 11%. As a result, I think potential investors should leverage this cheap entry point and buy this promising stock at a discount.

Risks

The following risks could constrain the compelling opportunities that lie in LPX:

- Inflation: The global effects of the economic recession will adversely hurt the company’s revenue and profitability margins driven by setbacks fueled by hiked wages, costly raw materials, increased interest rates, etc.

- Government policy: LPX is subject to environmental compliance expenditures and liabilities related to the emission of pollutants into the environment. Changes in environmental laws and regulations will cause the company to incur additional and unexpected compliance costs, which could be passed to its customers indirectly.

- Currency fluctuation: Since the company operates beyond the U.S., it faces a dollar fluctuation setback. Volatility in currency values (Canadian dollars, Brazilian reals, and Chilean pesos) and exchange rates could have an adverse effect on its financial results.

Notably, all risks are systemic. In my view, the company can only take measures to mitigate the risks since they are inevitable and do not arise from LPX operations, and its peers are subject to the majority of the risks.

Bottom line

LPX is an iconic player in manufacturing quality engineered wood building materials for use in the residential, industrial, and commercial construction industries. The company’s top line, bottom line, and revenue trends were slack in the first quarter of 2023 due to the macroeconomic headwinds related to inflation. Further, the OSB segment, the largest segment by sales by nearly 50%, is characterized by cyclic demand constraints limiting its potential to realize more revenue since its target customers are the new construction homes.

As a result, the management is massively investing in acquiring new plants while expanding the capacity of the existing siding mills. The Siding segment targets a diversified customer range, including new home construction, repair and remodeling projects, and outdoor structures such as sheds with less cyclic demand. The company’s strategic investment plan is ideal and will foster growth in the long run, as shown by the high forward PE ratio. As a result, I recommend this stock at the current discounted price but beware of the potential risks.

Read the full article here