Marketing automation company, Klaviyo, Inc. (NYSE:KVYO), earned a first-day valuation of $9.2 billion, after going public this week. Klaviyo is part of a new generation of firms advancing technologies that seek to automate work. In an era in which automation is becoming increasingly important, investors and the media have paid a great deal of attention to firms such as Klaviyo. It’s no coincidence that it was one of the stars of the new IPO season, going public in the same weeks as Instacart (CART), and Arm (ARM). Yet, although the firm has grown, it has so far failed to earn a profit, and an examination of its valuation shows that a lot of its price is dependent on the assumption of growth. This should give investors pause to think.

The Business Model

Steve Jobs liked to describe the computer as the “bicycle of the mind”, expanding human capacity, rather than replacing humans. The triumph of the computer gave way to the Age of Software, and this in turn is now giving way to a different kind of revolution: the automation of work through intelligent applications. AI is eating the world. Similarly, evangelists will argue that the effect of automation will be to enhance human capability, rather than replace humans, that fears of automation taking jobs fall into the “lump of labor fallacy”, and that, although whole classes of jobs may disappear, new classes of jobs will take their place, in the process, enriching society.

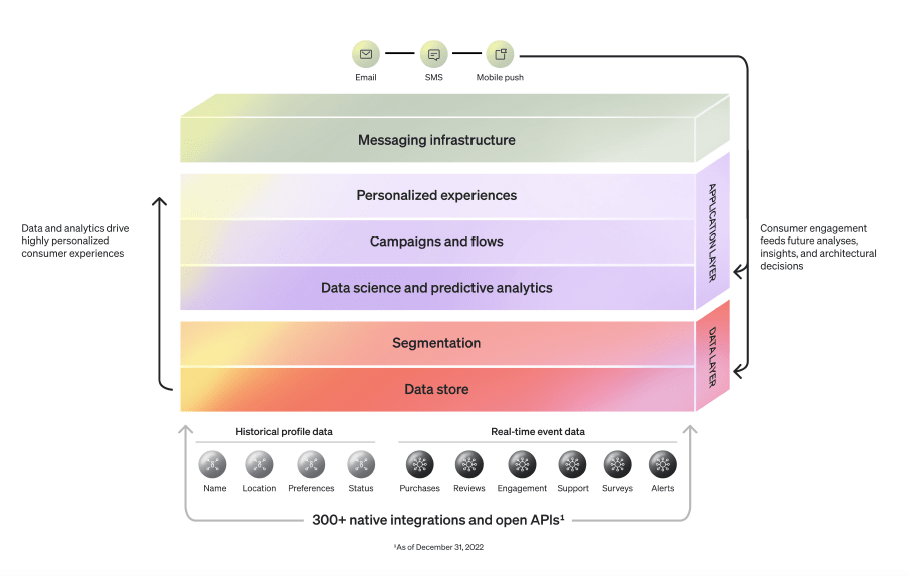

Klaviyo is part of this new wave of automation. From a jobs-to-be-done perspective, Klaviyo seeks to help businesses enrich their customer experiences across all their digital channels, while also helping customers work through the AI age at a time in which third party data is becoming less accessible; and first-party data has become more complex and less usable. Klaviyo does this by granting subscribers access to its SaaS platform, with its proprietary data, so that each business can plug in its data, have it analyzed and used to make predictions that can be used to send out highly personalized messages across the businesses various digital channels, enrich customer experiences, assess customer engagement and measure such things as “Klaviyo Attributed Value” (KAV), ie, the time-weighted revenue impact of messages delivered. The company believes that automating marketing is only a ‘first use case” and that its software can be extended to other use cases.

Source: Klaviyo, Inc. S-1/A filing

Klaviyo generates more KAV for its users than it takes in terms of revenue, in that sense, exists as a platform in the Bill Gates sense, the same way that Windows is a platform, rather than in the two-sided platform sense that has become more popular. In 2022, the firm had generated $37 billion of KAV, against $473 million in revenue. The median time to earn that KAV was 30 days, and for those customers with an annual recurring revenue (ARR) of more than $50,000, KAV was generated in under nine weeks.

The nature of the platform means that the more customers use the software, more customer profiles are uploaded (6.9 billion as of June 30 this year), the more data there is, the better the inferences, and the more value is generated for users. As customers enjoy more KAV, they bring more of their business to the company. The firm has successfully employed this “land-and-expand strategy”, achieving a net retention rate (NRR) of 119% as of June 30, 2023. According to the Bessemer Venture Partners “State of the Cloud 2023”, an NRR of 110-119% is “better”, while the “best” NRR is 120% and above. The average NRR in the last 10 quarters was 118.3%. With an 88% dollar-based gross revenue retention rate (GRR), the firm’s retention of its customers is certainly very high.

That Klaviyo is able to help its customers achieve their jobs-to-be-done is clear: as Clayton Christensen said, if a product gets the job done, you can charge money for it. The question is, can Klaviyo charge enough to be profitable? Tech firms tend to focus on the size of the opportunity -Klaviyo says its total global addressable market is $68 billion-, but these figures are highly subject to error, and even if true, the size of the market isn’t as important as Klaviyo’s ability to turn a profit.

