Today, we are revisiting an income name that, we think, has more upside in the real estate investment trust, or REIT, space. We called for a buy on any weakness a few months ago, and since then, shares have returned about 14%. The company is Ladder Capital Corp (NYSE:LADR), which is a commercial mortgage REIT, or mREIT.

This mREIT is internally managed, with management owning a good portion of the equity, so their skin is in the game. The mREIT has about $5.0 billion of assets. The sector, of course, was hit hard during the pandemic, then suffered from the rate hike cycle. However, we still see this as a stable income name with a secure dividend, which is still yielding a healthy 7.5%. We are checking back in on the stock as the company just reported its Q2 results.

We like that this mREIT specifically invests in a diverse portfolio of commercial real estate and real estate-related assets, with a focus on senior secured assets. While the commercial real estate sector is still a mixed bag, Ladder offers capital, and it does this by originating senior first mortgage fixed and floating rate loans collateralized by commercial real estate. The company also owns and operates some physical commercial real estate, including net leased commercial properties. The company also invests in investment grade securities secured by first mortgage loans on commercial real estate.

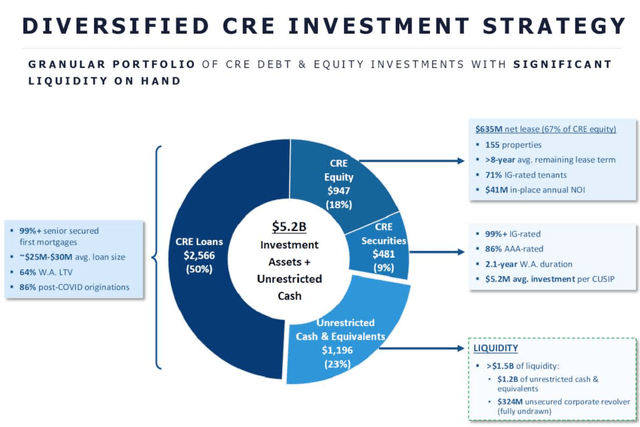

Here is a look at the current portfolio, as of the just reported Q2.

Ladder Capital Q2 2024 Earnings Slides

The portfolio includes 155 net leased properties, and that is about 67% of the commercial real estate equity. We like that management carefully vets their net lease tenants, and those tenants are primarily investment-grade rated, as evidenced by 71% of tenants being investment grade. The company is also committed to long-term leases, with an average remaining lease term of nine years.

At the end of 2023 the carrying value of Ladder’s securities portfolio was $481 million, 99% of the portfolio was investment grade rated, with 86% being triple A rated. Over 60% of the portfolio was unencumbered and readily financeable, providing an additional source of potential liquidity, and they have over $1.35 billion of liquidity. That liquidity is unrestricted cash and cash equivalents of over $1.2 billion, plus an undrawn unsecured corporate revolver capacity of $324 million.

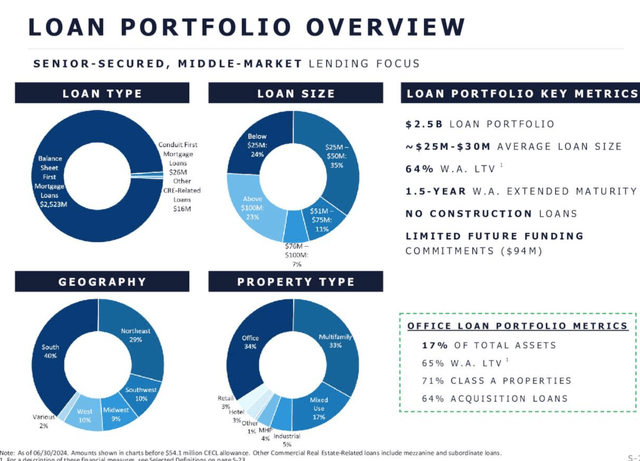

Let’s take a look at the loan portfolio, nicely summarized in the graphic below.