Growth Without Profit

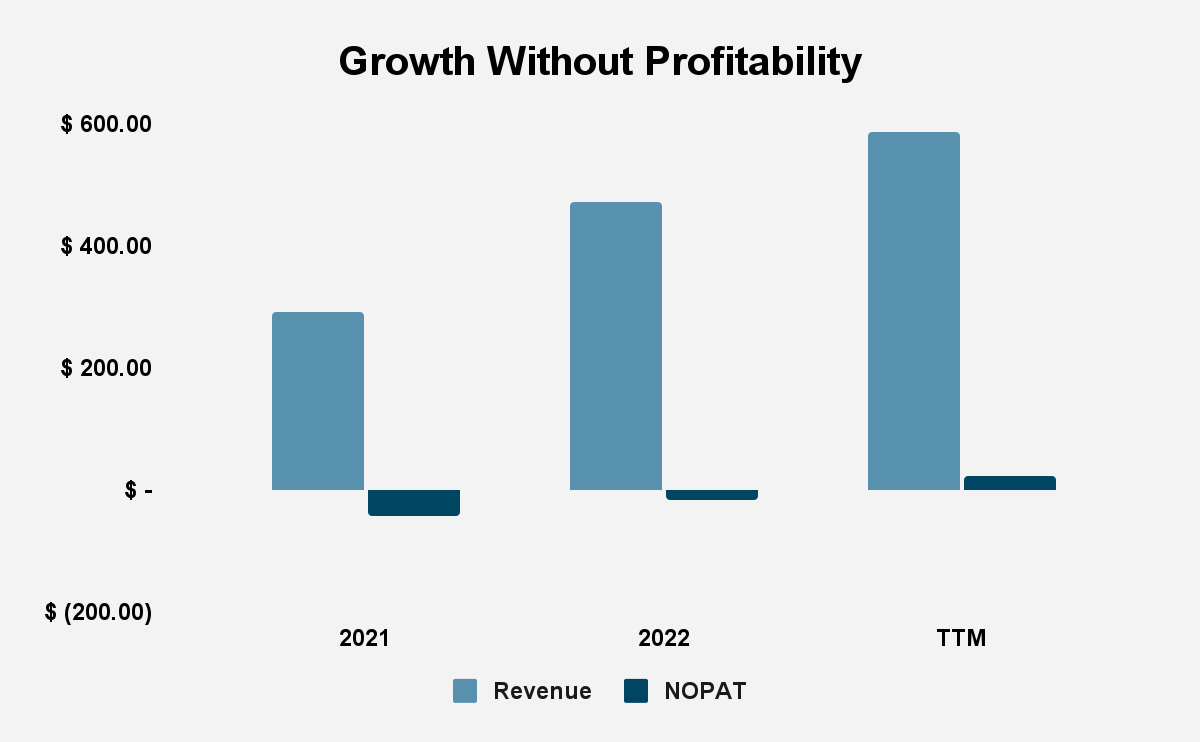

GAAP earnings are obviously problematic, and the kind of alternative earnings that Klaviyo advances are deeply flawed. Stripping away non-operating and non-recurring elements to determine net operating profit after taxes (NOPAT), gives us a truer sense of the firm’s profitability. Klaviyo’s NOPAT has risen from -$43.62 million in 2021 to -$17.32 million in 2022. Estimating NOPAT for the trailing twelve months (TTM) period by using a 2-year average for operating cash taxes, gives us a TTM profit of $22.11 million, driven purely by tax effects.

|

NOPAT |

|||

|

Economic Category (Values in thousands except per share amounts) |

2021 |

2022 |

LTM |

|

Revenue |

$ 290.64 |

$ 472.75 |

$ 585.08 |

|

Operating Expenses |

|||

|

Cost of revenue |

$ 84.70 |

$ 128.03 |

$ 144.00 |

|

Gross Profit |

$ 205.94 |

$ 344.72 |

$ 441.08 |

|

Gross Margin |

70.86% |

72.92% |

75.39% |

|

Research and development |

$ 65.60 |

$ 104.08 |

$ 126.90 |

|

Selling and marketing |

$ 156.34 |

$ 213.85 |

$ 245.90 |

|

General and administrative |

$ 63.24 |

$ 81.83 |

$ 90.12 |

|

Total Operating Expense |

$ 369.87 |

$ 527.78 |

$ 606.92 |

|

Total Hidden Non-Operating Expense, Net |

$ – |

$ – |

$ 7.37 |

|

Hidden Total Restructuring Expenses, Net |

$ – |

$ – |

$ 7.37 |

|

$ – |

$ – |

$ 7.37 |

|

|

$ – |

$ – |

$ 0.01 |

|

|

$ – |

$ – |

$ – |

|

|

Hidden Foreign Currency Expenses, Net |

$ – |

$ – |

$ – |

|

Hidden Other Real Estate Owned Expenses, Net |

$ – |

$ – |

$ – |

|

Hidden Acquisition and Merger Expenses, Net |

$ – |

$ – |

$ – |

|

Hidden Legal, Regulatory, and Insurance Expenses, Net |

$ – |

$ – |

$ – |

|

Hidden Derivative Related Expenses, Net |

$ – |

$ – |

$ – |

|

Hidden Other Financing Expenses, Net |

$ – |

$ – |

$ – |

|

Hidden Other Non-Recurring Expenses, Net |

$ – |

$ – |

$ – |

|

Hidden Recurring Pension Expenses, Net |

$ – |

$ – |

$ – |

|

Hidden Non-Recurring Pension Expenses, Net |

$ – |

$ – |

$ – |

|

Hidden Company Defined Other Expenses, Net |

$ – |

$ – |

$ – |

|

Adjusted Total Operating Expenses |

$ 369.87 |

$ 527.78 |

$ 599.55 |

|

Adjusted EBIT/EBT |

$ (79.23) |

$ (55.04) |

$ (14.47) |

|

Adjusted EBITA/EBTA |

$ (79.23) |

$ (55.04) |

$ (14.47) |

|

Interest for PV of Operating Leases |

$ 3.25 |

$ 3.03 |

$ 3.05 |

|

Core Earnings, or Net Operating Profit Before Tax (NOPBT) |

$ (75.99) |

$ (52.01) |

$ (11.42) |

|

Operating cash taxes |

$ (32.37) |

$ (34.69) |

$ (33.53) |

|

NOPAT |

$ (43.62) |

$ (17.32) |

$ 22.11 |

Source: Author Calculations

Given the challenges of estimating tax rates of firms of which we have limited data, not too much should be made of the TTM NOPAT and more attention should be paid to the core earnings trend. Core earnings, or net operating taxes before profit (NOPBT), do show an upward trajectory for earnings, with core earnings rising from -$75.99 million in 2021, to -$52.01 million in 2022, to -$11.42 million in the TTM period.

Source: Company Filings; Author Calculations

With rising profitability, returns on invested capital (ROIC) have also risen, from -48% in 2021 to around -15% in 2022. Taking with a large pinch of salt our estimation of TTM NOPAT, ROIC in the TTM period is around 20%.

Valuation

Given the uncertainty around the future tax position of the company, I propose a very conservative way of looking at its value, stripped from any tax impact. The reader is encouraged to look at alternative ways of resolving the problem. Starting from core earnings, we can create a simple model of the firm’s zero-growth value, which gives us a pessimistic assessment of what the value of the business is. In that scenario, the zero-growth value per share of the firm is $8.93 per share. This is an interesting exercise, although this conclusion depends on the discount value you use, whether you use a target rate, as I have done, WACC, as is the fashion, or APV or some other technique, and also on how you value the firm’s employee stock options (ESO). What the reader will come away with is a sense of just how much of the stock price is driven by expectations of Klaviyo’s growth prospects, rather than on the core earnings of the business.

|

Zero-Growth Value |

|||

|

2021 |

2022 |

TTM |

|

|

Core earnings |

$ (75.99) |

$ (52.01) |

$ (11.42) |

|

Discounted value |

8.00% |

8.00% |

8.00% |

|

NOPAT/Discount value |

$ (949.84) |

$ (650.08) |

$ (142.80) |

|

Adjusted total debt (including off-balance sheet debt) |

$ 65.47 |

$ 62.41 |

$ 62.41 |

|

Excess cash |

$ 313.38 |

$ 362.59 |

$ 409.88 |

|

Unconsolidated Subsidiary Assets |

$ – |

$ – |

|

|

Net Assets from Discontinued operations |

$ – |

$ – |

|

|

Value of Outstanding Employee stock option liabilities |

$ 33.10 |

$ 33.17 |

$ 33.20 |

|

Under (Over) funded Pensions |

$ – |

$ – |

$ – |

|

Preferred stock |

$ – |

$ – |

$ – |

|

Minority interests |

$ – |

$ – |

$ – |

|

Net deferred compensation assets |

$ – |

$ – |

$ – |

|

Net deferred tax assets |

$ – |

$ – |

$ – |

|

Zero-Growth Value |

$ (735.03) |

$ (383.07) |

$ 171.47 |

|

Price to-date per share |

$ 33.70 |

$ 33.70 |

$ 33.70 |

|

Outstanding shares |

$ 19.20 |

$ 19.20 |

$ 19.20 |

|

ZGV per share |

$ (38.28) |

$ (19.95) |

$ 8.93 |

Source: Author Calculations

Conclusion

Klaviyo is part of a new wave in the transformation of the nature of work: the automation of work. The firm seeks to automate marketing and move from there to other use cases. Despite the excitement of the sector, it is worth noting that the underlying business has so far failed to generate any profits. Indeed, thinking through how the firm is valued shows just how much of its price is dependent on the assumption of growth. If that growth fails to materialize, the price has a steep fall ahead of it.

Read the full article here