Ladder Capital Q2 2024 Earnings Slides

Almost the entire $2.5 billion loan portfolio are senior secure first mortgage loans. And 86% of the loans were originated in a post-COVID era. While loan sizes range from 24% being less than $25 million to 23% of loans above $100 million, the focus is still very much clearly on the middle market, as the average loans size is in the $25-$30 million range.

The main focus of the properties are nearly split between Office at 34% and multifamily loans at 33%. With rates so high and housing prices at all-time highs, so many more people are renting. We like the multifamily space for this reason. Office exposure overall is up because the company has a lower loan portfolio than at the start of the year. There are mixed use property types (17%), as well as industrial (5%), hotel (3%), and retail (3%) properties.

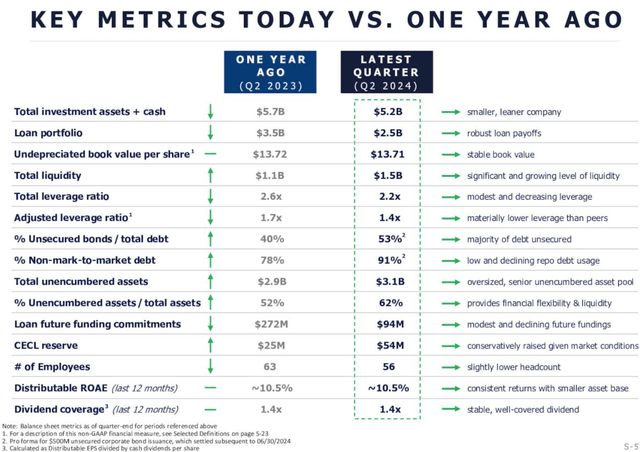

As we look ahead to a rate cutting cycle, Ladder has emerged from 2023 was as a leaner company. The company made significant adjustments to its leverage. Below you can see the benefits of the transformation.

Ladder Capital Q2 2024 Earnings Slides

We have a REIT here that is smaller and leaner. We have a significant discount-to-book value still, and book value has been stable. Leverage is down significantly from 2.6X to 2.2X, and liquidity, as we mentioned, is much higher. And importantly, returns are stable despite a smaller asset base. And for the safety of the income, the dividend coverage is still 1.4X.

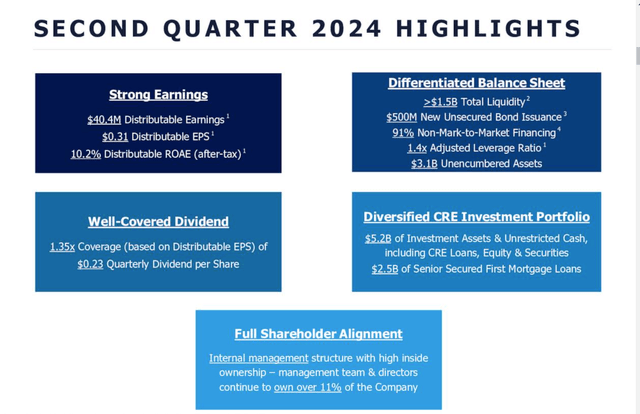

In terms of quarterly highlights beyond the improvements and moves in the portfolio, we saw strong results in our opinion.

Ladder Capital Q2 2024 Earnings Slides

So, here in Q2, Ladder generated distributable earnings of $40.4 million, or $0.31 per share. This performance yielded a return on equity of 10.2%, supported by modest adjusted leverage of 1.4x. The company also boosted its liquidity to $1.9 billion in July, thanks to a $500 million unsecured corporate bond. Overall, the company is delivering.

As we look ahead to H2 2024 and beyond, the company is in excellent shape for an orderly rate cutting cycle. Even modest rate cuts will provide some significant relief for tenants and borrowers, as well as make it easier to acquire capital at lower costs as needed. We like that the dividend is incredibly secure.

While analysts have a bit of a muted outlook, the consensus is still for about a flat performance from 2023. A return to meaningful growth is still expected beyond 2024, as the massive and flexible cash balance and liquidity is used to make new investments. We continue to like holding Ladder Capital Corp stock for income, and red days should be bought.

Read the full article here